Coaching Call: Starting Out In Syndications | Should You Do 1031 Exchange

What’s up folks? On today’s podcast, we are gonna be doing a coaching call where we go over the beginner questions on transitioning. Maybe you’ve owned some rental properties and you may be thinking you’re gonna 10 31 into a syndication or into a bigger deal. Guess what? , as far as I’m concerned, 1031s […]

Why You Should NOT Do 1031 Exchange! Instead, Do This!

Hello simple passive cashflow listeners. Welcome to another show. Now we’re going to be answering a very common question , should I be doing a 10 31, exchanging my property for another property? Quick announcements: we are going to be doing the 2022 mastermind retreat, open to past investors, family office members, and select you. […]

Ways You Can Defer Capital Gains From Real Estate

We’ve got our first question here. Other ways you can defer capital gains from real estate, besides 10 31 exchange as an opportunity fund. I’m not a few 10 of either of these opportunity funds or this. You can Google all about it. But the thing about the opportunity fund is you’re investing in crappy […]

February 2021 Monthly Market Update

https://youtu.be/T-la1Hyc5Gk This is the February, 2021 monthly market update where I go over the news and what’s been impacting the economy and our real estate investing Easter egg just to start out. So I put together all the recordings for the turnkey rentals. In a little turnkey download tab for we guys that’s all past […]

New Tax Implications from the 2020 Election w/ Toby Mathis [Part 1 of 2]

Hey, simple passive cashflow listeners. Today. We have Toby Mathis here, a partner at Anderson advisors, the guys who got me to pay no taxes. Thanks again, Toby for that. although I was the one putting in a whole bunch of money into deals, par in economy through the pandemic. So I can say I […]

Sheltering Capital Gains Without Painful 1031 Exchanges

So I’m cashing out some of my real estate that was inherited because the net income is very low given the asset value considering cashing out on a property that I bought 30 years ago in Arizona even though the rent ratio is amazing the income to asset ratio is low thought is to hold […]

Retirement Accounts: SDIRA QRP – Qualified Retirement Plans & Free Book

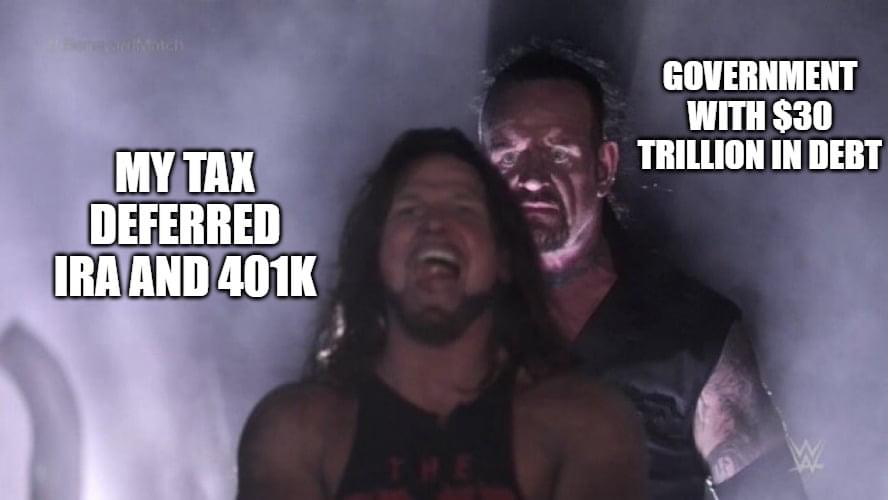

“Retirement accounts (with so-called tax benefits) only make sense if your AGI is over 340k AND you have a substantial amount in your IRA already (400k+). The wealthy people I meet don’t use these things as a primary wealth building too because it does not help them on their taxes today. These retirement accounts are […]

Rental #5: Birmingham

This is the first property in a series (1 out of 9) of acquisitions that resulted from a couple 1031 exchanges. If this is your first time reading this post I suggest you read these few prefaces first. The inspiration to go for cashflow vs appreciation The introduction to the 1031-O-Rama: 2 -1031s, 9 properties, […]

Start Here

Newbies:looking for buy & hold rentals 1) Listen to the first 8 podcasts. These were recorded back in 2016, and since I have moved on to syndications but was created as a foundation to help people get started with rentals like I did in 2009 when I was straight out of college. 2) Review the Turnkey […]

Podcast #19 – 1031 Tips and Tricks (Guest Appearance Podcast)

Link to ULTIMATE SPC 1031 GUIDE Link to ULTIMATE SPC TAX GUIDE 11 Not So Obvious 1031 Exchange Strategies My promise to my readers: No click bait here on SimplePassiveCashflow.com – all the tips will be provided on the SAME page, so relax! For real estate investors at some point, you are going to […]