I currently have a verbal agreement to put together a long-term joint venture.

I’m engaged and in the due-diligence period with multiple extensions.

Traditionally a down payment for such a transaction is a ring. Hopefully, if you have not gone through this experience before, you will learn about procuring this rare commodity. If not, I hope you find it entertaining.

For those who haven’t caught on yet – I’m talking about diamonds.

I think everyone knows that you get ripped off at a retail brick and mortar jeweler… even Fred Meyer Jewelers because you have to pay for all the overhead and compete with unsophisticated buyers. Plus I don’t like all the sleazy sales tactics and it is a huge time-sucking experience.

In the back of my head, I know the diamond market has to be rigged sort of like the sunglasses world where all the brands are owned by Luxottica and there is price rigging involved.

Now some people say they can haggle for a better price in person, but that takes time. Also, I am in the “first stage” of learning: I don’t know what I don’t know.

I turned my attention to the top 3 sites using Google and Reddit forums.

1) Blue Nile

2) James Allen

3) Rare Caret

I was happy with getting approximate “market value” on the website. I trusted the overall grading system in an online store.

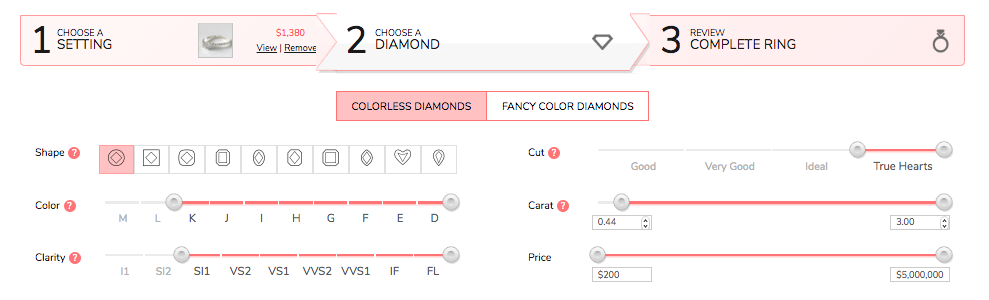

What I really like about these websites is that they allow you to sort hundreds of diamonds in online spreadsheet form with a sort feature based on different attributes.

This might be review but the big four C’s are Carat-weight, Colour, Clarity, and Cut. Unfortunately, you cannot buy the 5th C – Confidence.

(Not to be confused with the three C’s of evaluating people into your network: Character, Competence, Commitment.)

If you would like to know more than the 80% of people, take 10 minutes to read this article to determine the quality & value of diamonds, via the famous 5cs of diamond grading.

Now, in my humble opinion … real talk here… the most important factor is size. So Carat Weight is numerouno. Most people cannot tell you the difference between the other three attributes; they only see how big the freaking thing is.

For those who know a thing or two about diamonds, Cut is the second most important thing. Cut is the sparkle-factor, how much the diamond shines based on the angles of the Cut. I went and got the top grade Cut because that is a big wow-factor (second to of course how big it is).

The other two attributes, Colour and Clarity, I frankly don’t really care. Some people could actually like a little color or whatever that clarity thing is. So I set my search criteria to have all the levels in those two categories. One exception is that I just did not put the worst-grade Colour and Clarity in my selection. This for no good reason other than not wanting to have the worst one (as vain as it sounds). Call me dumb, but I feel embarrassed when I order the cheapest wine on the menu…I always go for the second cheapest.

Rare Caret seemed to have the best selection of diamonds, but their ring selection seemed to be lacking. So after a side by side comparison of Blue Nile and James Allen, I found James Allen to be ~5K cheaper for the same diamond.

At the end of the day, I knew what my budget was so I was just trying to get the best bang for my buck. In other words, the money was allocated and this is how I mentally process non-income producing assets.

Unfortunately, I was not able to use Mr. Rebates – a go to for getting a few percent points of cashflow by going through a simple shopping portal. Nor was I able to find many coupon codes using RetailMeNot.com or navigating their email digital marketing campaign. Most sophisticated marking emails are laced with smart links to kick out a discount coupon based on what links you click in the email and if you do not buy right away to get you off the fence as a buyer.

Sign-up via my link for all your future online shopping: http://www.mrrebates.com?refid=413597

You can spend a fortune on Carat-weight, Colour, Clarity, and Cut…but the most important 5th “C” of all, Confidence.

A lot of my high net worth single friends (who by the way get a lot of dates) don’t see the value of getting married in this modern era (other than if you would like to have kids). I definitely understand that perspective to some extent. This makes buying an archaic stone that may or may not have been a blood diamond just another thought to complicate things.

But as a recovering cheapo – simplepassivecashflow.com/cheapo – I understand that money is not evil and can buy a variety of things including freedom, time, and happiness. This purchase is a perfect example of that.

The way I see it, marriage is a lot like playing with leverage. It is a little more risk than going it alone, but the reward (if done right) is disproportionately greater (per the Shape Ratio’s risk-adjusted return).

My first plan was to make the big reveal in a new Honda CRV. Note – at this moment I’m over the whole Mercedes, Tesla, wealth-based off of the car I drive. Instead, I am striving to achieve the financial freedom level I am looking for.

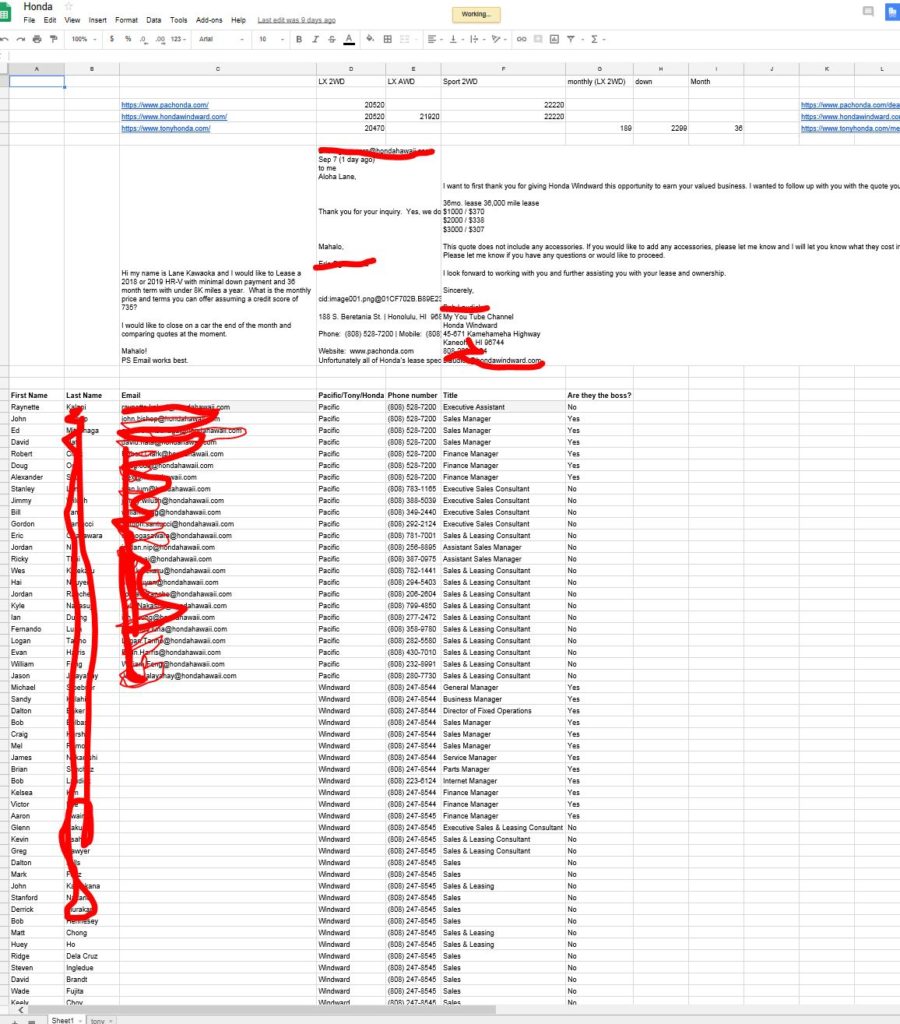

I even had my VA scrape a lot of Honda contacts to do my normal email blasts to put multiple dealers against each other. By the way, I lease cars because I did the math and it makes more sense for sophisticated investors who get higher than average returns.

I got the car but scrapped the idea because my buddy mentioned… “dude – you don’t want to propose at a car dealership.”

Takeaway here is that everyone has a blindspot and its good to have people around you to bring up counterpoints.

Thanks for following Simple Passive Cashflow. Onward and upward.