Cost Segregation & Bonus Depreciation – Jacob’s Version

Have you ever found yourself browsing endlessly online to simply know more about Cost Segregation to save on taxes without all the superfluous tax talk? Search no more! As a real estate investor, imagine using Cost Segregation as a real property investment strategy that will grant you tax free cash flow from fixed assets and […]

2020 Census Findings

Complete 2021.5 Survey Here https://youtu.be/3o1BaBMrtjU State of the Market Q2 2021

Tony Robbins UPW – Group Travel 2021 Palm Beach FL

Get a UPW discount by signing up here. We are forming a mini group mastermind like the last one in Sonoma. Sorry Lane will not be there because he is not allowed to travel with his kid now 1.5 months old 🙁 I attended it in 2016 and again in LA in 2019 and it was […]

Don’t let YOUR MONEY go down the drain!

https://youtu.be/WY9E4kWFz50Yeah, I think it’s, I think there might be a divergence within like residential stuff, which you guys work with. And then the commercial assets, like I haven’t seen the run-up in prices in commercial assets, maybe like a quarter point across the board of cap rates, lowering. By the way it’s you guys means […]

New Baby Shopping Lists & New Parent Tips

Downloadable Shopping Spreadsheet Shopping Links Going from a life without kids to your first is going to change your life. I was going to start a new website call Simple Passive Parenting but did not seem to be my passion project and something I couple spend listening hours of podcasts too (although some said I […]

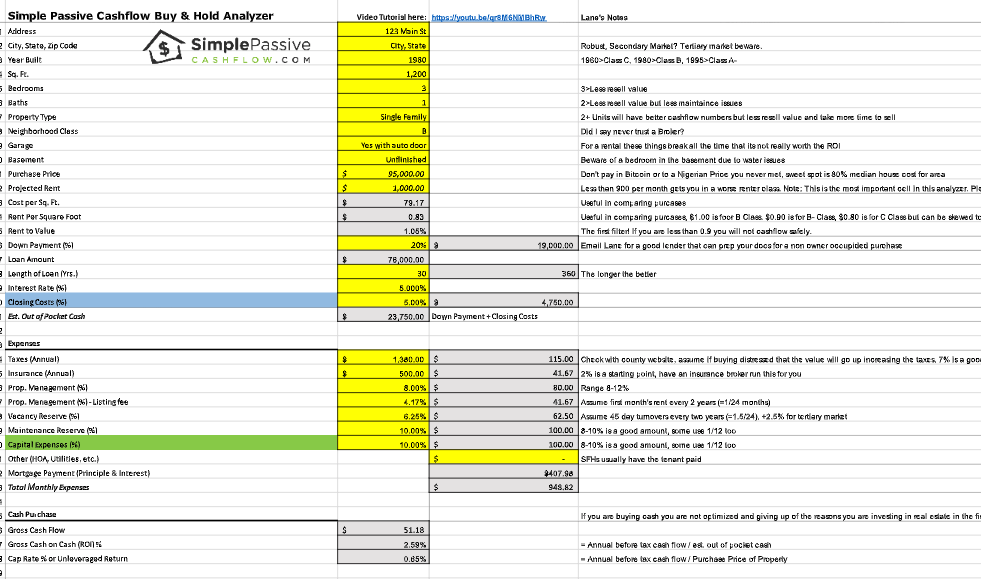

Return on Equity Calc Download Page

This is Your…. Journey to Simple Passive Cashflow! Check out the past deals, future ones, and get access to our “investor resources” share drive: More Goodies & Join Private Investor Club Download ROE Calc Here https://youtu.be/tAParC-gwro

Suspended losses (last resort to lower ordinary income without REP)

The order in which suspended losses are deducted is: 1. To first offset depreciation recapture and gain from the activity that was sold. 2. If the suspended losses are in excess of the total gain, the remaining suspended losses will then offset ordinary income. 3. If the suspended losses do not offset 100% of the […]

Things that you can’t learn in college

Things that you can’t learn in college: Schools teach concepts but it does not really help you learn personal branding, networking, and creativeness as trends change. They teach you what happen in the past which may not help you in the future They don’t teach you to be a good speaker you absorb material You […]

Oct 2020 Monthly Market Update

They you and try to rent them out and then became one. All right, everybody, this is October 2020. Monthly market update, you guys can find pass reports at simple passive cash flow calm slash investor letter. But let’s get going here, we always start off with a little bit of a free easter egg […]

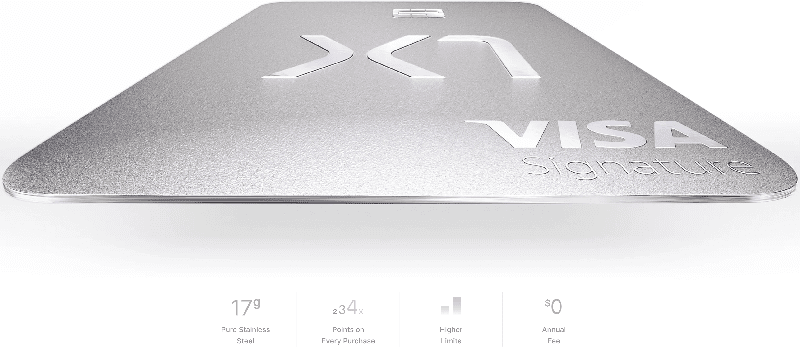

4X Reward “X1 Card” Credit Card Pre-Review

https://youtu.be/5wn0CJRc4OEI am not about wasting Time to pick up pennies these days when you can seek out a larger deal. The X1 Card is soon to be released and it is supposed to offer up to 4X rewards on all spend with no annual fee, no foreign transaction fees. To hit this level of rewards […]