The Cons of BRRRRs (Hint: not for high net-worth investors)

https://youtu.be/5_Slm_guB8EBRRRR is an acronym for buy, rehab, rent, refinance, repeat. If you have done one of these deals before good job you probably made a bunch of equity and likely got into a deal for no money. For my outsiders’ prospective its successful most times (~70%) but it always takes Time. As higher net worth investors, for […]

How do I get a Loan Forbearance from my mortgage company?

In these challenging times, we’re here to answer your questions. These days, your house is more than your home. It’s your home base, your safe spot, your office, your kids’ classroom, your entertainment space. Now more than ever, it’s the center of your life. If your situation has changed or if you’re out of […]

Quick & Easy 10k in 2019 With This Wealth Hack

This is a nice way to make 10 grand on the side, the way it works is authorized user goes on your account for a couple of months, and then you take them off. And most cards you can have two authorized user per card. So if you do the math, it’s like one […]

Download Buy & Hold Rental Property Analyzer & Video Walkthrough

Buying Your Next Rental (and Financial Freedom Journey) Starts Here! Step 1: Knowing your Numbers Spreadsheet download for Hui Deal Pipeline Club members. The Hui Deal Pipeline Club is a free investor club where I filter investments and underwrite the numbers and partners myself. Unlike other investor lists and groups, my investors have personal access […]

Financial Freedom for Doctors & Medical Professionals

And are you tired of running after financial freedom, struggling to pay your student debt even as an established professional doctor? Physicians are not the only ones who can issue an Rx (prescription). This will be my financial freedom Rx to them. Whether they are junior professionals or senior professionals it’s never too early or […]

My last rental!

More to come… Reluctant BRRSS in Alabama Here we go! Buy-Rent-Rehab-Sell for Syndications

$1,700 passive a month w/ 7 rentals w/ Realliferentals.com

Kyle McCorkel from www.realliferentals.com talks about his real life numbers on his rentals URL/Contact: www.realliferentals.com 140-Character Bio: Father, Husband, Son. Industrial Engineering Consultant, part time options trader and real estate investor. 1) How much simple passive Cashflow are you making today and how are you doing it? (You don’t need to give a number if […]

Untold Stories of being a W2 Lawyer (#169)

The Legal Labyrinth Notes from a lawyer learning to see beyond the maze Imbued with the dream of becoming a lawyer — upholding the law, arguing in front of a judge and jury, defending the underserved or mastering the art of the deal — you head to law school and never look back. Three years […]

Just sold rental 8 out of 11!!!

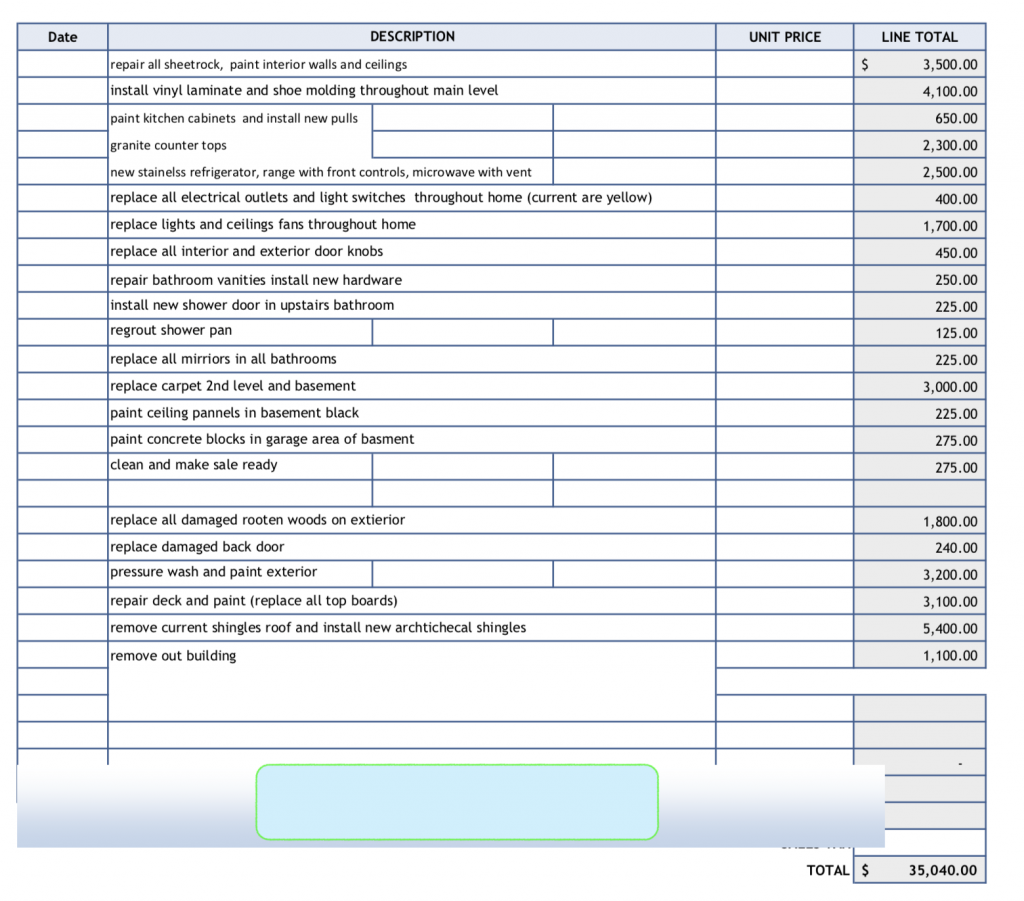

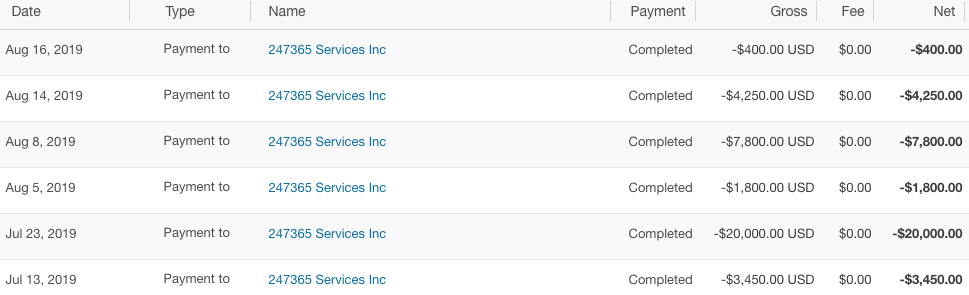

2157 Sara Ashley Way, Lithonia, GA 30056 I purchased this property back in 2015 as turnkey rental.It was a B class rental in B- location and rented for about $850 a month. It was a very stable property for a few years but in 2019 we had to evict the tenant who left this. When […]

Engineer investing in SFH then MFH – Jacob Ayers

We talk with this once Fire Protection engineer on his journey to FIRE via real estate. You can check out his website at jacobayers.com