Tax, death, and change are constants. Nobody can alter that! What counts most is how you can mitigate its effects, to live the good life you deserve.

Introduction

The tax code is written in such a way where only the first few pages of the tax code explain the tax rates. The remaining thousands and thousands of pages explain how the government will incentivize you for government stimulus activities. It is where you can get tax breaks for them.

If the government takes out these tax breaks, then it would remove the incentive for the so-called rich (leaders) in creating business and jobs, provide housing, oil, gas, food, or any government stimulus needed.

The government give huge tax incentives for those who invest in our country.

Take the hint and learn to work the system!

Talking the talk to get all you can out of your CPA

(although most of our Hui members fire their current CPA)

Tax Resources

For Simple Passive Cashflow Hui Deal Pipeline Members, book a complimentary session to the CPA/Legal team I use!

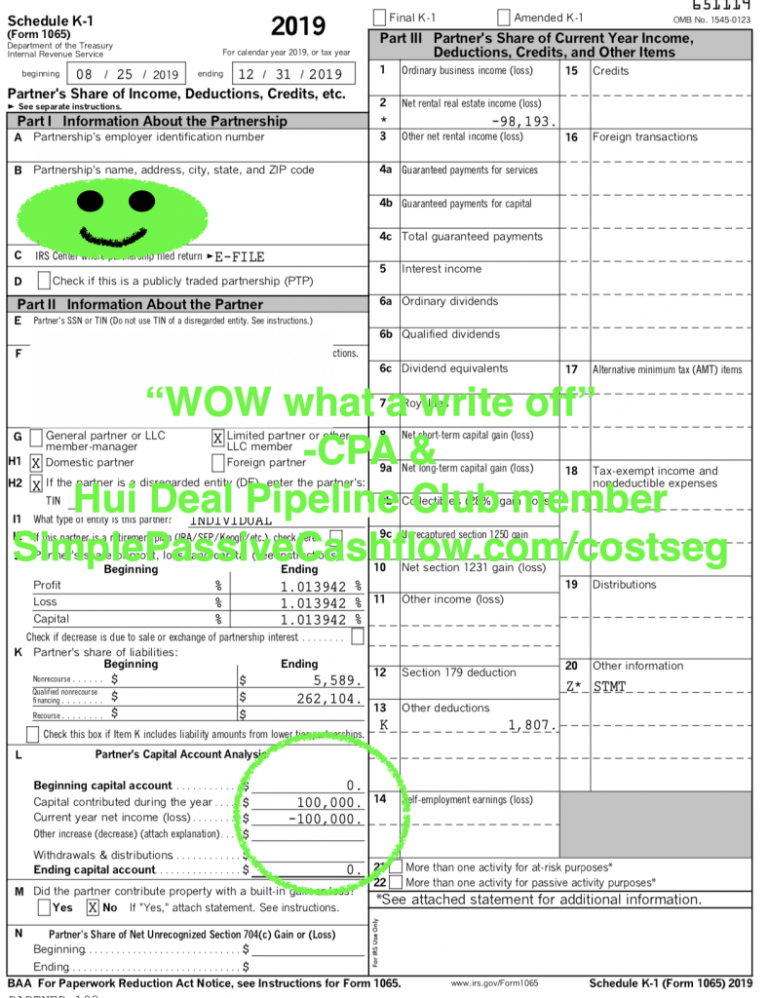

Cost segregations are the primary way we get passive losses via depreciating out assets.

Resources from 2020-2021

Tax Tips and Best Practices

Warning: Don’t be greedy when using the knowledge below.

This is just one book and opinion.

I take a lot of inputs from books and personal advisors.

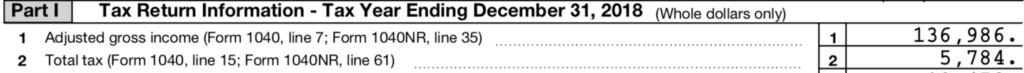

For people in FOOM (accredited and semi high income) I think as a general rule everyone should be looking to drive their AGI (married filled jointly) to ~200k which is a little more aggressive than 340k as I had once said as a good starting point. A second reason is to decrease your Long-term capital gains down from 20% => 10% => 0% which is possible if you focus on driving your AGI down. Using an analogy from diet/health… as you loose weight your biomarkers and body stress does down making it easier to exercise and continue to make positive progress. Many ways to lower your AGI and I encourage you to join our Family Office Ohana Mastermind for individual assistance on your personal situation. Or join our investor club here to start down the path.

Note:

Please don’t send me hate mail.

I’m here to educate hard working professionals on how to use the tax system in their favor.

The tax code incentivizes investors like us to invest money into projects that add value to society. If we do not then that is how they ding most people with taxes.

Too many people are hoarding equity in their home/rental or worse the bank and are not doing their part to stimulate the economy.

Again, this is where the government is saying they need to help out and pay taxes (via progressive tax bracket system).

What’s inspiring about investors is that we take the risk to move the country forward and are rewarded for doing so. 🇺🇸

Comprehensive outlook of your situation from a legal asset protection perspective and tax savings and financial planning perspectives.

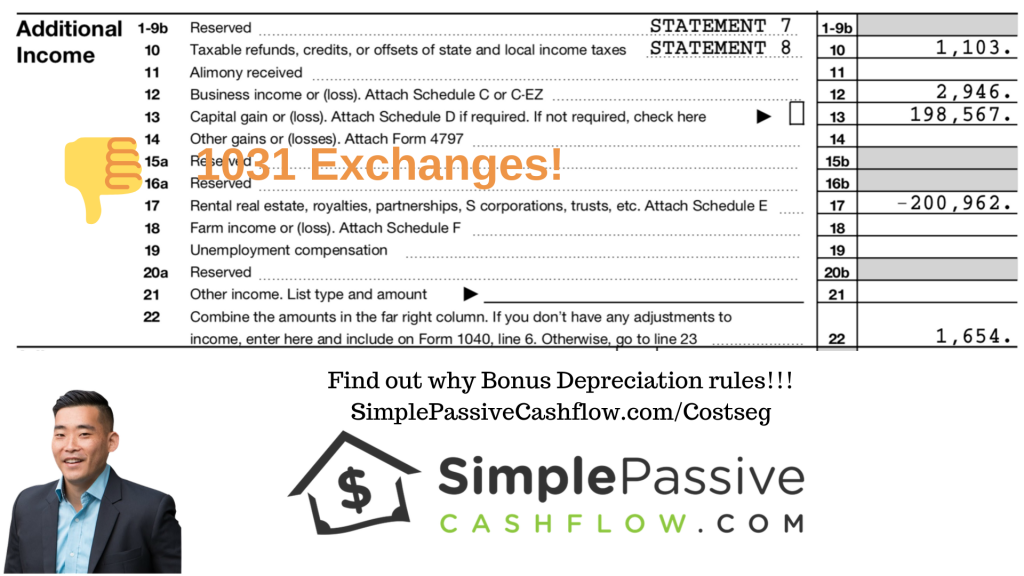

Bonus Depreciation has made 1031 Exchanges obsolete!

Follow REAL EXPERTS advise!

If you want the insider secrets and the network of pure passive investors.

Join our Family Office Ohana Mastermind

A lot of good ideas!

A tax write off for my business and fighting off the mosquitos at the same time!

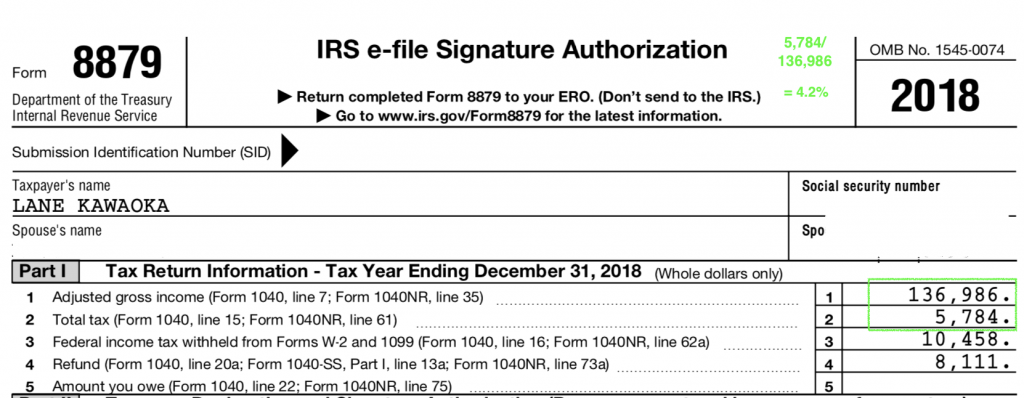

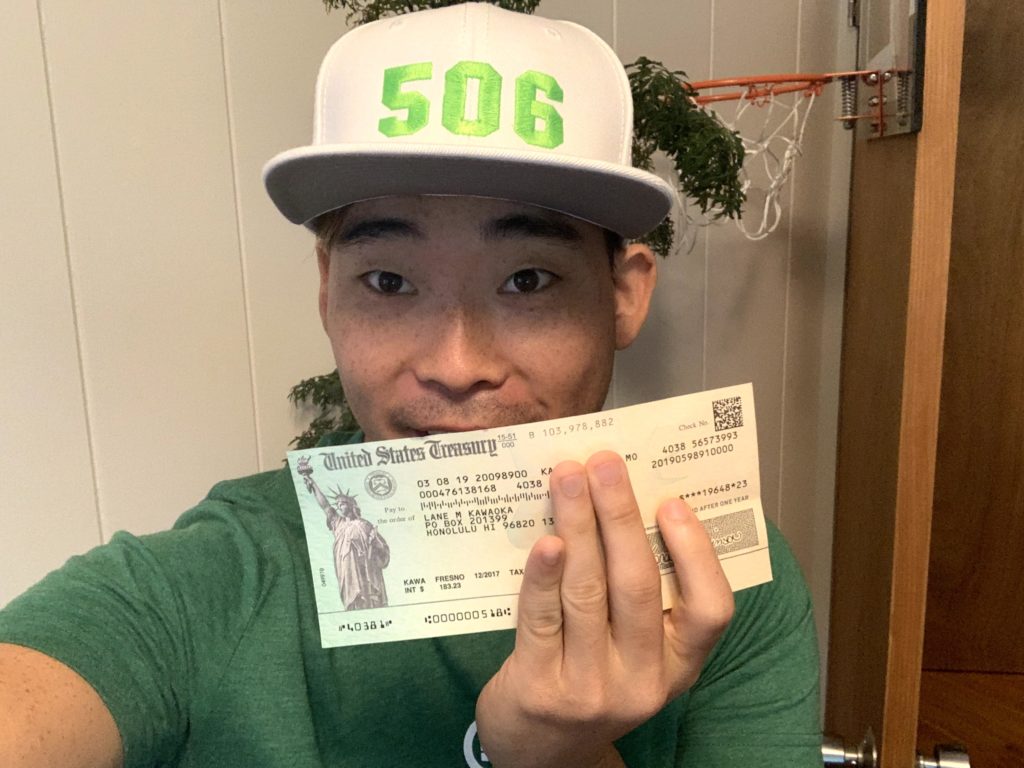

Paid only 4% taxes in 2018!

All because of the passive losses that real estate gave me.

2020 TAX CHANGES

How to Fill Out the New W4 Tax Form in 2020 & Should I extend?

For most of investors, it’s advisable to delay filling as much as you can so you can take note of whatever changes the congress makes.

In March 2020, the $2T CARES Act bought new guidance about being able to go back to the past tax return to amend based for bonus depreciation and other losses. More info. If your CPA looks confused or annoyed about addressing this you might need a new CPA. Let me know if you are looking for a referral.

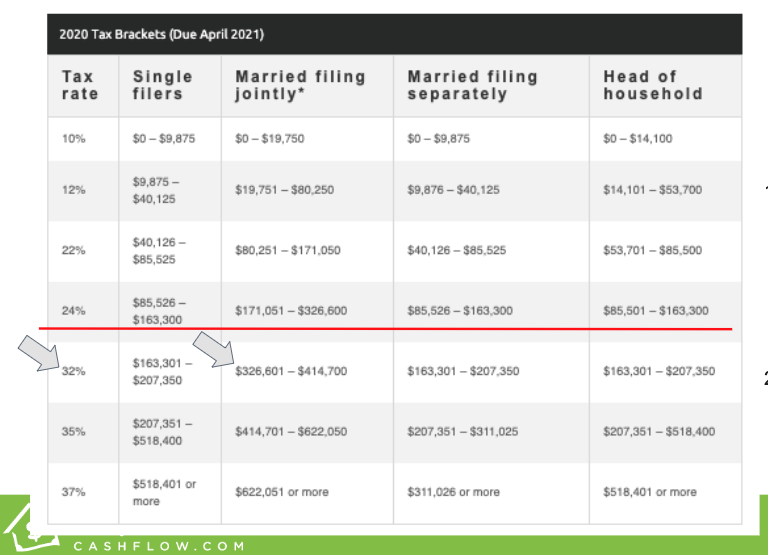

2020 Tax Brackets

NOTE: You need to understand where you fall in terms of Adjusted Gross Income (AGI) – there is a big jump from the 24% to 32% level highlighted with a red line. Those making over $326K (2020 tax year) need to be wary of taking out retirement funds or realizing taxable gains if it bumps you up over the red line. It may make sense because ideally the investments you are going into are making way more money but it is a reason why clients take the Family Office Consulting Services to make a holistic plan.

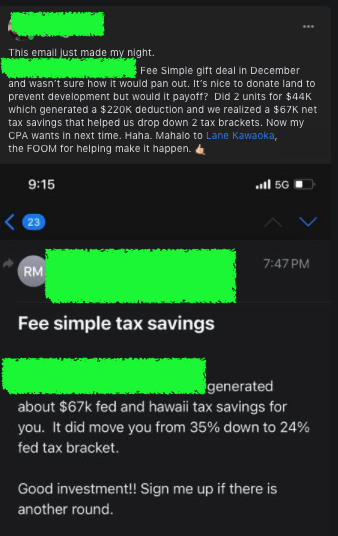

Land Conservation Easements are still around just don’t get too greedy and go over the 5X multiplier is the unspoken rule of thumb.

Join our land conservation easement alert to save on taxes with us

5-Year NOL Carry Back Notes

(Revised: 20.05.6)

2018 TAX CHANGES

(Revised 19.04.16 )

1) Standard deduction and personal exemption combined and seems like everyone is getting more so its a wash IMHO.

2) Less deductions for those who don’t have a business, like real estate investments. It just gets harder and harder for working professionals.

3) For those paying Alimony: Sorry but Yay! To more kids. We all know that’s a huge net negative unless you put them to work in the farm.

4) Mortgage interest capped: This is to pay for general cuts across the board. Smart investors will find a way to make their home an above the line business expense.

5) 20% pass through on personal return from business: Yes to this!

6) Estate tax limits increases: Must be a favor for some old poker buddies.

7) Lower corporate tax to hopefully re-patronize companies who ran away from USA.

TIP: I went down the following list and updated my personal spreadsheets to calculate my tax liability.

You should too!

Don’t hand it over to your CPA!

For INDIVIDUALS: Effective Date: 1/1/18 Expiration Date: 1/1/26.

Real Estate Taxes on Primary Home plus State & Local Income Taxes Capped at $10,000.

Standard Deductions:

Single: $12,000.

Head of Household: $18,000.

Married Filing Join: $24,000.

2% Itemized Deductions Eliminated:

Tax Preparation Fees.

Unreimbursed Business Expenses.

Continuing Education Expenses.

Licensing Fees.

Investment Expenses.

Alimony: (Effective 1/1/19) Alimony No Longer a Deduction to Paying Ex-Spouse and No Longer Income to Recipient Ex-Spouse.

Mortgage Interest Deduction Limited to $750,000 for Primary and Secondary Home New Mortgages Obtained After 12/15/17.

Home Equity Interest Deduction on $100,000 Only Allowed For Home Improvements.

Real Estate Tax Deduction for Vacation Homes No Longer Allowed.

Moving Expense Deduction No Longer Allowed.

Casualty Loss Deduction No Longer Allowed Except in Presidential Declared Disaster Areas.

Medical Expense Deductions Adjusted Gross Income Threshold Reduced from 10% to 7.5% But Only For 2018 & 2019.

Alternative Minimum Tax Exempt Income Thresholds Increased From $54,300 (Single)/$84,500 (Married Filing Joint) to $70,300 (Single)/$109,400 (Married Filing Joint).

Alternative Minimum Tax Exemption Phaseouts Increased From $120,700 (Single)/$160,900 (Married Filing Joint) to $500,000 (Single)/$1 Million (Married Filing Joint).

Note: This means that if your income exceeds the $500,000 or $1 million phaseout amount, you are no longer eligible to exclude $70,300 or $109,400 from Alternative Minimum Tax.

Child Tax Credit:

Increases From $1,000 to $2,000 Per Child, For Children Under Age 17. Also, This Credit is Refundable Up To $1,400 If You Quality (Meaning – You Meet The Low Income Tests).

Phaseout Increases From $75,000 (Single)/$110,000 (Married Filing Joint) to $200,000 (Single)/$400,000 (Married Filing Join).

529 Plans Change – You Are Now Allowed to Use $10,000 Per Year to Pay For K-12 Education Tuition, Materials and Tutoring.

Obamacare Penalty is Eliminated Effective 1/1/19.

Marriage Penalty is Removed From All Tax Brackets.

Income Tax Brackets Will Now Be Adjusted For Inflation Using a Much Slower Measure Called Chained Consumer Price Index For All Urban Consumers.

PASS THROUGH ENTITIES Effective Date: 1/1/18 Expiration Date: 1/1/26

U.S.-Based LLCS, S Corps, Partnerships and Sole Proprietors, Real Estate Investors, Trusts and Estates, REITs and Qualified Cooperatives

20% Deduction Allowed On Individual Income Tax Return. This 20% is Applied to Your Share of the Taxable Income From a Pass Through Entity.

Deduction is Phased Out if Your Income is Too High: Phaseout Begins at $157,500 (Single)/$315,000 (Married Filing Joint).

Non-Service Businesses Who Exceed The Phaseout Amount Default to This Limitation:

50% x Wages Reported On Pass Through Business or

25% x Wages Reported On Pass Through Business Plus 2.5% x Tax Basis of Depreciable Property.

CORPORATIONS: Effective Date: 1/1/18 Permanent – meaning No Expiration Date

21% Flat Tax Replaces Graduated Tax Brackets.

Territorial System Replaces World-Wide System

All Foreign Profits of U.S.-Based Corporations No Longer Taxed Effective 1/1/18.

Pre-1/1/18 Untaxed Foreign Profits of U.S.-Based Corporations Automatically Subject to Corporate Tax, Even if Those Foreign Earnings Remain Held Oversees. Tax Rates on “Old Foreign Profits”:

8% x Untaxed Foreign Profits Invested in Illiquid Assets Plus

15.5% x Untaxed Foreign Profits Invested in Cash and Cash Equivalents.

ESTATE TAX

Estate Exemption Increased From $5,490,000 (Single)/$10,980,000 (Married Couples) to $11,000,000 (Single)/$22,000,000 (Married Couples), Effective 1/1/18.

OTHER

50% Entertainment Deduction No Longer Allowed, Effective 1/1/18.

Tax-Free Parking/Transit Subsidy No Longer Allowed, Effective 1/1/18.

100% Write-Off of Qualified Fixed Assets, effective 1/1/18.

MUST READ: This article shows how per state is exactly affected.

https://www.washingtonpost.com/…/busi…/tax-bill-calculator/…

MUST READ: This article is a more technical rendition.

https://www.nytimes.com/…/…/12/17/upshot/tax-calculator.html

The maximum contribution for 401(k) plans is rising to $18,500 in 2018, up from $18,000 in 2017 — this also applies to 403(b), most 457 plans, and the federal government’s Thrift Savings Plan.

The catch-up contribution for those age 50 and up remains $6,000 for all of these plans.

Who Qualifies for a Roth

The IRS also increased the maximum earnings allowed by those who can have a Roth IRA to $120,000 up to $135,000 for singles and heads of household, and $189,000 to $199,000 for married couples filing jointly. These ranges are $2,000 and $3,000 higher than 2017 respectively.

[I personally don’t like these QRPs or qualified retirement plans (Roth-IRA, Solo 401ks, etc.) if you are an active real estate investor. If you are conservatively using prudent leverage and finding decent deals there is no reason you should not be able to retire in 10 years or less and thus negating the very reason for these accounts.

When you have money in these accounts it sounds good that you are not taxed on gains but you are restricted from getting a Fannie Mae loan. Using the QRP loans get you the second tier financing options, for example, a Roth IRA can buy real estate on leverage, however, will need a non-recourse loan which is often a fraction high-interest rate and lower LTV. No Bueno!

Caveat: If you are late to the game and already have a fat 401k then you should convert it to a solo401k. At that point, you should think about putting it into a syndication since you are restricted on how you can leverage it.]

TRANSIT and PARKING

The other types of benefit that has changed is pre-tax payments for transit passes and parking fees. It rose by $5 a month, to $260 a month. [These are the scarcity mindset things that are confusing]

Other changes for 2018 include deductions, exemptions and income tax credits.

Source: Forbes

Student Loans

The maximum deduction for interest on student loans remains $2,500. Eligibility for the deduction starts phasing out with individual incomes surpassing $65,000 and joint return incomes exceeding $135,000.

Taxpayers become completely ineligible when they pass $80,000 and $165,000, respectively.

Deductions in 2018

Single taxpayers and married couples filing separately get a standard deduction of $6,500 in 2018, up from $6,350 in 2017.

The standard deduction is $13,000 for married couples filing jointly, up from $12,700 in the prior year; and for heads of households, the standard deduction is $9,550, up from $9,350 in 2017.

The standard deduction for a taxpayer who can be claimed as a dependent by another taxpayer is a maximum of whichever figure is greater: $1,050 or $350 plus the dependent’s earned income.

The additional standard deduction for the aged and blind is $1,300. The additional standard deduction for unmarried taxpayers is $1,600.

Note: Expenses for your real estate business are above the line expenses.

Penalties [Cost of Doing Business]

This year’s penalties for not having health insurance — and not having a waiver or exemption — remains the same as 2017: 2.5% of your adjusted gross income, or $695 per adult and $347.50 per child, up to a maximum of $2,085, whichever is higher.

The IRS continues to impose the penalty of revoking passports for anyone with serious tax delinquencies, and the threshold for that is $51,000 in tax year 2018.

(This is for many of you that have visions of living abroad parts of the year.)

Estate and Gift Taxes

On the opposite end of the spectrum, the amount of money that married couples can pass to each other without taxes goes up to $5.6 million per individual, up from $5.49 million in 2017. Note: The term estate tax is often misunderstood by the media to include heirs other than children when that isn’t always the case.

Things that I ponder: If I should put more money into my Health Saving Account. I believe you are going to have health expenses before you ever spend a retirement dollar so you should fill this bucket first. I don’t screw around with any Qualified Retirement Plans

About 1099 Version 2018

(Revised 1/2019)

Here is a notice from my CPA on how to handle 1099s.

You are receiving this email if you had a rental property in 2017. If you did not have a rental property in 2018, you can delete this email.

Due to the new tax law that was put into effect on January 1, 2018, there is a possibility we may want to consider your rental property an active trade or business going forward due to the new Section 199A deduction.

In order to be considered an active trade or business, the following 3 criteria must be met:

- You are actively engaged in the pursuit of renting the property

- You have a profit motive

- You have involvement in the activity (even limited involvement such as hiring a property manager or paying the mortgage will meet this requirement)

The 1099s rules that apply to businesses issuing these forms to their vendors and independent contractors, also apply to those with rental properties. If you contracted with a management company, you should contact your property manager and ask them to confirm that they are issuing all required 1099s to individuals or businesses who provided services to your property. If you do not have a property manager, and have made payments via cash or check (payments made via credit card do not count for this purpose) to vendors for services (landscapers, contractors, handymen, cleaning crew, etc.) that were for $600 or more in total for any one person or company, you will need to either issue the 1099s yourself or have our firm prepare these for you. If you choose to prepare these forms yourself, please provide us with copies so we can add it to your file for tax preparation. If you would like us to prepare the forms, we charge a $50 base fee plus $5 for every 1099 that must be issued.

If you would like us to process these forms, below is a list of what I need:

- A completed W-9 for the individual or business that we are issuing the 1099 to (a blank form is attached for your convenience).

- Amount you have paid to each individual or business in 2018.

If you cannot get a W-9 from your vendor, please obtain all the information required for a complete W-9 and send us that instead. Please note a completed W-9 is preferred.

Please return the W-9 or vendor information and the total payments to me no later than ASPA to ensure that all of your forms are processed and delivered by the January 31st deadline. Once completed, I will email you that the 1099s are posted to your online portal so that you can distribute them. We will file them with the appropriate government agencies; you just need to make sure that you distribute copies to the vendors. If you would like us to distribute the forms directly to the recipients, there will be an extra $25 charge per form distributed, and you will need to let us know if you want us to do that when you send us the data. For any that are submitted after the January 28, 2019 deadline, a $25 per 1099 rush fee will be added to your invoice.

For 2019, it is advisable to request a completed W-9 prior to paying your vendors so that you have it on file for future reference and if needed for year-end forms.

Updates to 20% Pass-Through Deductions for Landlords

(Revised 1/2019)

The Tax Cuts and Jobs Act introduced the 20% pass-through deduction, allowing business owners to receive a “freebie” deduction of 20% of their qualified business income (QBI).

The BIG question: Does rental real estate rise to the level of a trade or business for purposes of qualifying for this deduction?

Most rental real estate investors will qualify under the following safe-harbor:

- The property is held directly by the individual or through a disregarded entity by the individual or passthrough entity seeking the pass-through deduction (i.e. a person who owns a single-member LLC which holds a property qualifies).

- Commercial and residential real estate may not be part of the same enterprise.

- Separate books and records are maintained to reflect income and expenses for each rental real estate activity or enterprise (a separate real estate enterprise may constitute multiple properties as long as all commercial or all residential).

- 250+ hours of rental services are performed for the enterprise (see detail below).

- You maintain contemporaneous records, including time reports or similar documents, regarding 1) hours of all services performed, 2) description of all services performed, 3) dates on which such services are performed, and 4) who performed the services.

Rental services include advertising to rent, negotiating and executing leases, verifying tenant applications, collection of rent, daily operation and maintenance, management of the real estate, purchase of materials, and supervision of employees and independent contractors (services performed by owners or employees, agents, or contractors all count toward the 250).

Note: Just because your rentals don’t meet the requirements for this safe harbor, doesn’t necessarily mean they won’t qualify for the 20% deduction.

However, whether or not your rentals qualify for the described safe harbor, if you plan on taking this deduction, you’ll have to issue Form 1099 for all independent contractors you pay over $600/year. This may be new for some, as landlords are generally exempt from this requirement.

Different States and Taxes

Don’t rely purely on taxes if you’re choosing a state to invest in real estate because it can deceive you. Note: Download the Rental Property Analyzer

For Real Estate Agents: IRS Provides Clear Test on How 20% Deduction

Applies to Rental Income Exchanges

Link to ULTIMATE SPC 1031 GUIDE

The Internal Revenue Service has issued final rules on the 20 percent business income deduction (Sec. 199A of the Tax Code) that was enacted in late 2017 as part of the Tax Cuts and Jobs Act.

Among other things, the rules confirm that the deduction applies to your business income, as a real estate agent or broker, if you operate as a sole proprietor or owner of a partnership, S corporation, or limited liability company. It applies even if your income exceeds a threshold set in the law of $157,500 for single filers and $315,000 for joint filers.

In addition, the rules provide guidance that NAR has been seeking on two other provisions of importance to you: 1) whether any real estate rental income you have is eligible for the deduction, and 2) how the deduction applies to properties you’ve exchanged under Sec. 1031 of the tax code.

Eligibility of Rental Income

If you generate rental property income, that income can also qualify for the new deduction, as long as you can show that your rental operation is part of a trade or business. The IRS has released proposed guidelines that include a bright-line test, or safe harbor, for showing that your rental income rises to the level of a trade or business. Under that safe harbor, you can claim the deduction if your rental activities—which include maintaining and repairing property, collecting rent, paying expenses, and conducting other typical landlord activities—total at least 250 hours a year. If your activity totals less than that, you can still try to take the deduction, but you’ll have to be prepared to show the IRS that your activity is part of a trade or business.

Capital Improvements vs. Repairs & Maintenance Expenses

Once your property is in service, you’ll need to determine whether each repair and maintenance expense you incur should be classified as a regular expense or a capital improvement. Capital improvements must be capitalized and depreciated which sucks because you can’t take the tax deduction right away. Most rental property owners will prefer to have as many of these costs as possible classified as regular repair and maintenance expenses in order to maximize current year deductions and minimize depreciation recapture.

There are three safe harbors that help move some expenses that would otherwise be classified as capital, into the regular expenses bucket:

Safe Harbor for Small Taxpayers

Routine Maintenance Safe Harbor

De Minimis Safe Harbor

Here are some examples of maintenance: (NOT Capital Improvements)

FIXING

- an existing AC unit

- a faucet or toilet

COSTS INCURRED TO:

- inspect, or clean part of the building structure and/or building system

- replace broken or worn out parts with comparable parts

REPLACING

- a few shingles on a roof

- a cabinet door

- a few planks or tiles on a floor

- a broken pipe

Here are some examples of Capital Improvements:

- Additions (e.g. additional room, deck, pool, etc.)

- Renovating an entire room (e.g. kitchen)

- Installing central air conditioning, new plumbing system, etc.

- Replacing 30% or more of a building component (i.e. roof, windows, floors, electrical system, HVAC, etc.)

Eligibility of 1031 Like-Kind Exchanges

Under earlier proposed regulations, if your income was above threshold levels set in the tax law—$157,500 for single filers, $315,000, for joint filers—and you had exchanged one property for another to defer taxes under Sec. 1031 of the tax code, the amount of the new deduction might be reduced because of the swap. NAR and other trade groups reached out to the IRS to change this treatment, and the IRS has made that change. Under the final rules, you can use the unadjusted basis of the depreciable portion of the property to claim at least a partial deduction.

“The final rules are the result of several months of advocacy and collaboration between NAR, our members, and the administration,” says NAR President John Smaby. “They reflect many changes that NAR sought to ensure the new 20 percent deduction applies as broadly as possible.”

Check out the following links:

Summary in The Voice for Real Estate video.

Video series on all tax law changes that are important to real estate professionals.

VIDEO: Thoughts against a 1031 exchange because you are a Distressed Buyer.

Depreciation Recapture

Recapture is often misunderstood. Recapture of depreciation on personal property is taxed at ordinary income rates. The only time you would have this type of recapture is when you take bonus depreciation and then sell the property in the first 5 years. Recapture on real property (buildings and improvements) is taxed at a maximum rate of 25%. This type of recapture can be avoided with a 1031 exchange.

For passive investors, their early losses will be carried over. The carried over losses will offset any recapture and will also offset other ordinary income when the property is sold. You end up normally with capital gain and ordinary loss for passive investors

What Is K-1 and How Is It Used?

No, we are not talking about the martial art type! 😂

NOTE: Your K1 will be in the last year’s form (2019 for 2020).

This form is what distributes your share as a partner.

FAQs About the form:

- Why is my “box 2” different than what I really received? 1) Depreciation deductions on real estate which is not a cash outflow. 2) Refinances can increase your cashflow but not increase what is on your form. 2) Mortgage payments are comprised of principal and interest portions.

What is “Un-recaptured Section 1250” gain mean? When you sell property, generally at a capital gains rate, but you have also taken losses in the time of the hold (depreciation deduction). So when you sell you have to recapture those depreciation deductions at potentially a higher rate. A 1231 is what is getting taxed at that potential higher rate.

Do know that we hire licensed professionals who take care of all the heavy lifting and we distribute accordingly to investors and a K-1 which you can pretty give to any CPA cause its pretty easy to input the fields on a personal tax return (way, way easier than a schedule E for a simple rental property for sure).

On a similar note, here is the situation which is actually very common but minor in my opinion in the grand scheme of things.

Scenario: Let’s say the asset makes money (like how will there be some commercial tenant income coming in during the build phase). There wouldn’t be distributions coming directly from these profits because it might go to buying additional construction items or just fortify cash the position. Technically, it is income and the entity has to pay taxes on it.

2018 For a Limited Time: Bonus Depreciation (until 2022)

On larger deals, we do cost segregations to write off most of the profits we make and sometimes even some of our W2 income! But that’s getting more into the weeds with taxes.

Resource: Cost Segregations for Single Family homes or Assets under $2M

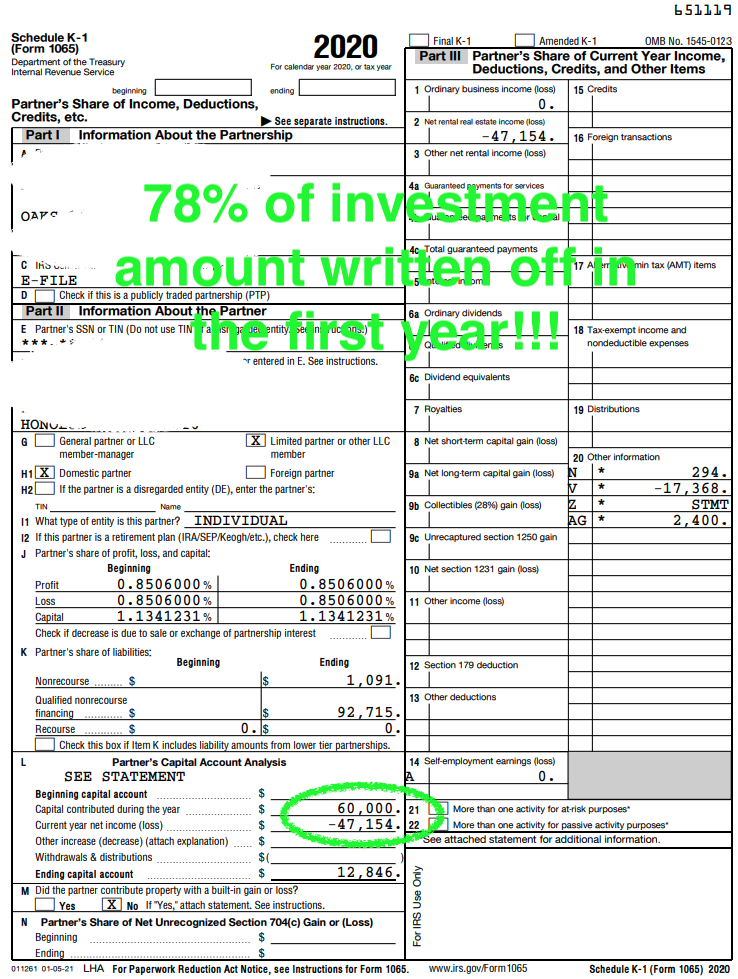

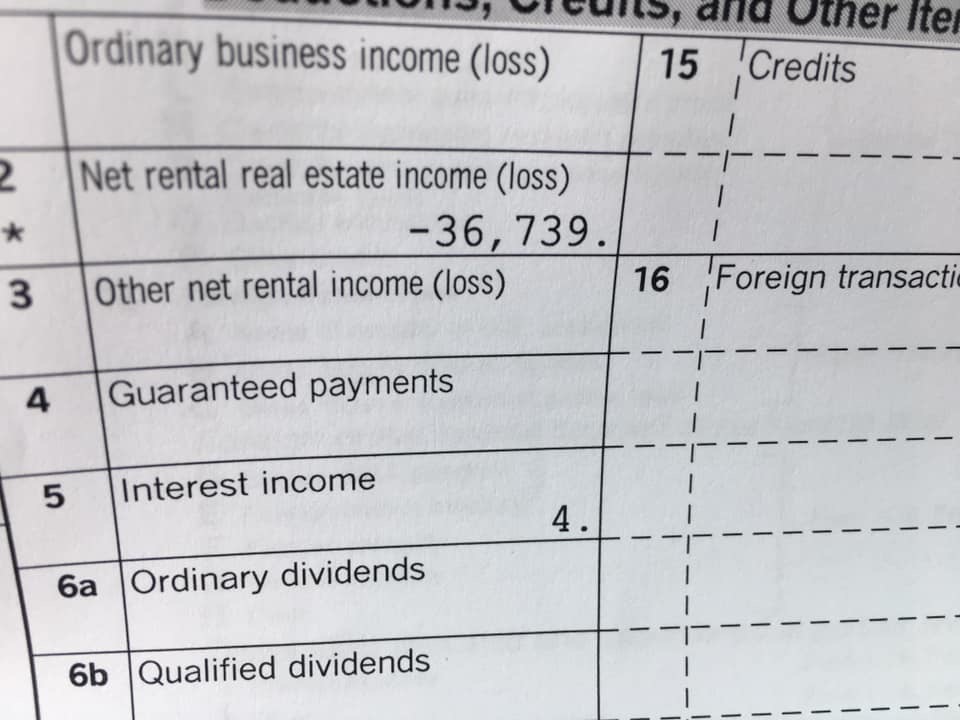

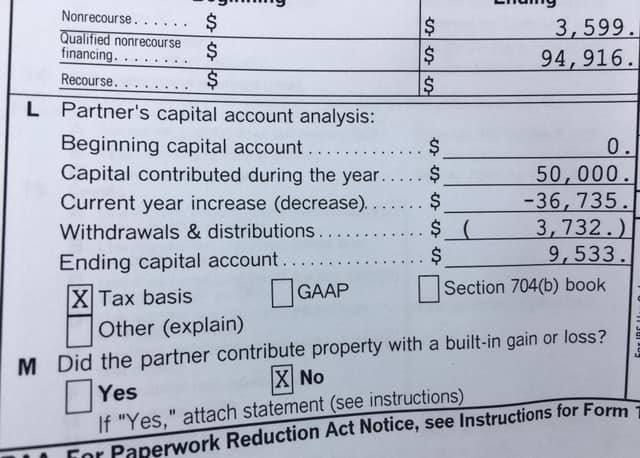

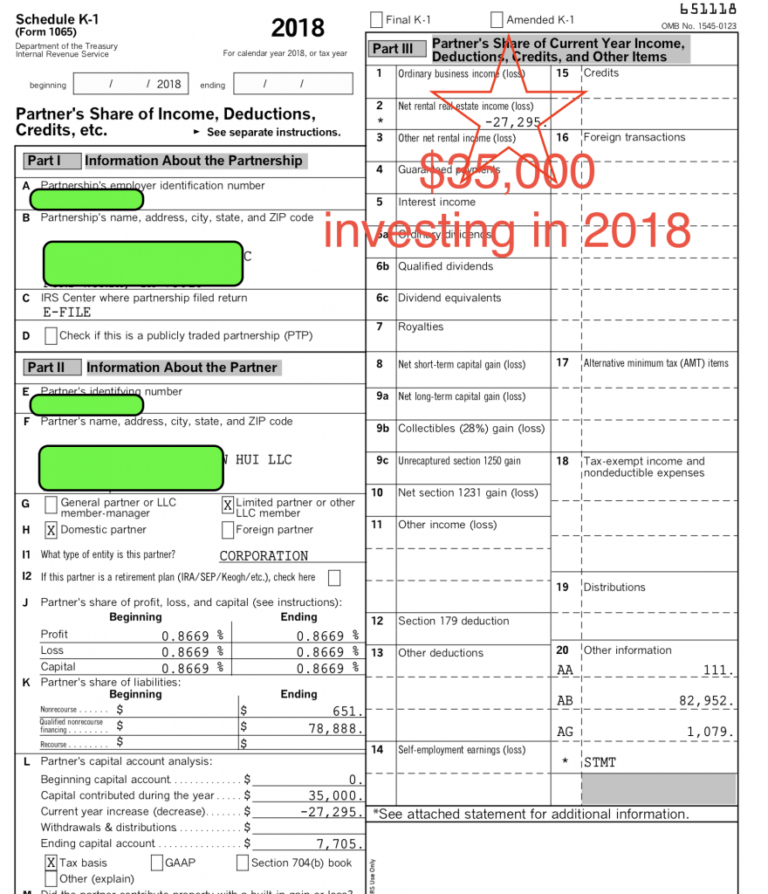

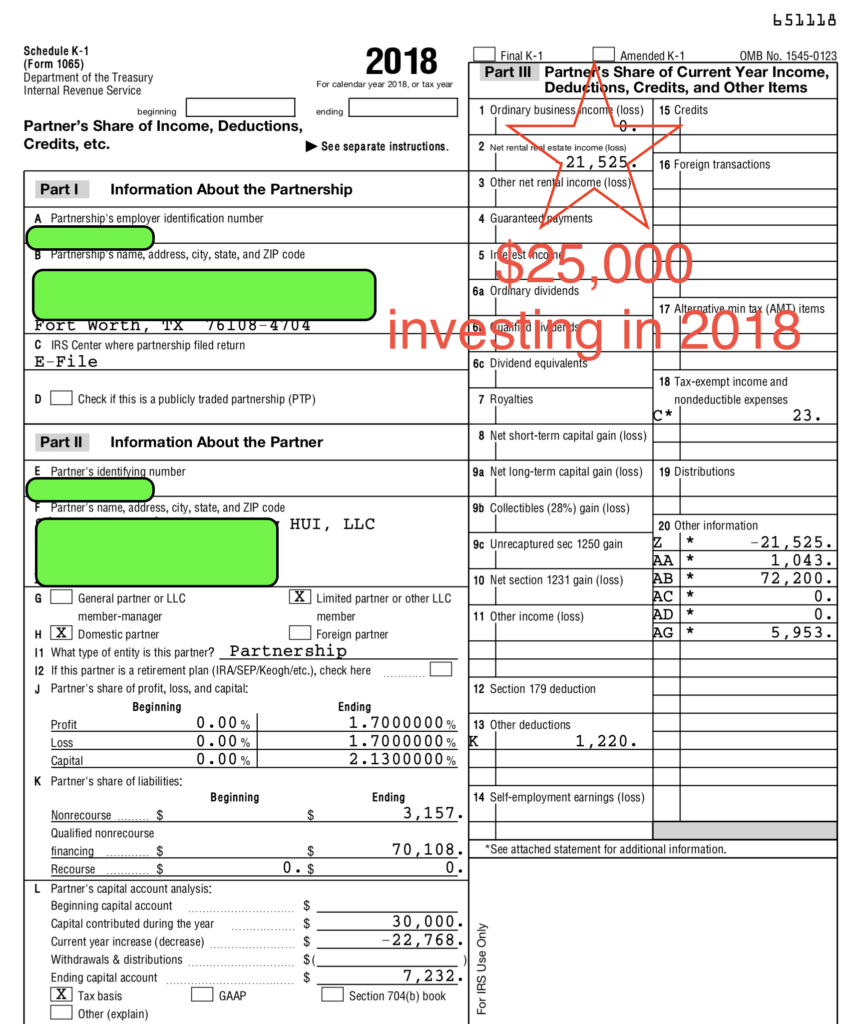

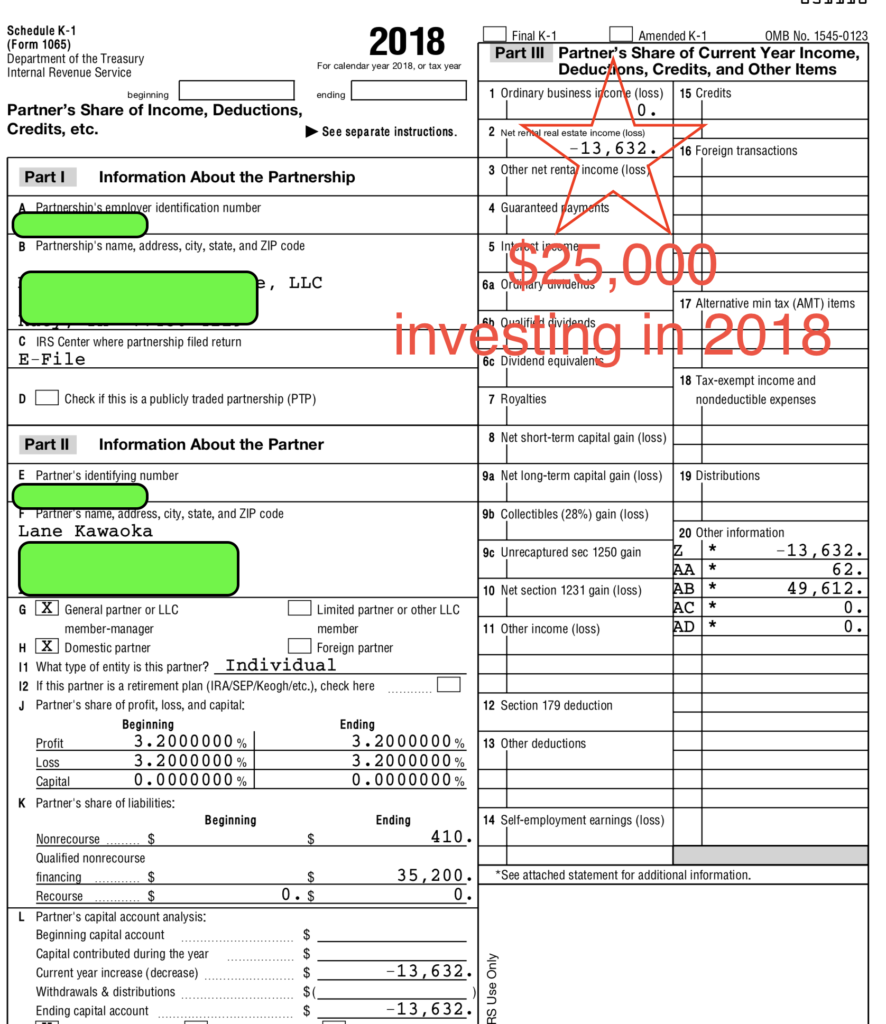

Not making any promises as depreciation amount is primarily based off building specifics and amount of leverage used in a deal but here is a real-life example from a $50K investment in the first year K-1 in 2018 utilizing cost segregation.

Passive Losses!👍

Note: Class C apartment deal

One of the reasons I moved from Turnkey rentals is because on bigger deals you can pay for a cost segregation to write off almost 30% of the asset in year one!

Don’t have to wait for 27 years! (Here is a cheaper service for cost segregations for single family homes or under $2M assets – but I am personally a little skeptic)

And if your CPA isn’t understanding or proactive in communicating this to you… you need one. (I can let you know who I use)

Look! Numbers don’t lie. Check on this, the depreciation I am getting on these deals:

Look at that net income loss! ⭐

That’s a TOTAL of $62,452 in SAVINGS!

Note: If you are in the highest tax bracket that’s like $30,000 tax savings!

As a full time real estate profession (I quit my day job) I am able to take all of those deductions. For those of you with day jobs you are capped depending on your income level however those deductions carry forward to that magical day when you fire the boss.

Grouping your passive losses on non participatory deals as a real estate professional – more info here

IRS Tax Code

APPLICABLE PERCENTAGE (For Purposes of this Subsection)

In general Except as otherwise provided in this paragraph, the term “applicable percentage” means:

(i) in the case of property placed in service after September 27, 2017, and before January 1, 2023, 100 percent

(ii) in the case of property placed in service after December 31, 2022, and before January 1, 2024, 80 percent

(iii) in the case of property placed in service after December 31, 2023, and before January 1, 2025, 60 percent

(iv) in the case of property placed in service after December 31, 2024, and before January 1, 2026, 40 percent

(v) in the case of property placed in service after December 31, 2025, and before January 1, 2027, 20 percent

QUALIFIED PROPERTY For Purposes of this Subsection)

What Can You Deduct (Master-list)?

“You must regularly use part of your home exclusively for conducting business,” writes IRS.gov. For example, if you use an extra room to run your business, you can take a home office deduction for that extra room.

In the unfortunate event of an audit, you might have a difficult time proving that your family room is a home business if your “office” also includes your wide-screen television and pool table.

- Cell phone

- Drone to take pics of deals

- Internet

- Cable to watch HGTV

- SimplePassiveCashflow.com/charity

- HIDDEN – See more in our eCourse

- HIDDEN – See more in our eCourse

- HIDDEN – See more in our eCourse

- HIDDEN – See more in our eCourse

- HIDDEN – See more in our eCourse

- HIDDEN – See more in our eCourse

- HIDDEN – See more in our eCourse

- HIDDEN – See more in our eCourse

- HIDDEN – See more in our eCourse

- HIDDEN – See more in our eCourse

- HIDDEN – See more in our eCourse

- HIDDEN – See more in our eCourse

18. Infrequent retreats/team building

19. Home Office (exclusive-use) – utilities, homeowners insurance, security, repairs only for the room

20. Supplies

21. Deminimis safe harbor – $2500 per line item per invoice (ie refrigerator) to avoid having to depreciate the asset over many years – [if you can buy something under the $2500 threshold DO IT]

22. Home office – HIDDEN – See more in our eCourse

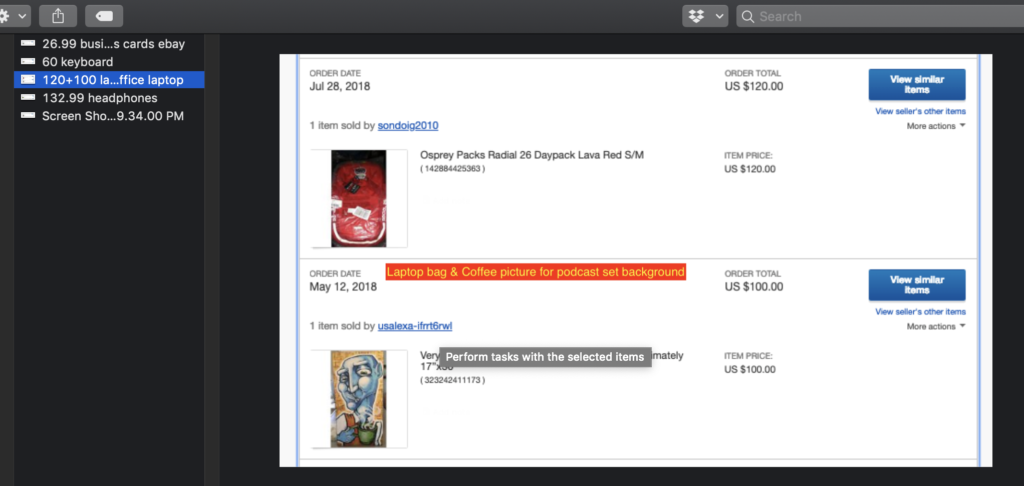

23. I was inputting some business expenses into my tax folder to submit my taxes. Likely I will extend but its stressful to have it build up to September like how I did in 2018.

Tips For Documenting

- Dropbox – use scan to pdf

- Google drive

- Excel

- Folders for each property – once I enter into excel I will put into folder to let me know that it is recorded

- Mile IQ

Book Club – Tax-Free Wealth (Session 1) Dec 28, 2018 – Page 0-50

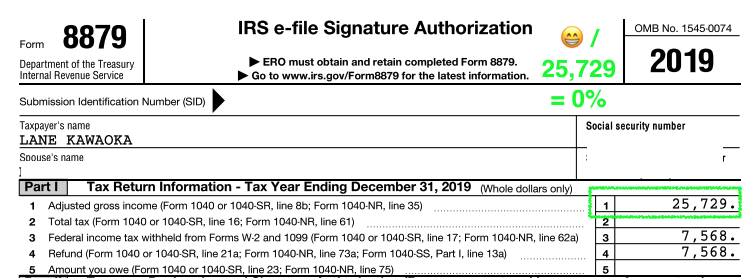

In 2017:

- 100k in W2 salary & pension I cashed out

- Deducted $25,000 from passive losses

- I paid a little over $11k in taxes

- Around 11-14% effective tax rate while the “average person pays 30-50% in taxes”

- 10 rentals – 100k with 1000 a month in rent

- 100k income

- 150k in deduction (about half from paper losses) then other half deductions from business expenses

- I spend money on courses, masterminds (Tony Robbins), Sonoma, Las Vegas this weekend. Learned “change your facts will change your tax”. Check out SimplePassiveCashflow.com/retreat. Free for current investors.

- Net about ~50k on paper. Only 25k got brought over to offset my w2 income. The other 25k got put into my passive loss “bucket” to be used at a later date

Note: Don’t be an idiot/greedy when using the knowledge below. This is just one book and opinion. I take a lot of inputs from books and personal advisors.

- PG-9 – Breakdown of depreciation

- 15 – Four hours of a day when traveling – SimplePassiveCashflow.com/retreat

- 27 – The key is whatever is typical for your industry. Passive investor?

- 28 – Necessary=purpose of the expense is to make money for your business

- 36 – Put kids to work and pay them a salary

- 42 – Make a business around something you enjoy so you can change your facts about the expenses you will incur

- Buddy of mine is a 1098 employee so he has his office in home as home office. Who cares how much the office deduction is but not its a place of business and can write off commute to work everyday

- https://simplepassivecashflow.com/2018-tax-update-w-commentary/

- https://simplepassivecashflow.com/big-takeaways-list-2018-tax-changes/

- 49 – Document

- https://simplepassivecashflow.com/opportunity-fund-zone/

- Are the book’s issues controversial? How so? And who is aligned on which sides of the issues? Where do you fall in that line-up?

- Invest where you travel!?! (12)

- Starter investor does not need LLC to write off for taxes. Its mainly for asset protection.

- Business credit card (26)

- Paying your kids is a little lame in terms of actual tax savings but good way to teach business skills and get everyone involved and feel part of the team.

- TIPS: 1) Throw the 529 away 2) Pay kids so they have income and put it in Roth IRA. Invest it and with-drawl contributions tax fee penalty free for college 3) just set up a IBC for them in lieu of Roth IRA – SimplePassiveCashflow.com/banking

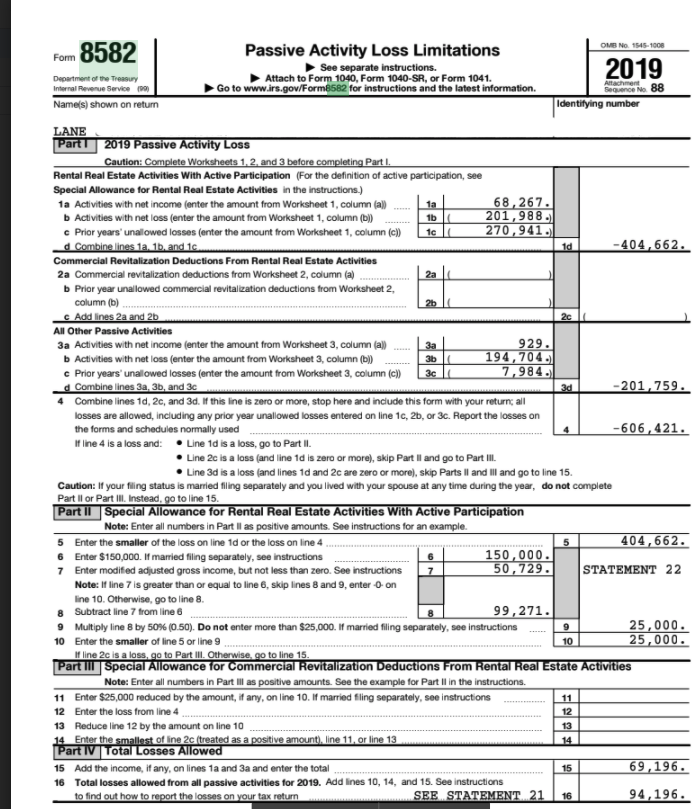

Passive Activity Limits

In 2017, I was able to bring $25,000 of passive losses to deduct off my W2 income to ultimately pay 14% effective taxes for the year.

Under the passive activity limits, you can deduct up to $25,000 in passive losses against your ordinary income (e.g. W-2 wages) if your modified adjusted gross income (MAGI) is $100,000 or less. This deduction phases out $1 for every $2 of MAGI above $100,000 until $150,000 when it is completely phased out.

Note: These limits apply to both those filing single or married filing joint.

In addition, in order to take losses against your ordinary income, you must materially participate in the activity by meeting one of the following seven tests:

1. You participated in the activity for more than 500 hours.

2. Your participation was substantially all the participation in the activity of all individuals for the tax year, including the participation of individuals who didn’t own any interest in the activity.

3. You participated in the activity for more than 100 hours during the tax year, and you participated at least as much as any other individual (including individuals who didn’t own any interest in the activity) for the year.

4. The activity is a significant participation activity, and you participated in all significant participation activities for more than 500 hours. A significant participation activity is any trade or business activity in which you participated for more than 100 hours during the year and in which you didn’t materially participate under any of the material participation tests, other than this test.

5. You materially participated in the activity (other than by meeting this fifth test) for any 5 (whether or not consecutive) of the 10 immediately preceding tax years.

6. The activity is a personal service activity in which you materially participated for any 3 (whether or not consecutive) preceding tax years. An activity is a personal service activity if it involves the performance of personal services in the fields of health (including veterinary services), law, engineering, architecture, accounting, actuarial science, performing arts, consulting, or any other trade or business in which capital isn’t a material income-producing factor.

7. Based on all the facts and circumstances, you participated in the activity on a regular, continuous, and substantial basis during the year.

Active & Passive Material Participation Passive Activity

https://www.taxact.com/support/1639/2016/active-and-passive-material-participation-passive-activity

Passive Activities

There are two kinds of passive activities:

- Trade or business activities in which you do not materially participate during the year.

- Rental activities, even if you do materially participate in them, unless you are a real estate professional.

Active Participation

Active participation is not the same as material participation, defined later. Active participation is a less stringent standard than material participation. For example, you may be treated as actively participating if you make management decisions in a significant and bona fide sense. Management decisions that count as active participation include approving new tenants, deciding on rental terms, approving expenditures, and similar decisions.

Material Participation Tests

(same tests as in taking losses against your ordinary income)

You materially participated in a trade or business activity for a tax year if you satisfy any of the following tests:

- You participated in the activity for more than 500 hours.

- Your participation was substantially all the participation in the activity of all individuals for the tax year, including the participation of individuals who did not own any interest in the activity.

- You participated in the activity for more than 100 hours during the tax year, and you participated at least as much as any other individual (including individuals who did not own any interest in the activity) for the year.

- The activity is a significant participation activity, and you participated in all significant participation activities for more than 500 hours. A significant participation activity is any trade or business activity in which you participated for more than 100 hours during the year and in which you did not materially participate under any of the material participation tests, other than this test.

- You materially participated in the activity for any 5 (whether or not consecutive) of the 10 immediately preceding tax years.

- The activity is a personal service activity in which you materially participated for any 3 (whether or not consecutive) preceding tax years. An activity is a personal service activity if it involves the performance of personal services in the fields of health (including veterinary services), law, engineering, architecture, accounting, actuarial science, performing arts, consulting, or any other trade or business in which capital is not a material income-producing factor.

- Based on all the facts and circumstances, you participated in the activity on a regular, continuous, and substantial basis during the year.

NOTE: You did not materially participate in the activity under test (7) if you participated in the activity for 100 hours or less during the year. Your participation in managing the activity does not count in determining whether you materially participated under this test if:

- Any person other than you received compensation for managing the activity, OR

- Any individual spent more hours during the tax year managing the activity than you did (regardless of whether the individual was compensated for the management services).

IRS Notice 2019-07

The Treasury Department and the IRS wanted to clarify the rules and prepared a document* to explain the Section 199A deductions.

BELOW IS JUST AN INTERPRETATION AND YOU ARE ENCOURAGED TO FIND YOUR OWN LEGAL AND TAX PROFESSIONAL *IRS notice 2019-07 (https://www.irs.gov/pub/irs-drop/n-19-07.pdf) explains the administrative rules and defines a safe harbor for real estate investors as is defined in Section 199A of the Code.

Safe harbor for the purposes of section 199A, a rental real estate enterprise will be treated as a trade or business if the following requirements are satisfied during the taxable year with respect to the rental real estate enterprise:

- Solely for purposes of this safe harbor, a rental real estate enterprise is defined as an interest in real property held to produce rents and may consist of an interest in multiple properties.

- The individual or relevant pass through entity (RPE) relying on this revenue procedure must hold the interest directly or through an entity disregarded (such as an LLC) as an entity separate from its owner under § 301.7701-3.

- Taxpayers must either treat each property held, for the production of rents, as a separate enterprise or treat all similar properties held for the production of rents as a single enterprise (i.e. owned by the same LLC).

- Commercial and residential real estate may not be part of the same enterprise. (There is a question regarding the treatment of mixed-use buildings under this ruling, that has not been resolved yet)

- Note: Taxpayers may not vary this treatment from year-to-year unless there has been a significant change in facts and circumstances.

- This includes a deduction of up to 20 percent of aggregate real estate investment trust (REIT) dividends and qualified publicly traded partnership income.

Additional Safe Harbor Requirements

(A) Separate books and records are maintained to reflect income and expenses for each rental real estate enterprise; (B) For taxable years beginning prior to January 1, 2023, 250 or more hours of rental services must be performed (as described in this revenue procedure) per year, with respect to the rental enterprise. For taxable years beginning after December 31, 2022, if in any three of the five consecutive taxable years that end with the taxable year 250 or more hours of rental services are performed (as described in this revenue procedure) per year with respect to the rental real estate enterprise; and

The taxpayer maintains a record of the following:

- Hours of all services performed.

- Description of all services performed.

- Dates on which such services were performed.

- Who performed the services.

- Advertising to rent or lease the real estate.

- Negotiating and executing leases.

- Verifying information contained in prospective tenant applications.

- Collection of rent.

- Daily operation, maintenance, and repair of the property.

- Management of the real estate.

- Purchase of materials.

- Supervision of employees and independent contractors.

- Rental services may be performed by owners or by employees, agents, and/or independent contractors of the owners.

- Financial or investment management activities, such as arranging financing.

- Procuring real estate.

- Studying and reviewing financial statements or reports.

- Planning, managing, or constructing long-term capital improvements.

- Hours spent traveling to and from the property.

Clearly Excluded From Safe Harbor

- Real estate used by the taxpayer including an owner or beneficiary of an RPE (relevant passthrough entity), as a residence, for any part of the year.

- Real estate rented or leased under a triple net lease for purposes of this revenue procedure, a triple net lease includes a lease agreement that requires the tenant or lessee to pay (at least a portion of) rent, utilities, maintenance, taxes, fees, and insurance

- LLC’s where commercial and residential real estate are part of the same enterprise, such as an apartment complex and industrial building in the same LLC.

These rules place the burden of keeping time spent records of the rental services, on the Taxpayer. The work can be performed by a combination of owners, agents, and contractors. The key will be that all those involved in an investment will need to keep time records starting January 1, 2019, and will need to consolidate them for the next tax year.

The goal, of course, is to obtain 250 Hours of Services to qualify for the Safe Harbor and the tax savings.

You should talk with the managing partner of the pass-through entities you own and make sure these requirements are being meet starting January 1, 2019.

Don’t have 250 hours?

Also, under the new law, improvements to the interior of a building may qualify for bonus depreciation. Unfortunately, there seems to be a wording error in the legislation, which will need to be fixed by Congress.

The error in the legislation is technical, so property owners will want to consult their tax advisors to determine what position they want to take on the error.

SUMMARY

High Paid W2 Earner & “Real Estate Professional”

The Perfect “Kobe & Shaq” Combo

The “real estate professional status” or REP allows real estate investors to take unlimited rental losses against their ordinary income – strategically you want to get out of the highest two tax brackets at least. This has now been limited to $250,000 in losses if single (and $500,000 if married) under the excess business loss limits introduced by the Tax Cuts & Jobs Act.

In order to qualify as a real estate professional you must spend at least 750 hours in a real estate trade or business and more than half your total working hours must be in a real estate trade or business.

Due to these requirements, many investors who work a full-time job or full-time in another business that is not real estate-related will have a hard time qualifying as a real estate professional.

Meeting the above requirements will not necessarily allow you to deduct your rental losses against your ordinary income. You must also materially participate in the rental activity using the same tests mentioned above, but is most commonly done by electing to aggregate all your rental properties as one activity and then working 500 or more hours in this single activity per year.

If one spouse qualifies for the 750 hour test, both spouse’s time on the rental properties count towards material participation, and losses can then be taken against either spouse’s income.

This is a great strategy for couples where one spouse works in a real estate trade or business, works only part-time, or not at all outside of your investment activities.

NOTE: In any year you elect to be treated as a real estate professional for tax purposes, you’ll need to keep a log of all your hours worked within a real estate trade or business.

How To Qualify As A Real Estate Professional?

1. You must Materially Participate (see below) in a real estate business. This definition of real estate business is open to some flexibility as it encompass the world of buying/selling, renting/leasing realty as a real estate business.

2. More than 50% of the personal services you perform in all businesses during the year

must be performed in real estate businesses in which you Materially Participate.

3. Material Participation real property businesses during the year must amount to more than 750 hours. You must omit hours worked as capacity as an investor.

BUT…

If you combine your real estate doings you might be able to call yourself a real estate professional if you do not elect to treat all those interests as a single activity.

If you have multiple rental properties and you don’t make this “grouping” election, you must establish material participation for each property separately, and must satisfy:

- More-than- 50% test and

- The 750-hours test for each property separately in order to qualify as a REP for that property and therefore you wouldn’t mean you qualify for any other property.

If you don’t make the “grouping” election, qualifying as a real estate professional for all your properties becomes impossible and as you can see the whole tax code becoming a bit impractical and counter to the spirit of the code.

If you have multiple properties, you may not be able to qualify as a real estate professional unless

you elect to treat all your rental real estate interests as a single activity (grouping). If you make the election, it applies both for purposes of qualifying you as a real estate professional, and for all other purposes of the Passive activity rules. This election is irrevocable so you can’t make the election in order to qualify as a real estate professional, and then revoke it with respect to a particular property later, when, for example, that property produces income, and you’d like to use that income to absorb losses from another non-real- estate-related passive activity. Making the election will also disqualify you from utilizing the $25,000 active participation rule that I used in 2017 to bring my AGI from 100k to 75K to pay 14% total tax rate. Making such double moves in my opinion is where hog get slaughtered… say a PIG (passive investor group) and just get fat!

Disclaimer: Look, I am not a tax professional and I leave it up to my professionals to make this election for me but I tell them what I want and ask how can we make this happen. You quite possible need a new CPA… one that gets it and one that isn’t stuck in the paradigm of a JOB.

Making this critical election, you only have to establish material participation, and satisfy the more-than- 50% test and the 750-hours test, for the combined properties as a whole.

Despite what many investors think and many tax professionals (working at H&R block) practice you don’t have to work full-time in real estate to qualify as a real estate professional.

For the last and final time, I am not a tax professional and not giving tax advice but I know hundreds of people personally making this election and they are still living and some even successfully navigated audits.

Even if you have another occupation, you can qualify if you materially participate in a real estate business, and spend more time, and more than 750 hours, on that business. But here is where things get tricky as you need to really be able to substantiate your REP status with active real estate participate like direct management (via property manager) on some properties or more practically for Accredited investors so holdings as General Partners where they have management voting rights. How much of that GP we don’t know what is substantial? But I have see some clients check the box of REP when they are bringing in thousands of dollars a month as part of LP and GP holdings. For those I believe it makes total sense. If they are not REP with that much LP/GP holdings I don’t know who is!

These tests are applied annually so if you are trying to offset W2 active income in a higher than normal year you might be more motivated to make the stretch for REP. A lot of my clients are trying to bring their AGI (adjusted gross income) under $350K from $500K+ which will bring them out of the highest tax bracket where they are getting killed in taxes.

If you are not a real estate professional with the aforementioned active participation you cannot take your passive losses (accumulating from bonus depreciations from cost segregations in LP deals and normal depreciation) and offset active income (typically from a W2 day job).

But if the real estate business that qualifies you as a REP and you materially participate in that business (perhaps via a stretch with the “grouping” method) you can strategically use your passive losses to offset your AGI and get you out of the tax red zone or whatever tax bracket you wish to get out of.

What’s Material Participation In An Activity?

Material participation in an activity means involvement in the operations of your real estate business.

The IRS has the following seven tests:

- Participating in the activity for more than 500 hours in the tax year (the most frequently utilized

test); - Participating in the activity if the taxpayer’s participation is substantially all of the participation in

that activity by any individuals (including non-owners); - Participating in the activity for more than 100 hours in the tax year, if nobody else (including non-

owners) participated more; - Participating significantly in the activity, if participation in all “significant participation” activities

for the tax year exceeds 500 hours (but this test isn’t accepted for showing material participation

in rental activities); - Having materially participated in the activity during any five of the ten tax years before the year

at issue; - With respect to personal service activities, having materially participated in the activity for any

three years (not necessarily consecutive) before the year at issue; - Showing regular, continuous and substantial participation on the basis of all the relevant facts

and circumstances, but only if more than 100 hours of participation during the tax year can be

shown (and management services aren’t taken into account for purposes of this test unless

certain stringent requirements are satisfied).

Should you are audited you will be asked to reproduce your appointment books, calendars, daily time reports, logs, or GPS logging information as a means of backup documents that provide a detailed account of what the taxpayer did with respect to an activity, when he or she did it, and how much time it took.

Tip: AUGUSTA RULE

Disclaimer (Again): Not giving you tax advice but merely giving you the idea to talk to your CPA (or get a new one)

The Masters Golf Tournament is played in Augusta, Georgia every year and residents there are able to rent out their homes for crazy money. Someone must have lobbied for a loophole in the tax law to allow 14 days of rental income to be exempt from taxes. Now I am not advocating short term rentals. Actually I am against that asset class for these reasons but if you would like to take a program I would recommend this one.

Here is how passive investors like me utilize this Augusta Rule.

I have investor or board members meetings at my house. Actually 12 times a year.

I create a backup document (takes a bit of time to setup). You can have a VA track down this information. I take the highest 3 prices along with estimates for food, beverages, parking, av equipment etc. and average them in order to come up with the highest reasonable price.

This is only used in the need for defense from an audit. Otherwise, the details are buried in the corporate books. I conduct the max 14 meetings per year.

PITA (Pain In The A_ _)

(more examples here)

This is another reason why owning rentals is such a pain and up-keeping LLCs is administratively a headache why I prefer to invest in syndications and use irrevocable and offshore entities.

- I got a letter from the Alabama Department of Revenue for a $100 annual fee plus about $70 dollars of fees for an Alabama LLC that I had stopped using to hold my rentals. Here are the steps I went though to dissolve the LLC and various fees.

- Called State of Alabama Department of Revenue who told me to go to Alabama Secretary of State to complete an “Articles of Dissolution”

- I went online and got this completed for $4 dollars.

- By chance the person on the phone told me I needed to pay additional fees to the County of Jefferson in Birmingham to dissolve the LLC. There were no instructions for this so I proceeded to their website which had no info so I called them.

- On the phone with County of Jefferson Probate office judge I informed them of the fetch quest I was on.

- They said they need to send in 2 checks to the Jefferson County Judge of Probate ($63) and Secretary of State ($100) and self addressed form to mail back whatever they did.

- Then once this is all completed in a far away land where the internet does not work I need to go back to the Alabama Department of Revenue and let them know that the LLC got dissolved (so they stop billing me every year) and to pay another $170 fee there too.

Do you have any PITA stories?

Email me at Lane@SimplePassiveCashflow.com and I’ll add it here. For sure, it will make you feel better!

Homework (Jan 4): Read Up Chapter 6- 11 of Tax Free Wealth Book by Tom Wheelwright

Notes from the book:

- Use an S-Corp to avoid self-employment tax on high income by dividing it into reasonable salary (income and self-employment tax) for the job and equitable gain in the corporation (income tax, but no self-employment tax) – X

- Using a corporation taxed at 21% if personal tax bracket is higher

- Use a corporation to provide services to your LLC or S-Corp to defer taxes, if you’re over the 22% bracket on ordinary income. You can shift 21% income to corporate in 2018 and pay only 21%, but you’ll be taxed later, if you receive salary or dividends from the corporation unless you do it in a year where you have a loss or large credits – X

- Discussion of two clients in real estate that leveraged their experience to receive government tax credits was good – X

- 67- Examples of possible deductions

- 1031- https://simplepassivecashflow.com/tag/1031/

- 5 Types of Income (68)

- Earned income – W2

- Ordinary income – pension, 401k – no employment tax

- Investment income – interest, capital gains, dividends – lower tax rate

- Inheritance income

- Passive income – during the life of the investment – regular income rates but can offset with passive losses

- Give income to kids (Cons: They run away with it)

- Postponing deduction if you have a low income year – or thinking of taking out a 401K

- Bringing you parents as business partners – make them a partners in your corporation or LLC and flow the income on their low tax side

- Basis step up with parents – downside is trouble siblings

- 90 – 20% passthrough (up to 50% of w2, 90-91)

- Deductions (off AGI) vs Credits

- 98 – Types of credits: Family, education, charity, investment (oil gas)

Homework (Jan 11): Read Up Chapter 12-15 of Tax Free Wealth Book by Tom Wheelwright

Notes from the book:

- Salary dividend split. Use salary.com

- 115,116 deducting sales tax items. Didn’t know certain things could be deducted like the following: (1) Manufacturing Equipment (2) Inventory (3) R&D Equipment (4) Purchases of other Supplies

- HAS ANYONE APPLIED FOR TAX EXEMPT AT STORE

- Page 120 Property Taxes

- Any one appealed? LLC transfer (Example regarding basement: If basement is made slightly bigger then would have had lower overall tax as it would have been considered a 2 story, and 2 story places are valued less)

- Page 134, 135: Minority Discount- Don’t have as much say so no discount. Marketability discount- Discount as not many buyers

- Page 145: Need to keep the entity the same in two different countries so that you are not double taxes

- Charitable remainder trust – give away after death to humane society, church, high school, college, etc.

- Watch taxes if made in different states

Homework (Jan 18): Read Up Chapter 16- 24 (last) of Tax Free Wealth Book by Tom Wheelwright

Notes from the book:

- 170 insurance or umbrella policy is first line of defense

- 171 USA is not a loser pay system

- 171 USA also allows contingency fees – cook islands. Control everything own nothing

- 176 Charging order protection – immobilizes your business moving forward. Can’t get a loan. Info on using retirement funds for deals.

Question: I am considering investing in a 506c investment on a multifamily property. They are raising a 1 million from investors, then getting a loan and making improvements to the property and repositioning it over 5-7 years. I wanted to use my funds from my SEP IRA which is currently in a qualified intermediary trust. What is the UBIT tax? Will I be subject to that on this deal? Also, should I set up an LLC that then loans the money to their LLC? How can I structure this for tax and liability benefits?

Answer: [Note: From CPA and not this is NOT legal or professional advice]: When you invest in a business (syndicate = business) with your IRA, the IRA will be subject to UBIT (unrelated business income tax) and UDFI (unrelated debt financed income).

For our purposes, UDFI is produced when an IRA uses debt to purchase real estate. Essentially, the portion of the property’s income considered UDFI is based on the percentage of rental income derived from debt.

For example, Property A is purchased for $100,000. You put down 25% of the purchase price as a down payment and finance the remaining 75% with a traditional mortgage from the bank. The property produces $10,000 in net income for the year. $7,500 (75%) of the net income is considered UDFI and is subject to UBIT.

There is a deduction for the first $1,000 of income subject to UBIT. Income subject to UBIT over $1,000 is taxed at trust rates. For 2017, trust tax rates start at 15% and max out at 39.6% after just $12,400 of income subject to UBIT.

UBIT is paid by the IRA account. If for whatever reason UBIT is paid directly by the taxpayer, the amount paid is considered a contribution to the IRA.

Follow up question: Is there any difference in how the UDFI will apply for these:

- SD IRA

- SEP-IRA

- Solo 401K

- SD IRA (operated as an LLC) so this one is confusing. My LLC owns an LLC (syndication) which owns a property

Try to decide if one is better than another for tax purposes!

Answer: The solo 401(k) is not subject to UDFI but it subject to UBIT. The IRAs are all subject to UBIT and UDFI. Note that generally the passive income flowing back to you is very low and the as a result we don’t see a huge UBIT tax.

Another idea would be to take a debt position (lending) rather than equity. The interest you would receive is free of UBIT and UDFI tax.

(This suggestion of a “debt” position or note investment with the SEP IRA to avoid UBIT and UDFI tax is a creative one… but it’s a very low chance of happening because it’s just too complicated and honestly not worth the effort from the syndicators side. It’s a very similar case of to a Tenant-In-Common (TIC) arrangement where an investor has 1031 exchange funds and wants to parlay that money into a syndication. It’s possible but from the syndicator’s prospective a lot of unneeded work when you can just raise the funds the traditional way. Caveat: if you are bringing in a huge amount of money say 50% of the raise then that might tip the scales in your favor)

You can tell that this is a really, grey area. One CPA mentioned, the answer depends on how you structured the syndication, UBIT may or may not apply for the real estate holding for solo 401k. I would really try to toss the Operation Agreement to your individual CPAs to examine and determine ahead of time.

- 195 What you like to do? Any hobbies you can turn into business to change your facts to change your tax. What has been your biggest struggle?

- 197 Start up costs and amortized

- 201 Accrual vs cash

- 202 offshore planning

- 218 Mutual fund tax trap

An excerpt from “Tax-Free Wealth” by Tom Wheelwright

THE MUTUAL FUND TAX TRAP

Mutual funds are the most common form of stock market investing. The problem is that mutual funds contain a tax trap that many people don’t know about. Think of a mutual fund as a pass-through entity like a partnership. The income earned in a mutual fund is not taxed to the mutual fund. Instead, it’s taxed to the investors. That might be okay if everyone entered a mutual fund at the same time. Everyone would simply report their share of gains and losses on the stocks sold in the mutual fund, and then they would see the value of their investment grow or decrease by those same gains and losses.

That, however, is not how it works. If you invest in mutual funds, you will likely buy into a fund that has been around for many years. Over the years, investors have come and gone while the fund has purchased many different stocks over those same years. The challenge comes when the fund goes to sell a particular stock. Let’s say you decided to invest in Mutual Fund A at the beginning of the year. The fund bought Stock B for $10 per share fifteen years ago. When you joined the fund at the beginning of the year, Stock B had a market value of $50 per share. The day after you join the fund, the fund managers decided to sell the stock. So there is a gain to the fund of $40 per share on the sale of Stock B.

Who pays the tax on the $40 gain? You do, even though you just joined the fund the day before. All investors who owned shares of Mutual Fund A on the day the mutual fund sold the stock share the gain. Doesn’t seem fair, does it? It gets worse.

Suppose you paid $100 per share for Mutual Fund A when you bought it in January. At the end of the year, the stock takes a dip in value and now your shares of Mutual Fund A are only worth $80 per share. You still have to pay tax on your share of the $40 gain from the sale of Stock B inside the mutual fund.

RULE #17: Mutual funds are one of the few places where you can lose money and still owe tax on your investment.

Can’t SDIRA a flip real estate because it doesn’t allow a long term hold but can do stocks???

- 224-225 Do your stock trading in a Roth IRA – never pay taxes on gain. Could be a good way for crypto believers to hold bitcoin. Personally I would rather have the gain go into opportunity zones investment.

- 228 oil and gas not subject to passive loss rules. Development wells vs exploratory wells

- 232 deductions for running a farm or orchid (wine?)

Get In As A [Founding] Group Coaching Student

The group coaching is something that I have been trying to put together a couple years now after I accumulated a lot of content and got a feel for coaching students these past few years in a one-on-one setting. Visit:

“The Mastermind: The Journey to Simple Passive Cashflow” will consist of:

1) 27 weeks of curated content with concepts building on top of each other

2) Participants go through those modules together and are able to interact on the Bi-Weekly Call and the Private Facebook group in a “group study” environment

3) Bi-Weekly hour power calls switch between the topics of a) Acquiring you direct investment and b) more high-level wealth building concepts and syndication education

It’s going to be a really cool format where people take the journey together. Think like a Fraternity/Sorority without the weird stuff. When I was going through programs it was most beneficial to connect and climb the ladder with quality people. Who knows someone of your Cohorts might do a deal together or become lifelong friends or accountability partners.

It’s a cool format! This is where people take their journey together. Think like a Fraternity/Sorority without the weird stuff. When I was going through programs it was most beneficial to connect and climb the ladder with quality people. Who knows someone of your Cohorts might do a deal together or become lifelong friends or accountability partners.

FAQ From Students To Their Tax Professionals:

“I sold my business can you explain what went down on my tax return?”

Answer: The sale of your business was a capital gain. Capital gains can only be offset by capital losses. However, you had no (or limited) ordinary income – actually a loss from the two non real estate investments that had depreciation. This created an unusual situation where under the capital bracket system used on your capital gains it looks like the losses from the non real estate investments are offsetting your capital gains but that isn’t what is really happening. The losses are lowering your taxable income and taxable income determines the tax bracket of your capital gains and a portion of those capital gains are taxed at the 0% and 15% tax bracket. So, all capital gains isn’t being taxed but rather only a portion of it (but it takes the appearance of the capital gains being offset by the losses).

Question : When taking a distribution from a retirement account, do I have to report the distribution?

Exclusive SPC Nation Offers

Suspended Losses (last resort to lower ordinary income without REP)

The order in which suspended losses are deducted is:

1. To first offset depreciation recapture and gain from the activity that was sold.

2. If the suspended losses are in excess of the total gain, the remaining suspended losses will then offset ordinary income.

3. If the suspended losses do not offset 100% of the gain from the activity that was sold, you may use suspended losses from other rental activities to offset the remainder of the gain from sale.

This is detailed in IRC Sec. 469(g)(1)(A). And if you want to have a wild Wednesday night, here’s an article that explains it in-depth: