With our technology today and the availability of financial information right at your fingertips, many people consider doing D-I-Y financial planning on their own.

We can’t blame them!

Some do not trust financial planners these days and they do not think that they’re not following the fiduciary rule at all. Perhaps, they have this one acquaintance who suddenly, out of nowhere, will message you and invite you for coffee. Only to find out that they want to discuss wealth management and financial analysis!

Is it still worth your time and resources to trust a financial planner?

What’s a Financial Planner and What is Their Purpose

A Financial Planner assists you on your financial goals and purpose. They may involve in your budgeting, saving, tax strategies, wealth building and financial legacy creation.

They figure out your financial situation, digging in from your past financial problems towards creating doable financial goals that will bring freedom. In which, they must respond to the BEST interest of their client.

They figure out your financial situation, digging in from your past financial problems towards creating doable financial goals that will bring freedom. In which, they must respond to the BEST interest of their client.

David Rockefeller

Financial Planners and My Experience

Today, we call this ACH direct deposits but the importance of this cashflow has not changed. Yet, in the 1960-1980s, Americans were brainwashed to invest in non-income based investments that had heavy hidden fees with the creation of mutual funds.

This topic really fires me up!

Here is a little humorous video to lighten the mood. Warning… the video is 20 minutes so better put the sign on your desk saying you are “away at the toilet” or “away at lunch.”

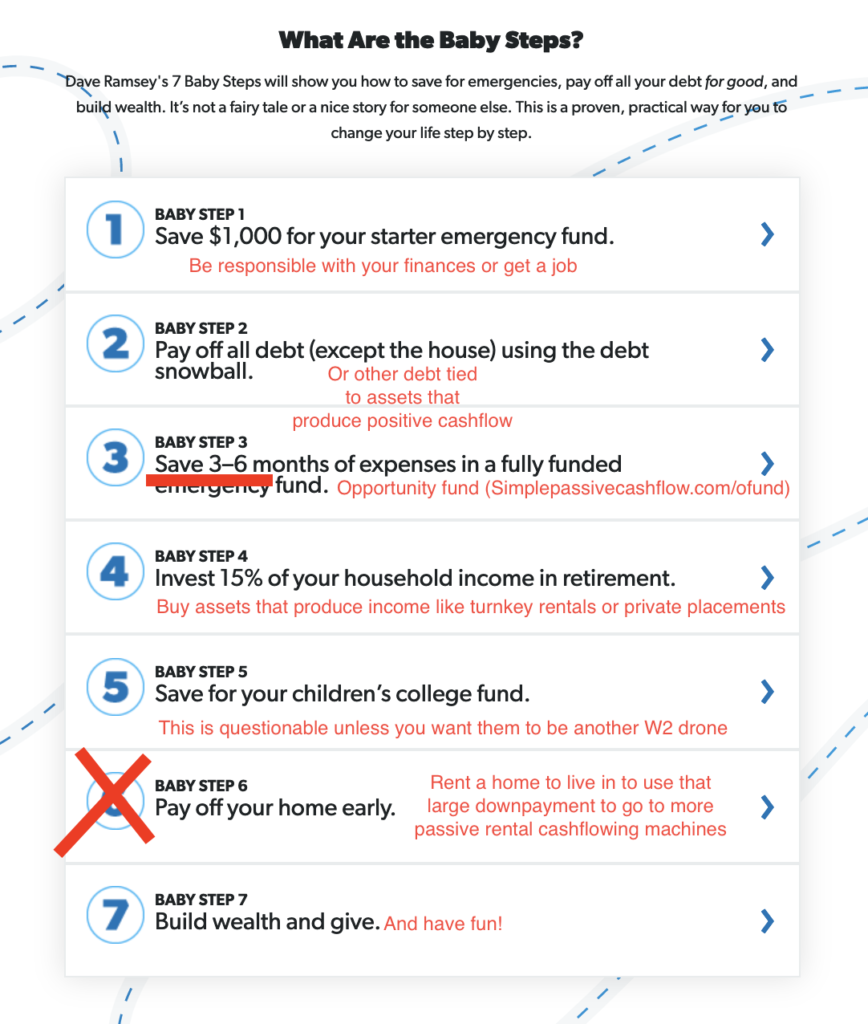

I’m not a fan of Suze Orman/Dave Ramsey show because of their scarcity/frugal money saving ideas. But for some people who can’t seem to save two pennies to save their life, I guess it is better than nothing.🤷🏻

Obsessed on planning for your retirement?

NOTE: Check out Suze Orman WTF face at 4:41 when the caller says their financial planner recommended buying an annuity (shocking 5% commission for the financial planner) .

At 4:00 financial advisors make commissions and often put you in investments that are good for their pockets.

Obama tried to do a good thing and pass a law where all financial professionals (like brokers and insurance agents) had to adhere to the “fiduciary” standards—meaning they’d have to work in your best interest if they were advising you on your retirement investments. Unfortunately, this died recently and there is no more fiduciary rule.

Let’s make it clear, financial planners are NOT financial experts.

Have you noticed that many ‘experts’ are simply fee-based salespeople?

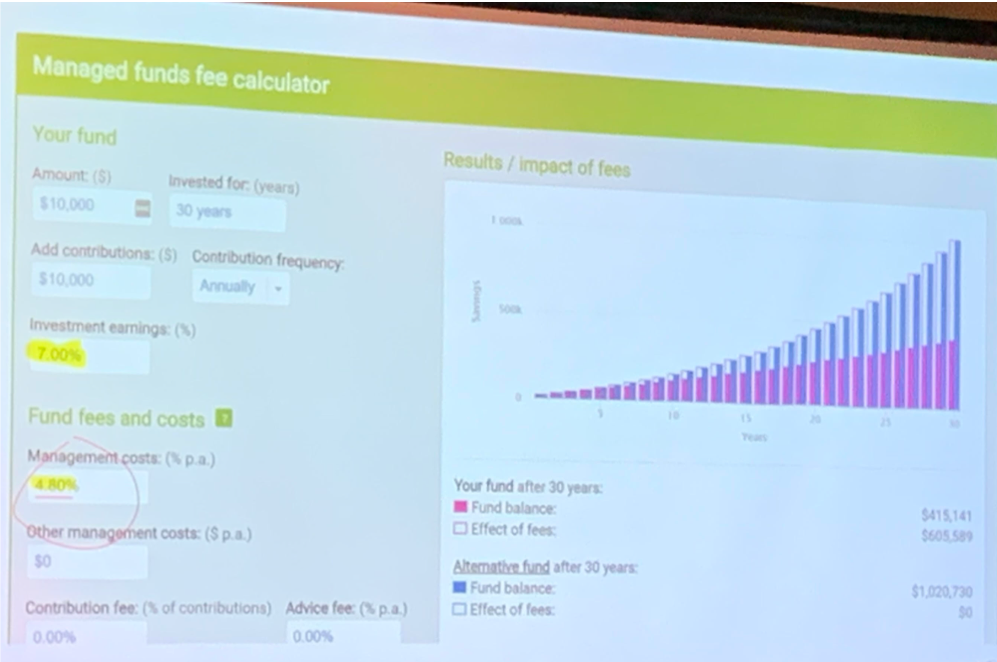

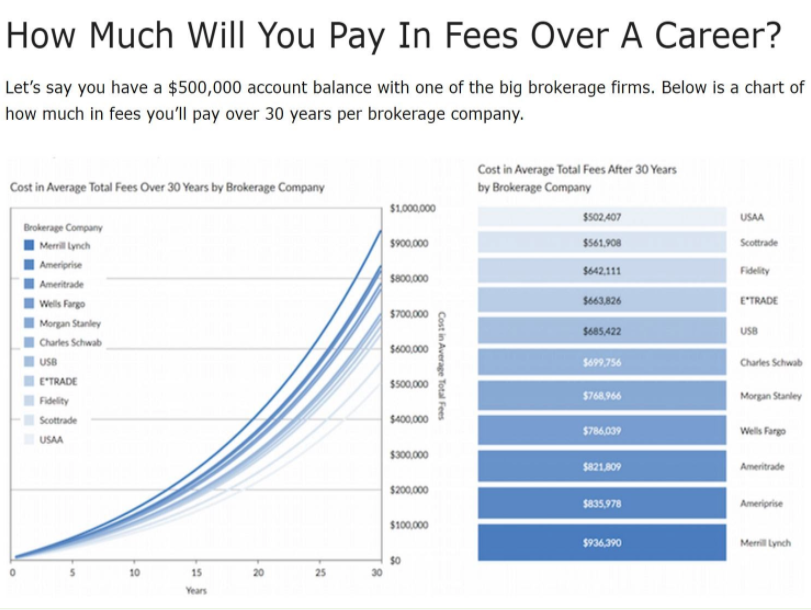

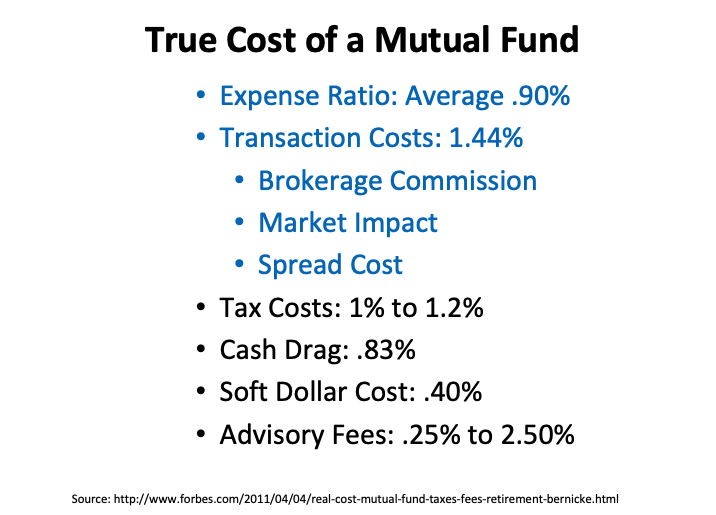

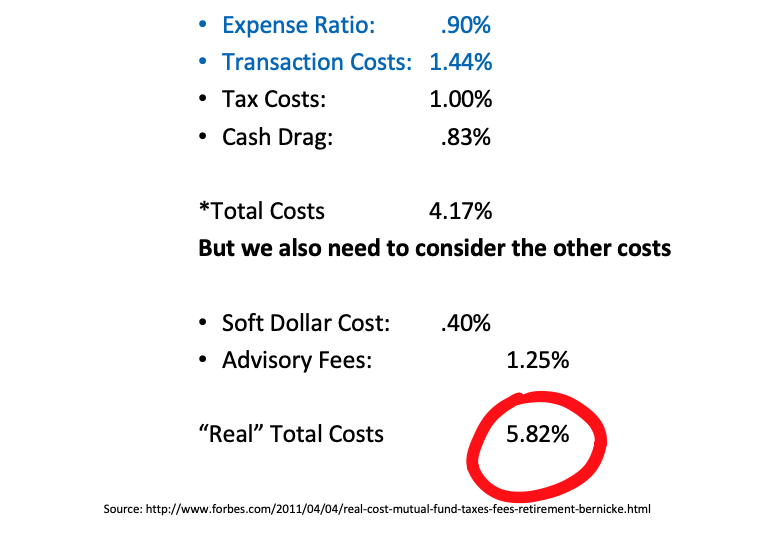

Most financial planners, advisors, wealth managers, professional managers, brokers, etc. are paid fees regardless of whether you make money. Even those who cater to the ultra-wealthy or manage family offices receive asset management fees based on total funds under management.

Look you don’t have to invest in real assets and get the amazing returns and tax benefits but whatever you do don’t invest with a financial planner!

Why?

Putting your money in an S&P 500 index fund and forgetting about it will almost guarantee you higher returns than relying on a finance professional. The S&P 500 beats financial professionals, including advisors and mutual funds, 92.2% of the time. You’re better off investing on your own and investing in an S&P 500 Index Fund!

Note: Federal Department of Licensing discussion on conflicts of interest or kickbacks to the tune of $17 billion

My Recommendation:

I do not recommend any financial planner because I don’t take financial advice who is still working for a paycheck and not out of the rat race (lives in their parent’s basement) but if you must go with one of my friends or a flat-fee one – http://www.fpany.org/

I have heard of these guys/gals do their sales pitch and use fear-based words like “diversity”, “security” and “risk” where the 25-year-old kid is trying to sell random investments to me. And don’t get me started when I tried to tell them about the being your own bank concept. #FacePalm They just tried to sell a higher return (6% whoop-ti-doo) with no liquidity. Totally not what I was going for. Not saying these guys are bad people, they just don’t know any products of the Wall Street institutions.

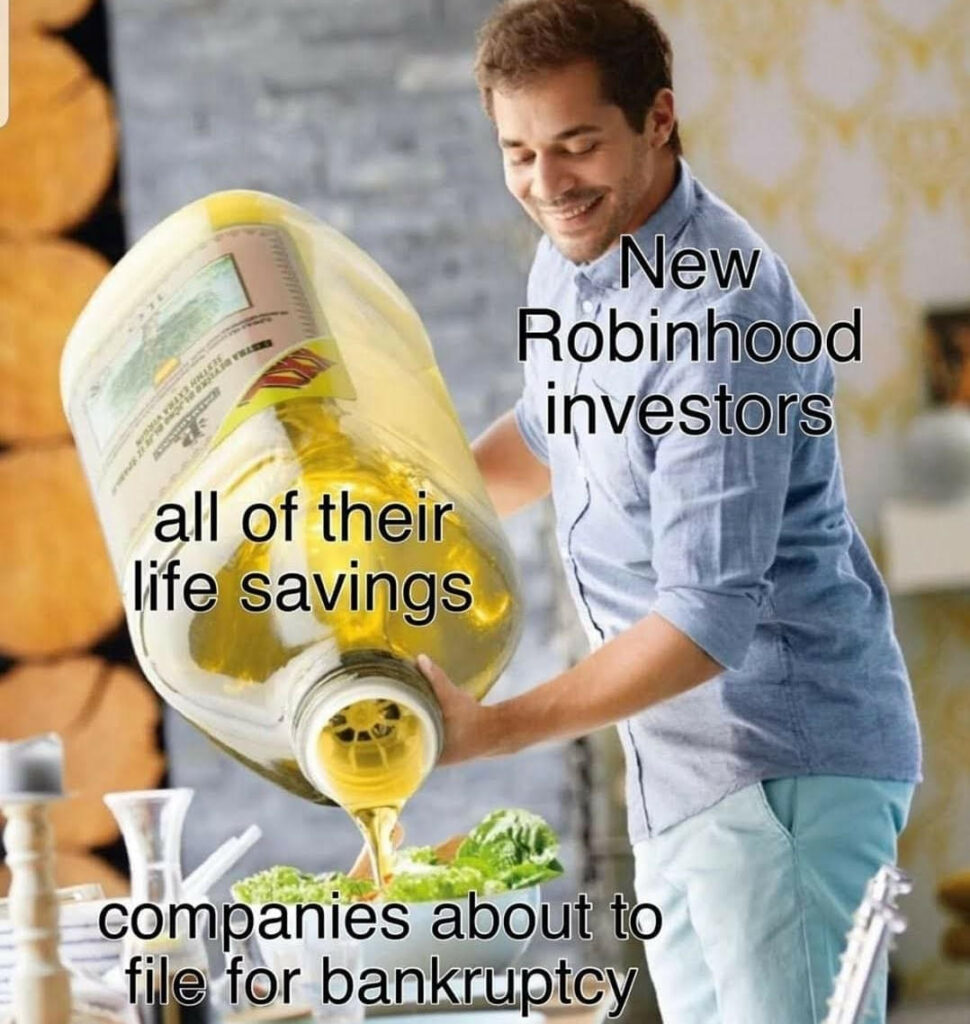

Note: When I call out financial planners I am also calling out brokers and insurance salespeople. I repeat, never listen to a broker! If they make enough phone calls, eventually they get someone to purchase a stock and make their commission.

Don’t be another Tool who invests in mainstream retail investments. You are getting robbed with you knowing!

Share this with your co-workers & friends/family that still believe in the Easter Bunny (happy pre-Easter!) and have a false sense of security in what this financial planner says.

Who took all your money?!? We are living in the best time to be alive with all this information at our fingertips.

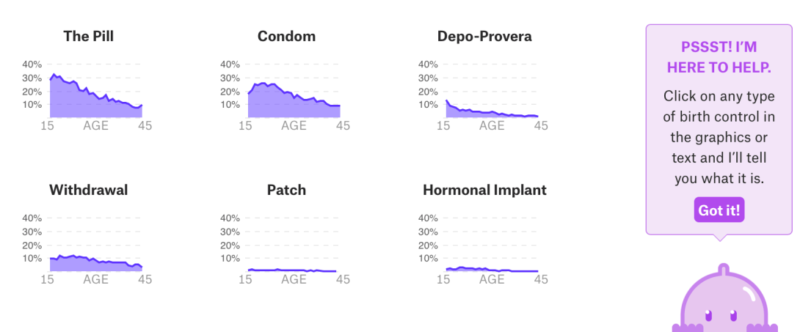

Why do people still choose to follow the advice from financial planners working for a commission or so-called low-cost index funds that have about a million middlemen taking the majority of your returns? Who knows, probably why 10% of people in this test are still using the “pull out method” as their form of birth control?

This is a little off topic but make sure you are still awake there because financial education is very important.

Check out this podcast with a CFP telling us of the insider secrets in the industry.

Speaking of less known tricks! Last year, I learned this cool financial hack utilized by the smart money. By being your own bank and using the “Infinite Banking Concept” you can create a dividend-paying whole life insurance. It is called Life Insurance but its just a tax code loophole to make a tax free yield in an account that is sheltered from lawsuits and creditors. I can assure you this is another thing your financial advisor or life insurance sales guys just don’t get. Likely because they are still working for a paycheck and it actually decreases their commissions.

Go to SimplePassiveCashflow.com/banking for more info.

“Fiduciary”- AKA Fid- “dushe” -iary – Means nothing more than someone is intentionally not going to screw you. Or sell you investments that put more money in their pocket.

For you, high net-worth professions still dabbling in paper assets you won’t want to miss this other trick that I will reveal on there too.

Financial advisers and portfolio managers get paid no matter what.

They make money by taking a percentage of your portfolio called an asset management fee. They have skin in the game.

Here’s how it works when things are good and the tide is floating all boats:

- Your manager creates your portfolio but doesn’t really out preform the index funds

- You have a gain and your manager takes 1% of that sum.

- Your manager cannot save you from a market downturn because they don’t put you in hard assets (cause they can’t get paid off of it)

- You lose 20% of your nest eff and yet your manager takes 1% of the sum.

- They still invite your to the customer appreciation party 😉

In bad times these managers rarely take any blame. Conventional conversation says nobody could see a downturn and we were dollar-cost averaging anyway.

If the market is good, they can take full credit for their supposed management skills.

They try to make things confusing with their complex trading systems which no one can explain in order to glorify their position and allow you to just let them drive.

No one really gets rich with Wall Street investing other than the insiders. Not retail, mainstream investors. As real estate investors, we do not buy retail (turnkey is sort of retail) but syndications and private placements are not retail.

I only invest in things that make sense. Where the income has to exceed the expenses. And where there is a forced appreciation (not market appreciation) where you have control over your destiny.

In the end, you want to buy direct as possible. Buying REITS is the same thing as buying mutual funds with a bunch of middlemen. Crowdfunding sites remove a few layers but as a syndication working with a Crowdfunding site is very expensive way of acquiring capital. Sometimes I wonder who are the people using this high cost of private equity… Perhaps they are “desperate syndicators?”

Do you believe in the Easter Bunny?

Annuities pay extremely high commissions, often 7% or higher. On a sale of a $200,000 annuity, an insurance salesperson can earn $14,000.

When you have to pay Peyton Manning and Brad Paisley to advertise your product.. I’m out.

The drawbacks of an annuity (especially the opportunity costs of buying your first turnkey rental) are often ignored by ignorant salespeople. An annuity is one of the worst investments you can make!

Insurance salespeople use scare tactics to sell annuities using terms like: 1) capital preservation, 2) diversification, 3) risk.

They claim, with an annuity, you’ll never run out of money. The one so-called advantage every insurance salesperson will tout is the guaranteed monthly income the holder will receive once he reaches retirement age. No matter the state of the economy, the salesperson touts, “you will always get paid, and your principal will not lose value.”

Before we get into the drawbacks of annuities, it’s important to discuss the principle differences between the two main types of annuities, fixed and variable annuities.

Fixed annuities are very much like a bank CD. You deposit a sum of money, and the insurer agrees to pay a certain interest rate over a specified period. Supposedly, you’re protected from downside risk in that your principal is contractually guaranteed.

Variable annuities, on the other hand, are more like mutual funds and can go up and down with the market. However, there are some significant differences between annuities and mutual funds that make choosing mutual funds over a variable annuity a no-brainer.

Stock Market Scenario (2022)

With the differences between fixed and variable out of the way, here are the primary reasons why you should avoid annuities:

1. Limited Upside

With fixed annuities, in exchange for the security of a monthly income, you give up most of the upside on your investment. Fixed annuities protect principal but also limit the upside. Some fixed annuities allow the holder to participate in the upside of their investment; however, they usually cap it at around 4% per year.

So even though it’s true if the market falls 20%, the investor won’t lose any money with a fixed annuity, on the flip side, if the market gains 20%, in most cases you will not participate in the upside. If you do, you’ll be limited to 4%.

With fixed annuities, even with the highest paying offerings, the most you will top out at is 4% per year. Factoring in inflation, that 4% on your principal in today’s dollars, may not be worth much when you retire in 20 years.

Some compare variable annuities to mutual funds, but there’s one big problem with that comparison. Even though you can enjoy more upside than with fixed annuities, variable annuities are saddled with additional management fees not associated with mutual funds.

These high fees, usually known as insurance costs or M&E (mortality and expense) charges, result in higher annual operating expenses than mutual funds.

Average annual expenses are up to three times higher than a typical mutual fund’s expenses, sharply reducing your future investment returns.

3. Taxes and Penalties

Annuity distributions are taxed at ordinary rates. The monthly distribution on a fixed annuity is taxed just like interest on a CD. That fixed annuities are taxed like CDs is not unexpected. That variable annuities, invested like mutual funds, are taxed at ordinary rates when money is withdrawn should make every potential buyer of annuities run for the hills.

So on top of the already high management fees, you’ll more than likely pay more in taxes when withdrawing your money at ordinary rates instead of the capital gains rate you’d pay from withdrawals on your mutual funds. On top of the obvious tax disadvantages of investing in annuities, the various penalties associated with annuities should also deflate any enthusiasm for these products.

Annuities are contracts that require you to hold them for a minimum amount of years (i.e., surrender period) before the guaranteed payments kick in. If you withdraw your money within this surrender period, you’ll incur early withdrawal penalties. Surrender periods vary from two years to 10 or more, and the corresponding charges typically decline with time.

For example, a deferred annuity with a 10-year surrender period would charge 10 percent on money withdrawn the first year, 9 percent the second year, 8 percent the third year and so on. On top of the early withdrawal penalty, if you make a withdrawal before age 59½, you’ll be subject to a 10 percent federal tax penalty. With these types of penalties, annuities are designed to keep you in for life.

Unlike bank deposits that are guaranteed by FDIC for up to $250,000, annuities are not federally insured. The insurance companies themselves make the guarantees, and those guarantees are only as secure as the insurance company making them. If the insurance company goes belly up, you’ll be out of luck.

It doesn’t sound so great when you really dig into the math. For example, if you bought an annuity at age 35 that doesn’t start paying until age 65, you’re tying up your money for 30 years. For what? The chance to make a maximum of 4% a year on a fixed annuity, taxed at ordinary rates? Variable annuities aren’t much better as outrageous fees absorb any potential upside.To illustrate how bad annuities are as an investment, especially for retirement, consider the performance of the S&P 500 over the past 30 years, which had an average annual return of 6.73%. You’d be far better off putting your money in an index fund for 30 years and letting that money compound so by retirement age, your return will far exceed the 4% return on a fixed annuity, and you will enjoy the advantage of your withdrawals being taxed at the capital gains rate instead of at ordinary rates with annuities.

Like a subpar cell phone pushed by an overzealous salesperson, annuities are subpar financial products pushed by overzealous insurance agents who stand to make a killing on commissions if they sell you one.

They prey on the fear that you’ll run out of money in retirement if you don’t go with something that pays you a guaranteed fixed income. You may want to think twice before considering annuities as an investment. I can’t think of one person annuities would benefit and the only ones profiting from them are the insurance companies and their agents selling them. Don’t fall for their incentivized sales pitch!

The hardest part of breaking up is just transferring over the money when your salty-FP does not help you and stops being your pal.

An excerpt from “Tax-Free Wealth” by Tom Wheelwright

THE MUTUAL FUND TAX TRAP

Mutual funds are the most common form of stock market investing. The problem is that mutual funds contain a tax trap that many people don’t know about. Think of a mutual fund as a pass-through entity like a partnership. The income earned in a mutual fund is not taxed to the mutual fund. Instead, it’s taxed to the investors. That might be okay if everyone entered a mutual fund at the same time. Everyone would simply report their share of gains and losses on the stocks sold in the mutual fund, and then they would see the value of their investment grow or decrease by those same gains and losses.

That, however, is not how it works. If you invest in mutual funds, you will likely buy into a fund that has been around for many years. Over the years, investors have come and gone while the fund has purchased many different stocks over those same years. The challenge comes when the fund goes to sell a particular stock. Let’s say you decided to invest in Mutual Fund A at the beginning of the year. The fund bought Stock B for $10 per share fifteen years ago. When you joined the fund at the beginning of the year, Stock B had a market value of $50 per share. The day after you join the fund, the fund managers decided to sell the stock. So there is a gain to the fund of $40 per share on the sale of Stock B.

Who pays the tax on the $40 gain? You do, even though you just joined the fund the day before. All investors who owned shares of Mutual Fund A on the day the mutual fund sold the stock share the gain. Doesn’t seem fair, does it? It gets worse.

Suppose you paid $100 per share for Mutual Fund A when you bought it in January. At the end of the year, the stock takes a dip in value and now your shares of Mutual Fund A are only worth $80 per share. You still have to pay tax on your share of the $40 gain from the sale of Stock B inside the mutual fund.

RULE #17: Mutual funds are one of the few places where you can lose money and still owe tax on your investment.

Our mastermind did a book club on this book and here are the recordings.

Printable file to share with love ones

Printable file to share with love ones

Financial Dogma

“Wall Street is the only place that people ride to in a Rolls-Royce to get advice from those who take the subway” -Warren Buffet s

This is a confession that I have trouble hanging out with regular people because I struggle to biting my tongue whenever I hear money myths.

Part of the problem is that people and their parents (role models) have lived this way for so long that I am fighting uphill. Combine this with confirmation bias and fragile over compensating egos who don’t have a clue what they are doing financially it’s just better to shut up and smile silently.

Many of the misconceptions out there are born from millions and millions of marketing dollars to feed the Financial Complex and commissions for misled sales-folks just trying to pay for food, shelter, and clothing.

I was reading this article on brainwashing your child to like your favorite sports team and it made me realize how impressionable we all are. And how it is all reinforced by each other.

Here are some of these myths that I want to call out in this safe SPC environment:

- A 529 college saving is for the investing clueless. A 529 plan is a type of savings account designed to help pay for college-related expenses. There are two types of 529 plans: college savings plans and prepaid tuition plans where college savings plans are more typical because prepaid tuition plans come with big premiums and are not guaranteed by the state Like a 401K or other retirement accounts, it grows tax-free. By investing any after-tax contributions in stocks, bonds, or a mix of other investment options you choose you can shelter it from taxes until you can take it out if used for qualified educational expenses (undergraduate or graduate studies, including tuition, books, computers, and even room and board and now private elementary, middle, and high school tuition). Prepaid tuition plans allow you to pre-purchase all or part of tuition costs for an in-state, public college. You can also transfer your investment to a private college 529 plan that is sponsored by over 250 private and out-of-state colleges. You are essentially locking yourself into current tuition rates but the sophisticated SPC Nation knows that you are losing out on the immense opportunity costs if you invested that money instead in income producing turnkey rentals or syndications. And that brings us to the bigger issue… investing within a 529 is will get you some tax incentives but you are still investing in garbage (stocks, bonds, REITs, money market accounts, mutual funds) with the most risk and lowest returns. Other notes: be careful not to put into the child’s name because that would not be smart because they will likely like to screw off in Japan or something (unqualified and will face a 10 percent penalty tax). Also, the maximum lump sum contribution allowed before a gift tax is applied is $15,000 per year ($30K per couple if your child is so lucky to have two parents) #gratitude. If you are trying to game your FAFSA to get student loans in most cases if a dependent child or their parent owns the plan, financial aid eligibility will only be reduced by five to six percent. If the child owns the account and files as an independent, it can reduce aid by 20 percent (we told you not to do this above). You can get really tricky if a non-parental relative owns the fund, there will be no effect on financial aid — unless they withdraw the money. In this case, FAFSA sees the funds as income, and this can reduce financial aid eligibility by up to 50 percent. To avoid reducing your child’s eligibility, be sure to withdraw the money after any financial aid has been awarded. But remember you are still investing in garbage (stocks, bonds, REITs, money market accounts, mutual funds) with the most risk and lowest returns. Invest in hard tangible assets where the risk is less and returns are stronger!

- Non- solicited Advice. Ever hear retirement advice from a fellow co-worker? Well if they have been there investing their money in risky stock/mutual funds or better worse the company sponsored 401K or pension plan. Why the heck would you take their advice? One of the most common pieces of advice is that they tell you if you delay your retirement to age 65, you get more money!

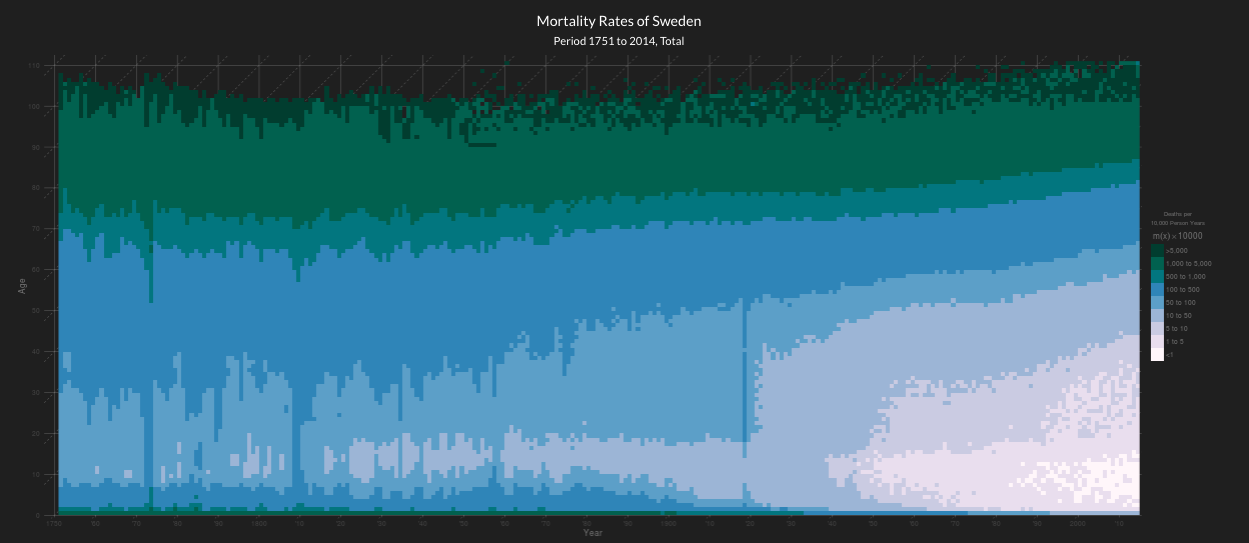

Of course, you will because the Government has done the math and they figure many of those sorry souls will die decreasing their entitlements they have to pay out.

Of course, you will because the Government has done the math and they figure many of those sorry souls will die decreasing their entitlements they have to pay out. - The tax code is written in such a way where only the first few pages of the tax code explain the tax rates. The remaining thousands and thousands of pages explains how the government will incentivize you for government stimulus activities where you can get tax breaks for them. If the government takes these tax breaks it would remove the incentive for the so-called rich (leaders in creating) business and jobs, provide housing, oil, gas, food or whatever government stimulus is needed. Learn more from our Book Club study of Tax-Free Wealth. Avoid Ordinary Income – The wealthy avoid ordinary income because you can pay up to 39.5%.

- Borrowing as a Strategy for Asset Protection. Having a paid off house is the worse thing for asset protection. Everyone knows what you owe (or lack thereof) and you are a sitting duck for litigation in a country that leads the world in silly lawsuits. Encumbering your assets (hopefully good ones that produce income) in debt makes you less of a target to a predatory lawyer. PS… debt increases your return on investment as well as locks in your value because as inflation continues to rise you are paying back the balance on the pre-dated amount.

REITS are like mutual funds. There are so many middlemen taking your money with hidden fees. It is like investing in real estate just as much as drinking high-fructose corn syrup “real” soda.

-Lane Kawaoka

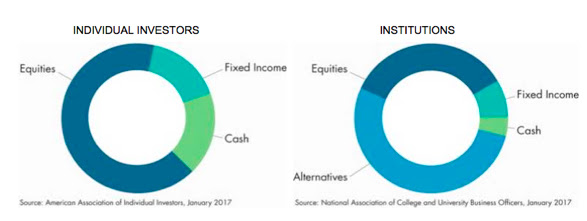

According to the 2017 American Association of Individual Investors Asset Allocation Survey, the average individual investment portfolio consisted of about 66% equity, 16% fixed income, and 18% cash.

Large institutional investors or “Smart Money” asset allocation models contrast that of the average retail investor.

According to a January 2017 report from the National Association of College and University Business Officers (NACUBO), university endowments report average asset allocations of 35% equity, 8% fixed income, 4% cash and 53% alternatives.

With 401(k)s and IRAs heavily invested in mutual funds and with investment advisors heavily skewed towards equities to drive up fees, it’s easy to see why individual investors prefer the convenience of Wall Street.

Why does the smart money allocate a majority of their assets to alternative investments? The simple answer is the returns are better.

Alternative investments are shielded from the volatility of Wall Street.

The JOBS ACT opened up the playing field is allowing more people into syndications.

This guy sold me a scammy life insurance policy, unlike the ones that the rich do… what can I do?

You basically have three options:.

First option: Cash it out and just walk away with the cash that’s in it is the obvious choice that I would recommend in most cases especially when you can put it into a turnkey rental or syndication. In that case, you obviously no longer have a life insurance policy so the death benefit goes away.. Because of the way it was designed, it hasn’t built enough cash value yet for there to be any tax consequence so she doesn’t have to worry about that..

Second option: You could borrow against this policy and use the money that way.. Basically, she could do banking inside what she currently has, the downside is that it’s not a great cash building policy so there’s more cost in it than what you’d like to see and then the loan rate may not be real favorable..

Third option: Open a new policy (one that is designed for cash build up) and do a 1035 exchange into it where you could use the policy for banking.. The nice thing here is that you would have a little cash right up front to boost the new policy.. The downside is just going through the process of getting a new policy..

So basically, if you need/want the insurance death benefit and/or would like to use the banking strategy, the best bet would probably be to get a new policy that designed for that purpose and dramatically reduced cost.. If you don’t really care about using the banking strategy then you can just cash out and walk away with no issue..

Why We Avoid Investing in Wall Street

Wall Street investments:

- Is a roller coaster. Your investments are at the whim of the market. And things move so quickly.

- You have little input or control. With real estate you can use insider knowledge.

- Investments are retail meaning there are many layers of salesmen. Everything is based off sales commissions. The key is to get closer to the source to cut out all the layers of middlemen.

“We know what is going to happen if you keep investing in the same old stocks/mutual funds/bonds… you will keep working at your job with a lackluster retirement in 40-50 years. Invest in real estate for cashflow is a proven way that I created my pension today and allowed me to retire before I hit the age of 34. Do the math… the numbers don’t lie… people do” -Lane Kawaoka

Thank you for supporting SimplePassiveCashflow. I made this website because I was lonely and wanted to build a tribe. Join me below: