For the longest time, owning a home has been every American’s dream. The idea may seem to be very appealing and highly marketable, but does buying your own home more advantageous?

Or you are simply being influenced by your real estate broker or closed knit friends surrounding you?

Introduction

In the minds of many, psychologically and mentally, it represents security, stability, and financial independence. Renting has traditionally seen as throwing money away, as many people also see homeownership as a financial investment in their future thanks to the popular belief that property will only ever rise in value, even if the recession of 2008 demonstrated otherwise.

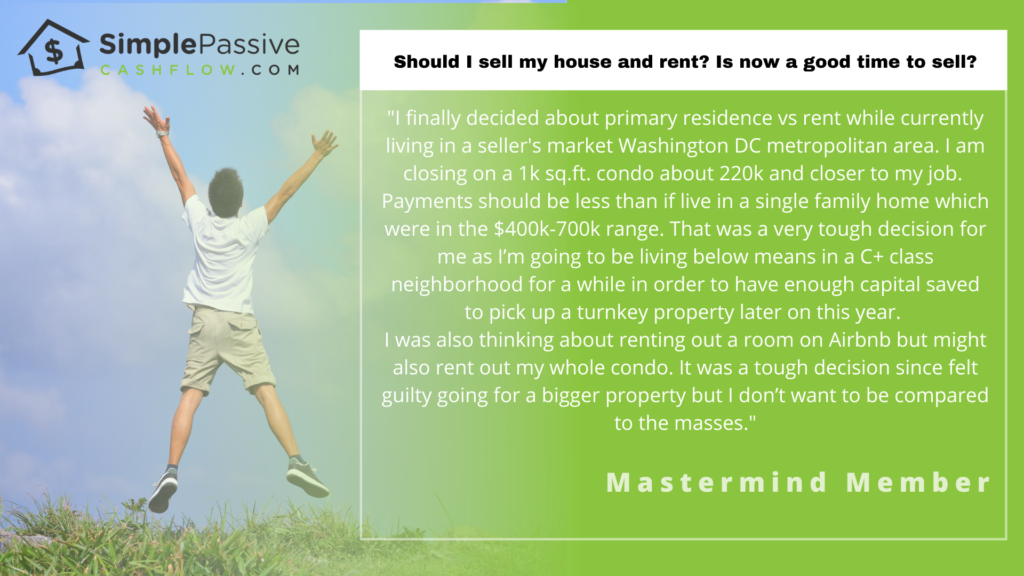

Lane’s Thoughts:

” To our Mastermind member, good decision! This was a hard decision for me too and I wasted a few years getting to financial independence by getting a primary residence. However it got me started and I was lucky with some appreciation. Life is a bunch of binary decisions of yes’s or no’s. You’ll eventually have a turnkey property. Just made a decision to get you to FI!”

The reality is that allowing for inflation, house prices have increased by just 1% during the last century, representing an extremely poor return on investment, and one that has been easily outperformed by the stock markets and direct investment in businesses and hard assets. Research has shown that the net value of homeowners is, on average, 44 times greater than that of non-homeowners, however, it’s unclear whether this is a correlation or causation.

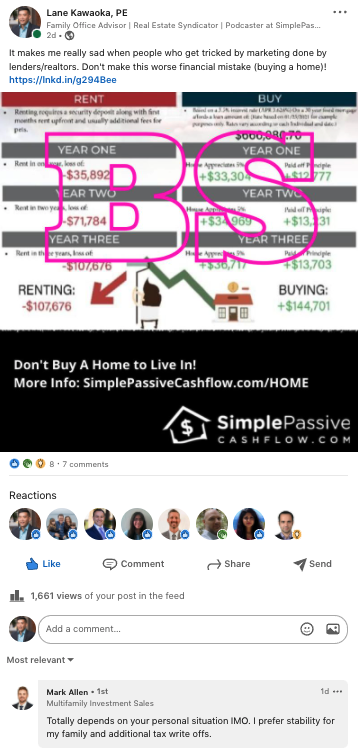

Watch: Don’t make this worst financial mistake!

So should you buy or rent? The truth is that there’s no ‘one size fits all’ answer to that question. Every individual has different circumstances that determine if buying or renting their home is best for their long-term financial prosperity. This guide is about you making the right financial decisions for you. It’ll examine the pros and cons of buying and renting, what you should take into account before making a decision, and the relative financial considerations of a mortgage versus rent.

👈 Must Watch!

He realized that it was a mistake to buy his own home…

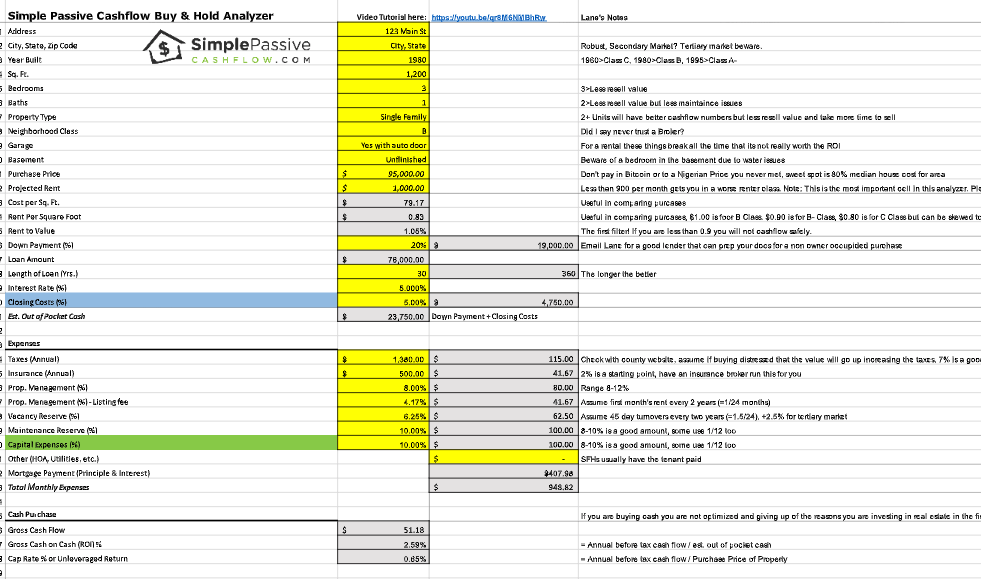

If you are a numbers guy:

Join the movement of high-income earners who are renters!

They did the math and did what made sense.

***I spent $300 dollars for an editor to get the grammar and spelling right on this article. I am sick and tired of seeing young families make this mistake.

This is how I care for you guys!!!

What do I do?

I live in Hawaii a primary*** market. Therefore it makes more sense for me to rent a $1M home for $3,000 a month. My poor landlord is making only 3.6% on their money and that does not include any taxes, expenses, or capital expenses!

Where I get to live in a great home and put my money into buying all these mobile home parks or apartments that are kicking off cashflow, so I never have to pay taxes, appreciation with leverage, and my tenants are paying down my principal payments.

***San Francisco, Hawaii, Los Angeles, Seattle, Boston are examples of primary markets which are NOT ideal for cashflow investing.

***To make my wife happy these are the things I buy cause we can’t change out things in the house.

Let me guess you’re thinking, “It’s a property. Home price will increase over time anyway?”

Yes, it could appreciate but I consider that gambling. Sophisticated investors invest on cashflow where the rents exceed the mortgage plus expenses (and enough money to pay for professional property manage to do our dirty work).

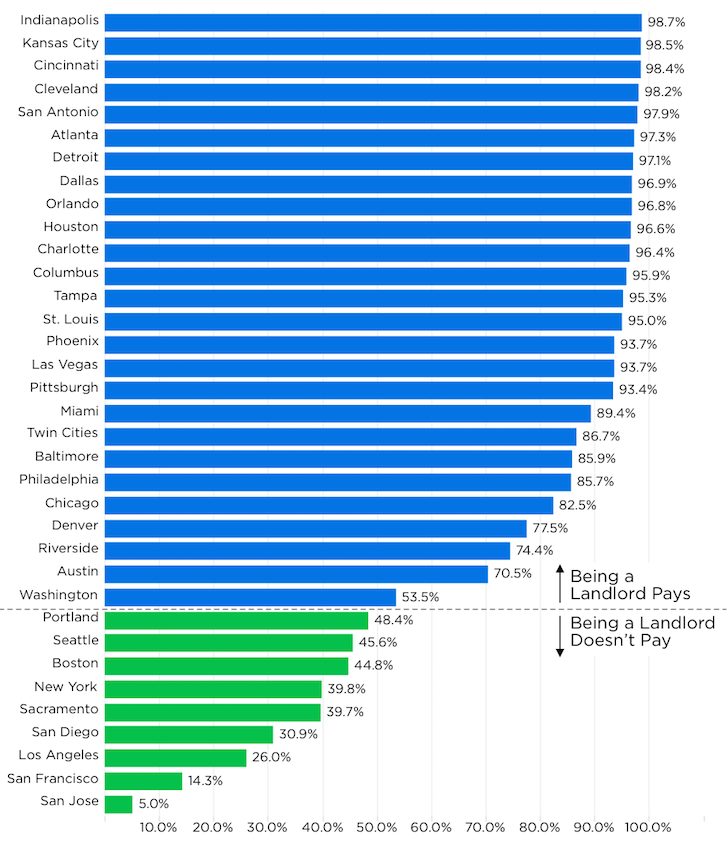

Sophisticated investors look at the Rent-to-Value Ratio and look for at least 1% or more to be able to cashflow after expenses. You find the Rent-to-Value Ratio by taking the monthly rent dividing by the purchase price. For example a $100,000 home that rents for 1,000 a month would have a Rent-to-Value Ratio of 1%. Most people I work with live in primary markets (as opposed to Birmingham, Atlanta, Indianapolis, Kansas City, Memphis, Little Rock, Jacksonville, Ohio, or other secondary or tertiary markets) where the Rent-to-Value Ratios are under 1%.

Most investors don’t follow this prospectus but then again most investors only own a few rental properties at most.

Why is it most sophisticated investors who invest for cashflow own over 20–50–1000 units?

What’s in this guide?

This guide will cover everything you need to consider about purchasing a home, renting, and purchasing a property to rent. This includes:

- The advantages and disadvantages of renting

- The advantages and disadvantages of buying

- The costs associated with renting vs buying

- Choosing a property

- Taking on a home loan

- Using your home to finance your future

- Buying a property to rent

- Useful resources

Financial Freedom

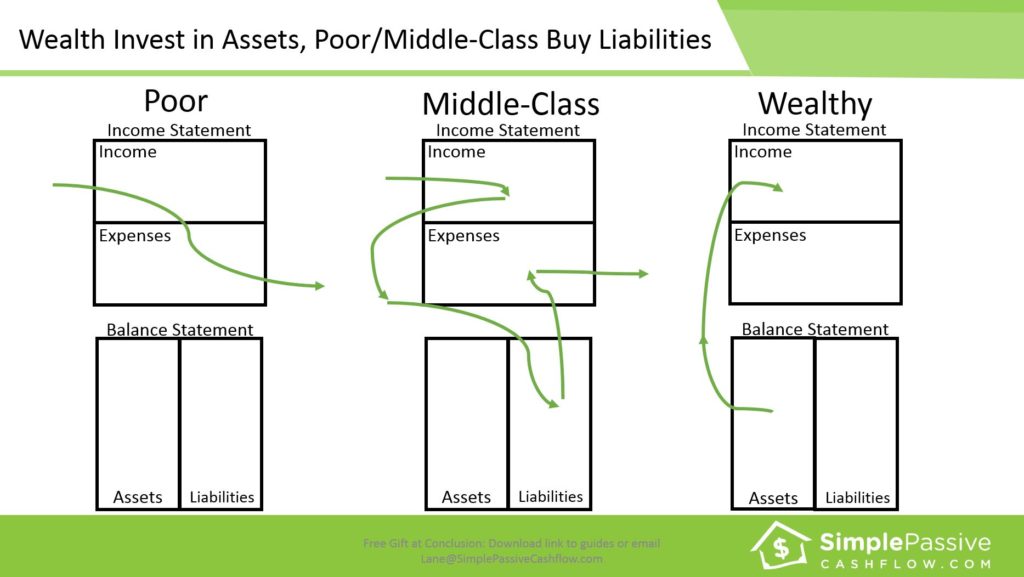

Firstly, this guide is about helping you to achieve financial freedom. What the wealthy do to achieve security and optimize investment returns is not always conventional wisdom. When financial freedom is your goal, there are two simple principles to follow:

- Prioritize purchases/acquisitions that make you money

- If a purchase/acquisition doesn’t pay you and you are speculating on increasing home values, don’t do it.

While this may seem black and white, sticking to these principles will again depend upon your individual circumstances. See the difference in how the poor, the middle-class, and the wealthy live financially:

For some, buying will generate the most financial opportunities, for others it’ll be renting

Hint: If you can’t save money to save your life then buying a home acts as a forced savings account, which will benefit you in the future.

So let’s look at the case for each.

Rent or Buy? What To Consider

Before going any further in this guide and considering whether buying or renting a home is the best option for you, there are a few important things you should bear in mind as you continue. These are:

- Are you comfortable living with unknown and variable costs? Or prefer having your costs fixed?

- Do you like to personalize your home, or are you happy to live with other people’s choices?

- How much space do you really need? Do you really need 2,000 square feet and that 4th bedroom to raise a family or is that your ego’s need to keep up with the Joneses talking?

- How much time and work are you prepared to put into the upkeep and maintenance?

Renting

Chances are that you’ve been told repeatedly that renting is like flushing water down the toilet. That you are paying money out each month and twenty years later you have nothing to show for.

The wealthy do not believe this misnomer and see housing as just another line item in their personal finances.

Our changing lifestyles mean that renting can be a sensible option for many people which can actually help you achieve your financial dreams.

So, what are the advantages of renting?

Flexibility and Mobility

The biggest argument in favor of renting over buying is the flexibility and mobility it offers. If you have to – or want to – move regularly, then renting allows you to easily pick up and relocate. Equally, if you decide you don’t like the property/neighborhood after all, that your commute is too long, or that you want to get your kids into a better school district, you have the flexibility to do that. Remember, gone are the days where you stay a loyal employee for decades. Often many professionals need to be mobile to compete for the best positions and salaries. Many of my friends in IT and Tech report dusting off the resume after they have reached the 6-month employment milestone. Having geographical mobility is essential in competing for the best jobs.

Liquidity in difficult times

Renting can often be cheaper than buying. Some rents even include utilities, and when things break, it’s not your problem, call the landlord – it’s their problem! That means you have more available cash.

Don’t forget that life is unpredictable and things change. Perhaps your income goes down, unexpected bills occur, your mom falls in the shower and can’t get up, or your deadbeat brother-in-law hears of the rental properties you are picking up and needs a place to hang out and join your family. The beauty of renting is that if your financial circumstances change, you have the option of moving to a cheaper property without too much difficulty instead of selling the home in a fire sale due out of distress.

Credit ratings

Not everyone has a perfect credit history. Experts estimate that around a third of all American adults have a credit score below 601 and so are considered a poor or bad risk. This greatly reduces the likelihood of qualifying for a regular home loan, meaning that borrowers would have to pay higher interest rates on any borrowings. If you fall into this category, buying is unlikely to be worth the expense.

Note: Don’t let real estate or lending brokers trick you into using the “scarcity tactic trick” where they say interest rates are at all-time lows! Buy now because it’s not getting any lower! Remember they get paid when you buy or originate a loan. Locking in a low-interest rate is a poor reason to go into a 30-year commitment for something you should not buy in the first place, even at a 0%.

Buyer’s remorse

A survey by Trulia found that 44% of American homeowners had some form of buyer’s remorse, and around a fifth had actually been prevented from changing their situation because of making a mistake when purchasing a home. With renting, if you’re not happy, you’re free to move at the end of your lease. Paying a couple of dudes to move your stuff from time to time is pretty cheap in the grand scheme of things.

Local costs

If the area you live in has high property taxes, high insurance costs, or low rent-to-value ratios, then the math on renting makes sense. The rent on identical properties can vary hugely based simply because of their location, for example a $100,000 house might be leased for $500 a month in one town but $1,500 in another. Where rent to ratio values are low, renting is the savvier decision. Often primary markets such as San Francisco, Seattle, Los Angeles, New York, Washington DC, Honolulu, (are cool places to live but) have low rent to value ratios, as a result of too much wealth living there driving up the overall market. Investing in secondary and tertiary markets where the rent to value ratios are high means that the income more than supports the mortgage and expenses, for positive cashflow.

Examples of these locations are Atlanta, San Antonio, Houston, Indianapolis, Birmingham, Memphis, or Kansas City. In these areas, it may make sense to buy a primary residence to live in.

Disadvantages of renting

Of course, while there are many advantages to renting, there are also drawbacks that can’t be ignored, and each individual needs to decide if the benefits outweigh the disadvantages.

Not feeling at home

Tenants are rarely allowed to decorate the property the way they would like. Décor is usually neutral and can feel clinical. Personalization is usually limited to putting up pictures and damage caused by doing so must be rectified before the tenant leaves. If personalization is important to you, then get over it… nah just kidding😉

Rent Increases

Rents usually rise annually. In some areas, rents increases are limited by local regulations. In most instances the landlord is free to increase it by as much as they like. In areas that are very popular, rent rises can be a significant increase to reflect increasing market demand.

Lack of security

While renting offers flexibility, it also lacks security. Your landlord might decide that they want to sell the property or have someone else live there. If you’re on a month to month lease, typically your landlord only needs to give 30-60 days’ notice.

Moving residences costs money, and you’ll need to find a deposit plus up to two months’ rent in advance for a new property, alongside the fees listed below. And that’s all before your landlord returns your deposit.

Lack of tax breaks

Homeowners brag about claiming extra tax write offs on their mortgage interest against their tax bill. This is true that tenants can’t claim anything against their rent but this argument is a very weak one and likely dogma created by brokers to motivate you to create more transactional commissions.

Spending 100 dollars’ interest to deduct it on your taxes is actually one of the dumbest pieces of financial advice I have ever heard. They’re basically telling you to incur expenses to save a fraction of it. The tax benefits that you get as a real estate investor will blow the mortgage interest tax deduction out of the water due to taking other expenses as and operational business, depreciation, and not to mention the overwhelming greater return on investment if you bought a rental property than buying a primary residence to live in. And if you have seen the 2018 new tax laws it’s just a matter of time until the tax deduction for the regular person is going to be phased out. The middle-class just can’t catch a break!

Additional costs

Taking out a new lease incurs a number of costs. These can vary with state and your circumstances, but typically include:

- Broker’s fee: whether or not you need a broker will depend on where you want to live. In many big cities, landlords or property managers frequently won’t consider any applications that haven’t come through a broker. Typical fees vary between one month’s rent and 15% of the total annual rent. However, this is not the case in most circumstances but I’m just trying to be a good journalist here.

- Application fee: this covers the cost for credit and criminal background checks. Usually cost between $35-75 per person.

- Security deposit: we’ve already mentioned this, and it’s generally set at one or two months’ rent. However, some property types, especially condominiums, charge a move-in fee as well. This covers the charge of updating mailboxes, reprogramming buzzers, etc. This can range from $100-$200.

Based on a $1,000 monthly rent:

| Fee type | Minimum | Maximum |

| Broker’s fee | $1000 | $1800 |

| Application fee | $35 | $75 |

| Security deposit | $1000 | $2000 |

| Move-in fee | $100 | $200 |

| Total | $2135 | $4200 |

What about my furry friend?

Many rentals will charge a cleaning fee or surcharge for a pet. Due to people abusing the “service animal” loophole this is usually at the landlord’s discretion. However, more and more people are single or don’t have a roommate, landlords are becoming more accepting of our four legged friends. In fact, many landlords including myself see your pet ownership as a sign that you are more of a dependable long term tenant – minus the crazy cat lady/man with more than 3 cats.

But my spouse wants to buy our own home?

If you are in a Primary market the prevailing market rent to value ratios under 1% usually means that if you rent you will be able to live in a much nicer home than if you bought, assuming you had the same PITI mortgage payment.

Say you are looking at a $1,600 mortgage on a $350,000 home (typical 20% down payment). Now consider taking that same $1,600 monthly payment you will be amazed that you would be able to live in a nicer home. This does not even take into account the hidden costs of homeownership that we will talk about in a bit – and you can dive into the numbers with the accompanying spreadsheet.

And by the way, have you ever driven a rental car? It’s a lot more fun when you are not worried about a dent or paint chip here or there.

Purchasing a home

Now we’ve looked at the pros and cons of renting, we’ll do the same for purchasing a home or property, what to consider when taking out a mortgage, and how your home could be used to finance purchasing a property to rent.

Supersize me “homeowner style”

Average sizes of homes have increased according to the U.S. Census Bureau. In 1973 the average home was 1,525 sq. ft. Today that number approaches 2,500 sq. ft. That’s almost a 64% increase in square footage on the average home!

Despite the average family size decreasing from 2.9 persons per household in 1973 to 2.5 persons today, kitchens have doubled in size in those 4 decades along with the average ceiling height in a home rising by more than a foot. But more space in a home ultimately means more space for “things” and the increase in maintenance costs. Add to the mix cheaper and faster construction methods and you have the beginnings of a bubble.

The graph below illustrates Robert Shiller’s data. Shiller, a Yale University Economics Professor, shows how housing prices have changed over time using an arbitrary starting point of 100 adjusting for inflation.

Difference between a home and a property

This might seem like a strange concept, but there is a difference between a home and a property. Why? A home is somewhere you live, where you invest emotionally as well financially. It’s your anchor. A property can be anything from a piece of land to a luxury penthouse, but where you don’t intend to live and is purchased as an investment.

Buying a home is a huge commitment. No-one can argue with that. While home ownership is usually associated with stability and security to many, that stability and security can be a double edge sword become if your circumstances change.

When our parents and grandparents bought their homes, they probably expected to stay in the same area, near their families, working for the same employer for most of their life. If they wanted a new job, chances were that they’d find one in the same area. People didn’t often move away from their roots.

Employment trends have changed where very few jobs are for life anymore. And many people – especially professionals – find themselves looking further afield for work. Perhaps the perfect job is on the other side of the country. What do you do? Being tied into owning a home can restrict where you can work and, therefore, your earning potential.

Homeownership also ties up your cashflow, and the more expensive your property, the more that’s true.

The biggest mistake I see young couples make is not having a personal balance sheet that has a net positive cashflow. This cashflow is the oxygen for investing and learning about investing. Along with just plain overspending, buying a house is the biggest cashflow suck in the middle-classes’ budget.

For an analysis of the opportunity costs – check out the accompaniment spreadsheet that outlines the numbers.

The Big Questions

Before deciding to purchase your home, you need to understand what your priorities are. Without understanding these, you could easily make a costly mistake. Let’s call these The Big Questions, and they are:

- What do you want your financial situation to be in five or ten years’ time? What would your desired savings be? Are those savings realistic and achievable if you purchase a home?

- What space do you consider essential? How much do you own? Are you willing to downsize and declutter if necessary? Are you someone who likes to be able to get away from the other people in the house and have your own space? Would you be prepared put your ego aside to live with a smaller home if this gives you financial freedom?

- How much time are you prepared to spend on renovation, repairs, and maintenance?

- I know what you young parents are thinking… and I ask you do your kids really need a yard? They’re on their electronics all the time anyway. And with you taking that higher paid job to afford the mortgage they will never see you.

The advantages of homeowning

- Depending on the area, mortgage repayments can be lower than rent.

- Unlike renting, where a landlord can decide not to renew your contract, you can live there as long as you like as long as you make your monthly payments and ever-increasing property taxes.

- A fixed rate mortgage means that your costs are predictable.

- The interest and property tax on the mortgage are tax deductible. Note: BS Flag!

- For those who struggle to save, a home is a forced savings plan.

- The value of the home may/might appreciate – also tank like in 2008

- You have an asset you can sell or refinance if you need access to cash.

The disadvantages of home ownership

- It’s a very long-term financial commitment. How many of us can imagine where we’ll be in thirty years? 5 years even?

- Mortgage payments may not be cheaper than renting. And purchasing a property requires a down payment plus considerable closing costs. Money today is more valuable than in the future especially if you can invest and make 10-20% per year.

- Any maintenance and repairs are your responsibility. There’s no way to predict what might go wrong, and costs can add up.

- Should you want or need to move, selling a home can take some time, making you less mobile.

- The value of your home may fall, depending on the economy.

- You can have terrible neighbors who start a side business selling Meth or, potentially more impactful, have the next door teenager start their own garage band.

- If your life circumstances change, e.g. your wages fall and you can’t afford the mortgage, then you’re stuck in the situation until you’re able to sell.

- Have you ever seen those scummy “buy your home for cash” ads? It works because everyday people run into problems and one day it might be you. (Sorry, that was a low-brow sales technique!)

The History of a Mortgage

Majority homeownership in the United States is mostly a recent phenomenon. Until the mid 1940’s, most Americans did not own their places of residence.

Big banks and their activities could be argued to have been the catalyst for the “American Dream” of homeownership becoming the majority statistic post-1950. The National Bank Acts of the 1860’s kick-started this gradual change. US Treasury securities now backed the US National Currency and standardized practices of US national banks. And by the 1890’s, American banks saw the popularity of Mortgages rise.

These early mortgages at the turn of the 1900s were in stark contrast to those that we see today. A typical homeowner in 1916 would pay up to 50% down with a 5-year interest-only-structure whereas a typical homeowner will save for 20% with the standard 30-year plan.

Amortized interest front loads the fees and interest in the beginning of the terms and greatly advantages the bank instead of the homeowner. For more discussion on this phenomenon check out this webinar on the topic to pay your mortgage off much faster with instead of simple interest.

What to consider when taking on a mortgage

The vast majority of people purchasing a property, whether it’s for their own use or to rent, will need a mortgage. A mortgage is a long-term commitment, typically thirty years in the USA. Fifteen years is the next most popular option. On average, most people now occupy the same home for around nine years.

Purchasing a home isn’t cheap. Lenders typically require a 20% down payment, which immediately reduces your available funds. You’re then tied into an ongoing financial commitment that reduces your cashflow for years to come. Even though the high level of competition in the mortgage market means that interest rates are generally competitive, mortgage payments are still a significant chunk of your income.

If you are also a real estate investor looking for additional income be mindful that one of the biggest factor’s in getting a loan is the debt-to-income ratio. Having a large mortgage (loan) without the income coming in from your primary residence will greatly impact this ratio.

Fixed Rate Mortgages vs. Adjustable Rate

We all know that interest rates vary. Most Americans opt for fixed interest mortgages, preferring to know what their costs will be for the foreseeable future. The downside is that any drop in rates can be taken advantage of only through refinancing, which incurs additional costs.

While Adjustable Rate Mortgages (ARMs) are available, and often have lower interest rates initially, rates can rise dramatically if the economy changes, making them a higher risk. However, homeowners can always refinance.

Costs of Taking Out a Mortgage

As mentioned above, there are a number of costs associated with securing a mortgage, which can become significant. Although they can vary depending on the state and municipality, these costs, typically are:

- Mortgage application fee: around 1% of the total loan, payable on the application even if the loan isn’t approved. This is why it seems like everyone is trying to give you a loan because it’s really profitable to be a lending broker.

- Home appraisal charges: even if you stay with the same lender, they may want to appraise your home to confirm the current market value. Charges vary between $225 and $700.

- Loan origination fees: a charge applied by the lender for processing the loan, before the application is sent to the underwriter. Usually between 0.5% and 1%. The smaller the loan, the higher the percentage is likely to be as both require the same amount of work.

- Documents preparation fee: a charge for preparing key documents, including the refinance mortgage, note, and truth-in-lending statements. Typically, $200-500.

- Title search fee: before lending, the lender wants to check that the home’s title is free and clear of liens and encumbrances. It’s usually carried out by a separate company which will check court records, prior deeds, and property databases. Usually $700-900, which includes insurance to protect the borrower against any losses caused by legal issues relating to the search.

- Recording fee: set by local or State government, these are the fees for recording the refinancing publicly. Varies between $25 and $250.

- Survey fee: to ensure that the property boundaries are followed and are not being encroached on by adjacent properties. Usually between $175-300.

- Inspection fee: not always necessary, but some lenders require an inspection of the home’s plumbing, electrical and HVAC systems and roofing, and check for potential infestation. $175-300.

- Attorney fees: again, not always required, but some states require attorneys for both the borrower and lender to confirm that the closing documentation is correct. Typically, $500-1000

- Flood certification: if a property is in a federally-designated flood zone, homeowners may be required to add flood or life of loan insurance coverage. Certification costs between $50-150.

Fees on a $100,000 mortgage:

| Fee type | Minimum | Maximum |

| Application fee | $1000 | $1000 |

| Home appraisal | $225 | $700 |

| Loan origination fees | $1000 | $1500 |

| Document preparation fee | $200 | $500 |

| Title search fee | $700 | $900 |

| Survey fee | $150 | $400 |

| Inspection fees | 0 | $300 |

| Attorney fees | 0 | $1000 |

| Flood certification | 0 | $150 |

| Total | $3275 | $6450 |

These are all in addition to a 20% down payment.

While these costs may be negotiable to an extent, they still add up. It may be possible to roll the costs into the loan, but will then attract interest alongside the capital amount, and may push up the interest rate.

Choosing a home

Part of the purpose of this guide is to help you achieve financial freedom. Choosing the right property will make a real difference to the possibility of doing this, so careful consideration needs to be given when purchasing a home. Remember you are competing with other emotional buyers. It’s a race to the bottom, and based on the “greater fools theory” where there will always be a greater fool paying more.

Property size

When buying a home, people often choose to buy the biggest and most expensive home they can afford. A logical fallacy is to think “this is my forever home where my 5 kids and grandchildren will hang out!”

It’s not surprising as homeowners want the best for themselves and their family. But purchasing the best home on the market and being financially solvent is mutually exclusive. Instead, buyers should consider taking on a smaller, cheaper property. Not only will mortgage costs be lower, so will maintenance and taxes, and you’ll have better cash flow which can be the foundation of your financial freedom.

Apartments vs houses

Apartments offer a number of benefits. Again, they are usually cheaper than houses and are easier to maintain. Even better, emergency costs are shared by all the residents in the building, reducing the cost of repairs.

As investors, we like investing in apartments as opposed to homes. Simply put tenants can only screw up 6 sides of the property in an apartment (ground, ceiling, and 4 walls) whereas a home has a total 10 sides and a yard at their disposal. Factor this into your decision as you evaluation the hidden maintenance cost.

Cheaper properties

A cheaper property means the down payment needed is smaller. If you have a large enough amount, the funds could be used as a down payment on two or more properties for an immediate investment. Alternatively, as lower costs free up cash, these savings can be used to purchase another rental property which is proven to snowball into more and more investments.

The problem with a fixer-upper

Buying a fixer-upper is know to be a way to “save money.” If you’re buying a home, you want it to increase in value. Taking on a fixer-upper can seem like a way of guaranteeing this, which is why it’s become a very popular option with people who can’t afford a decent house in a good area. But while taking on a fixer-upper can seem attractive there are a number of common mistakes that inexperienced buyers make which end up costing them money rather than making it. These are:

- Rushing into a purchase without fully costing out the necessary work or considering all the holding and sales costs.

- Buying an overpriced value home rather than a fixer-upper. A true fixer-upper should be around 10-20% under the local market value.

- Not checking the floorplans and layout to ensure that they’re accurate and workable, leading to considerable expenditure to correct it.

- Finding out that the property has foundational or structural issues.

- Underestimating the cost of repairs.

- Underestimating the work required.

- Not considering whether it’s an area that people are likely to want to live in. This is especially true if adjacent properties are boarded up or also require extensive work.

- The repairs are NOT financed, so require more funds out of your pocket, which again cripples your precious investment capital. In terms of the finances and return on your equity this is where you hurt the most.

For investors this is false because use liquidity to acquire more income producing assets. Therefore doing repairs after buying a house creates an out of pocket expense that drains liquidity and what makes it worse is that is not paid out of loan proceeds. Instead you want to use the loan proceeds to make the upgrades or repairs which requires the upgrade or repairs to be made before the property is purchased.

On average, respondents paid just over $250,000 for move-in ready homes. Meanwhile, fixer-uppers cost slightly under $200,000, on average. After renovations, though, fixer-upper homeowners ended up spending almost $247,000 in total when they managed to stay within budget. Fixer-upper homeowners who went over budget spent over $25,000 more than move-in ready homebuyers for a total cost of $275,700+.

Using your home to purchase other properties

Another way of purchasing other properties is to use the equity you’ve built up in your home. This can be done by a complete refinance of your home or you could consider taking out a HELOC.

HELOC stands for ‘home equity line of credit’ or, more simply, ‘home equity line’. In some ways, it’s similar to a mortgage, as it is a debt secured against your property. It differs from a mortgage in two significant ways. These are:

- A home equity loan (mortgage) is a lump sum, paid at once. A HELOC allows homeowners to borrow or draw money on multiple occasions usually over a period of 5-10 years, as the need arises, up to a maximum amount.

- As mentioned above, a home equity loan usually has a fixed mortgage rate, while a HELOC normally has variable interest rates linked to Bank Prime.

Typically, during the first 5-10 years, borrowers need to pay back only the interest on the sum(s) they have borrowed. Repayment periods begin after the borrowing period and are usually between 10-20 years. The repayment amount is calculated by dividing the capital accessed by the number of months in the repayment period. However, borrowers should be aware that some lenders require the capital to be repaid in its entirety at the end of the drawdown period.

Some lenders won’t allow a second charge to be secured against properties, so borrowers should seek permission from their mortgage company first.

Advantages of HELOC

- HELOCs are a convenient way of funding one-off needs, such as a down payment on a second property, or renovation.

- Interest is paid only on the sum borrowed, and during the drawdown period, borrowers can repay just the interest.

- Upfront costs are very low. The cost for taking out a $150,000 HELOC loan is typically less than $1000 and may be paid by the lender without a rate adjustment.

- Some HELOCs can be converted into fixed-rate loans when a drawdown is taken.

Disadvantages of a HELOC

- HELOCs are adjustable rate mortgages (ARM) but are much riskier than a standard ARM thanks to the way the interest is calculated. If the interest rate increases on 30 April, then the HELOC rate will rise on 1 May. There are also no interest rate caps.

- Ensuring that the HELOC is repaid can require considerable financial discipline, especially if the capital must be repaid at the end of the drawdown period.

Buying a property to rent

As fewer people are buying their own home, there is a strong demand for rental properties across the country. This demand has been fueled by factors such as the 2008 economic crash, the high number of people with poor credit ratings, stagnant wages, rising house prices, and the increased mobility of the workforce.

Owning one or more rental properties can be a good investment in your financial freedom. But it requires careful consideration. It’s not like buying a home. When you buy your home things like space, schools and amenities will be your primary focus, and you’re likely to spend more to get your perfect house.

When choosing a rental, you need to look at the local market. Check with local real estate agents what type of properties are in demand and choose accordingly. It may be that single bed apartments are snapped up, or that there’s a shortage of family homes. Buying in the best locations with the best school districts will lead to more competition and overpaying for the asset and its income stream.

If you do your homework, buying a property to rent can be profitable over time. It’s a way of generating a passive income, while also building up savings through increasing the equity in the property. In many cases, renting will cover the mortgage and the taxes, if not generate a small profit on top.

Renting out your home

Should you want to relocate or want to improve your cashflow, renting out your own home is a possibility. However, this option comes with a number of potential complications – both financial and emotional – that need to be considered.

Financially, you’ll need to inform your mortgage company when your home stops being your residence. Different mortgage lenders have different rules for borrowers who convert their homes into rental properties. It’s common for them to require you to live in your home for at least two years. Typically, interest rates for buy to rent properties are higher because of the increased risk to the property, and you may need to refinance.

When you purchase a home, you invest in it emotionally as well as financially. You decorate it in your preferred style. You make memories there. You have a connection. Then strangers live in your home. Perhaps they’ll be good renters and take care of it as if it were their own. But perhaps they won’t and seeing what was once your home damaged can be a devastating experience. Even if you find good tenants, seeing someone else in your home can be an emotional experience. With a property bought purely as an investment, it’s much easier to be dispassionate and deal calmly with any issues.

Factors to consider when buying a property to rent

Just as with deciding whether to rent or buy your home, deciding where – or even whether – to buy to rent needs to be carefully considered.

Rent to value ratios

The Rent-to-Value Ratio is a quick calculation real estate investors run to determine if a property will cashflow. Take a $100,000 home that rents for $1,000 a month, the Rent-to-Value Ratio would be 1% ($100,000/$1,000). One of the biggest factors to consider when buying a rental property is the rent to value ratio. In some areas, such as Seattle, Los Angeles and the East Coast, properties are expensive to buy, but rents are relatively low. In these areas, rent to value ratios can be less than 0.75%, meaning that there is little chance of even covering the costs, making purchasing a property a poor decision. In areas where housing is cheaper to buy and rent to value ratios are much higher, then it makes sense to purchase a property and rent it out. Some markets you can find these Rent-to-Value Ratios over 1.5% in solid areas.

Type of property

As already mentioned, knowing the local market and which type of properties are in demand is important. A property sitting empty is costing you money, not generating it. However, even knowing that, there is still the decision as to whether it’s better to take on a more expensive property that will attract a higher rent, or two or more smaller ones that may have a higher rent to value ratio even though the rents are lower.

Location

In real estate, the mantra is ‘location, location, location’, and that’s just as true for rental properties. Getting the location of the property right is just as important as choosing the right property type. If the market wants apartments in the city and large houses in the suburbs, buying an apartment in the suburb could be a costly mistake.

Location opens up other possibilities such as vacation properties. These can range from city apartments, beach or lake-front houses, to near big tourist attractions, anywhere that people are keen to visit. With the development of sites such as AirBnB, it’s easy to advertise properties for short-term rentals. While the property is likely to be empty at times this could easily be offset by the higher amounts that you can charge, and you can get to enjoy the property too.

Resources

Hopefully this guide has given you plenty to think about, and you now feel confident that you’re in a position to make decisions that will benefit your financial future. However, the right decision needs the right information, and so we’ve included these rent-vs-buy calculators from Realtor.com and Trulia.com to provide a personalized breakdown to assess whether buying or renting in your neighborhood of choice is most financially beneficial option for you.

Closing

The wealthy (not necessarily the rich) believe that home is not a place or house. It is the people that make a home. All too often a big house (the dream) is paired with long commutes and stressful jobs which minimizes the time away from home and what really matters.

The wealthy don’t attempt to keep up with the Joneses. They keep things simple and spend their resources (time and money) on the essentials and make sound financial decisions.

On an emotional note, although buying a home goes against everything from an investment standpoint there is something to be said about the security of owning especially if you have a family with kids.

We skimmed the surface on rental properties. For more information please visit SimplePassiveCashflow.com and check out our podcast.

About the author

Lane Kawaoka is co-owner of MFPE Investments LLC, which controls 1400+ units and where he is responsible for finding investment opportunities, analysis, and marketing. Mr. Kawaoka obtained a BS in Industrial Engineer and MS in Civil Engineering and Construction Management from the University of Washington. In addition to an analytical engineering background, Lane has real-world experience in working as a project manager for over $220 million dollars of capital construction projects in both the public and the private sector. Working as a high paid professional in Corporate America and frustrated by the traditional wealth-building dogma, Lane was compelled to inspire and mentor other working professionals via his top-rated podcast at SimplePassiveCashflow.com.

What are you doing this weekend? Me?!? I’m sure as heck not repairing my depreciating home and out trying to spend my money.