Download Buy & Hold Rental Property Analyzer & Video Walkthrough

Buying Your Next Rental (and Financial Freedom Journey) Starts Here! Step 1: Knowing your Numbers Spreadsheet download for Hui Deal Pipeline Club members. The Hui Deal Pipeline Club is a free investor club where I filter investments and underwrite the numbers and partners myself. Unlike other investor lists and groups, my investors have personal access […]

Dec 2019 – Borrowing Standards – Rental Income

For all you investors still looking to get your own turnkey rentals or direct ownership deals there are some recent changes as of December 2019 on borrowing standards as it relates to how FNMA and FHLMC are looking at using rental income for qualifying. Basically, if you own/rent currently and have a year history, lenders […]

My last rental!

More to come… Reluctant BRRSS in Alabama Here we go! Buy-Rent-Rehab-Sell for Syndications

My turnkeys for sale – 2019

Update 1/2/2019… Thank you for your preliminary inquiry. Please submit to me a signed and scanned, Letter of Intent with your Highest and Best Offer. And the name of your property inspector so we can coordinate a showing. I don’t really have an asking price cause I’m too busy to figure it out. Go ahead an […]

136 – Changes in the Residential Lending World with Graham Parham

YouTube Link: https://youtu.be/AT6x3ViRPos Article Link: Text “simple” to 314-665-1767 to download the Hui Google Drive files and the 2018 Rental Property Analyzer For a free electronic version of my bestselling book in 12+ categories text the word “ebook” to 587-317-6099. Please help the show by leaving a review: http://getpodcast.reviews/id/1118795347 Join the Hui Deal Pipeline Club! […]

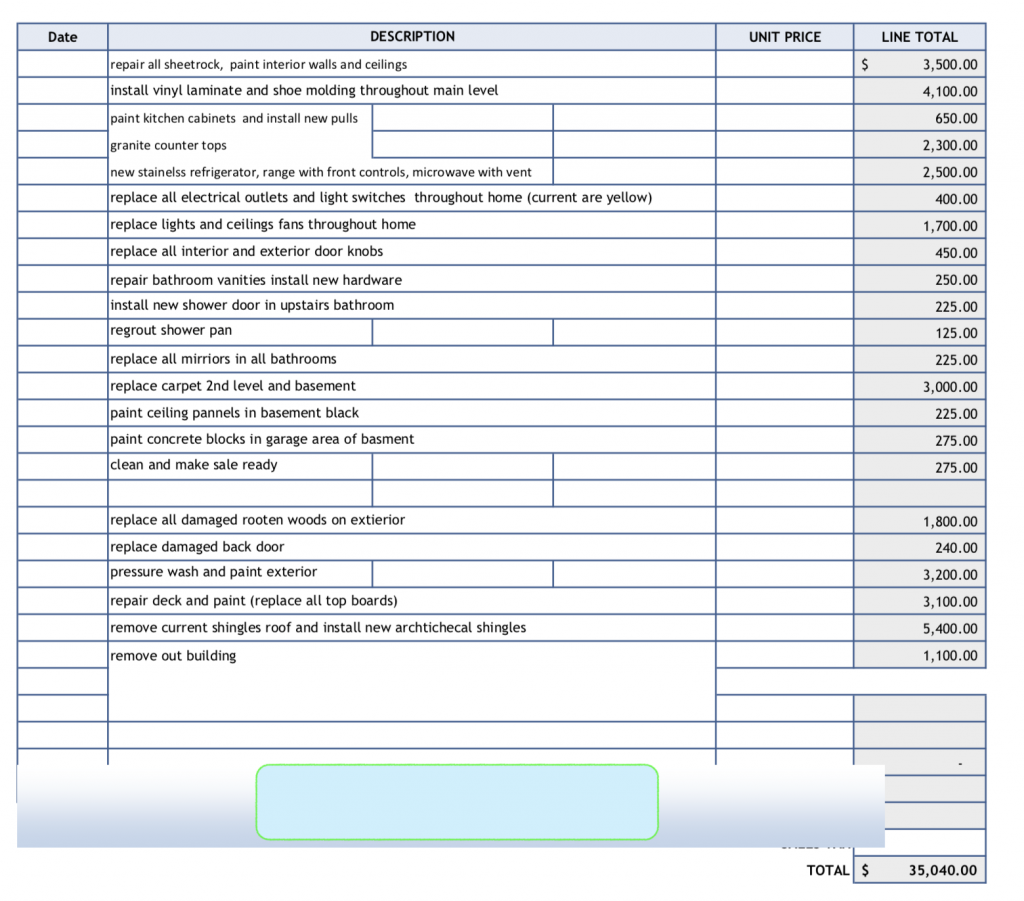

Sample Inspection report

I would say this is a bad report because it’s not Prescriptive. It is very important to have a chat with your inspector so they know it’s not going to be a warm and fuzzy home to live in but a rental property. They will need to avoid citing nitpicky things because the seller is […]

126 – Gino Barbaro talks Apartment Investing

YouTube Link: https://youtu.be/lvd9F9OmDI0? sub_confirmation 1 Article Link: Text “simple” to 314-665-1767 to download the Hui Google Drive files and the 2018 Rental Property Analyzer For a free electronic version of my bestselling book in 12+ categories text the word “ebook” to 587-317-6099. Please help the show by leaving a review: http://getpodcast.reviews/id/1118795347 Join the Hui Deal […]

Info on using retirement funds for deals

Question: I am considering investing in a 506c investment on a multifamily property. They are raising a 1 million from investors, then getting a loan and making improvements to the property and repositioning it over 5-7 years. I wanted to use my funds from my SEP IRA which is currently in a qualified intermediary trust. […]

The Journey to Simple Passive Cashflow

/book-club-tax-free-wealth/ beta group coaching program.

Apartment Video Walk-Throughs on YouTube Channel

Check out all the videos on our YouTube channel. Subscribe to get the latest and hidden videos. Des Moines, Iowa – 52-unit C+ Class Apartment (April 2018) – Video San Antonio, TX – 192-Unit Class B+ MFH (March 2018) – https://youtu.be/-5h2GKZ3I58 San Antonio, TX – 253-Unit Class B+ MFH (March 2018) – https://youtu.be/vj8ZMteppfg Oklahoma City, OK […]