“Lane challenges the status quo… what we all grew up learning about money and investing… and teaches how to build cashflow to leave the “rat-race”. Over the past 2-years, Lane’s leadership, advice, and friendship has been integral on my path to building a real estate and note portfolio beyond my imagination. I’ve also hit the elusive accredited investor status with 1 financial maneuver I learned on listening to Lane’s show. And the crazy thing… I’m just getting started! Thank you, Lane!”

— club member

“It continues to amaze me how many physicians refuse to open their mind and invest in other things other than the career. I’ve recently cut back eight shifts per month and my partners are like how can you afford that but, considering I am on my 27th multi family deal and just recently sold all my single family rentals Im not retirement ready but definitely cut back the stress of ER. Keep pushing, refreshing your energy and well put together deals!”

— club member

“We lost $100k with another pop-up syndicator. Unfortunately the SEC has been investigating them for over a year, now. We recently got an email saying they were going bankrupt. We never got the kind of monthly reports from them like you give us. So glad we found you Lane.”

— club member

“My wife is officially is quitting her job at the end of this year. Thanks for helping us be able to do that. One of her friends had to go back to work 10-weeks after having their second kid because they need her income to pay the mortgage. It makes me cringe just thinking about that.”

— club member

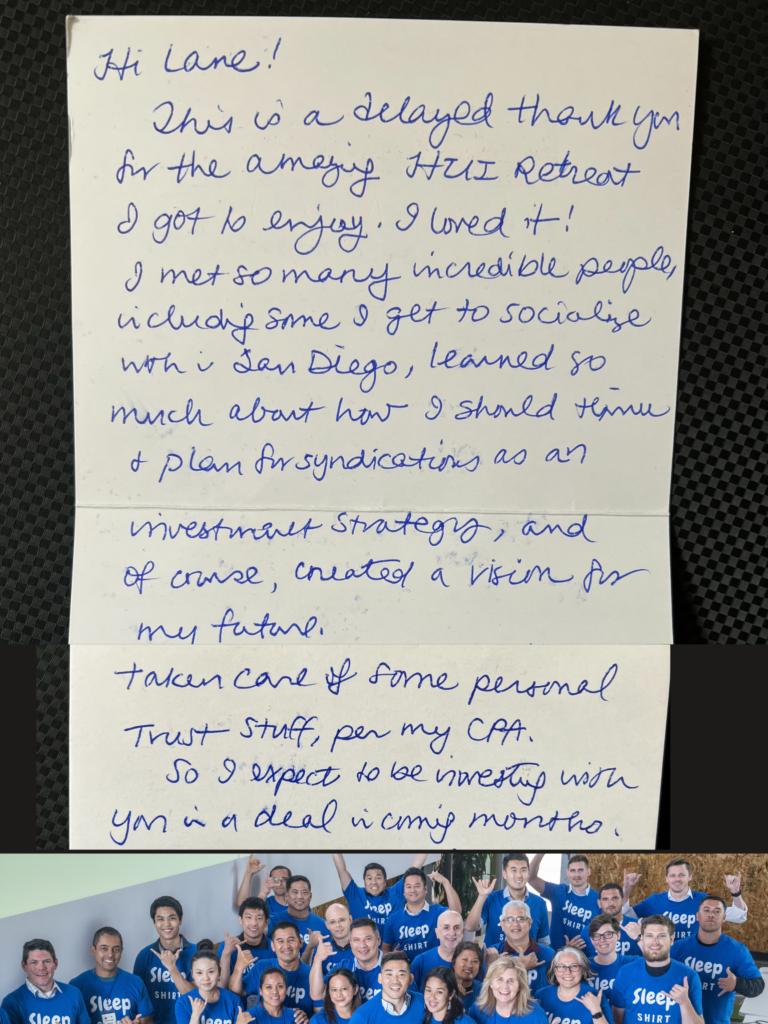

“Most of your people seem to be working professionals. Where as I’m an “old fart” that just retired. So my focus now is how to juggle retirement income into investments (I just started up my IBC, and plan to fund it with retirement accounts, and syndications that exit) and building legacy wealth.

My story (situation/scope): I was up to 10 SFH when I met you in 2018? or was it 2019? 3 properties were in Honolulu, 7 on the mainland, and 4 of those 7 were in an SDIRA. Similar to you, I was frustrated with how much hassle it was managing the out of state property managers, and I was still working full time and a single mom of 2. In pre-retirement we took over management of our rentals. This was more hassle than I wanted to have in my retirement so we started researching alternatives and found out about syndications. Once we started investing in Syndications (by selling my stocks, getting a HELOC at 0.5% interest from a local bank, increasing an RMD from my bene IRA. selling a property) We were able to get us to where my investments equalled my w-2 income in 2020. So with the pandemic starting…… I retired!

Next March, I’ll be 59 1/2 and able to draw on my IRAs without penalty (and no tax on the Roths) so I recently started up an IBC thanks to your team. This will be my “holding tank” as I sell off my SDIRA SFHs and wait for a syndication to come up. I’ll also be eligible to start drawing on my OR state pension and since I’m no longer dependent on that monthly income, I’m planning to take out chunks so I can invest my pension income. In 4 years, I’ll be eligible to draw on my state pension.

At the last Hawaii Retreat we were able to sit at the same table with your legal team for lunch found that we did not inherit our parents property the right way to qualify for the step up in basis, so I had to deal with huge capital gains taxes when I sell. Luckily, your Rockerfeller deal came about at that time (And you other realitor contact just helped us sell one Honolulu property) so we invested in opportunity zones.

So that’s 4 people I’ve met through your networking opportunities that have helped me along! And countless other contacts just by showing up at mixers. Your net work is truly your net worth!”

— Tracy, retired club member

begin your journey to financial freedom!

My name is Lane Kawaoka, and I hope my blog/podcast will help families realize the powerful wealth-building effects of real estate so they can spend their time on more important, instead of working long hours and worrying about their financial troubles. There are a lot of successful families with good jobs (teachers / engineers / programmers / finance) yet they struggle to make ends meet financially. It is their kiddos who ultimately get the short end of the stick. Being a Latch-Key Child growing up, both my parents had to work and I was left home alone after school to fiddle with my thumbs.

With Real Estate you are able to grow your wealth exponentially faster than the conventional 401K’s and stock investing, therefore you are able to escape the dogma of working 50+ hour weeks at a job that is unfulfilling. And if you are one of the lucky ones who happen to do what you enjoy… well good for you 😛

Money is not everything but it is important because it gives you the freedom to live life on your terms.

Annoyed by the bogus real estate education programs out there (that take money from people who don’t have it in the first place), I set out to make this free website to help other hard-working professionals, the shrinking middle-class. I hope to dispel the Wall-Street dogma of traditional wealth-building, and offer an alternative to “garbage” investments in the 401K/mutual funds that only make the insiders rich. We help the hard-working middle-class build real asset portfolios, by providing free investing education, podcasts, and networking, plus access to investment opportunities not offered to the general public.

“The true meaning of wealth is having the freedom to do what you want, when you want, and with whom you want.

Building cash flow via real estate is the simple part. The difficult part occurs after you are free financially to find your calling and fulfillment.

But that’s a great problem to have ;)”

excerpt from The One Thing That Changed Everything