Are you geared towards the typical Emergency Fund like what usually is preached from you mom/dad and the Suzy Orman show?

Set aside 3-6months of cash emergency funds in order to have liquidity in case something arises.

You’ve heard the advice a million times and you even shared it with people close to you since you are fired up with financial knowledge about market liquidity and cash management. Only to find that the wealthy call it their “Opportunity Fund”.

Liquidity with Opportunity Fund: What You Need to Know

This is not about Opportunity Fund Zones. This pertains to a different meaning of your personal Opportunity Fund which involves minding your “own business” which is your personal liquidity and investment/deployment strategy.

An Opportunity Fund is earmarked amount of month that you have set aside as “dry powder” so that whenever a certain deal comes along you can go in on the opportunity.

This is what you use as an investor in case you have an additional deals that exhausts your liquidity.

That’s right! This is a better option rather than borrowing money from a friend or a family member or getting FOOM.

You could also use the terms “liquidity account” not your “savings account”. This is very different than what the masses think about in terms of an emergency savings account.

The “gurus” say you should have a specific dollar amount saved, let’s say six months reserves. If your monthly expenses are $1,000 a month, you should have $6,000 in a bank account to draw from in case you lose your job. However, this does not make sense because most of our clients make 10 times of that and having $60,000 of liquidity sitting around making 0-1% is silly.

Sources of Opportunity Fund

Funded Life Insurance

See the info page here and make sure you sign up for the free ecourse.

American Home Preservation (AHP)

Look, if this is the first you’ve heard of AHP then you’ve been missing a lot!

AHP was formed to help distressed families to find viable solution to their mortgage problems that other lenders (like banks) are unwilling to consider.

They used to give out 10% a month. However, due to their sudden popularity they have to drop it to 8% per month. Even through there was a decrease in percentage, it is still a good deal due to its liquidity. More info.

As mentioned within the Mastermind and coaching clients, I kept $70K in AHP and $100-500K in my life insurance banking to park cash as I wait for the next syndication.

I don’t like to hold any more than 10-25K of liquidity (making less than 5%). This is what I call “liquidity anxiety.” Most times I recommend having no more than 2x the monthly credit card bills to float charge. This way we avoid last minute transfers and over-draft fees – and invest everything over that.

This is a part of my 1-2 punch to avoiding liquidity anxiety and having an Opportunity Fund to go after deals as they come up. More info.

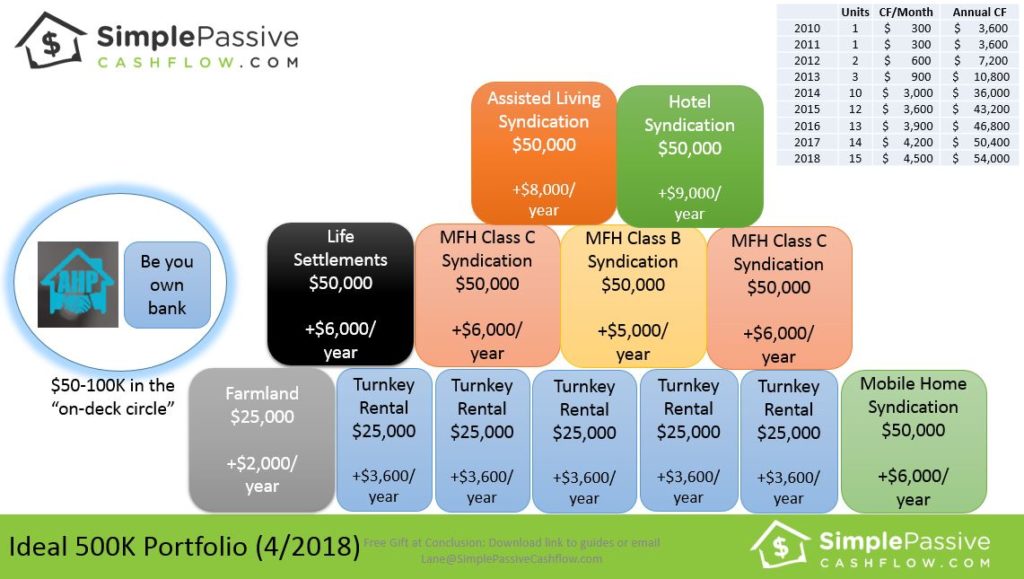

A lot of you who are Hui Deal Pipeline Club members (join here) have seen my diagram below:

The diagram is supposed to be a loose guideline of what I have been trying to do with my portfolio. I highlight the word “loose.”

I call this my “on-deck circle” cause I don’t like how the term… “dry-powder” sounds.

Another idea (a little more conservative is to) borrow from your infinite banking life policy at ~5% and go invest in AHP at 10%…. basically just make a little profit on the delta (arbitrage) the difference.

Additional recourses:

Factors to Consider in Managing Liquidity

Everyone is going to have varying levels of liquidity risk tolerance, goals to diversify your portfolio, or amount of asset per investor needs to be managed. Every situation is unique and why we recommend joining our group for further education.

By having an opportunity funds around we inherently minimize the chance to sell an illiquid investment. We work with clients to strategize their Asset Allocation Model while taking into account their liquidity needs

The Upside of Using Liquidity to Lower Your Risk

In a surprising occasion, just like if you found a good real estate investment deal that is beyond your budget already having places to pull cash from ensures you don’t let good rare deals get away.

That said those who join our Family Office Ohana Mastermind build the needed relationships to find out which opportunites to go into (more importantly who to stay away from). And therefore they have more than ample dealflow to allocate their funds and start to build a steady stream of consistent deals as opposed to great deals and sucker deals which is common for new alternative investors.