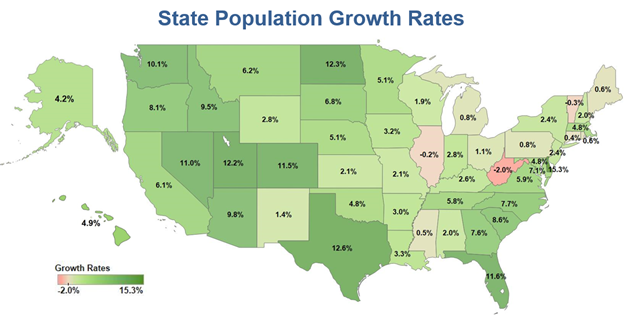

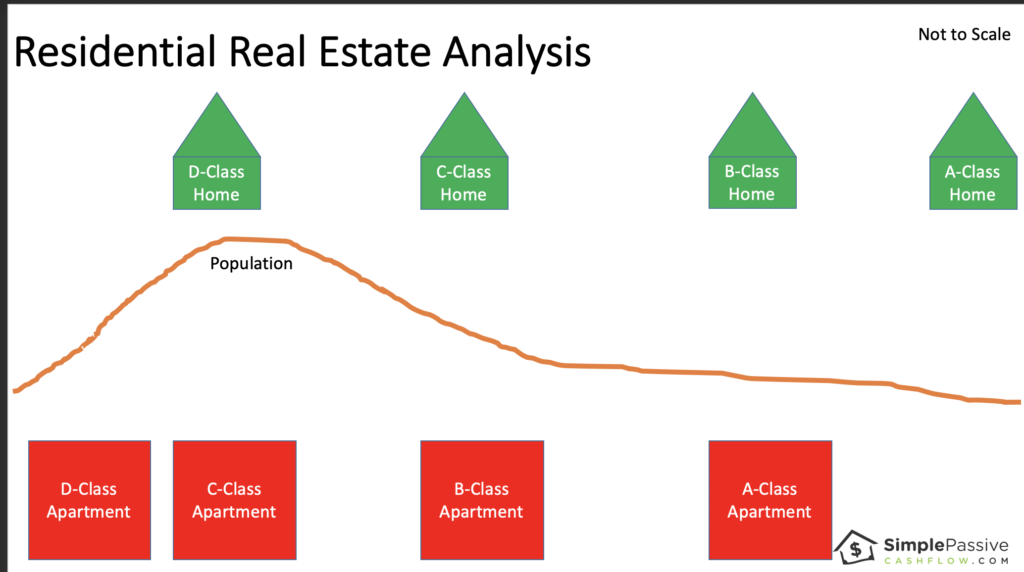

The population is still going up…

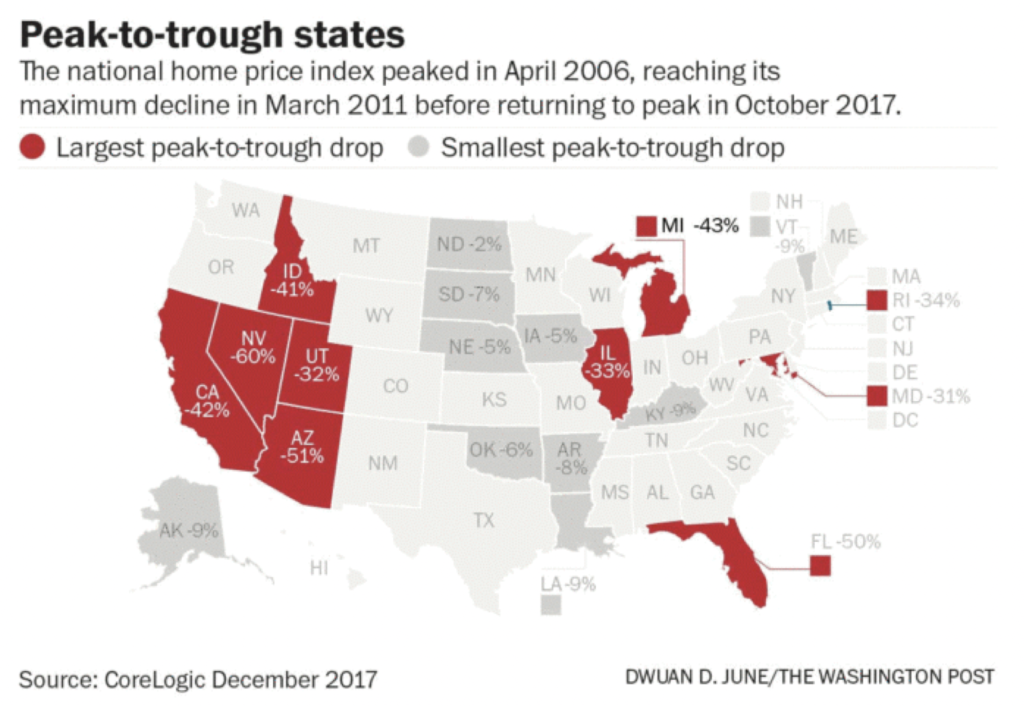

Between 2010 and 2017, population growth averaged 5.5% for the US as a whole. Delaware boasted the highest growth rate, 15.3%, over these years. A state with a relatively small population, however, needs fewer new residents to achieve such a high growth rate. The double-digit rates recorded by Texas (up 12.6%) and Florida (up 11.6%), both high-population states, are therefore that much more impressive. There were three states that posted population decline between 2010 and 2017: West Virginia (down 2.0%), Vermont (down 0.3%), and Illinois (down 0.2%). – ITR – 19.02.28

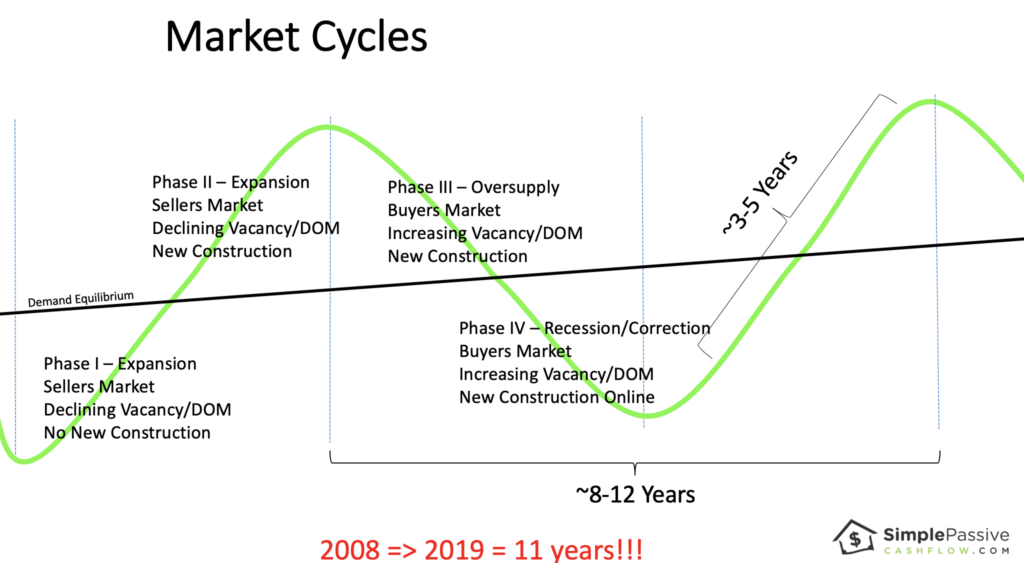

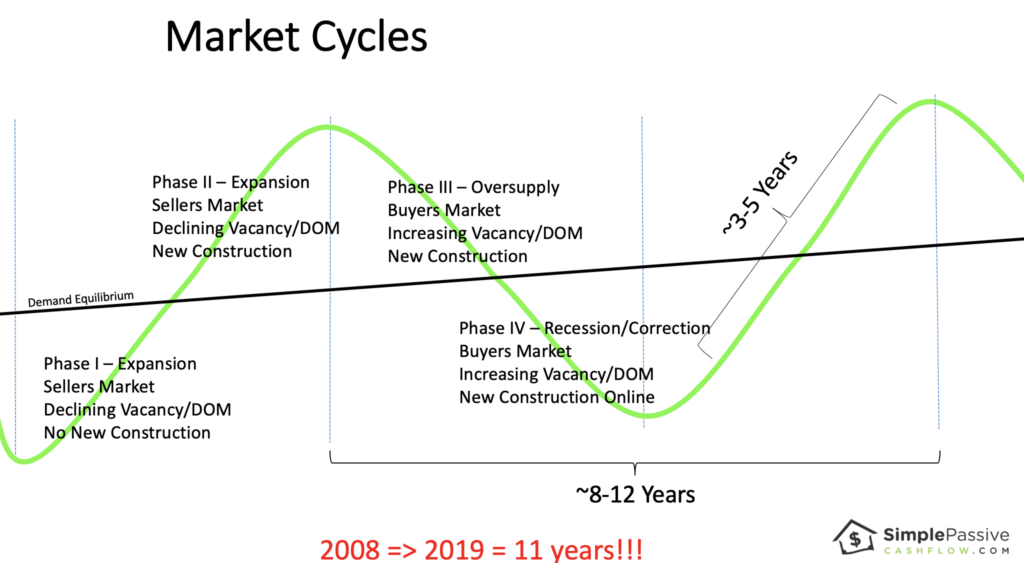

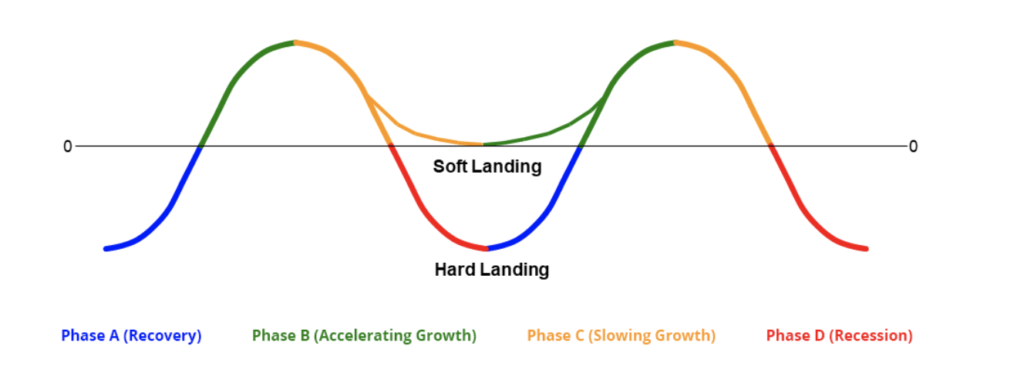

Since I feel we are in the 9th inning of an 11 inning ball game, I decided to pass on a recent Class-A apartment deal in a secondary market.

Here is my thought process…

Real estate is one of the best risk-adjusted investments out there. In private placements or syndications, we are able to crowd-invest in larger & more stable assets while maintaining control with operators who are aligned in our best interests. By going into a project properly capitalized with adequate capital expenditure, budget, and cash reserves, you are able to remain steadfast through softness in the market where rents stagnate and vacancy decreases.

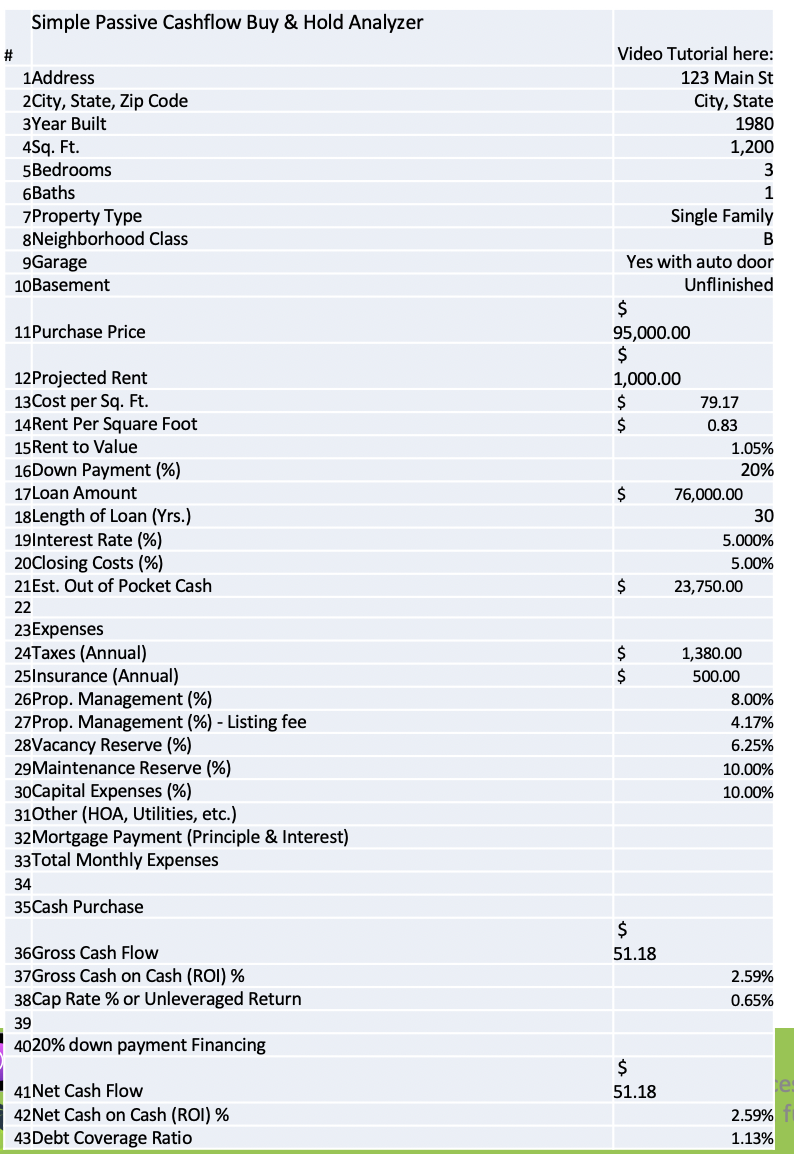

(If you are starting out you should start with turnkey rentals even though they are much more volatile)

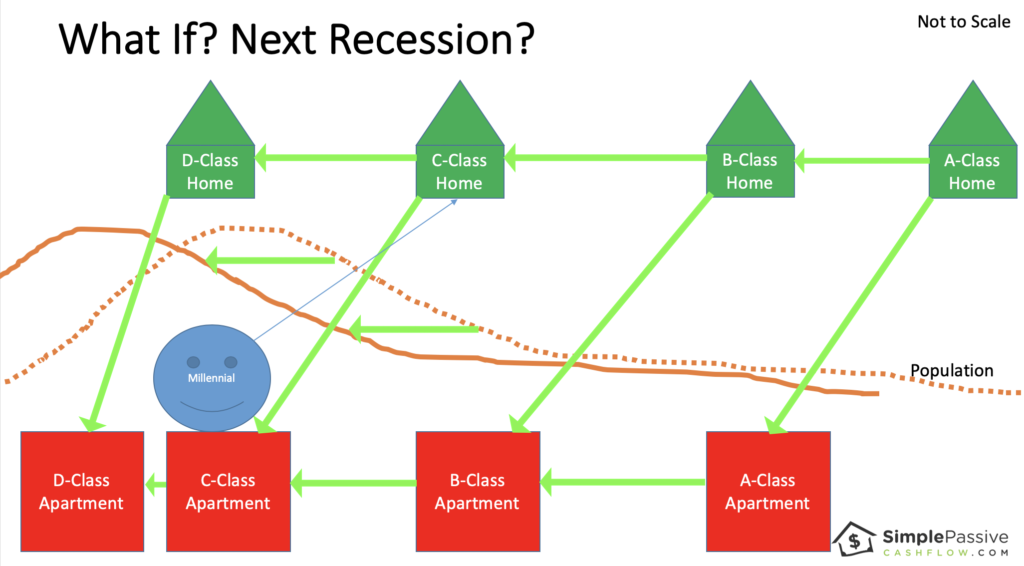

Pause there. In troubled times what happens?

People lose their jobs and there is a bit of shuffling.

Yea, people need housing, but there will be some vacancy as some people will lose their jobs and be displaced elsewhere.

Following this train of thought…

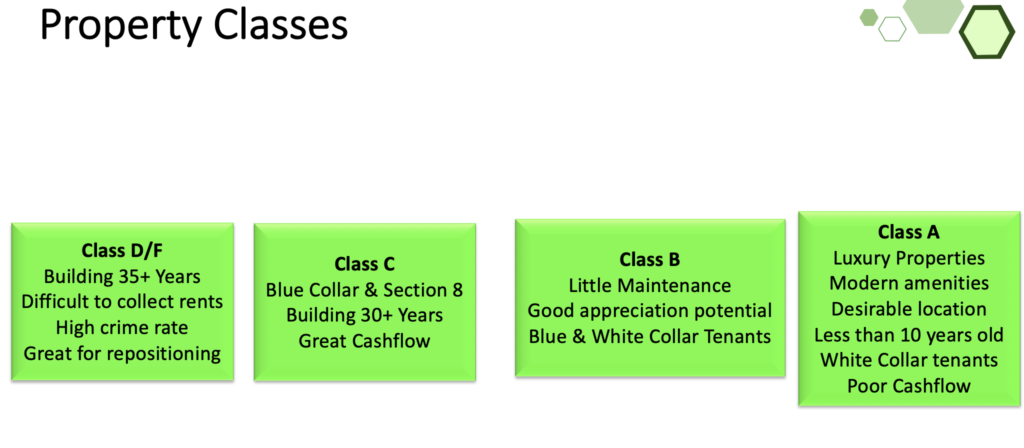

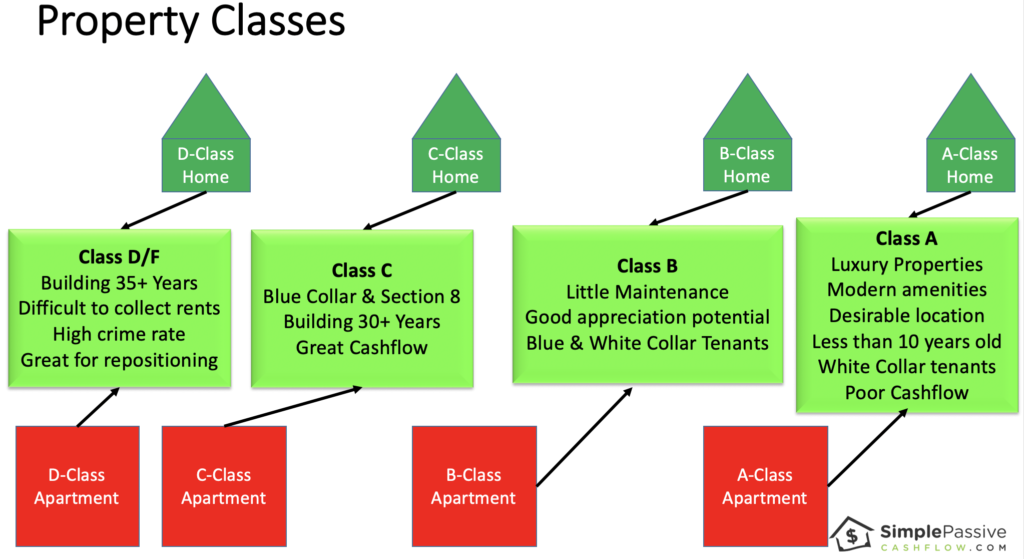

In a recession, the high end or class A will be hurt the most. It is Class A workers who fulfill much of he discretionary services. We are already seeing softness in rent by rent decreases in class A of the high-end markets such as Seattle and San Francisco.

For example a once $1,700 one bedroom is now $1,625.

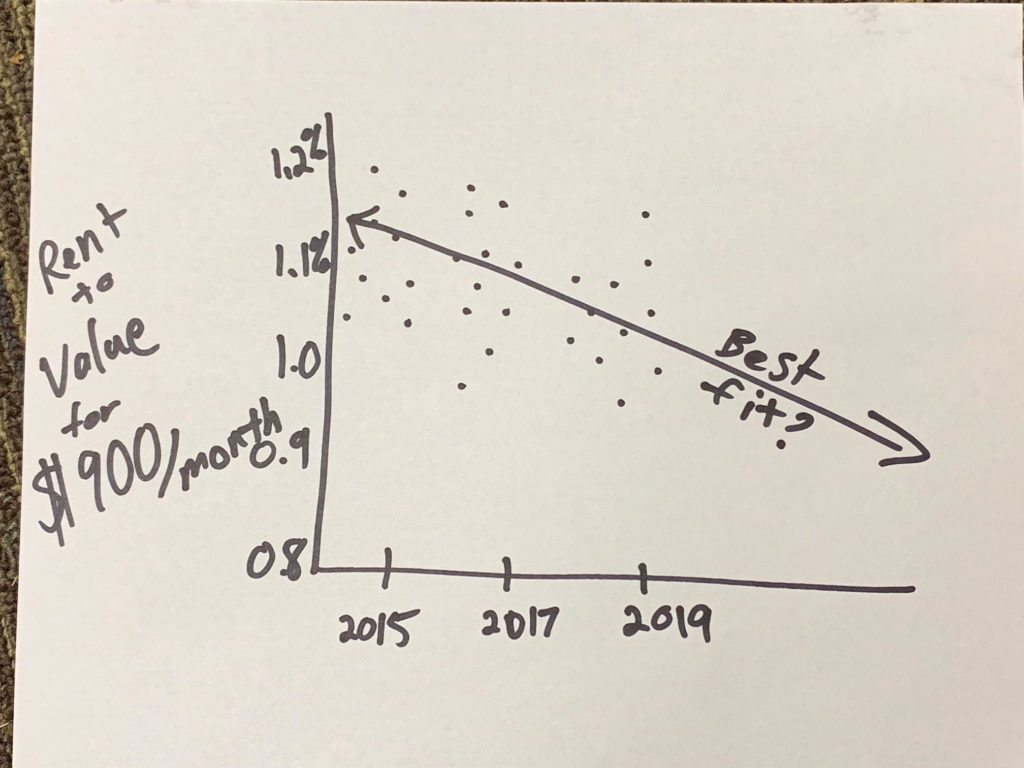

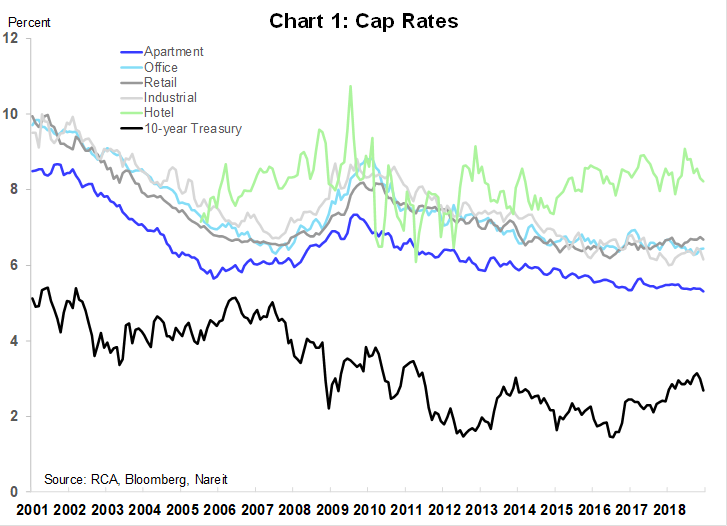

Most deals model for 1-5% in annual rent increases or escalators. Other than the Cap Rate to Reversion Cap Rate truck, this is the second most manipulated assumption in investment modeling.

In this unfortunate but natural event, the A-Class renters will fall to class B housing. Some homeowners will even lose their jobs creating foreclosed investments for smaller investors in the single-family home scale.

What’s happens to the B and C class renters?

It is likely that they will also lose their jobs at higher or lower rates, but that is up to debate. In the same fashion as the A-Class renters, the Class B/C renters will downgrade to make ends meet.

I imagine this similar to a game of musical chairs (where the chairs are getting crappier and crappier). Or it looks a lot like the natural housing shuffle in the summer near colleges with people moving in and out. The landlord/investor is likely to see increased vacancy.

Multifamily occupancy varies from 85-95% in stabilized buildings. Some markets are hotter and some are colder. It is important to use the correct assumptions depending on the markets. For example, Dallas typically sees 92% occupancy while Oklahoma City sees 89%.

One of the reasons we love multifamily is because of the decline of the middle class and the need for more scalable workforce housing. [And those millennials can’t save] The population is increasing too.

[I like to use this image cause I make fun of millennials… this is the millennial version… cause they can’t seem to afford (or want) to own anything]

When I travel to Asia (which I see as a more mature society, for better or worse) there is a much larger wealth gap than in the USA. People are living in cramped apartments or very rare single-family homes. And they are driving a Mercedes on barely enough money to share a family moped. This is the trend that the USA is following.

As with many things, you need to look past the headlines and the general data. Instead of analyzing a whole asset class, as the media likes to do, let’s break down vacancy in terms of classes.

Here are some typical vacancy rates (notice the spread).

Class C 4.5%

Class B 5.0%

Class A 5.5%

Why? Because there is just more demand for the lower class properties cause there is more demand than supply.

Many times the business plan is the be the “best in class.” For example, businesses want to be the best mobile home park or best high end remodel because you attract the richest customers in that niche.

I like to monitor the number of new units coming online because that is your downward pressure. It is rare that new builds are for Class C or Class B.

The micro-unit trend is an attempt to build for Class C and B tenants due to the need. But often the numbers don’t make sense when you have purchased the same building materials and mobilized the same crews to build a Class B asset as opposed to a class A asset.

Let’s go through that Armageddon example again.

Class A will have to drop rents severely and see great vacancy.

Class B and C will see vacancy come up too as people are losing their jobs but should see some absorption from ex-A Class tenants.

Mom and dad will also see some absorption as deadbeat son or daughter move back home.

Shows like Friends and How I Met Your Mother will go on for another decade.

Note: one can argue that class A+ will not be affected at all which I believe is true. That’s why we are trying to invest right to enter that untouchable status.

I remember when I sat through the same economic presentation at work from 2010-2014. The sentiment at the time was that it was going to be an extremely slow recovery. It makes sense that the length between the 2008 recession and now is very long which is why I mentioned an 11-inning ball game.

This is why I took a set back from some pretty Class A deals because I asked myself the following questions:

1) What will happen to the rents if IT should happen?

2) Is the modeled 90% vacancy rate going to get blown up?

Class B and C apartments in strong submarkets will perform best over the long term. If you ensure the loan term is long enough so you don’t get hurt then you should Outlast the bumpy ride ahead.

Beware of the self-destructive behavior of not investing. You know what I mean… are you someone who self-sabotages?

Understand the micro and proceed if the numbers make sense.

I have to admit Class C and B assets are boring but work especially in a seller’s market because 1) they cashflow and 2) have a forced appreciation value-add component to give you levers to pull in tough times.

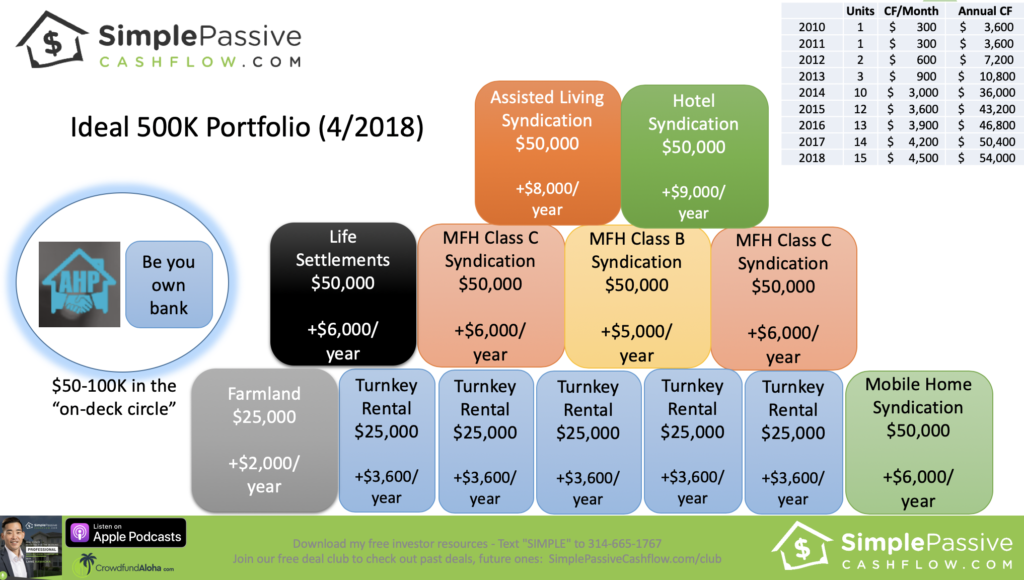

Again going back to Mr. Kiyosaki’s three-sided coin quote, investors go through three stages.

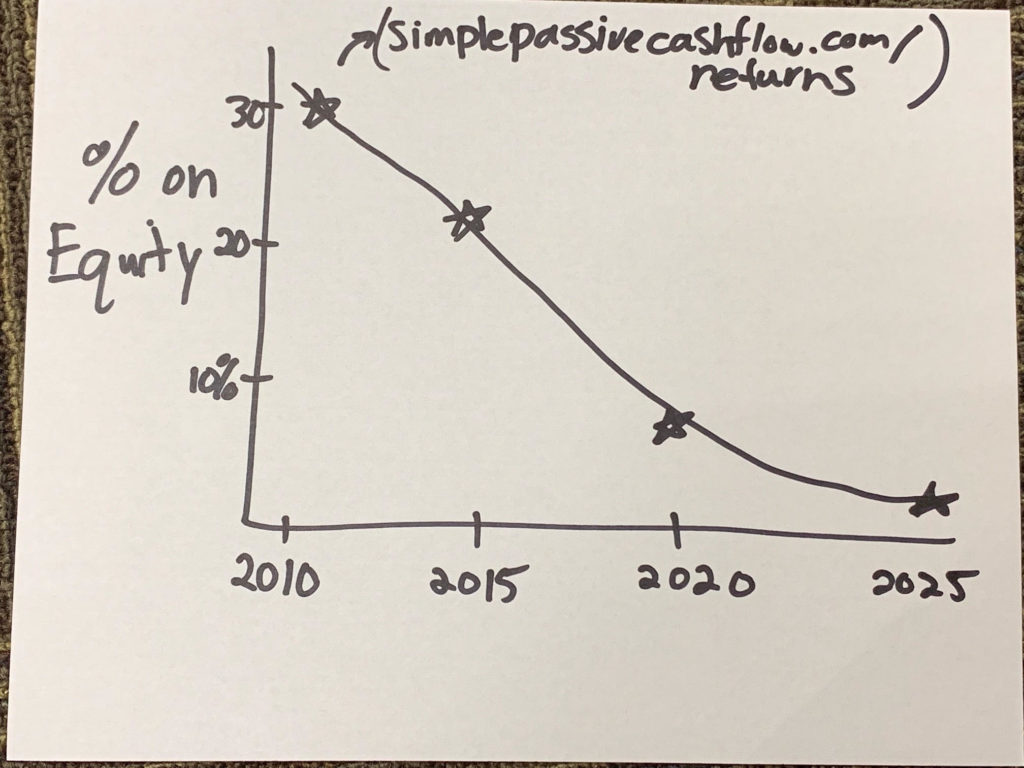

- Historically low-interest rates

- Historically high rent increases (not 8% anymore but still 2-4%)

- Historically low vacancies

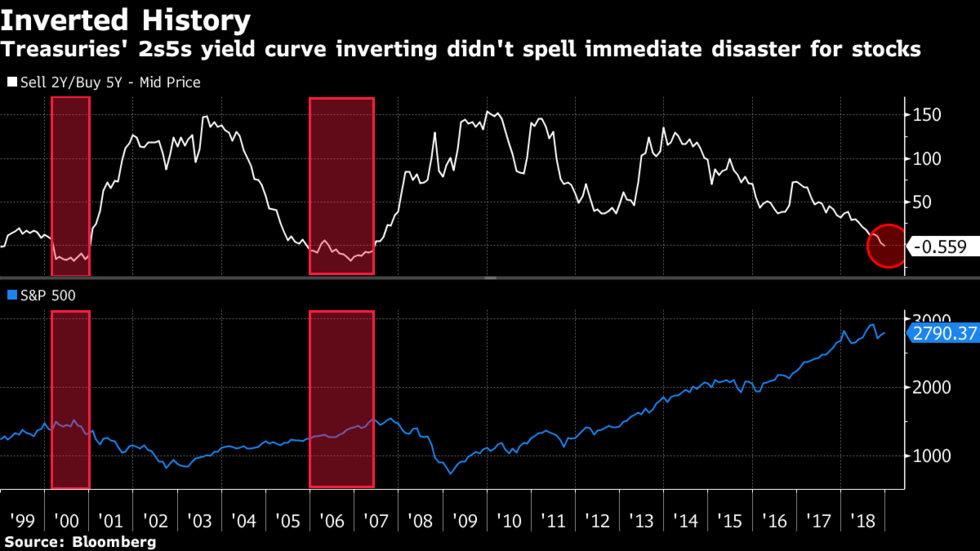

- 2 and 10 yield t curve. When that crosses you have just-a matter do time. Because its a measure of fear.

- Automation and AI – huge shifts in jobs. People need to work but technology has been increasing since the beginning of time.

- Wage growth

- Bankers prospective: how deals are getting funded and by who (institutional or dumb capital)

“The guy not investing right now and hoarding cash (with net worth of under $1M… because if you can live off your cashflow then cool you can do what you want) is just afraid and lacks deal flow. Its like the person who complains that there is nothing to do during the weekend in LA (insert city with a vibrant scene) when in actuality they don’t have any friends (lack dealflow)… and by the no one likes (has a bad attitude and that person who makes excuses”

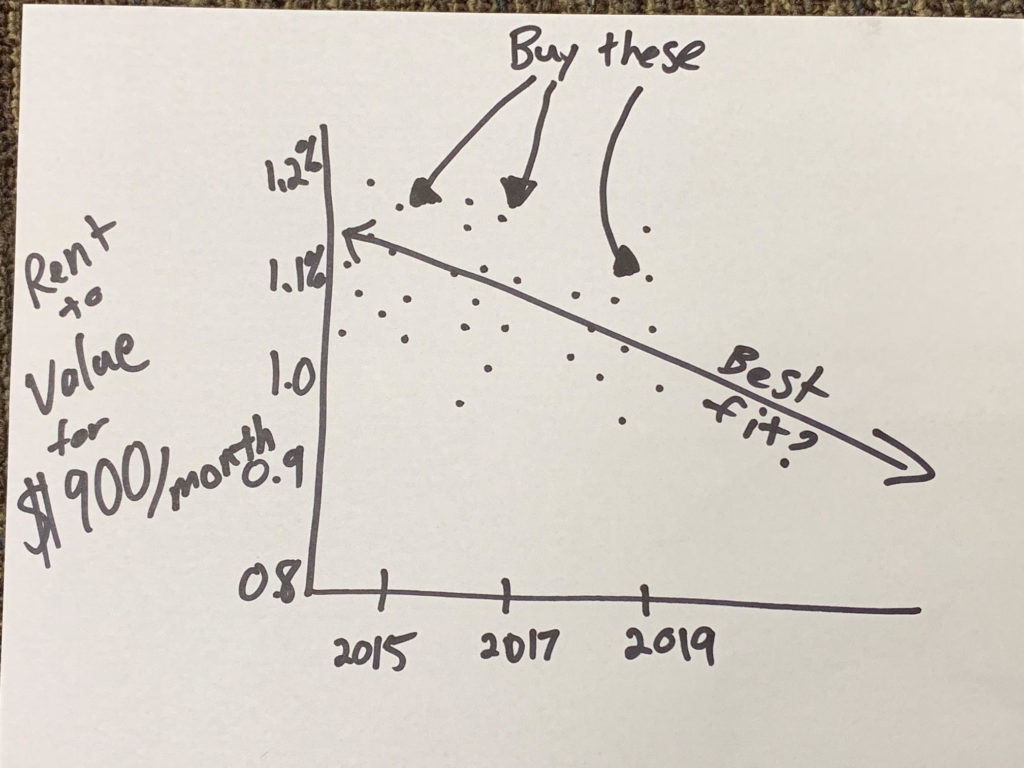

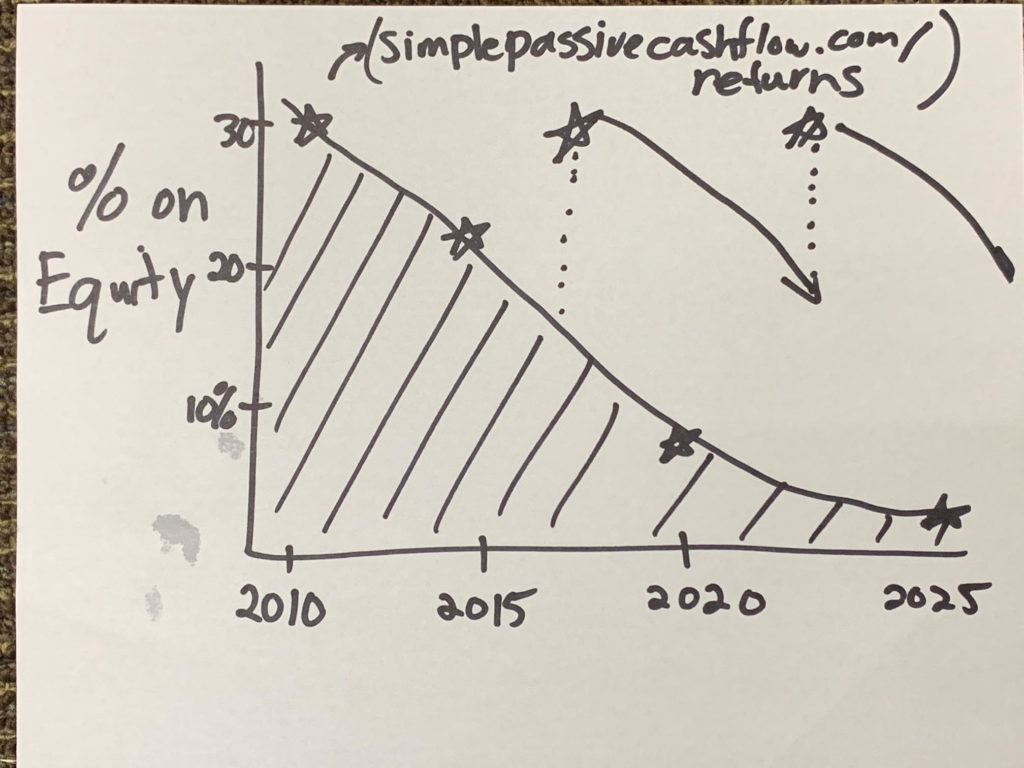

[Investors are chasing for decreasing yield these days] – REI.com – 19.03.4

[Sophisticated Investors know interest rates and caps go up and down together and their money is made in the delta between the two] – REI.com – 19.03.4

Of course, all the Pro-Apartment publications will say this: Get Ready: Recession-Proofing An Apartment Portfolio – National Apartment Association 19.03.7

But enough of this doom and gloom because most gurus out there call recession everyday just so they can have Tweetable content. And they make a living selling subcriptions to their $79/month newsletter. But we are better than the average investor! And understand that future softness could very well be slowdown before the next great bull market.

To join our Hui Deal Pipeline Club and stick with the group join below: