Would you like to make extra cash from your credit card?

Most people are unaware of renting out your credit card authorized user slots (AUs) or piggybacking your credit where others can jump in as an authorize user and you (credit card owner) can collect great commissions in return.

Intro to Tradelines

Tradelines are what a bank (Chase, Barclays, Bank of America, Discover, or Capital One) calls a line of credit. Therefore, your credit card is a tradeline.

You act as a credit partner, think of yourself being a landlord for your credit card but you never see your tenants nor do they mess up your credit.

If like landording without the PITA.

A credit partner is someone who sells the right for someone else to be temporarily added as an Authorized User (AU) on their credit cards.

Normally, the Authorized User (AU) stays on the account for only a couple months and then they are removed.

As a credit partner, it is important that your credit card will be sent to you to prevent misrepresentation and misused.

The credit partner (you) receives a commission for each authorized user added. The more credit cards you have, the more Authorized User (AU) you can accommodate.

Some may find tradelines a little weird. But initially, Ebay (shipping payment off hoping to get your stuff) and Uber (jumping in a strangers car) was perceived as weird business model as well.

Why do others want to pay you money to piggy back on your credit?

Authorized Users (AU) can increase their credit score. In a way, there is a feel good feeling with this where the losers are the credit card and insurance companies and the customers get to increase their credit score so they can qualify for better loans. Who knows it might even allow them to qualify for a home or car purchase.

This is just another wealth hack we use at Simple Passive Cashflow!

Although this may not be for some of the higher income earners of the Hui Deal Pipeline Club members who are Accredited investors but a great way to trade time for a bit more cash.

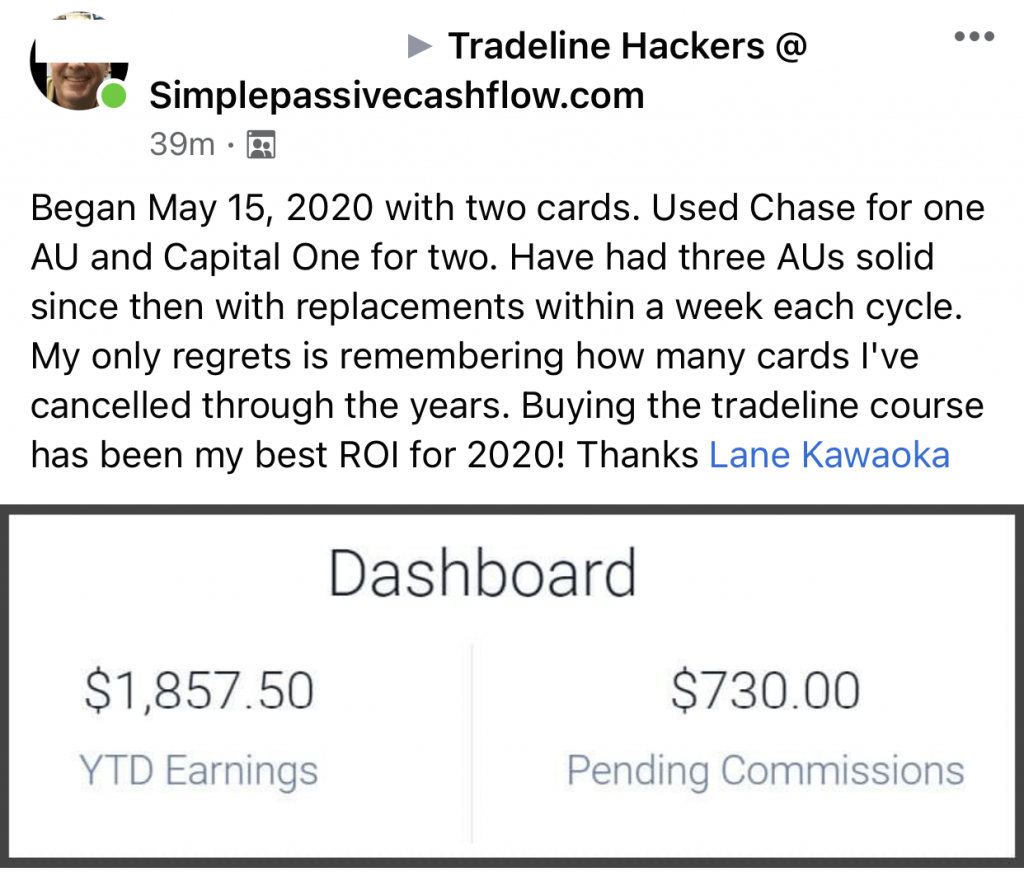

I've already sold $1040 dollars in tradelines in my first couple weeks! Woo Hoo!!!

-Happy eCourse Customer & Hui Member

Additional Authorized User

There are cases where parents with high credit scores, add their children as Authorized Users (AU). This gives their children their first credit insight and assists them with building the establishment for a solid credit record — particularly if the record has been on favorable terms for quite a long while.

The bank doesn’t care either way if you add your companion or child as an Authorized User (AU) on a conventional card or a representative as an approved client on a business card, yet they probably never expected this advantage being sold on the open market.

Selling tradelines is a great side hustle!

Why Do People Buy Tradelines?

– To get a credit card approved

– Secure the best rate on loans (or even approved)

– Reduce insurance costs (car and homeowner)

– Receive debt consolidation solutions

– Obtain business loans

– Who would not link to buy a $100 tradeline to bump their credit score 50+ points?

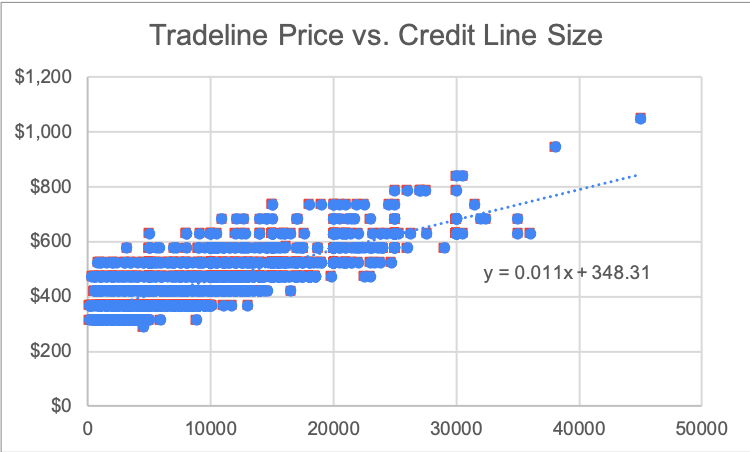

“$50 Tradelines” is one of the most popular Google searches out there for those looking to build their credit score. But you can sell some of your more longer credit lines for $200-300+

“Do tradelines really work? Who cares we are just selling it to those who are taking that risk!”

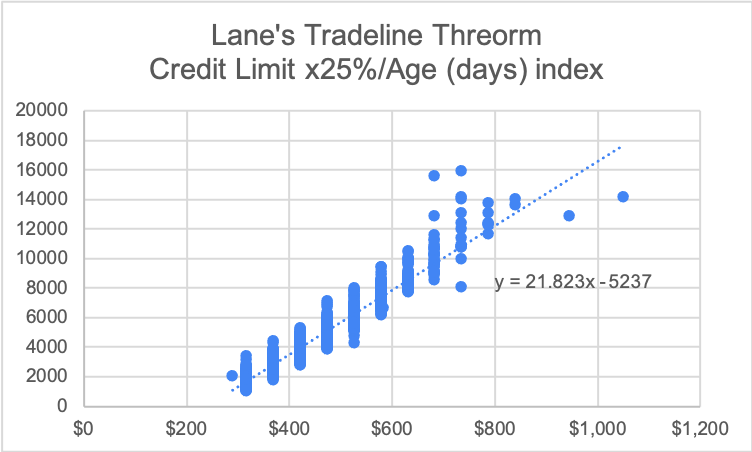

How Much Can You Make Using Tradelines?

Make $5-10K (taxed as ordinary income via 1099) with minimal effort from a Tradeline broker Company. Inside the course we keep you updated on who to work with along with the latest updates to be aware of.

A typical commission schedule is as follows:

Get the raw data in the eCourse

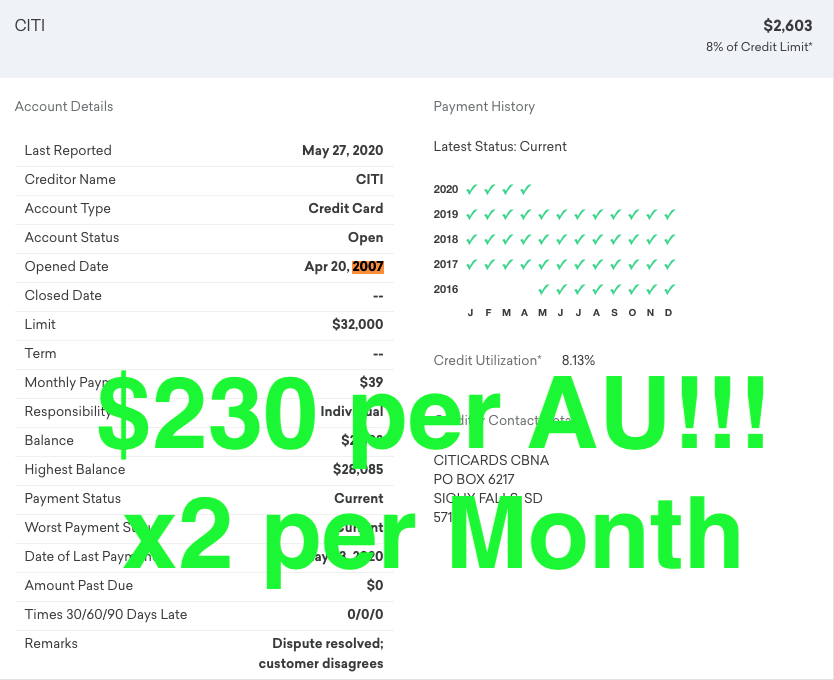

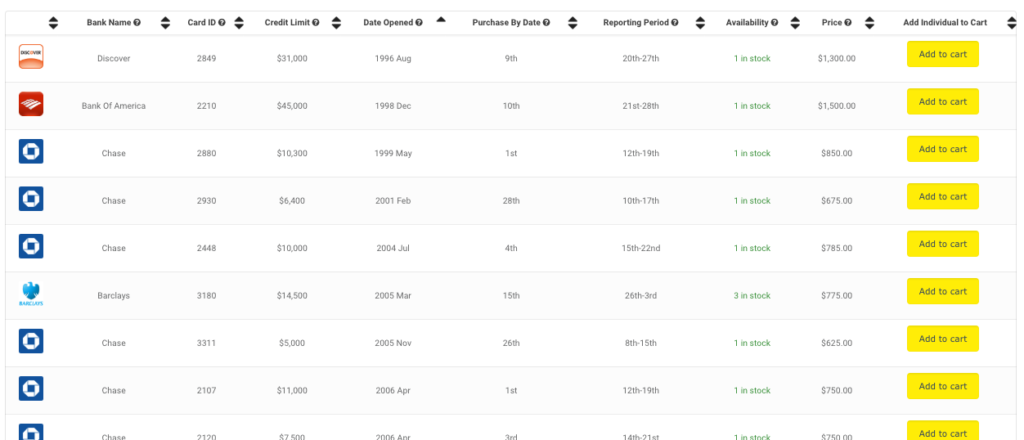

This is the screen an Authorized User (AU) sees when they see you and other options. These are the prices they pay, minus the intermediary fee and that’s what you make.

Note: I have seen new cards get as much at $100 per Authorized User (AU)

What Do You Need to Get Started?

You need a credit card that’s at least two years old (this is called a seasoned line) with no late payments on it’s record. We recommend that you have a clean credit history with no delinquencies in the last year.

The longer you’ve held the card, the higher the credit limit ($10,000+), and the more cards you have, the better. You need to use these credit cards and pay it off in full each month. Your balance should be paid in full each month and should never exceed 10% of the credit limit. This is where an organized spreadsheet is critical. Sign up for the Tradeline eCourse to get access to a spreadsheet that I’ve made and more!

Tradelines are great for those people who have tapped out their liquidity and retirement accounts and could use some extra side cash.

Learn how to sell tradelines and not yourself, please don’t sell any body parts or rob a bank!

What if My Credit Lines are Less Than 2 Years Old?

“Unfortunately we are not enrolling any more cards that are less than 2 years old. If a card is three or four months away from being eligible, we can round it up, which was the case with your Barclays. We’ve actually had the discussion of removing unaged inventory from our list, so the truth is we do not want unaged inventory, despite the fact that we can easily sell it. Many people buy it because the price is lower, and then complain to us later that they did not get any good results, and in some cases it can even lower their credit score. This is obviously not good for our business to sell something that does not provide positive results. On the other hand, people with practically nothing in their credit file still might benefit from an unaged account. The problem is there are a lot of people who buy it and do not benefit and we have to deal with unhappy customers which is something that we strive to avoid by reducing/eliminating this possibility.”

How to Start Using Tradelines

- Open a free account at Credit Karma to see a list of all your accounts. This will let you know where you stand in terms of credit limits, payment history, date opened, current utilization, and each account’s reporting date.

- Call your credit card issuers to increase your available credit. The amount of commissions you receive from an AU signing up increases with a larger credit limit and longer credit card age. Note that most people will receive $5,000-$15,000 per card. I have been screwing around with credit cards since my travel-hacking days since the early 2000’s and have some nice limits already so I am going for the moon! ($30,000+).

- Research companies brokering tradelines. Go over the account verification process with them. For good reason, banks don’t really like this little muse. I’ll give a warm introduction to the company I use to those who sign up for the eCourse!

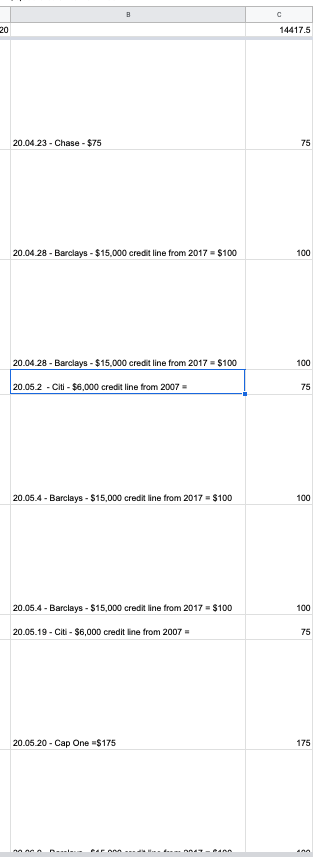

How much have I made since 2019?

The current total is $20K+ (last update 3/2021)

FAQ’s

Q: Why haven’t I heard of this before?

A: Wealth hacks and financial topics are not a common discussion topic, unless you’re avidly searching online for it or if you’re hanging out with the right group of people. You can join this free investing club for like-minded, hard working professionals to learn other wealth hacks and gain passive cashflow.

Q: Why aren’t more people doing this?

A: This is probably similar to why people don’t pursue financial independence. They hear about it, think it’s nice, but they DON’T TAKE ACTION. This is why we’re using our tradeline course to help people take that first step and walk them through the process.

Course includes step-by-step process on:

- Which tradeline company to use (with an introduction to them via email)

- Things you need to do to protect yourself

- How to choose an authorized user

- An exclusive tradeline group (where you can interact with others doing the same thing) and more!