Start Here

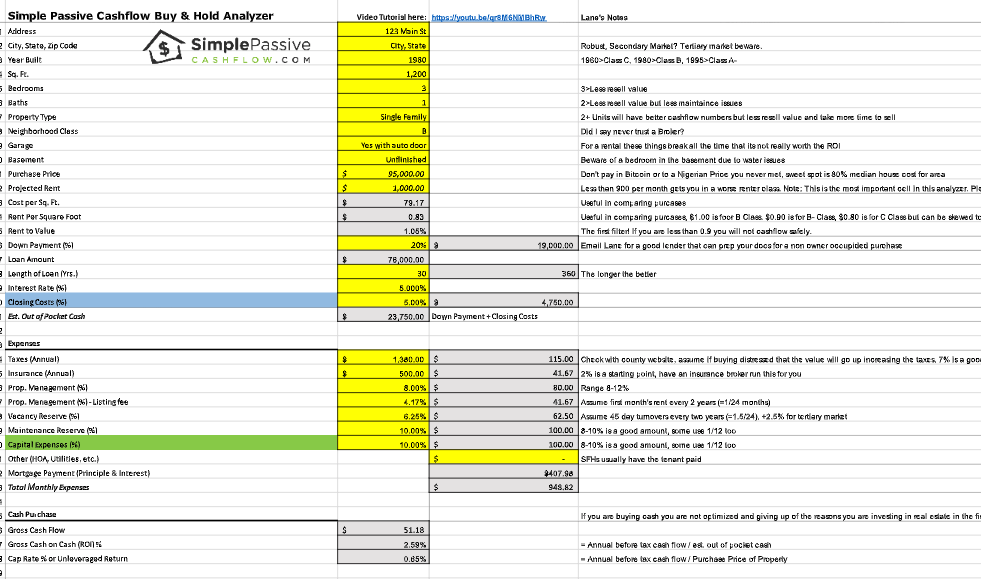

Newbies:looking for buy & hold rentals 1) Listen to the first 8 podcasts. These were recorded back in 2016, and since I have moved on to

Newbies:looking for buy & hold rentals 1) Listen to the first 8 podcasts. These were recorded back in 2016, and since I have moved on to

This is the Simple Passive Cash Flow podcast, but we have taken over the podcast and released each chapter of the book that went Amazon

Now in this next chapter seven, which is . The BS in the traditional financial wisdom. I took a lot of things that I saw

Now in this next chapter seven, which is . The BS in the traditional financial wisdom. I took a lot of things that I saw

What’s up folks? On today’s podcast, I’m gonna be dropping chapter six of my book, the Journey of Simple Passive Cashflow. This chapter is called

This is the Simple Passive Cash Flow podcast Over the last several weeks we’ve been giving out each chapter to the journey, the simple Passa

This is the Simple Passive Cash Flow podcast, but we have taken it over and releasing my latest book that was released a couple years

This is the Simple Passive Cash Flow podcast, but we have taken it over with my book that was released a couple years ago, the

All right. Welcome to the Simple Passive Cashflow podcast. We’ve taken over the channel by. The chapters of my latest book, which we released a

All right, here we go into chapter one of the book. Again, we are releasing my old book that released a couple years ago, the

What’s up folks. My name is Lane Kawaoka, and we are going to be reading my book, the journey to civil passive cashflow. And this

1) LP Syndication Guides & Turnkey Rentals

2) Accredited & Pure Investor Networking Opportunities

3) Free Trial of Passive Investor Accelerator eCourse

Join Our Community!

*No sales pitch. Period.