Historically, agricultural property has been a good option for investment since the need to eat and live is inescapable.

But are all investors geared towards this investment option? That’s right, NO!

Some investors see this as their last option (or at most don’t include it in their list) since it has a high upfront cost especially if buying farmland.

But, these facts can make that change:

🌿 The U.S. agriculture and food sectors are key drivers of economic growth, producing $2 trillion in annual revenue.

🌿 The agriculture and food sectors employ 19 million people in full and part-time jobs, 9 percent of total U.S. employment in 2013.

🌿The U.S. agriculture is also a reliable source of affordable safe food and agriculture products for the world.

Why Agriculture?

Agriculture takes time. Nature won’t be rushed!

A 20-year horizon is the industry standard for calculating an IRR in opportunities such as this. However, the farms and Peini Cacao will continue to produce amazing fine flavor organic cacao, chocolate products and sustainable passive cash flow well past the 20-year mark and for generations to come.

Offering a true legacy investment for your heirs!

The farms we have acquired are in the areas of Toledo and Stann Creek, Southern Belize’s world-famous cacao producing regions. Cacao has been grown in these places since the Maya first discovered it and the land has all the natural conditions to produce world class, fine flavored/organic cacao.

Right altitude, rich soil, the perfect amount of rainfall, sunshine, humidity and the ideal micro-climates.

However, due to lack of capital most of the farms in this area are not reaching their full potential. In fact, many are already abandoned.

Why Agricultural Real Estate?

When you are looking to acquire traditional investment real estate, the local Market is the key indicator.

In a residential real estate investing, you need to consider tenants and tenants need jobs. What are the schools, tax policies even the weather like in that area. Everything is LOCAL.

But when you are looking for agricultural real estate, you identify land in the country that has the best growing conditions, and you sell the crop that you produce to any country in the world where the demand exists. Everything is now GLOBAL.

And remember, you are producing FOOD, a staple that every human being the world over needs daily, in a world where the population is increasing, and the availability of arable land is decreasing.

“An agriculture boom is forming”, said Jim Rogers, who intends to invest in agriculture more than in Amazon.com Inc. (The Edge Financial Daily, Singapore.)

Coffee Farm Tour in Panama in 2018

Coffee Farm Webinar

Coffee Farm Investing

Coffee is a part of our daily mornings, even the whole day. Unsurprisingly, it is one of the most popular beverages thus making it an important product. Most production happens in third world countries wherein it is where they also rely their living from.

Robusta or Arabica?

This is not to deep dive into the type of coffee available in the market but to dwell on the economics and profitability of investing in coffee farms.

The People

In 2016, I met this Irish guy (Darren Doyle) at the bar at my Syndication mastermind meetings and he told me about this idea turnkey investment owning cashflowing coffee parcels in Panama with completely turnkey operators on-site to optimize the investment. (https://www.linkedin.com/in/darren-doyle-8539b1a2/)

Oh no not more turkey! I mean turnkey rental type investments!

But I do love coffee. Did you ever try the Simple Passive Cashflow Latte? Buy the supplies here.

It sounds crazy, I know! But then I considered how it passed my THREE RULES OF INVESTING:

1) Evaluate income and expenses for positive cashflow (not much debt on it because its hard to get international financing but when we do watch out!)

2) Leverage with favorable debt terms

3) Hard asset

Look what the wealthy do! They don’t buy into trendy tech startups.

They are in the most boring commodities like coffee.

I got to know Darren and his partner David Sewell (https://www.linkedin.com/in/david-sewell-22aa278b/) a bit more (and after another meeting at a different bar) and a few months later I told him I was in! After all they have been doing this since 2014 how bad could it be. 😊

How I Started Coffee Farm Investing

Why Own Land?

The world’s wealthiest families have owned land.

Being a Land-Owner set you apart in society.

Going back to early civilization, when man learned how to produce food on his land and could produce more than he could consume, he then had excess which he could store and sell.

He now had savings and the ability to generate revenue. As well as the ability to feed his family.

Values of owning agricultural real estate still hold true today.

However, in today’s society we think that only the rich can afford the large swaths of land and large financial outlay needed to get into the business. That it is somehow out of the reach of the regular guy on the street.

2017: Became an International Real Estate Investor

This investment is perfect for your QRP because it does not use leverage and no UDFI tax on leverage portions.

Why Own Land Offshore?

Apart from the obvious reasons of diversifying your assets outside your home country so that you do not have all your eggs in one basket, you simply may not be able to grow the in-demand, high-value crop in your home country.

Specialty Coffee and Fine Flavor Cacao do not grow in Canada, Ireland or the US but they do grow in Panama and Belize!

Another reason for owning coffee farm parcels in Panama and cacao farm parcels in Belize is due to the way our business model is structured, there is no leverage.

As an active real estate investor leverage is good, financing is good. But financing also blows air into already over-inflated market and commodity bubbles.

No leverage means no air and less risk of collapse.

This coffee is so good that it kept the “Sandman” Mariano Rivera up as he visited the shop in Panma.

Learn More About This Investment From Title to Land

Journey To The Coffee Farm

📢 I put it out to the much smaller 2017 version of the Hui Deal Pipeline Club and together we bought a dozen parcels. I tried to visit my investment in 2017 but because I was being a Cheapo I booked two separate airlines and my first flight was delayed. 😉

“I read the documents and one concern I saw was that we did were unable to compete in the coffee business in the country of Panama” –Hui Deal Pipeline Club member

“Well duh?!? Are you planning on quitting your day job to start a coffee farm enterprise?” -Lane

“Well, no I was just pointing that out… Do we get free coffee?” –Hui Deal Pipeline Club member

Fast forward to the Spring of 2018, I finally got to make it out there to kick the dirt and to see if it was real and the guy Darren was for real or he was not just selling me a pot of gold at the end of a rainbow…

It took a lot of traveling from Honolulu ➡️ Houston ➡️ Panama City (PTY) ➡️ David (DAV) ➡️ 1-hour drive up the mountain to Boquete.

🌐 Where on earth is Panama ???

Located in Central America

Breathtaking View 🤩 We Made it!!!

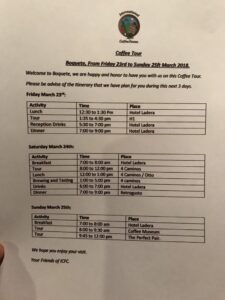

FUN FACT: Darren had arranged for one of the farm workers to take me to Bouqute. They had a sign for me! My first time for this Cheapo. Want proof???

⬇️ Right here! ⬇️

HOTEL LADERA: Where We Stayed

“The hotel we stayed in was amazing!”

Coffee Tour Itinerary

“All the kids these days are investing in the latest fad like tech or crypto currency. If I have learned anything these past few years watching the wealthy is that they invest in the most boring stuff and the basic commodities. What is more of a necessary than Coffee?” – Lane Kawaoka

We had a long couple days ahead of us. Apparently, there is a difference between “specialty” coffee and “cash-crop” coffee. “Cash crop” is the vast majority of coffee farming everywhere even in Panama – where they strip the entire branch for coffee cherries like barbaric savages taking ripe and unripe berries.

Specialty coffee is what we do at my coffee farm and it often sells for 10-20x more than the normal cash crap. And possibly yours too.

To do specialty coffee, we pick the best ripe berries which is tough to do and requires worker training and them actually caring. To give back to employees (native Indians) the company gives back a portion of income to fund housing improvements and education for workers children who live on site. When we were there we brought the children come cheap toys and goodies (see the above video). You have to understand that this is a third world country and even though the native Panamanians can’t read or write they have strong families and hard work ethic.

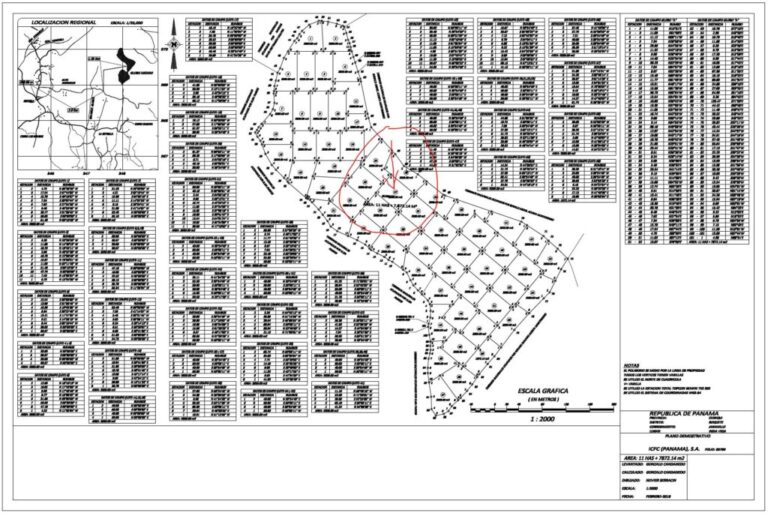

The business plan is very simple. Buy distressed raw-land or under-preforming coffee farms in the best locations from native families looking to leave the business behind. The investor comes in and provides capital for the land purchase, gets ownership in the land, and ICFC runs the planting, harvesting, processing, and end sales to produce a profit for everyone.

Take a look at the above video and you can clearly see how modern this operation is. Oh yeah, its damn good coffee! ☕

“Shade crops will be managed, water systems implemented, and soil and leaf improvements conducted.. Old trees that are past their peak will be cut down and replaced by saplings of new, healthier, more in-demand varietals from our own nurseries.. And the coffee and cacao will be processed and analyzed for quality in state-of-the-art, on-site wet & dry processing plants and proprietary laboratories.

When implemented, these plans need time to mature….. to “harvest” the extra rewards. These extra rewards will provide increased profits in the form of increased coffee and cacao quantity, higher quality and higher sales prices.

A key part of the business model is to be able to supply micro-lots of single-origin, traceable, specialty coffee and fine flavor cacao worldwide to buyers of these in-demand specialty products.

When acquired, the farms will usually be growing and selling some, usually substandard, coffee or cacao.. The business model intends to continue the operations with new and modern management practices to generate near-term income within 15-18 months and to develop an increased and sustainable annual income from these farms that will last for many years.”

Here is the money shot! Geisha coffee from the Geisha Coffee varietal plant.

Better than Kona Coffee!

Why join in and buy a parcel of your own?

The competitive advantages are as follow:

- High Altitude – unique microclimates (on the Pacific and Atlantic ocean) – Geshia varietal = $ Income

- The Dream Team: David/Darren (business and sales), Andres – shown in the picture (coffee growing operations), Biology staff, Dave (roast and blending team) – After losing $40,000 in a past deal, these are the people I want to go down in the “airplane”. -Andres Lopez, the General Manager, is born and bred in Boquete, Panama. He has been in the coffee industry for 25 years and has been advising some of the top coffee producing families before joining ICFC in June 2014. Along with his team, which includes Jose Saraceni, the in-house agronomist, and Valentina Pedrotti, in-house Biologist and value chain analyst, they look after the farms day to day to turn them around and produce amazing Specialty Coffee.

- Happy Workers (giving back by providing education, running showers, and new living shelters)

- The competition is slim. No one is close to using this sort of modern equipment, science, and business systems. Coffee is one of the most scientifically studied wonder drugs out there. And besides how cool it is to talk about being an international coffee farm investor!

Even after 20% of the net revenue is used to improve the quality of lives for poor farmers, the annual average return (IRR) is anticipated to be 12%. Cashflow typically begins in 15-18 months and paid annually. This is meant to be a legacy investment.

NOTE: Please hurry as the heavy equipment just got set up in 2018 because the first fields are beginning to produce. Don’t miss out on this investment opportunity as the team reaches their ideal coffee acreage and the focus shifts from capital generation/farm acquisition to operation.

“Currently we own and operate 10 coffee farms in the Boquete area and have built our own on-site, in-house coffee processing plant which is now fully operational.

We are pleased to be able to report that we have helped about 250 individuals gain ownership of these valuable coffee farm parcels in the last 4 years. About 785 – 0.5 acre parcels, valued at $8.2 million, are now real hard assets held in truly diversified portfolios all over the world.

Get you half acre parcel today for under $20,000.”

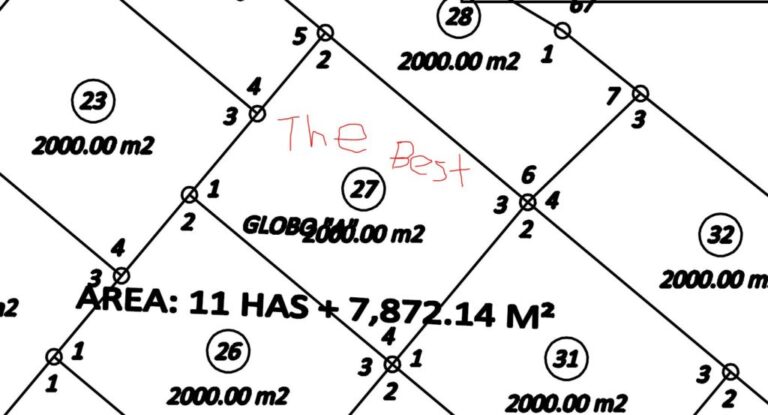

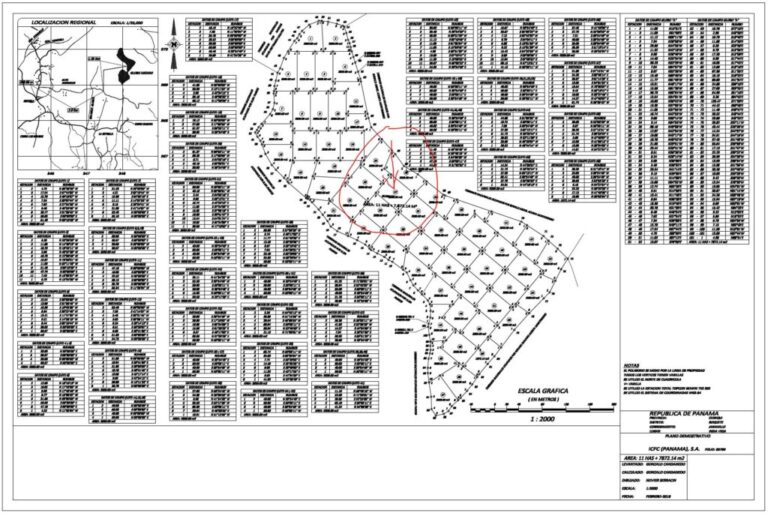

Here’s the location of my land parcel!

[Fun Stuff] How to make Coffee: Pour Over with a Chemex

[Fun Stuff] How to make Coffee: Infusions

Reach out to Lane@SimplePassiveCashflow.com for special pricing for Hui Members.

Chocolate Farm Investing

5 Solid Business Reasons for you to consider, that Peini Cacao Is A Unique and Attractive Real Estate Ownership Opportunity:

1. Chocolate is a PROVEN PRODUCT. With sustainable and growing demand and limited supply, worldwide. A $98.3 billion industry worldwide. Our business model allows you to participate alongside us from “seed to bean to bar”!

2. YOU OWN THE LAND. An appreciating real hard asset, deeded to you, safe and secure, private and offshore. Diversify your portfolio away from traditional real estate and into productive farmland.

3. Your cacao farm parcels are PROFESSIONALLY OPERATED for you. TURNKEY EXPERIENCED MANAGEMENT in-place since 2016. Cacao nursery, farms, processing facilities, factory and 2 retail stores already fully operational. Farming, processing, marketing and sales all done for you.

4. You will participate in the DOWNSTREAM REVENUE. Generated from cacao trading as well as high end, handmade artisanal chocolate products. Sold both nationally and internationally, wholesale and retail.

5. Earn a sustainable long-term income. Averaging 11.9% annually (proforma IRR) for a long period of time. Well managed cacao plantations can operate successfully for generations offering a legacy investment for your family and heirs. We are working with nature, so returns start out slow, but reach 10% by year 5, 16% by year 10, 22% by year 15 and up to 28% by year 20.

Our plan was not rocket science, but by investing much needed capital, introducing good farming practices and management techniques and by utilizing modern processing machinery combined with a liberal application of current “cacao science” and know-how, we are getting this land planted and operating to its maximum potential, resulting in plenty of upside potential for everyone involved.

That includes our parcel Owners, our workers, ourselves, the current 204 native Maya cacao farmers we are working with and the surrounding community.

The ripple effect is quite large, and the tangible signs are noticeable as we have already injected over $1.5 Million into the local economy.

To ensure that we were providing a solution and not contributing to the problem, we joined forces with a group of Maya cacao farmers called the Na’Lu’um Cacao Institute. They have been established to educate the local subsistence farmers and help them break the circle of poverty they are in by training them and finding buyers for their beans.

Peini Cacao is helping provide training and FREE saplings, as well as a steady, reliable buyer of their beans and at a fair price, so that they can earn a decent living and support their families.

Quick Visit to the Chocolate Farms in Belize in 2019 (Chocolate section below)

All 204 farmers who have signed up to our Socially Sustainable Bean Buying program have now been certified organic under our banner. In 2018 we supplied 30,000 cacao saplings to these farmers to plant out their farms with another 30,000 scheduled to be provided in 2019.

In 2017 and to date in 2019 we have purchased and processed around 60 metric tonnes of cacao from these farmers. We are there every single weekend during buying season and we pay on time.

This is not commonplace in the cacao industry in Belize where farmers are often left with no channel to market when underfunded NGOs fail to turn up on buying day. One of the main reasons why they were not previously motivated to fully plant their land.

All of the cacao beans we acquire are processed in our centralized, purpose-built fermentation and drying depot before being sun dried to a specific moisture content of 6.5 to 7.5% in our traditional Maya style drying beds.

These fermented and dried beans are being sold internationally to bean buyers in Europe, Asia as well as CARICOM market.

Discussions are ongoing to also supply cacao nibs, cacao butter, cacao powder and many other cacao related products world-wide.

Many of the beans are being processed into finished chocolate bars, bon bons, truffles and other chocolate products at Mahogany Chocolate and are available in our store located in Mahogany Bay Resort & Beach Club.

We also created and launched 2 new chocolate bars, the 72% dark chocolate Belizean and 50% dark-milk chocolate Brukdown, that are currently available in 48 retail locations nationwide, including Belize International Airport.

We have built strategic relationships in the US, Europe an Asia to help promote our brand and Belizean cacao around the world. One such relationship is Werner Ruegsegger, a Swiss Chocolate Maker with 45 years of experience in the chocolate, confectionary and baking industry.

All of us working together to revive the Belizean cacao industry, to produce amazing Belizean cacao and chocolate products and continue to help the local Maya farmers.

Socially- Responsive Chocolate Farming

Chocolate Farm Nursery

You are directly involved in improving the lives of the native Maya Indian cacao farmers of Belize by helping us to provide them with good honest work, fair wages and medical and pension benefits. Peini Cacao reserves a full 20% of gross operating profits to provide a bonus pool from which such benefits may be provided to our workers.

We also provide a channel to market for 204 independent subsistence farmers by buying their wet cacao beans every week during harvest season as well as supplying training and FREE saplings as part of our sustainability program.

This unique program in the cacao industry is a shared responsibility of the cacao farm parcel Owners and the principals of Peini Cacao to ensure a better life for our workers. At least 1 farm at a time!

Chocolate Updates

ICFC successfully completed its first 3 coffee harvests (2015/2016, 2016/17 and 2017/18), sold the entire crop each year, made its first 3 years earnings pool distributions and has deeded parcels to Owners, all in its first 4 years of operations. ICFC has started its 4th annual coffee harvest – the crop year 2018/19 with the 4th year’s distributions due the Fall of 2019.

ICFC General Manager of Farming Operation, Andres Lopez, and his team of Agronomists and Biologists implement our “art of cacao science” here in Belize with the same expertise and dedication as they do in Panama. Mixing traditional Mayan methods with our modern, scientific approach, we are taking cacao farming in Belize into the 21st century.

For Quality Testing

Peini Cacao has made its 1st years annual distribution in October 2018 after it’s first successful year of operations and is on target to make the 2nd annual distribution in the Fall of 2019.

The Deal

Cocoa Farm in Belize

Your opportunity is to own 0.5-acre parcels in cacao farms in Belize.

Your parcel will be part of 6 plantations in the Toledo district of southern Belize totaling 204 acres with 190 acres of property suitable for cacao – giving us 380 – 0.5-acre parcels. 3 of these farms were fully planted in late 2017 with the 3 newest farms due to be planted come rainy season of 2019.

The current price is $24,500 per 0.5-acre parcel plus 5% government property transfer taxes. This one time, turn-key cost includes the purchase price of the land and all the costs of developing the property. There are no future taxes, charges or fees associated with your parcel ownership in Belize.

Contact me for best pricing as part of SPC Nation.

“There is nothing better than being an international real estate & coffee farm land investor. It sure makes sitting through work meeting drinking out of your ICFC mug”

NOTE: This photo is outdated since I am no longer trapped in my cubicle 😁

“If you are listening to this podcast and implementing the strategies discussed, you are likely to become financially free in 3-7 years whether or not you use my coaching services or not. For most of you I talk to in our free intro calls I see a theme of mission and investing for a greater good. I found an investment that pays 20% of their revenue to improving the lives of their community by improving living conditions paying for children’s education. And by the way it’s not all altruistic, this specialty coffee makes for an amazing pro forma.”

Q&A WEBINAR [10/24/2018]

- What’s the succession plan for when he steps down, and how can we be assured high-quality management of our parcels long-term?

- How big do they expect to grow the portfolio/how many farms do they plan to purchase?

- Does he know if the purchase of this land qualifies US citizens for a Friendly Nations Permanent Resident visa? Not needed.

- Any concern on the legal side of this – foreign workers suing landowners, workplace injuries, etc.? I know other countries aren’t as litigious as the US, but still…

- Your website states that cash flow typically begins in 15-18 months and is paid annually. [Part of that is just me under promising] When looking at the actual financial projections see that it says there is no cash flow until year 4. Is this because they are only selling parcels on new farms now (and it takes time to acquire & develop them) or am I missing something?

- How are the payouts done? Parcel specific or averaged over the farm or farms? Are coffee and cacao similar returns?

- Have any original investors sold or selling their parcels?

- When filing taxes, what sort of tax documentation do we get at the end of the year? 1099? K-1!

- Purchased a parcel 9/2017 and have yet to receive any deed. What are they doing to expedite the process for new investors?

- Biggest Threats/Risks, like disease etc.?

- The life cycle of coffee trees and farm rotation/replanting plans?

- What is Specialty Coffee and why does it sell for a premium?

- Was there was a note on the site about not sharing audited financials. is that true?

- How do we calculate the return/ IRR?

- Deeding process?

- Is there any discount if simplepassivecashflow members buy as a group?

- Will there be equal number / percentage of geisha trees planted on each farm, since that will likely impact the return?

- Share webinar with email or website?