When Should You Not Invest in Syndications?

If your net worth, income minus expenses is under $300,000, or you’re barely able to save $30,000, look, syndications are not for you stick with these turnkey rentals or even do these BRRRS that we’re kind of against in this whole video. And you’re going to have a little more gains that way. What you’re […]

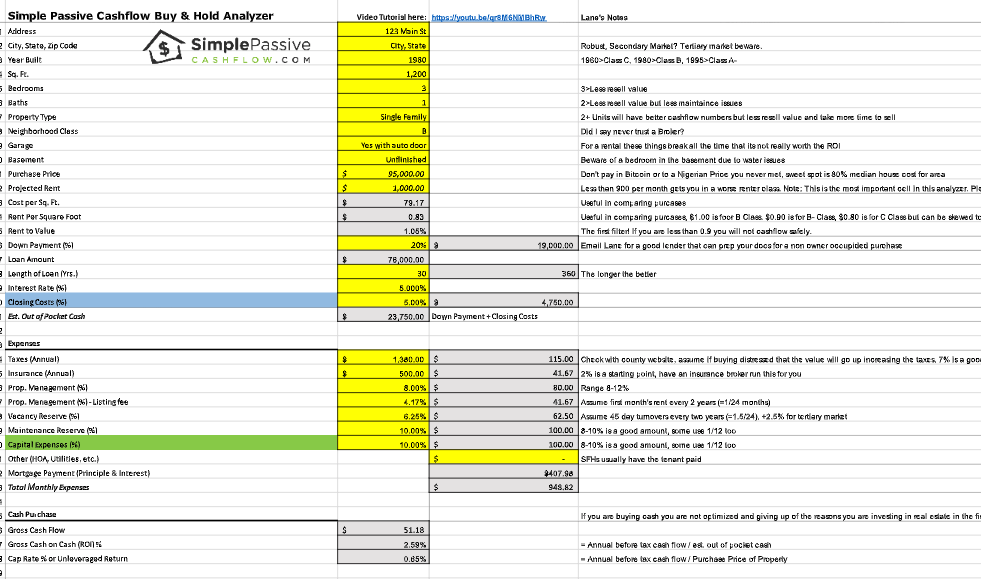

Tips for Getting Your First Remote Rental

If you haven’t checked out the strategy where people are using their key logs to use simple interests, as opposed to average horizon interests, go and check this strategy out@simplepassivecashflow.com/heloc to learn more now, fair warning. It works and it pays down your mortgage in a fraction of the time. But paying down debt is […]

Do THIS When Selling a Property That is Also Your Home Office

So, if you did use a home office in your home, exclusively for business, and then you don’t want to have to face the capital gains consequences, when you sell, you would need to stop using that home office for business purposes for at least two years. How did they get around? Like, I mean, […]

Can You Extract Depreciation From Your Primary Residence?

Can you cost segregate out and aggressively extract the depreciation on a primary residence that you want to live in. Let’s talk a little bit about that, that you cannot do. You’re not allowed to depreciate your own call. The exception to that would be if you’ve got certain areas that are used exclusively for […]

Do it Yourself Cost Segregations w/ Bill Smith

Hey Simplepassivecashflow listeners. Today, we have Bill Smith here who is going to tell us all about the, do it yourself, cost segregation. For those of you guys who own single family homes or rental properties on your own, this can be a great cost effective means for doing a cost segregation, but hey Bill […]

Is a Cost Segregation Worth it on a Single Family Home?

How much does it cost segregation cost? It doesn’t make sense to do it on a smaller property, or is there a certain rule of thumb that you have. In general. It’s hard to say if there’s an exact rule of thumb, but I have done studies on single family dwellings that were purchased for […]

Getting Your First Rental Property

Tired of the steep tax you’re paying, as a professional, and you want more cashflow in which you can benefit from? Or you’re thinking of diversifying your investments and plan to try real estate investing? Imagine if you can rapidly jump into being a passive investor. Focusing on what others failed to do that if […]

Return on Equity Calc Download Page

This is Your…. Journey to Simple Passive Cashflow! Check out the past deals, future ones, and get access to our “investor resources” share drive: More Goodies & Join Private Investor Club Download ROE Calc Here https://youtu.be/tAParC-gwro

Renting vs. Buying a Home: The Largest Inhibitor to Financial Freedom

Buying vs Renting a Home The Biggest Money Mistake That Will Affect YOUR Financial Future! Run the numbers yourself! Download the spreadsheet! First Name* Email* What you are looking for?* Newbie – Looking to getting started with 1-4 Unit Residential Intermediate/Expert – Want to learn about scaling and syndication Submit to Download Don’t make this […]

Renting vs. Buying a Home: The Largest Inhibitor to Financial Freedom

Buying vs Renting a Home The Biggest Money Mistake That Will Affect YOUR Financial Future! Run the numbers yourself! Download the spreadsheet! First Name* Email* What you are looking for?* Newbie – Looking to getting started with 1-4 Unit Residential Intermediate/Expert – Want to learn about scaling and syndication Submit to Download Don’t make this […]