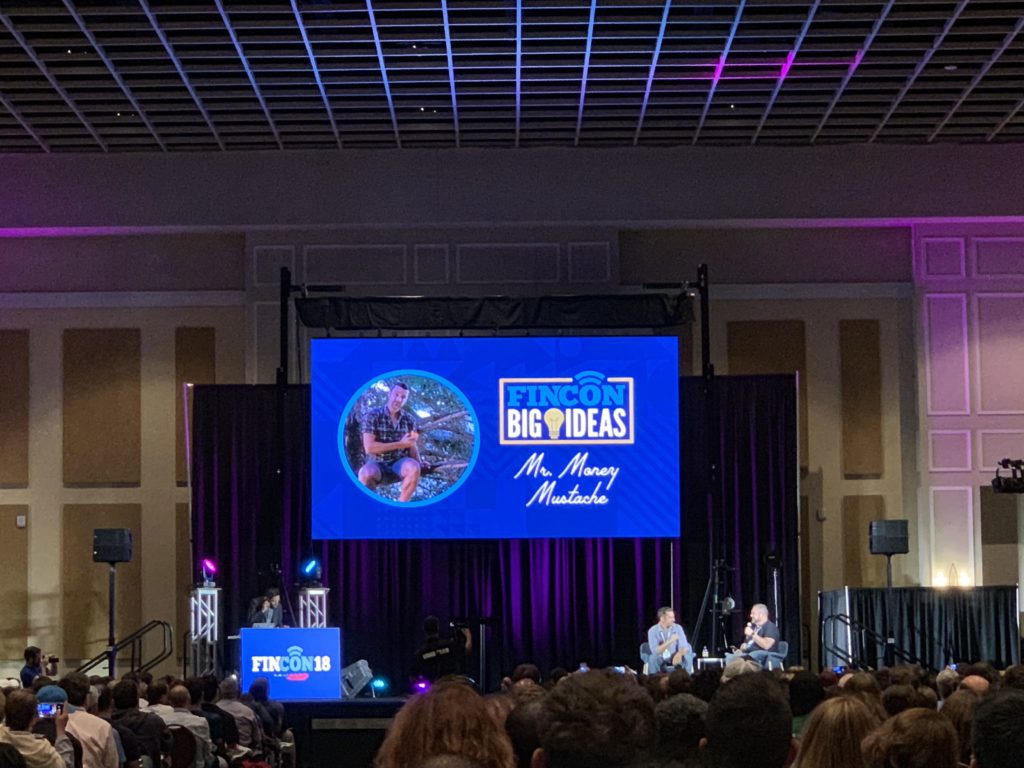

Just got back from FinCon2018!

What’s that?

A pretty impressive event. Its where 2000 financial bloggers, you-tubers, and podcasts this year gathered around all this money.

In 2006, I started reading financial blogs. Sole of my favorite was getrichslowly, Wallet Hacks, and of course mr money mustache. FinCon started in 2011 with just a couple hundred people.

Real estate investing is a minority. 95% of people are debt adverse and about the 4% rule. Buying cash so so debt. Living small is selfish? Make 150k a year and retire when you are 35…

The Millionaire Next Door book is not the type of lifestyle I would like to live.

https://www.youtube.com/watch?time_continue=17&v=kD8uNm5ck0QA lot of financial advisors which I don’t really like.

I am cool with how it is enough to be happy and content.

Other Findings:

New investment account that incorporates mobile interfaces and suto-AI. Mint app has click to invest and banking apps have click to refi. It’s a little dangerous.

A cool 5% instant liquidity online savings bank that invests in inventory loans. Let me know and I can connect you with that as I try to do more due diligence on my own.

Liberty health share – religious-based health insurance

Side gigs – consistent theme from high performing growth mindset W2 employees who are not getting fulfillment at their bureaucratic day jobs.

Interviews to follow in video…