Whenever you find yourself on the side of the majority, it is time to pause and reflect

Mark Twain

FAQ’s

If you’d like a free consult please email team@simplepassivecashflow.com

Applicants will have to qualify for the policy by completing a medical exam and having the insurance company review their application.

Other requirements may be needed depending on the amount of insurance being applied for.

In general, the cost of insurance is lower on this savings product, and the underwriting requirements are less stringent, making this policy easier to qualify for and also more affordable.

If you are personally not able to qualify for the insurance policy, you could have a healthy individual that you might have an insurable interest in, create the policy (such as your spouse or children).

Unlike retirement accounts (401k, IRA) you do not have to take withdrawals at a certain age/time, you have total control of your funds.

For properly structured whole-life policies there are no surrender charges, which is another benefit for whole life compared to IULs which typically have surrender charges for the first 10-15 years

Are you aware that there is more to it than simply saving your money in the bank and be in a better position?

Wanting to be more knowledgeable of how you can leverage the services of financial institutions rather than purely relying on what your financial advisor can offer?

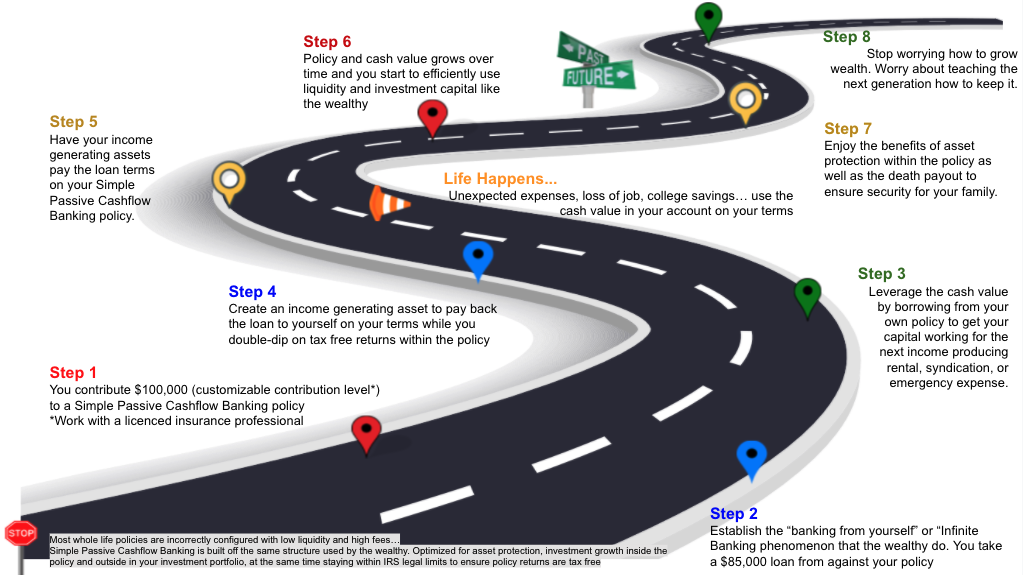

Banking from yourself (with life insurance as the mechanism) allows cash flow investors to augment the investing they already are or will be doing.

Why?

- Grow your money TAX-Free (Use the same loophole that the politicians put in the tax-code for themselves to use personally)

- Asset protection – litigation and creditor-protected.

- Your money grows in two places at the same time. In this secure policy and your higher yield investments (syndications + rentals)

- Better than 401Ks, Roths, 529s because no government regulated restrictions on how can you use this money.

Just imagine that in 2016, I learned about this little-known financial hack utilized by smart money.

How come this was not taught to me early on?

You might be scratching your head and curious why am I sharing this with you!

Simple answer: I can’t be selfish to the learnings I got from my experiences! These are precious that I have to share.

You see, by being your own bank and using the Infinite Banking Concept you can create dividend-paying whole life insurance. You may consider this before getting into futures. Please note that it’s called life insurance BUT it’s just a tax code loophole to make a tax-free yield in an account that is sheltered from lawsuits and creditors.

Add this to the list of things your typical financial advisor or life insurance sales guys who they just do not get it. Why? Because, likely, they are still working for a paycheck and it actually decreases their commissions.

“Infinite banking” is just one term for this. The magic of the infinite banking concept is to create tax free “wash loans”. Where the dividend rate on the cash value is equal or greater than the interest rate on the loan and maximizing the use of Paid Up Additions, which have a lower commission rate than the regular policy – this is why most FPs don’t like this.

And for you high-net-worth folks still dabbling in paper assets, you won’t want to miss this other trick that I will reveal on there too – Email me for this info at Lane@SimplePassiveCashflow.com

This is a part of my 1-2 punch to avoiding liquidity anxiety and having an Opportunity Fund to go after deals as they come up. Let’s call this “on-deck circle” because it is better sounding unlike how the term “dry-powder” sounds.

Today, starting a small policy with 25% of your household’s annual cash flow is a good idea to start, even for asset protection that the policy provides (even in bankruptcy).

About half the states protect the whole life insurance policies payable to spouse or children with partial protection in all states. Additionally, these assets do not appear on your kid’s FAFSA . If you are like me and want to load your kids up with student debt (to get a BA in pottery or psychology) and ensure your golden retirement for numrouno (you) then this is a good strategy.

I appreciate our call a couple of years ago when you asked why anyone with a low income and small savings like me would get involved with IBC. You had recommended it only for those with a net worth above 500k. Using it in combination with your recommendation to move forward in real estate has allowed me to acquire 7 more units in the past couple of years. So thanks very much for that 15-minute call that has really been life-changing!

Hui Member

Infinite Banking w/ Lane Kawaoka Outline

Purpose Statement

Infinite Banking is how cash flow investors enhance the investing they already are or will be doing.

Benefits

- Net 5-6% Return (we'll go over this later)

- Tax-Free (we are basically using a loophole in the tax code that does not tax life insurance)

- Safe / Predictable

- Liquidity

- Loan Provision

- Death Benefit / LTC

- Tax – Free growth on my earnings.

- Steady, consistent, year after year “upside-only” accumulation, somewhere between 5% and 7%. No home runs, just single after single, each and every year.

- To make certain that any gains I earned will be locked away and not subject to market downturns.

- To allow me to borrow money personally without interest, without a payment schedule (I would want repayment optional), and without affecting my credit score.

- To allow me to lend money to my family members at the preferred rates I designate.

- To transfer to my spouse, children, grandchildren, or my favorite charity without taxation on the gains and without the expense of probate.

- To be creditor-proof, protected from frivolous lawsuits.

- To not have required distributions, like an IRA. If a withdrawal is taken I want it to be my decision and not the government’s. I don’t want them to ever tell me when, how much or how often.

- To be backed by the strongest financial companies in the world. Stable companies that are over 100 years old.

- To carry my personal family name, like the Phillips Family bank.

If you want the insurance death benefit and/or would like to use the banking strategy, then the best bet would probably be to get a new policy that designed for that purpose and dramatically reduced cost.

If you don’t really care about using the banking strategy then just cash out and walk away with no issue at all.

Strategy

Next up is this method of hedging yourself to a 0% loss. This is if the stock market goes down 10-20% in one year then you lost 0%.

Unfortunately, by taking this type of deal (that the rich do) you cap your upside at 12%. If the market goes up 14% you only get 12%.

To elaborate, hedging is a strategy being used to reduce the impact of negative effects to investment. In short, to hedge is part of managing risks.

Guess what!

Here is where the hedge strategy comes together. We leverage your investment by using 3X leverage. If the market goes up 7% you get 21%. In that case, where the market goes up 14% you only get 12% you actually get 36%.

I know it sounds crazy!!!

It’s like bowling with the bumper rails in place.

Real-Life Example: IBC vs. Bank

Infinite Banking Highlights (Recap)

-

Growth

Expect to net a 5-6% return. This comes from a gross interest credit of 4% guaranteed, along with a long history of paying dividends that are currently paying an additional 2-3%.

-

Loan Provision

Policies carry a unique guaranteed loan provision that makes it possible to use core wealth-building principles such as leverage, velocity, and cash flow to maximize the way your money works for you. Because money on a loan comes from the general account of the insurance company, NOT directly from the cash value, we can create value in more than one place at the same time.

-

Safety

100% safe from market volatility and guaranteed to grow. These mutual life insurance companies we represent have been paying dividends for more than 150 years. This includes times like the Great Depression, World Wars, and a myriad of different market cycles.

-

Liquidity

Unlike having money in a qualified plan such as an IRA or 401K, money is accessible at any time without the worry of a 10% IRS tax penalty. Liquidity can be the difference between capturing an opportunity or letting it slip away.

-

Tax Free Growth

Money grows and comes out on a tax-free basis, and unlike a Roth IRA, there are no contribution or income limits.

-

Death Benefit

Since we are using dividend-paying whole life insurance, there's always a 100% tax-free death benefit. Although we're primarily focused on the living benefits and cash growth, this is a significant benefit. It’s insurance we don’t have to pay for in any other way.

-

Long-term Care Coverage

Provides an efficient way to plan for the ever-increasing expenses associated with long-term care. By utilizing the accelerated death benefit rider (no additional cost), you can utilize a portion of the tax-free death benefit to cover long-term care costs.

Velocity Plus w/ Lane Kawaoka Webinar Outline (More to come…)

Purpose

- Leverage

- Max income w/ least amount of dollars

- Alternative for retirement plans

- Great for groups

Concept Structure

Leverage: $100k for 1 property? No, use $100k for 4 properties instead!

Here’s how $100k does the work of $400k:

- Years 1-5: Policyholder and bank contribute

- Years 6-10: bank only

- Ratio: 25% policyholder, 75% bank

- No collateral needed beyond policy

Product: Indexed Universal Life

- Use an index

- Cap

- Floor

- Capture 80% of upside

- No downside

- Policy structure: max cash growth/min costs

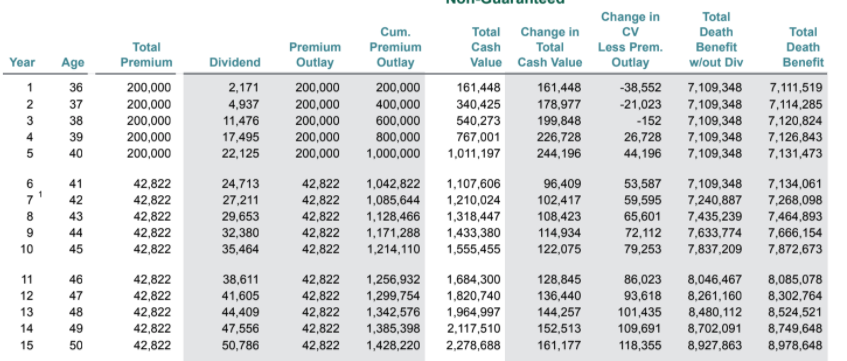

A Look at the Numbers

- 46-yr-old

- $1M total going in ($500k from policyholder / $500k from the bank)

- Then the bank takes over total

- At year 15—pay off the bank loan

- Age 65-90—tax-free income of $115k/yr

- $250k goes in, a total of $3M comes out!

How it Works — Leverage Throughout

- Spread — growth vs. loan interest

- Leverage the bank for 15 years

- Pay off bank loan using policy loan

Leverage Throughout — A Snapshot

Example numbers at year 15 after we pay off the bank loan:

Figures:

- Total Cash Value: $1.8M

- Loan Balance: $1.2M

- Net Cash Value: $600k

Let’s say we get a 10% credit the next year:

- $180k (calculated from Total Cash Value)

- Loan grows by 5% —$60k

- Growth in Net Cash Value — $120k (That’s a 20% gain on our net equity)

The overall return is 18%!

Primary Risks

- High-interest rates

- Poor performance

Some things to consider:

- “Stress Testing”

- 80’s interest rates–$98k/yr income

- Great Depression–$78k/yr income

- Baseline income was $115k/yr

We are not talking about your father’s whole life insurance

Whole life insurance is only one part of the above strategy. below is a discussion on my thoughts on the product as it stands alone.

First off, it’s a product which you pay for. The providers (insurance companies) are using the best minds and big data to price out your coverage premiums which include marketing, sales commission to your FP, and a wee bit of profit for their company.

In most cases, if you die while owning life insurance, you get paid the death benefit, tax-free because of the step-up in basis at death

Term life insurance gets really expensive after the term ends and as you get older (cause its price by the chance of you dying).

Whole life insurance is designed to pay out when you die so you can see how it’s sort of like a bank account. The way we are using this policy is by taking loans against it.

NOTE – A Guaranteed Universal Life policy if a flat death benefit where the Whole Life grows.

These policies allow you to accrue interest on the amount of cash value that is not being “borrowed out” of (technically borrowed against) the policy. People in the industry call this “direct recognition.” Just be aware that “non-direct recognition” pays dividends as though no money was borrowed against the policy. Just something to ask when setting up your policy.

Downsides of the Whole Life product

You are front-loading your costs and fees. This can be devastating for someone in the early stages of wealth building. (Almost as bad idea as paying off low-interest student debt or mortgages before investing)

I like the ability to use this vehicle as a means to bank from yourself but keep in mind that you should not need insurance you don’t need.

I think you should insure well against true financial catastrophes and self-insure against everything else. Yet I insure my iPhone because I am weird like that… actually, I justify it that I would search the world wasting my time for two weeks before going and buying a new device. So insurance for a phone would save me time since I would not hesitate to give up looking and put in a claim.

Returns are typically low (when compared to what we do in real estate investing)

So just getting a policy alone and not implementing the “wash loans” does not make sense.

Most times the commissions are maximized by the FP. This can get complicated on how to design this stuff so it’s an ideal situation for a greedy FP to pull one on you. By maximizing the use of “paid-up additions” while minimizing the amount of “regular policy” you can decrease the commissions and still execute this strategy.

Other Pitfalls

80%+ of whole life policies are surrendered prior to death because their beneficiaries need to money beforehand. Perhaps on an ALF (even though some policies have this benefit).

It’s slightly more expensive for older people and smokers to get ensured however I have found it to be negligible (1-3K difference on a 50k premium) between a 30-year-old non-smoker and a 50-year-old non-smoker.

Smaller policies like for your kids have much more fees because the setup fees fit into the policy. So buying a $20K policy for junior who does not smoke might not be the best idea.

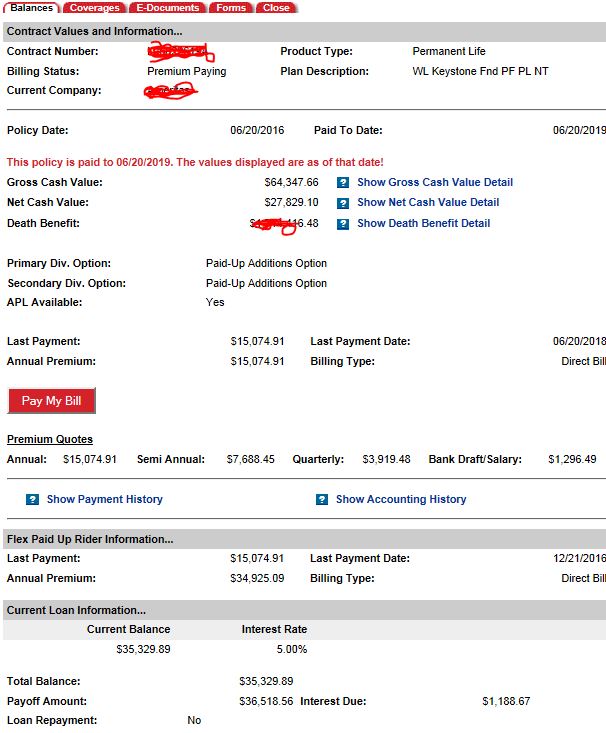

Withdrawing Money via Loan

You can take money out of your Cash Value portion. When I contributed to my policy I got 70% of what I put in as Cash Value on day one to be able to take out as a loan. This I could use for deals or whatever I wanted. This is super simple as you can go online or call your provider and tell them “you want to take a loan from your Cash Value”. Simple they send you a check or ACH transfer and usually takes about a week.

Replenishing Money to Payback Your Loan

I am actually writing this to myself as it’s a little tricky and this way I remember the steps.

I print out a simple letter (examples below) and mail it with my check to my friends at Ameritas.

5/1/18

Dear Ameritas,

My name is Lane Kawaoka (######).

I have enclosed a payment for $65,000.

Due to my flex rider please apply my payment in the following order:

- $64,510.01 to the expire Loan balance (pay off loan then…)

- Any excess to be paid to the $15,074.91 to the Annual Premium

Please advise when the next bill will take place via email.

7/14/18

Dear Ameritas,

My name is Lane Kawaoka (######).

I have enclosed a payment for $60,000.

Due to my flex rider please apply my payment in the following order:

- $64,510.01 to the Loan balance (pay off loan then…)

- $15,074.91 to the Annual Premium

- Any excess to be paid to overfund my account

In addition, please switch my premium billing to an annual basis and remove my automatic billing per month.

Please advise when the next bill will take place via email.

Flex Paid Off Rider

In whole life policies, you have this add-on where you are allowed to add paid-up additions (purchasing larger death payout and cash value). In my policy, I need to put in at least 70% of $35,000 once every three years.

NOTE – There are other types of these riders where the requirement is to put a more consistent amount every year, but personally I prefer the one out of three-year arrangement because my business income fluctuates so much.

Without penalty, I can go over 120% or $42,000 every year as my max. If I want to put in more I would have to make a new policy and get another physical. This limits the risk for the insurance company if you are putting away infinite amounts of cash after deciding to pick up the hobby of skydiving while smoking 2 packs of cancer sticks a day.

Are you convinced? Let me know if you need a referral!

Infinite Universal Life (IUL) FAQ’s

Normally when we are talking about a banking policy we are talking about a whole life product, however sometimes an indexed universal life (IUL) is preferred, which is why it makes sense to work with only people you (we) trust. The cap defines the upper limit of the policy cash value crediting rate.

Typically (2014-2019) IUL caps have gradually fallen, leading some to wonder what would stop carriers from gradually dropping caps to the policy’s minimum guarantees. This concern is particularly common when the client is considering whole life as an alternative, because whole life discussions begin with guaranteed performance enhanced by dividends. Legally this is possible, and advisors may need some clarity to make a decision.

So, how relevant and valid is the concern that caps may fall to the level of policy guarantees?

Cap levels are essentially driven by the amount of money the carrier has available to purchase long options in support of its IUL book of business. While option pricing is a combined function of option budget, market volatility, and the price of zero-risk products, data indicates it is the option budget that is by far the overriding driver. This is particularly true when considered over the medium to long term.

It’s indisputable that the reason whole life dividends, universal life declared rates, and IUL caps have fallen over the last 20 years is the declining interest rate environment. As rates fall, the general account return must also fall because its portfolio is comprised of primarily fixed-income investments. When rates rise, bond returns in the general account will increase slowly as the life insurance carrier replaces maturing bonds and adds additional bonds with a new premium. The question is “Will the carrier keep the extra return instead of passing it on to the end client in the form of higher caps, dividends, or declared rates?”

The life insurance carrier would say that they take their profit in the form of money management fees, costs of insurance, and policy changes; thus regarding the improved yields as policy owner money. On the other hand, cynics would disagree and say the life insurance carrier will pocket the increased yield.

The answer is no. And here’s why…

IUL products are mostly sold to clients below the age of 65 who will live for a long amount of time. If interest rates rise but caps do not, then an IUL product becomes less attractive compared to similar products issued by competitors with higher caps and higher client yields. Healthy clients, encouraged by agents and other advisors, will surrender their policy so that they can move to more competitive products. Furthermore, this would create another problem for the original carrier because the remaining pool would be unhealthy, and this would result in more early death claims and therefore further losses.

The answer is yes.

One of the great advantages of life insurance is that as standard practice the carriers guarantee the mark-to-market value of the bonds that support the cash surrender value. This was not an issue in a declining rate environment because the carrier could sell the attractive higher-yielding bonds and pocket the gain. However, when rates are rising, and especially if the rise is rapid, the reverse is true. Thus, clients induced to surrender by higher caps elsewhere create a significant mark-to-market liquidation loss for the short-sighted carrier.

For example, if the insurer has a general account with an average bond maturity of ten years (typical for the industry) the losses would be a 9% loss on the cash value surrendered if there was a 1% increase in underlying market interest rates, and a 35% loss if there was a 5% increase. For a single client, this is unpleasant but unlikely to break the carrier. However, if it happens on a large scale it creates an enormous loss that no senior management team is likely to survive.

Given the potential for considerable losses and that the carrier hits its profit objectives by passing through the increase in general account yield, the carrier is incentivized to pass through improved yields to the client in the form of higher caps. By doing so, the carrier attracts more premium while simultaneously protecting prior profits. By not doing so, the carrier risks mass surrenders which could result in the loss of hundreds of millions of dollars.

No one knows when interest rates will rise, but data and logic tell us that the life carriers will protect their profits. To do that they must pass on improved yields to the client in the form of increased caps and/or improved participation rates.

More IUL info to put you to sleep (just get a pro to work with that you trust not to stuff you in the high commission plan).

Private Placement Life Insurance (PPLI)

It’s basically a variable universal life offered by some banks and insurance companies. The one thing you CAN’T do is invest with it however you want. Although you can customize the “subaccounts” you invest in, you CANNOT do your investments through that policy. You have to use hedge funds or mutual funds (known as subaccounts when used in insurance policies). It’s just a VUL on steroids. But you wouldn’t want to borrow money from it while those accounts go up or down with the markets.

So think of it as a 401K where you are stuck with the bad investment options.

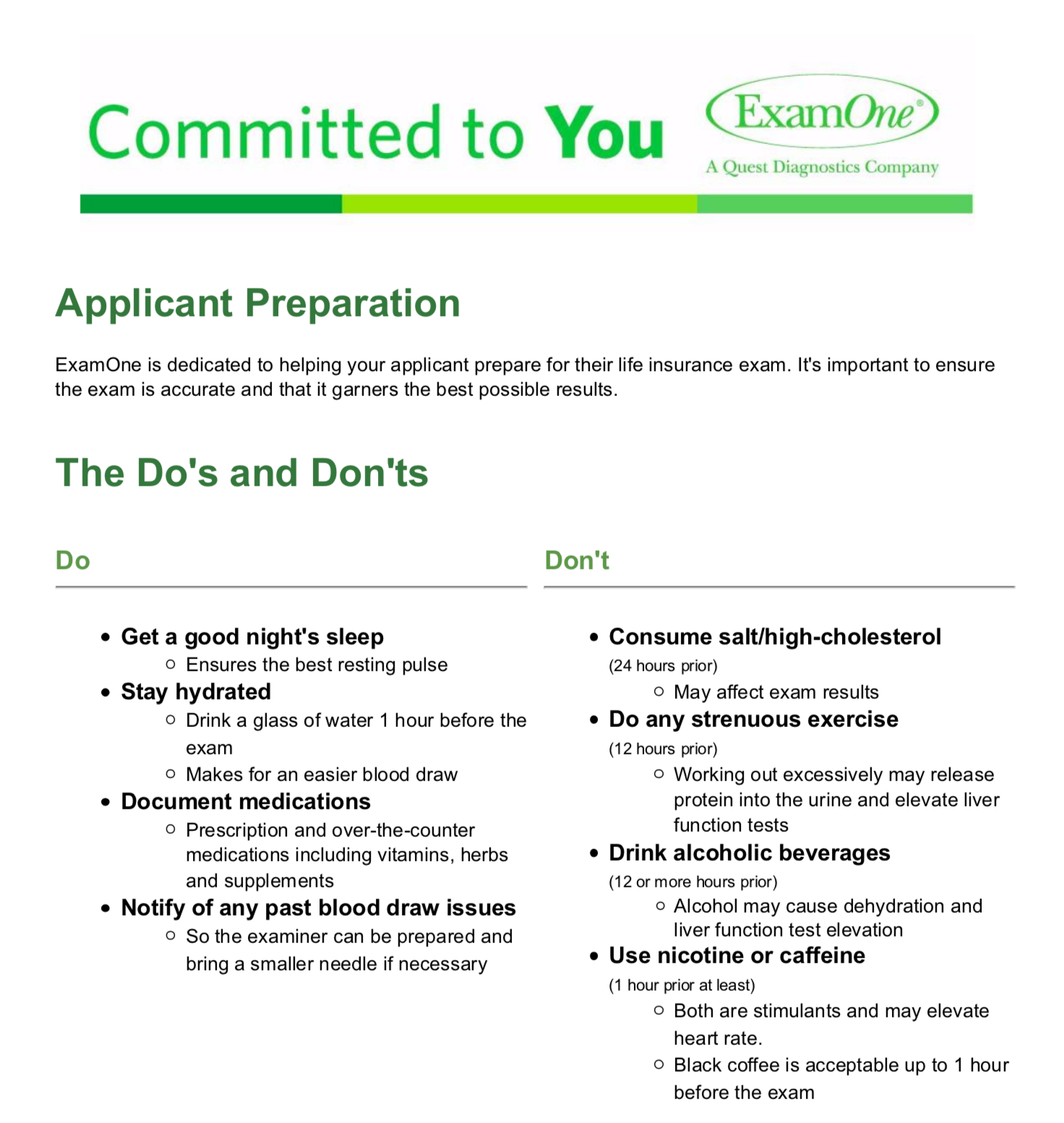

Physical Exam and Interview Tips:

Process of Applying for a Policy (2020)

Called my guy and completed an application in the online portal. Had a short discussion on how much I was looking to put in per year and how long of a time horizon. This is where it is critical to have a peer network around you to bounce these ideas. You want to know how much you are putting into these policies and how to configure them before you talk to the sales guy.

The process took about 15 minutes. I had to answer some basic health/lifestyle questions and some more specific questions like when I went to the doctor last and what was it for and did I have any pre-existing calculations.

Good questions to ask so you are on the same page with your IBC broker:

- % rate the CV grows

- % rate I pay on loans

- how much % rate the outstanding loan amount grows or if it does… this part always confuses me and I heard that it is different in every policy

- What is the minimum I need to put into the account every year. And how much I need to put to not lose my ability to over fund?

- And just verifying that the max is 250k a year?

- Historically, does the increase in loan rate coincide with increase in dividends and vice versa?Not sure if all IBC companies are the same but per Chris regarding Penn, “Both the dividend rate and loan rates can change each calendar year. In Penn Mutual’s case, they paid 6.34% for about 12 years in a row (longest of any company without decreasing), and then decreased a few years ago to 6.1%. The loan rate has remained at 5% that entire time. If the dividend rate significantly increases or decreases, the loan rate follows suit

- The %rate the CV grows when there is a loan vs when there isn’t a loan

- Can you still overfund after year 5, and, if so, how much?

Infinite Banking FAQ’s

It took me a long time to understand myself and it really helps to have a few people around you to talk you through it (other than the insurance sales person). That is what our Mastermind is for.

You just want to make sure you are customizing whole life insurance for the three “levers”.

Slow down buddy it is cool that you are making money two places, tax free (because it’s life insurance), and provides litigation protection but don’t forget you are paying a price for this. There are heavy fees in the beginning (30% of what you load in) which does decrease as the years go by and goes down to around 10% by year 3.

DO NOT FORGET THAT YOU LOST the opportunity cost of the money paid as fees. None of those fancy (confusing spreadsheets) include this.

An IBC is not really for a guy under 200-400k net worth because that person needs to invest every free dollar they can and cannot afford to pay the fees for the benefits of an IBC plan. It’s more for people who are loose or inefficient with their liquidity. Or in other words, have 30-100k+ of cash hanging around not doing anything frequently.

For me I am always broke when you look at my bank account, because I suffer from severe liquidity anxiety (don’t want any cash making less than 10%). Often I will work with clients who have 100k’s of money just sitting around so we use IBC as a means to slow them down so they can become a Sophisticated investor and make a bit of yield in an IBC.

Life Insurance Creditor Protection By State [Is Your Cash Value and Death Benefit Covered?]

It’s crazy huh! But when you get outside the world of retail investments 4-5% is the baseline and 12-15% is pretty attainable without going crazy with risk. That is what really frustrates me about mainstream financial advice and wall-street investments.

The insurance companies have 2 sources of income, insurance products, and investments. I think of them as a big syndication company. They have their insurance business and raising money from people to be part of the mutual company. All those people out there buying term insurance feed the main business, they collect way more money than they payout. And then people that buy the whole life policies are part of the mutual company, essentially have shares in the company.

They pay us out a return (the death benefit will pay out unlike term policies which eventually expire) but raise the money now to support the business and buy assets. They’ll overpay for class A, stabilized assets, and take returns of 4% where the market may be only willing to pay for 8%. They do also buy bonds and make loans. But they don’t invest in the stock market. So they pay out the guaranteed return of 3% (similar to a pref) and then at the end of the fiscal year they look out how they did and pay the mutual owners a dividend. They are forced to buy insurance on all of their written policies to raise cash to pay them should they have a problem. They also aren’t a bank so they don’t get to participate in fractional reserve lending. They have much stricter regulations in how much cash they have to keep on hand to service the policies which is another reason they are only paying 1-2% dividends per year.

The insurance company is investing its assets in investments that the insurance company thinks can meet its obligations under the contract. Anecdotally, I’ve seen insurance companies buying real estate, buying government debt, and AAA corporate debt. I am sure they have access to investments the average retail investor does not. How they manage to give you a guaranteed rate is probably a “trade secret” otherwise everyone would do it. My understanding is that the insurance company has another company “reinsure” just in case it can’t meet its obligations. The insurance company can also pay “policy dividends” over and above the guaranteed rate, but policy dividends are not guaranteed.

Have no fear my friend you basically have three options:

- Cash it out and just walk away with the cash that’s in it… In that case, you obviously no longer have a life insurance policy so the death benefit goes away… Because of the way it was designed, it possibly does not have enough built-in cash value yet for there to be any tax consequence so you don’t have to work about that…

- Borrow against this policy and use the money that way… You can use it as a properly design self-banking instrument, the downside is that it’s not a great cash building policy so there’s more cost in it than what you’d like to see and the loan rate may not be really favorable.

- Open a new policy (one that is designed for cash build-up) and do a 1035 exchange into and this time get a policy optimized for banking… The nice thing here is that there would be little cash right upfront to boost the new policy because we are using the old one… The downside is just going through the process of getting a new policy with physical evaluation etc…

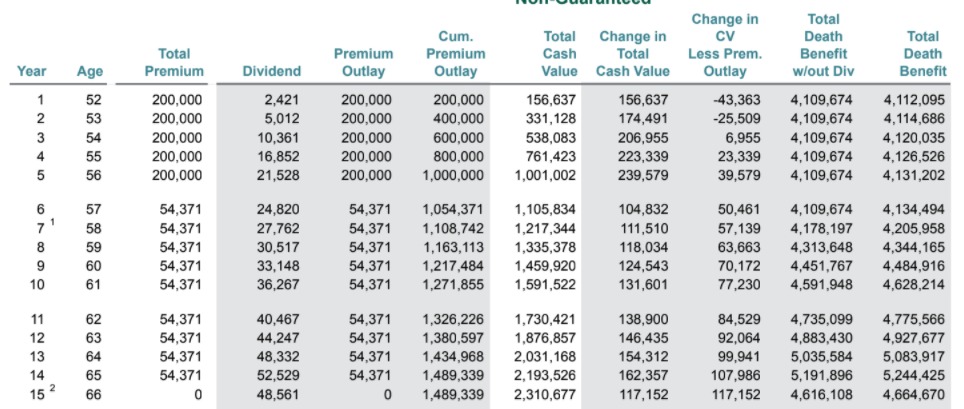

What’s the difference between a 35-year-old and a 52-year-old male’s IBC?

1) 161k vs 156K first-year cash value

2) Someone’s widow will have 3M more dollars to blow when their FI obsessed husband is dead

Insider insights of Infinite banking within the Family Office Ohana Mastermind – SimplePassiveCashflow.com/journey

Testimonials