MFH is the obvious choice when it comes to jumping into syndications because it is the shorted logical leap for a single family home investor.

Here are some other reasons:

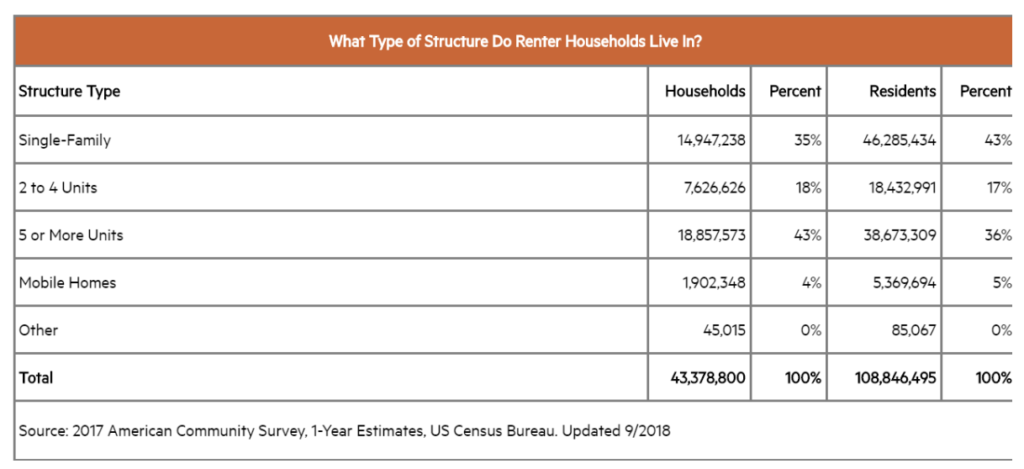

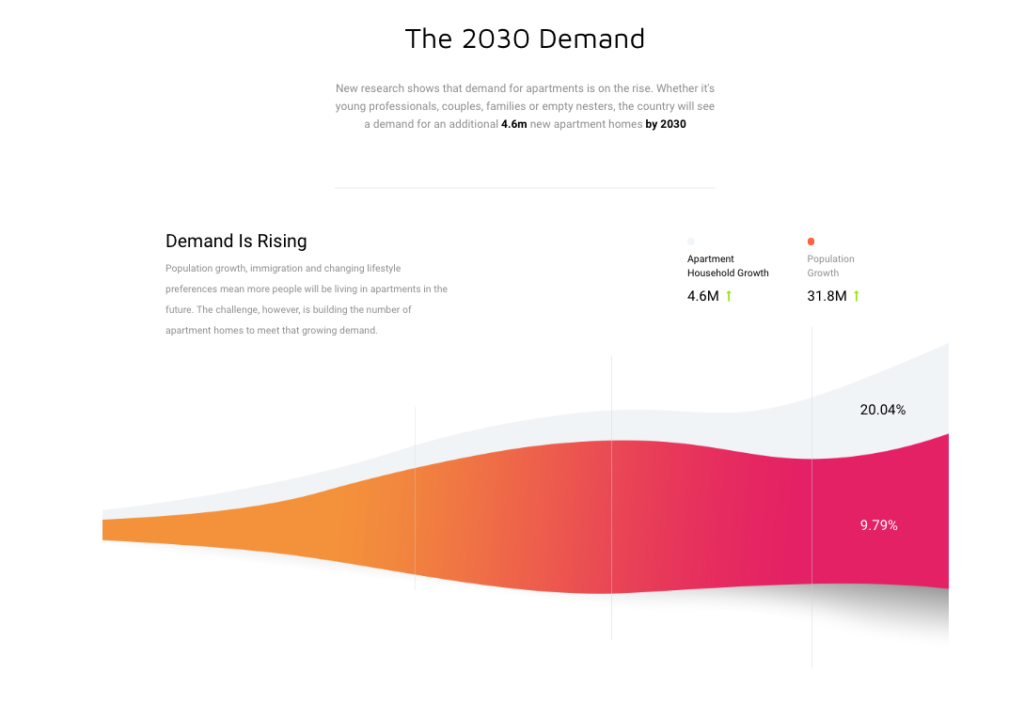

- We need more housing for class-C and class-B renters due to population increasing and rising interest rates

- Inflation favor hard assets

- We are no longer a buying nation we rent (think millennials)

[This is the millennial version… cause they can’t seem to afford (or want) to own anything]

- The government is trying their best to incentive investors – Follow the money people!

- 2018 tax changes with bonus depreciation make it better for projects like large apartments to get better tax treatment than ever before via a cost segregation.

-

The country needs 4.6m new apartments by 2030 (Source). We need more class C and B housing. Our country is becoming more like Asian Countries where the is a bigger divide in the wealth gap and need for low-income communities.

Market Indicators:

- Large employers or job growth

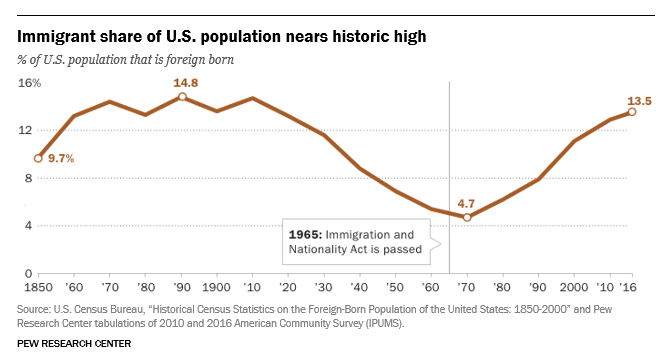

- Population increasing

- Rent increases

- Occupancy/Vacancy stabilized

Typical business plan (3D example here):

- 60+ units or more to get economies of scale and to have dedicated staff on site

- 1970-1980s Class B or C buildings

- Utilize Fannie Mae or Freddie Mac Non-Recourse debt with up to 12-year loan terms

- Buy right – rehab units with $2,000-8,000 per unit – reposition by improving operations and stabilizing rents for exit

- Property cashflows day one after purchase

- Re-brand (new signage and online presence)

Value-add:

- Poor existing property management

- Old tired units or leasing center

- Outdated amenities

- Creative improvements using best practices and technology

- Additional opportunity for extra income

Miscellaneous ideas for thought:

- 2010 to 2015 is the golden era of Multifamily. Many rents were going up 5-10% per year (average 2-3% in a good market).

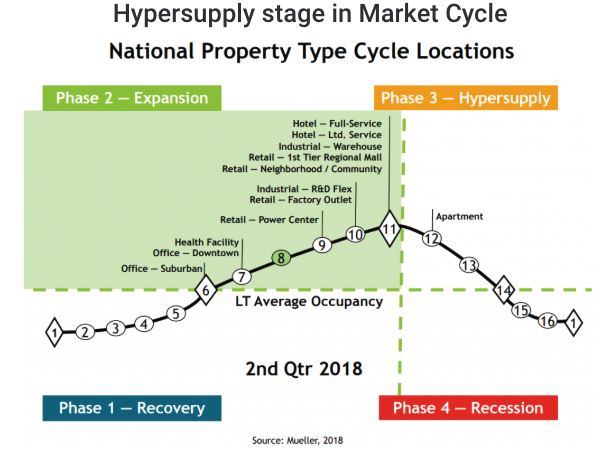

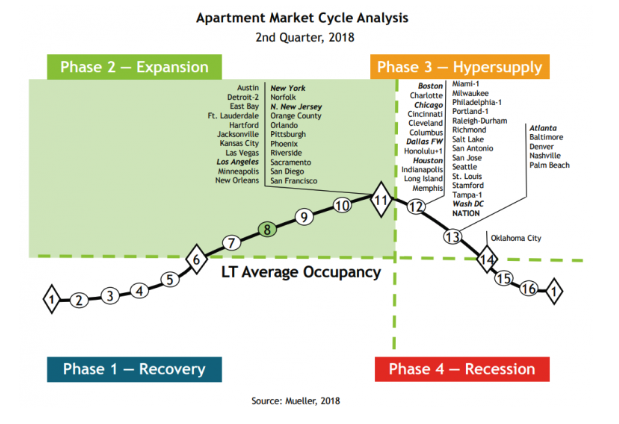

- The (Global/National) markets go in cycles, the sub-markets (physical locations) go in cycles (see below)

- Asset Classes go in cycles but hopefully, you are investing with the pros who transcend the high-level norm.

Lending

Unit Mix Discussion

When looking at the unit mix profile take notice of the mix of studio/efficiency units and 1,2,3 bedrooms. This can throw off your rent per square foot metric which is important when comparing comps. A sudio/1 bedrooms will have higher rent per square foot amounts however the tenants will be more transient.

The 2/3/4 bedroom units will yield lower revenue per square foot but will attract more of a family type renter and improve the intangible community aspect.

Headwinds

Millennials Leaving the Renter Pool?

Once they get married and have kids, they move out to the suburbs into a single-family house. 82% of couples between the ages of 25-39 married with 2 or more children live in a single-family home. The only difference today is that Millennials are getting married and having kids later in life so they stay in the renter pool longer. And the lack of affordable homes caused by the great recession of 2008 has delayed new builds to be created which creates more demand as population increases. New builds are really starting to come online.

The 73 million Americans aged 18 to 34 are beginning to cycle their way out of apartments and into homes. In fact, the net growth of 18-34-year-olds falls to zero by 2024.

Fun facts about new builds:

- 2009 and 2010, multifamily housing starts hit a low of about 100,000 per year.

- The 40-year historical average (1970-2010) is 355,000 starts per year.

- Multifamily housing starts gradually increased, peaking at 383,000 units in 2015. Production then declined modestly, to 381,000 in 2016 and 345,000 in 2017 but reverted to 354,000 in 2018.

- Annualized multifamily housing starts stood at 289,000 units in January 2019, up from 278,000 units in December 2018, but down from the one-month annualized peak of 435,000 in January 2018.

- Multifamily statistical models forecast about 401,000 average annualized starts in each of 2019 and 2020, 389,000 in 2021, and 390,000 in 2022, all of which are modestly above the 40-year historical average of 355,000 multifamily housing starts per year.

- The cumulative 17-year shortfall of multifamily housing starts (benchmarked against historical norms) peaked at over one million units in 2013 but is on a choppy decline, standing at 905,000 as of February 2019.

Zelman & Associates are forecasting multifamily starts to increase 3% year-over-year in 2019 and another 1% in 2020, as opposed to a decline which many researchers previously forecasted.

MFH is great but you need to be aware of new Class A apartments being built to put downward pressure on pricing – Source MHN

MFE 2-6-19 – 2018’s Record Deal Volume Suggests Positive Trajectory for 2019 – “driven in large part by increased interest in the student housing sector, which accounted for 17% of all deal activity in the third quarter, compared with a consistent 4% over the past 13 years” – [I don’t like student housing as I am seeing an education bubble with all the lending. It’s crazy how dorms get renovated every few years]

MFE 2-6-19 -Freddie Mac Sets Multifamily Production Record – “$78 billion in total production bests the company’s prior record of $73.2 billion set in 2017. Overall, the company financed more than 860,000 rental units, more than 90% of which are considered affordable to low- and moderate-income families making 120% of area median income (AMI) and below.” – [More more more!!!]

Past performance is no indicator of future success. Many operators in Dallas 2012-2014 were able to double investors money in just a year or two – come to find out they only implemented 20% of the rehab. It was mostly market appreciation which is out of our control and can bail out a bad operator.

Dallas Growth 2010-2018 +projections Co-star 19.02.7

Multifamily Investing Lingo

Real Estate terms:

- Pretty simple if you understand the way to utilize them and how they play together in real estate transactions

- Applies a lot in larger transactions (multifamily), but can be applied as well in smaller (single family) transactions

Income (types):

- Different ways you can make money on a property

- Rent – not what is on the contract, but what the market would yield for the space that you have

- Other Income

- Pet Fees

- Laundry

- Reserve Parking

- Late Fees

Gross Market Rent:

- Sum of all the different types of income you can earn from the property

Deductions that can be taken from the Income types (can also be called Efficiency deductions):

(Loss to) Lease:

- Loss of income based on the market value of the property minus the amount you are renting the property for

- Example: You have a property you are renting out at $750/month. The current market value of the property is actually $825/month (based on listings in Craigslist, etc.) You have a $75 Loss to Lease per month on that property

- This is money that will never be gained, as the market changes so much

- This has to be factored in when looking at properties, and you should constantly monitor the market you’re in to see what kind of Loss to Lease you’re taking on

(Loss to) Vacancy:

- Especially on bigger properties – you will never have it leased all the time

- Normally, there is a week or two of vacancy, sometimes more (up to a month or even longer) between tenants

- A lot of people like to estimate 5% loss due to vacancy, but should be considered more scientifically than just stating a number. For example, if it’s a single family home, you’ll want to factor in at least one month’s rent, which would be equivalent to 8%. If it’s a duplex you’ll want to factor in one month’s rent for your most expensive unit. The more units you have, the more you can expect that vacancy rate to go down. But be conservative when you’re writing up a deal – the smaller the deal, the higher your vacancy rate. So start at 10 if it’s a one or two unit deal, and then drop accordingly.

(Loss to) Collections:

- Isn’t just money you will be getting back from tenants who are late on payments

- Includes loss of money from tenants who move out and are not able to pay their balance

- You need to factor it on your own in the market you are in and what the economy you are dealing in is

- Example: If you are dealing in C or D type neighborhood, you will have to factor in [Loss to] Collections. If you’re in a B or A type neighborhood, then you can lower Collections down to zero and assume the loss will just come out of Vacancy

Physical Occupancy vs. Economic Occupancy in Apartment Investing:

Note this is mostly used as an example of what LP’s should be aware of. In most cases LP’s either know too little for example they just look at the Pro-Forma returns and don’t look at the assumptions that the operator used to get there. Or they spend so much time evaluating things that have little impact to the numbers for example running away when they hear of minor foundation issues or rodents that can be remediated with a few thousand dollars of seller concessions. In the Passive Investor Accelerator & Mastermind we try to focus on what is really important but obviously that is not free (but going into a bad deal is costly too). Vacancy in apartments decreases top line income and getting occupancy as high as possible is the goal. There are two different types in apartment investing 1)

Physical Occupancy and 2) Economic Occupancy. Physical occupancy (number of units that have a tenant with a signed lease, occupying a unit) is what most people are familiar with in apartment investing and what is often overlooked when a passive investor reviews the underwriting assumptions of a syndicator. This is shown on the rent roll with the tenants name next to the unit number which also needs to by physically audited with boots on the ground verification. Physical occupancy is a percentage calculated by dividing the number of occupied units by the total number of units for example a 100 unit apartment with 8 units vacant has a physical occupancy is 92% (92 ÷ 100).

Pay attention here… if a rent roll shows a unit is occupied, doesn’t necessary mean it’s also generating income. A tenant might be a deadbeat or the nice way of putting it there might be “loss to lease.”

Economic occupancy is the amount of money of actual rents received as related to the occupancy. This also takes into account tenants who don’t pay the full rent and also things like concessions ($200 move in specials, discounts to motivate tenant prospects). This is the net rents received (not including other income). The net income will deduct for bad debts/loss to lease. The economic occupancy is calculated by dividing net rent received by the gross rents possible.

On the same 100 unit apartment, assume each unit rents for $1000/mo. There’s a gross potential of $1,200,000/year (100 units x $1000 = $100,000/mo x 12 = $1,200,000/year). Using the same physical example say there are an additional 10 deadbeats (that the previous seller stuffed in there right before the sale) and 10 people only able to pay half the rent… then you are looking at an economic occupancy of 75%.

This might be a little too much info for a LP but Economic occupancy can be a sign of the following:

Bad Management and bad collection practices

Bad tenant qualification practices

PM stealing money

Bad rent collection practices

Lack of maintenance, causing tenants to leave

Or a clear sign of opportunity!

Effective Gross Income (EGI):

- Gross Market Rent minus whatever loss will come out during operations (Efficiency deductions)

- Real money that comes in through the property

- From your EGI, you will still need to deduct your expenses (listed below)

Expenses:

- Insurance

- Professional Services – Leasing commissions and/or other professional services you bring in (legal, accounting fees, etc.). If you’re an LLC, you will need to put in your budget the cost (tax) for the LLC every year ($400 – $500), IRS

- Regular Maintenance (landscaping, snow removal, heater service, pest control, touch-ups and minor renovations on unit before tenant moves in, fixes like clogged-up toilets, etc.)

- Rule of thumb for Regular Maintenance: Brokers will place it 3% of your EGI, but is more effective to think it as dollars per unit.

- Example: If property is something you bought, did a full renovation on, put tenants in, and then got it refinanced (BRRRR – Buy Rehab Rent Refinance Repeat), your maintenance should be lower because you’ve done everything and should be able to call for a warranty call at the very beginning if it’s something the contractor who did the work on your property didn’t do. If you’re very good at turning these properties over, then you should have very little maintenance going in

- If it’s a newer rental, could be anywhere from $300 – $400 every year

- If it’s something you’re inheriting (inheriting maintenance issues as property already has current tenants and will need to deal with it as you go), you will want to go with higher maintenance numbers: $700 – $900 per unit per year

- Will really depend on how much you project it to be (check out the property thoroughly, and/or if there are existing tenants, ask them what are the maintenance issues) as it can really kill or make you a lot of money on your deal.

- Property Management Fee – 6%

- Property Management means looking after the property and make sure operations is running smoothly

- If you are managing the property, you will want to put that in your own pocket

- Asset Management Fee – 2%

- If you are hiring a Property Manager, you will also need to hire an Asset Manager, or you can be the Asset Manager and that money will also go into your own pocket

- Fee of managing the Property Manager

- Asset Manager will be the one to pay mortgage, ensure real estate taxes are being paid, monitor the markets and ensure that the right rents are being charged, will also have veto power to veto work orders that might come up that you don’t want to have done because they’re too expensive, etc.

- Asset Manager is also there to look at the real value of return on the asset

- Utilities

- Everything from heat, water, sewer, even CCTV systems, phone lines

- You will want to look at the prior owner’s expenses for utilities were (around 18 months’ worth), or look to see what the market or other people are paying

- Make a good guesstimate on what your utility projections are going to be and go from there

- Real Estate Taxes

(Above the) Line:

- Term sometimes used by brokers when grouping Gross Market Rent, Efficiency deductions, EGI and Expenses (everything that gets deducted out to determine the profitability of the deal)

- Note: I don’t really talk in terms of Cap rates because you can manipulate the “above the line” assumptions to get whatever you want

Net Operating Income (NOI):

- EGI minus all the expenses that can be deducted from it

- Does not include mortgage payments or Debt Service (money you have to borrow to buy the property)

Classes:

Class A

- Built in last decade and are more luxury

- Struggle in recessions as white-collar workers drop back to Class B Assets

- People are jogging around at night

Class B

- Generally 10-25 years old

- Younger white-collar and blue-collar residents

- Cap rates are higher than Class A and lower than Class C

- Females not advised to take that evening jog around the block

- 1970-1985 built

- Mix of blue-collar to lower, single mothers etc

- Good cashflow but comes with issues that property management must keep in check

- In a recession, a lot of B and A class renters fall back to Class C

- Its ok during the day but personally I would not want to be there at night

- There is crime but you want to look for minimal violence/homicide

- 1960s and older

- Generally Section 8, government-subsidized residents such as LURA, LURK with rent restrictions

- You don’t even want to get out of the car to walk around during the day

- High crime area, security needed

- Can be amazing rewards for taking on this risk

Capital Expenditures (Cap Ex):

- Also usually referred to as Below the Line expenditure but is also sometimes considered as Above the Line, depending on whether you are selling or buying a property

- Long-term improvements to your building/ property

- Major renovations to bring unit/ property up to market standard (replacing the roof, replacing the furnace, full renovation on a unit)

- Any expense that will add long-term value to your building

- You will need to set aside money for this (Cap Ex Reserve)

- Not taxable as it is just money you are earning but will be setting aside in a savings account

CAP Rate:

- NOI divided by the price you’re buying the property for

- Determines the money that the property will give you

- Example:

- If NOI is $100k and the price of the property was $1 million, then CAP Rate would be 10%

- Intended to be used when valuing buildings (especially commercial real estate)

Cash Flow (CF):

- NOI minus Debt Service

- Also determines your Return on Investment (ROI) on the property

Debt Services Covered Ratio (DSCR):

- Looked at by the banks

- How many times the deal can cover the Debt Service

- Calculation: NOI divided by debt service

- Most banks will want to see a DSCR above 1.25%, you will want to see a DSCR of above 1.5% to get a higher ROI

Green Credits:

- Breaks in your interest rates for employing energy saving means

- Full report

FAQ:

What about popcorn ceilings and asbestos?

Many buildings have asbestos from the 1960-1970s. We have a binder in each office that shows how to handle different situations should the asbestos be exposed. All the managers go through training as well. As long as we don’t disturb the drywall than it’s safe. This is consistent with how many organizations do things outside of real estate… I know because I am a facilities Engineer as a day job.

How can you increase the value (increase income or decrease expenses)?

- Application Fees

- Late Fee

- Pet Rent

- Early Termination

- Month to Month Fee

- Lapse in Renters Insurance Fee

- Redecoration Fees

- Resident Discount Program (This seems counter-intuitive unless we’re at CostCo.)

- Marketing Coordination Fee (to pay for social media at the property)

- Eviction Holdoff Fee (You can’t pay, so we’re going to charge you not to kick you out)

- “We also have community gardens which we charge for”

- Sell/rent moving boxes to new residents.

- Refer business to moving services. Place an affiliate link on your website and new resident welcome emails.

- Install an automated Stockwell or vending machines.

- Sell laundry/cleaning supplies.

- Sell cleaning services.

- Offer dog walking/dry cleaning pickup services.

- Offer a steam cleaner, power washer, or other useful tools for rent by residents.

- Place native ads/sponsored posts from relevant local/lifestyle businesses on your community blog.

- Offer furniture rental packages.

- Sell ads on the digital signs in your leasing office/elevator lobby/parking garage.

- Create moving kits with tape, boxes, packaging, etc. Sell them from your website, or build a set of items you can resell through Amazon. One-click buy and move!

- Shared sponsored posts from local businesses on your property Instagram account.

- Upsell garages, bike lockers and/or storage space.

- Upsell smart home technology packages.

- Offer RentPlus to help residents build long-term credit. They charge a small fee to the resident, you get a cut.

- Rent rooftop space to cellular providers.

- Place Google banner ads on your blog.

- Install solar panels. Sell excess energy back to the local electric provider.

- Sell featured space in your resident loyalty app to local businesses.

- Sell renters insurance to new residents.

- Offer interior design consulting through Havenly. Make affiliate income when your renters buy goods and services through the app.

- Buy cable and Internet services in bulk at wholesale rates. Resell them to residents at a discount and make money off the markup.

- Host resident events. Partner with brands who are willing to pay to get in front of your renters as a target audience. (There are lots of them out there.)

- Publish a resident newsletter (print or digital). Sell ad/editorial space to local businesses.

- Rent space to Amazon so they have a place to put their lockers.

- Offer move-in upgrades: electronics setup, upgraded thermostat, priority parking/access to loading dock/elevators, moving assistants.

- Turn your move-in gift into a subscription box trial. Make money when new renters upgrade to an ongoing subscription.

- Host “premium” resident events that get people excited. Charge a small admission fee. Open them to the public and charge more for non-residents.

- Sell the furniture and items you showcase in your model. Partner with Wayfair, West Elm, or a local furniture store on this.

- Sign up for Amazon Associates (or any other affiliate marketing network). Create timely gift/necessity guides (Mother’s Day, spring cleaning, back to school) that are relevant to your residents.

- Open your community business center to local coworkers. Charge an hourly/daily fee for use of the space and services. Make it free or significantly discounted for residents. Provide coffee.

- Rent out space in your common areas to a small food/beverage retailer. Craft cold brew coffee, anyone?

- Open your property to short-term/corporate rentals.

Resources:

Reports for your digest:

18.11.15 – 3Q18_US_Multifamily_Capital_Markets_Report

18.11.18 – Yardi Monthy Report