Diversification is a common term in investing and most investors never put their money in a single basket. Of course, money has to constantly work for them.

Are you aware that there are other options to build wealth outside the traditional ways (like stock, bonds, mutual funds, etc.) that exist?

And that’s what hit me! Not everyone is mindful of it.

Never blame others. We are responsible for our own exposure to information and additional knowledge besides what we were taught in school!

Whether it’s lack of information or being with the wrong network, the good news is even the government is having a movement to make it easier for individuals to invest in tangible assets or businesses rather than speculating whether Meta will do well next quarter.

With due diligence and allocating time to research, other investments exist that generate passive income just like what American Homeowner Preservation (AHP) has.

What is Note Investing?

Note investing occurs when the investor acquires debt and in the long run, you’ll act as the lender. You will secure mortgage payment from the initial borrower and undoubtedly purchasing of note will be done at a much-discounted cost.

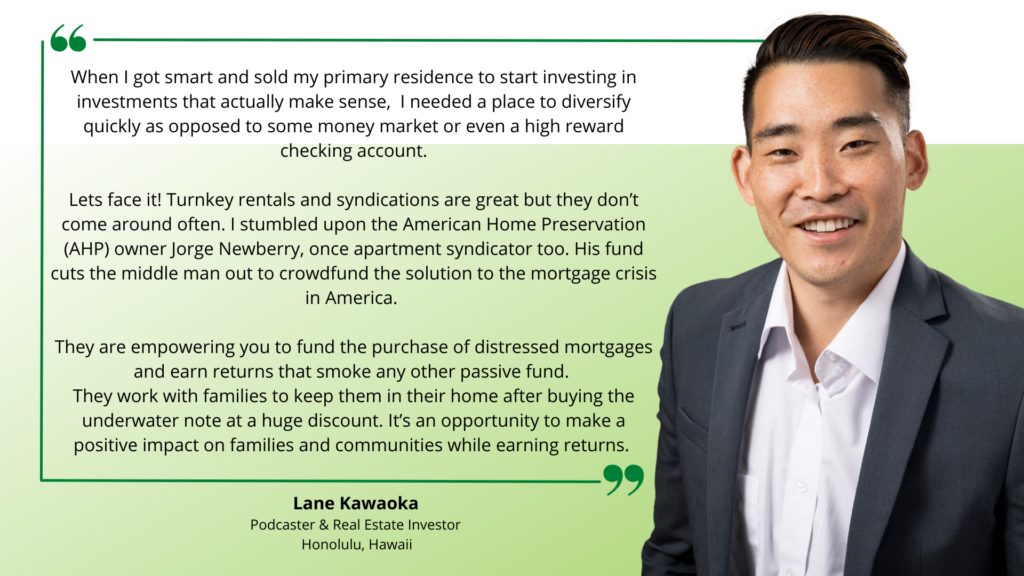

Like the other deals in the Hui Deal Pipeline Club… I have my own skin in the game.

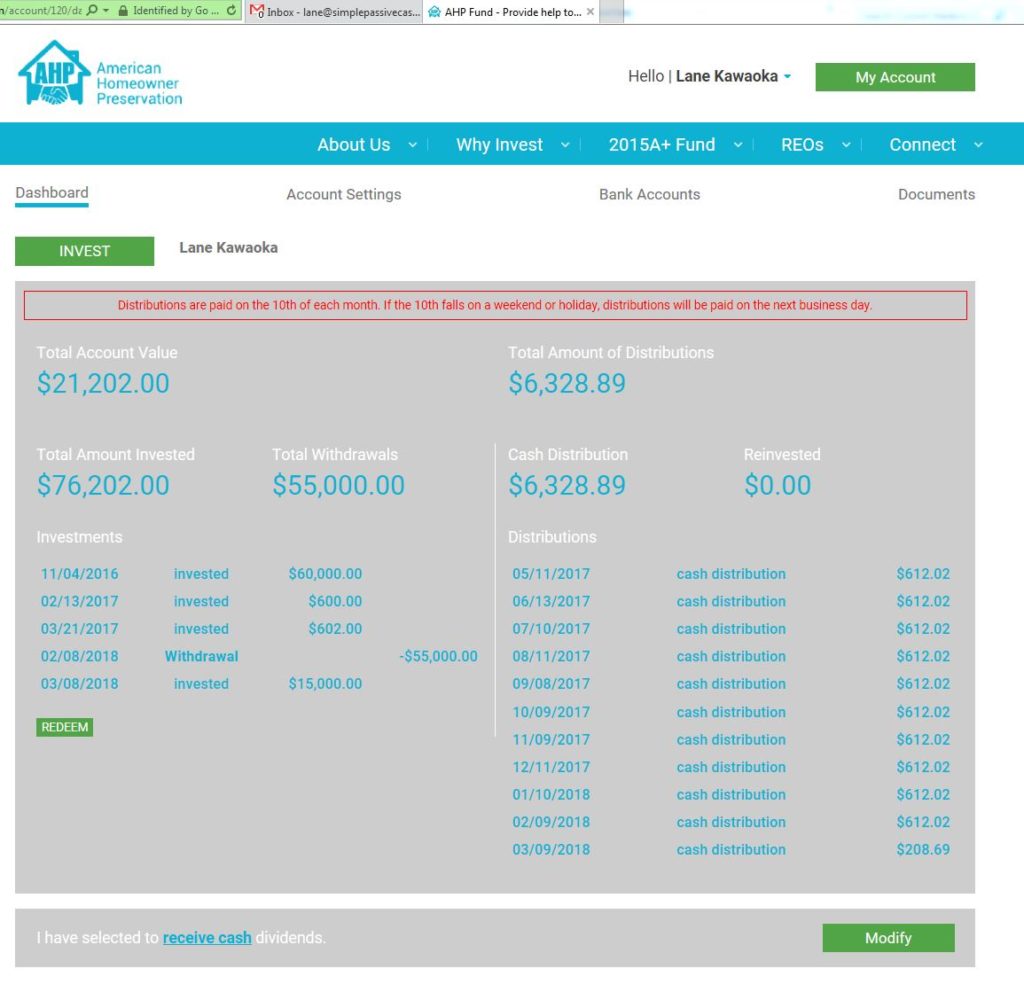

Lane’s AHP Account

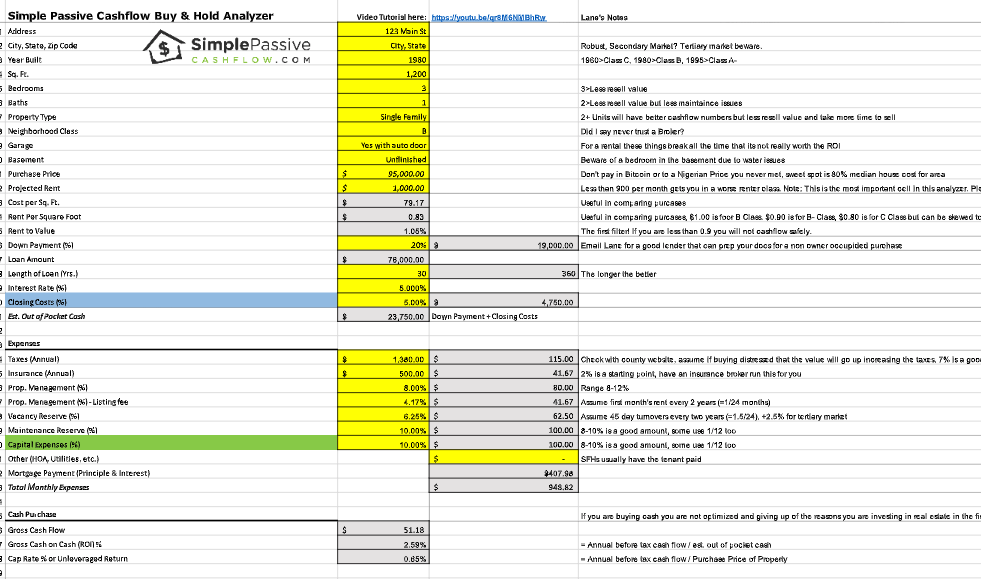

I have always had a good amount in my AHP account since 2016. I like the liquidity and use it in conjunction with my life insurance policy to go into private placements which come up irregularly. The 1% a month is enough to pay for my car lease… Talk about a free car.

Car Lease From AHP

$600/month from AHP minus $475 monthly lease equals some left over for some socially responsive coffee farms. ⬇⬇⬇

NOTE: This is a non-compensated review of my investment in this fund since 2017. Disclosure: I have been in the original fund and personally know Jorge Newberry and he sponsored my podcast from 2017-2018. But other than that I would invest in this fund.

As I mentioned before within the Mastermind and coaching clients, I use $70K in AHP and $50-100K in my life insurance banking for a go-to for me to park cash as I wait for the next syndication. This is a part of my 1-2 punch to avoiding liquidity anxiety and having an Opportunity Fund to go after deals as they come up. I call this my “on-deck circle” cause I don’t like how “dry-powder” sounds. More info. (Also has the latest info on the latest 2018 AHP fund in the first half of the webinar)

2020 Financial Review

ANSWER:

“Thanks for the question. AHP Servicing has utilized funds for two primary purposes: a) buy distressed mortgages and b) build out a national mortgage servicer. When we launched the fund in November 2018, the competition to buy loans was strong and there were limited acquisition opportunities. Thus, we closed the fund to new investment from May 2019 – November 2019. There was also a leadership change in this period. In March 2018, I moved from CEO to Chairman of the Board and brought in a replacement CEO from Wintrust Bank. The new CEO added some needed management infrastructure but also brought a more conservative investment approach which resulted in lower-than-anticipated returns.

COVID hit in March 2020. At that time, courts, county recorders and municipalities slowed or even suspended functions in many parts of the country. Thus, we could not complete some REO sales and foreclosures, while at the same time borrowers were calling in requesting forbearances as they were unable to make their mortgage payments. This created challenges, but also opportunities.

From July 2020 through February 2021, we purchased 731 loans with total debt of 103.1M and estimated property values of 119.3M for a total acquisition price of 48.3M. Although we still cannot complete foreclosures in some parts of the country and some borrowers are still having challenges making payments due to COVID-related income disruptions, the situation has improved, and today’s low interest rates and surging real estate market have been helpful.

In addition, we have built out a national mortgage servicer, licensed in every state except for New York (where we expect to be licensed shortly). We have built our platform utilizing Black Knight’s MSP technology, which is utilized by the majority of the largest servicers in the country. This cost a million dollars and makes us a viable servicing option for institutional mortgage holders. We expect large growth for the servicer, especially once the economy enters a downturn. In summary, things have not gone as planned, but we believe that we have navigated the challenges and that resolution of our existing portfolio of assets (the majority of which were purchased during the height of COVID) and growth of our servicer will result in AHP Servicing’s long-term success.”

– Jorge Newbery 21.07.20

Notes from American HomeownerPreservation (AHP):

All of us at AHP Servicing are pleased to unveil our next Reg A Offering, with a goal of raising up to $50 million. We are continuing the work begun 10 years ago by our sister company, American Homeowner Preservation, purchasing non-performing residential loans and working with borrowers to allow them to remain in their home or settle their debt at a discount.

Our goal for this offering is to provide investors with an opportunity to earn favorable social and financial returns. Highlights include:

- Open to accredited and non-accredited investors

- Minimum investment of just $100

- A preferred annual return up to 10% per year

- Monthly Distributions

- Best efforts liquidity (no lock-up period)

- Best efforts return of capital within five years of the investment

- Socially responsible investment focus

To learn more about the offering, review the offering statement, and invest, please visit our new website at ahpservicing.com. You can invest online or call us at +1 866-AHP-TEAM and ask to speak with Brian Hamilton or Rachael Minnick, our Investor Relations Associates. (and do me a favor an tell them Lane sent you!)

Our team at AHP Servicing cannot thank you enough for your strong interest in this offering. At AHP Servicing, we measure our return in dollars and in sense, and we know that you do as well.

Check out: Full news brief here

—————————————————— END OF 11/8/2018 UPDATE ———————————————————–

Highlights of the Investment

✔ You are helping people stay in their homes as AHP buys the loans from the banks and attempts to structure a more manageable payment schedule for the existing homeowner.

✔ AHP pays 12% a year in the fund that ends in May 2018. You get 1% every month like clockwork. For the latest news go to InvestingAHP.com.

✔ I use it as an “Opportunity Fund” holding tank because of the liquidity.

✔ Talk about a diversified fund that is 3rd party audited that gets you great returns. This completely blows the pants off of those dinky private money loans in terms of liquidity, security, sophistication, and ease. #WhyDoesNotEveryoneDoThat

You can start with $100 bucks and then you can incrementally increase your investment however you want.

AHP 2015A+ Files Audited Financials with SEC

American Homeowner Preservation 2015A+ LLC filed our 1-K annual report with the Securities and Exchange Commission on May 1st. The filing included our audited 2017 financial statements. Both the Audit and the Auditor’s Letter are available for review. In addition, the complete 1-K filing is available on the SEC’s Edgar website.

The audit indicated that in 2017 2015A+ generated a 40.46% annualized return and generated a net income of $1,425,753.00.

In 2017, after expenses were paid, we attained our goal of paying a return of 12% per year to our investors. Excess gains were utilized to buy additional assets.

We are pleased with the performance of 2015A+ and hope that you are enjoying your returns.

Jorge Newbery, Founder and CEO, American Homeowner Preservation. On a mission to help Americans crushed by unaffordable debt. This Ex-Apartment investor talks about going $28 million dollars into the hole. This is quite honestly the most authentic and insightful interviews I have had this 2016. Editing the podcast was like watching a freaking drama movie!

Podcast #34 – Jorge Newbery goes $28 million into the hole and the fight to get back to even

“We talk a lot about syndications on this podcast and most of the time, these offerings are only for those with an accredited status per the rules and regulations of the SEC. Now sponsoring the SPC podcast is the American Home Preservation Fund, a crowdfunding solution to the mortgage crisis in America, empowering investors to fund the purchase of distressed mortgages. The AHP fund aims to keep people in their homes by investing in notes. It’s an opportunity to earn returns while feeling good about making a positive social impact. You can start investing with as little as $100. To learn more visit InvestInAHP.com and if you want the free Burnzone book send me an to Lane@simplepassivecashflow.com.”

Podcast #101 – Interview Jorge Newberry – Note Buyer Bootcamp Announcement and Non-Performing Notes

Photo: April 2018 conference

Photo: New Servicing Center with debt collectors/solution artist who are kind and caring

“It’s now time to give Uncle Jorge Newberry’s American Home Preservation some shine. Jorge was featured on my favorite podcast for 2016… #34. Jorge has created a fund that allows accredited and non-accredited investors the ability to fund the purchase of distressed mortgages via notes. The AHP team collaborates with the families to keep them in their home. It’s an opportunity to make some money help rebuild blue collar America. Start investing with as little as $100 at InvestInAHP.com and if you want the free Burnzone book send me an to Lane@simplepassivecashflow.com.”

If you are getting 1% a year in your bank account… 10x that!!!

Let us send you a hard copy!!! Fill up the form below 🔽

Full Name*

Hi everybody. We are going to be doing a deep dive into the 2020 financial audit of servicing. If you guys haven’t heard about this, go to my website@simplepassivecashflow.com / AHP. I’ve known George since 2016 more poorly. I’ve floated a 60 to a hundred grand in his fund.

Got a nice cool. Return every single month, like clockwork. If you guys go back@simplepassivecashflow.com slash HP, you’ll see all the past webinars we’ve done on this fund. One of the things I personally invest in, but the question that comes up a lot of times is, as a fund, it’s hard to determine other than, talking to other investors had they had a good experience, but supposedly the financials are audited.

But look around. Nobody knows what the heck that means. So we’re going to dive into it today and George has got the report up and I guess let’s get into it. Welcome George. Hey, Eileen. Thanks for having me on. these reports can be pretty dry and overwhelming.

Maybe walk us through what are things, this is the HP. Audit obviously, this is something you can do with any private fund that you’re investing in or possibly wanting to invest in. But maybe George take us through how these reports put together and who does it?

How do they go about it? Sure. So we have all. Regulation eight plus companies generally are required to file audited financials with the sec through their Edgar system. And in fact, I believe that’s a requirement of most, if not all publicly traded companies.

And The reason for it is you want to know if you’re investing in a company and like you said, you don’t know the minutia, what did they invest in today? What did they sell today? So the independent auditor’s report will be an independent company.

That’s engaged to review all the financial records of the company and then issue a report. And so we do this every year. We’ve been doing it since we started our first regulation, a plus fund in 2016 and we get these done and then they’re filed with the sec and they can be reviewed there. This was a challenging year, 2020, but this will show how we fared and then I can go through each page and interpreted, everyone can interpret for themselves, but I can certainly share some context about how we did last year and what the state of HP is right now.

And of course, this is obviously George is the principal HP, and you guys can look at the numbers on your own, but, as I always do it, like with our apartments we have the PNLs and all the line items, I usually look at a certain things I personally do it and we’ll see how it kind of George does it.

And, but you guys can all have a C dig through this stuff, find your own. Yep. I’ll try to add some color. So it may all make sense. And certainly if you’re an investor HV, or even if you’re not, if you’re considering an investment in HP, we definitely encourage you. If you have questions on it or anything else about HP to reach out to us and we can assist we’re at HP servicing.com and this little plug in there, Jane.

I’ll dive in and go through this. This is Richie may that’s our auditor. You can choose through any. There’s a number of auditors in the country. Richard Mays has a lot of expertise in the mortgage industry, which is why we chose them. They do a lot of mortgage servicers, originators companies and invest in mortgages.

They have a lot of experience.

There’s a whole bunch. You can access this. This is on the SCCs website. We can also provide your copy. If you go sec filings or Edgar HP service, and you’ll see all our filings since the beginning of when we first filed with the sec in order to do the HP servicing offering.

that’s on their 20, 15, eight pluses on there. And. This first page is simply, some background on the audit and the auditor disclosures and whatnot. So not really too much meat there, but certainly something that anyone is welcome to to read same with the second page, but then you get to the meat, we started out with a balance sheet and then we’ll get to the profit and loss, but basically it’s showing and this report what we held.

On our balance sheet at the December 31st of 2020. And it also compares it what we held on our balance sheet on December 30, first, 2019. At the end that year we had 665,000 in cash. Some of these are fairly easy I’m going to mention them anyway. So cash.

End of the year, 665,000. We had an escrow cash of over $3 million. as our servicing portfolio has grown. we’re servicing both loans that we own, and that is own. We do continue to hold more and more cash and in escrow Accounts receivable. This is money that we’ve advanced sometimes on behalf of third parties.

So if somebody has a loan that we’re servicing, we may advance money on their behalf to let’s say, pay a legal bill or pay taxes. It’s typically repaid the next month when their remittance comes through and we can apply the payments that they received against the amount that we’ve advanced.

In this case, it’s almost a million bucks, $922,000. Here’s the biggest item though is mortgages that we held for sale. And they categorize basically all the mortgages that we purchased as held for sale. These totals, you can see just over $37 million. I’m looking right here. can see my cursor.

So just over $37 million in mortgages. Now a key item to understand is this is basically what we paid for the mortgage. So if we buy a mortgage. Where a family owes a hundred thousand dollars and the home is worth $150,000. And we buy that mortgage for $50,000 using very round numbers.

Then it’s booked at 50,000, even though they’ll oh, 150, we book it at what we paid. We don’t realize a gain or a loss until the asset is actually disposed of. This 37 million is what we actually paid for those loans. A note receivable third-party this is if we make any advances on loans that we actually own, or two entities that were related to, I’d say specific like 20, 15, eight, plus if we made advances on or legal or anything for them, that would be included in their prepaid expenses.

If we paid Prepaid and expenses on behalf of the company that we expect for services that not yet been rendered, that would be in the $300,000 other assets, property, and equipment any kind of computer equipment servers Would be included in there deposits, probably our security deposit on our bill, on our leases and other things like that.

$40,000 in the end, $45 million in assets. Now what do we owe? We have out 1.3 million in payables. These can be any kind of bills that we owe 1.1 million in escrow liability. So this is in all likelihood. This escrow that we’re holding $3 million. It’s probably offset by. We probably owe some of that.

So 1.1 is likely money that we owe that produces that cash probably down to 1.9 short-term debt. We borrowed money on a credit line or something like that. Short-term $662, I’m sorry. $662,000. Long-term debt. If we are long-term note we had last year, we bought a lot of loans. We spent almost 50 million at the end of the year.

I think we bought a significant number and We borrowed $14 million against the notes that we purchased. In fact, that was all incurred in the last six months of last year. But it’s what, like the number of the average one, the value on that stuff, and then the rate

it’s very light leverage still. It’s very light level. Yeah. We bought about in the last six months of last year the ideal strategy for the performing stuff, to use on that. We just use it to, if we had enough money to close, so basically we bought about $50 million.

I think it was 48 million in change that we spent for loans where the amount due on the loans was about a hundred million. The property values back in those loans was about 120. That’s what we purchased between July 20 20 and February, 2021. That’s pretty aggressive for us. And we bought these a great prices.

I think on average, we’re talking about 50 cents on those. And again, you look back to last June through November, which is when we made the deal. Some of them didn’t actually close to February for different reasons, but that’s when we made the deal and set the pricing, it was still pretty uncertain, the real estate market was surprisingly doing well, but I don’t think people would consider it

we’re acknowledging that it was doing great. And so as we kept buying the pricing was very attractive and we’re seeing that some of those loans were exiting right now and 2021 at significant markups, because back then you buy a loan it’s based on what’s the value of the underlying property.

And if that value goes up, people are willing to pay more. And also if we ever sell the property, let’s say we get an REO or a deed in lieu and we’re selling it. We thought it was worth a hundred last year and now it’s worth 120 and we’re selling it. That’s great. So we’re seeing a ton of that happening now.

And I think we’ll continue to see that through. I would expect certainly this year and probably sometime into next year, I imagine there’ll be a A point where this goes the other direction and in my mind strategically. We want to sell as much as possible today. If we get an REO, it will sell at a big premium, typically over what we paid for it, whether it was last year, early this year, or even or before COVID but also all the loans that we modified, we didn’t sell loans.

Since I came back as CEO in, in mid 2019, I said, Hey, no more loan sales. Let’s just hold everything we had. And we did that. But now these loans where we modified the loan and people are paying we’re now selling these loans at the average is mostly they’re selling for over 90 cents, which we typically bought them at 50 to 60 cents or less.

So that’s. Resulting in some significant gains this month we’re selling about 5 million next month, we’re selling about 9 million and we’re working on another pool that we’re probably closing in July or August. Those should provide some significant liquidity and we’re hardly buying anything right now because we see so few opportunities out there that have attractive pricing.

So back to the audit So member’s equity. That’s how much equity is in the company, $27 million. They add up the liabilities and the equity to come up with a total of $45 million now profit and loss. How did we do last year? We lost money. We earned asset management fees of two oh nine loan servicing fees of six oh nine interest income of nine 21.

Gain on on sale of mortgages, seven 24 other income, one 63. So we made $2.6 million last year. Significantly offset by expenses. We had over $4.4 million in expenses. In salaries and wages occupancy, basically rents and equipment 346,000. Admin nine oh six oh four professional services like attorneys just over a million dollars advertising.

115,000 depreciation, one 33 interest expense four oh two. So total loss of 4.4. Now, why is that? Why would we lose? We’d be losing money while ASP servicing is two things are the money that we raised goes for two purposes. One is to buy mortgage loans. Two is to build out a national mortgage servicer.

So that’s why, we’re all the salaries that’s because we have a national mortgage servicer that we built, which is licensed everywhere, except for the state of New York. We’re still working on getting her license in the state of New York has taken a long time,

where’s the interest paid to the investors.

We’re fortunate that is. Distribution. So next page. Right here. So we can jump there right now. Member equity, this is we’ll go for each year. We started out in the first year. We were active for two months. We raised 3.9 million. And then the next year we had $15.7 million come in as investments in 20 19, we distributed a 4.3 million so at the end of 2019, we had $12.9 million outstanding to investors that rose a lot through 2020, we raised over $20 million and we distributed Around a million dollars.

We didn’t do too many ramps with, so we distributed just over a million dollars and we lost $4.4 million. So basically think about this when we raise we’re always bringing in money every day from interest payments. We’re bringing in money from. Loans that are sold Oreos that are sold.

I shouldn’t say loans that are sold like short sales, REO sales. And so that’s the money that we pay out to investors in our monthly distributions. Overall, still we lost $4.4 million last year. So our total on sanction investors right now, 27, or right now as of December 30, first, $27 million,

the 10%. Back to investors 1% every month. Which line is that again? It’d be member distributions right here. 1.1 million. Okay. So that didn’t skip a beat. It came a little tough in March and April and bear in mind. Roughly half of our investors, because we’re still in the capital raising phase reinvest their money.

So they simply, instead of getting money out the door, that money is added to their investments. So with the reg a plus offering, you go out to a whole bunch of the masses. How many investors isn’t this whole there’s over 1300 investors. Wow. So you’re saying George and email.

It don’t expect an answer. Yeah, I know we have our investor relations. Michael Distasio is our primary contact in investor relations. He’s the one who’s normally responding to emails phones and other outreach. If you email me, I’ll definitely try to assist.

I usually forward it to Michael, unless it’s something that’s particularly out of the ordinary. I think you’ve told me this before, but now that we have the financials up, What is your logic on, like how much cash to keep on hand to be able to go after a good opportunity?

Or do you just raise it? We just raise it or we borrow it if we get caught short and we have a closing, like that’s next week or at the end of the month or something like that. So we don’t have Hey, we always want to keep a certain amount of cash on reserve. Literally money does come in every single day.

We usually know if there’s a big purchase coming up. That if we get over short money, we can usually borrow it on a short-term basis. So I’m not, keeping cash on hand, we’re paying investors or return on that. So I don’t try to keep anything significant dilute your investor pool.

What is there a certain percent number that you’d like to keep as cash? No, it’s a couple hundred thousand, $200,000. I think people will get nervous if they say, oh, we’re, we only have a hundred thousand dollars in the bank just because there’s always pay, just as money comes in every day, there’s bills that come And once in a while, it’s like an emergent, Hey, we got to cover this taxes today or something like that. So there’s always typically a hundred or 200, lots of times more and we try to manage that. Sometimes we’ll get Significant payoffs or Oreos or significant money comes in or investments come in and it’s not readily deployed.

We sweep that money to a money market account. So we’re earning some anemic rate of interest, but at least there’s a little bit of money versus sitting in the kind of operating account order earned zero. So that’s done regularly. It doesn’t add up to much, but it’s something.

Just a, I guess a personal question. What do you think about sweeping that money into a block five or like how Elon is putting money in Bitcoin? What is your thoughts on. I’m sure it goes against the PPM. Yeah, you’re right. In our STC offerings statement, we’d have to disclose that.

I don’t know. I guess the only reason to keep cash on hand is because we may have needs payables and stuff like that, acquisitions, but it is not I’d be a little nervous if we did that and then it wasn’t readily available when we needed it. So I think, These sit in the bank either in an operating account or in a money market account.

And definitely not Bitcoin. I don’t know how it’s doing today. I was reading on the news the other day. It seems to take a big hit. Went through the numbers and let’s get into how did the business go last year? I know you’ve mentioned March and April and I feel your pain.

I was a little. Afraid myself of what would happen with collections and March came. And then I was really afraid of April, right? Because that was when the lake happened. You would think people exhausted their cash reserves in their bank accounts that maybe can’t pay rent. But yeah, take us through 20, 20.

March and April were really tough. And even in may we were anxious that this was it, we had seen a big run-up for years ever since the 2008, nine, 10, 11 things started creeping up in 12 and 13 and primarily real estate values increasing.

And that had gone on for a long time, 18, 19. I kept thinking it was going to turn and and then COVID hit, I thought, okay, this is it. There’s usually a trigger that emotionally people say. That’s it, things are collapsing. And I was braced for that. And I was really concerned because we have tens of millions of dollars in assets and the potential, they’ve they could have gone down 10, 20, 30% and that would have been have a significant negative impact.

But the opposite has happened. They’ve gone up 10, 20, 30%. And I don’t think anybody expected that in March and April when our phone suddenly start lighting up from customers who were historically paying. And now they’re saying I just can’t pay, I’ve been laid off.

I don’t know if you remember the number and unemployment of our car correctly. It was spiking into the, 10 million, 20 million some. Huge numbers. And if I’m recalling correctly and all of a sudden, a lot of people were laid off. A lot of people couldn’t pay. We were giving forbearances because these are people that historically were paying income interrupted.

They needed a cup, a little break, but now our income started. Drawing up and then most challenging is we had a decent number of Oreos when an REO cells, that’s a big infusion of cash, anywhere from, tens of thousands, sometimes hundreds of thousands, and that stopped in most parts of the country.

Many parts of the country. We couldn’t complete a sale. We couldn’t get the deed. Some of the county recorders closed. The sheriffs maybe had the deed from a foreclosure and they wouldn’t issue the deed and that went on for months. So it really challenged our cashflow.

But we started seeing funds also getting nervous and they started selling a loan. So in June we said, Hey, we’re going to start buying opportunistically and that’s Turned out to be a good bet. And things have gone up significantly since then. And now it’s the opposite side.

For seven, eight months, we were aggressively buying, every dollar. We were paying distributions but just about every other dollar we had, we were buying loans. And now it’s the opposite. The last pool of loans we bought. Of significance was in February right now, we’re selling aggressively everything that we can sell.

Everything. that’s REO, we’ll sell everything. That’s a performing loan. That’s been, we modified and is now performing. We sell, there’s no extra value we can add to either of those situations and to exit into this market is great. The loans that we hold that are unresolved, that we’re still working on the homeowner with a modification or to complete a foreclosure, any of those things we’re holding onto, we’re going to take them to a resolution.

And then sell them and again, we’re not buying. So what we have is what we’re focusing on are I really want to get these things max resolved as many as possible and sold, by the end of this year. And I think for the next, six, seven months to get to the end of the year, it’d be a great opportunity to sell.

You mentioned you sold some of your apartment buildings. I imagine you did well, probably a lot better than you thought when COVID first hit that things you could sell stuff so strongly. We’re doing that and I think the buying opportunities will be limited and what you can buy.

There’s certainly stuff to buy, but you have to pay a lot. And so we will be on the sidelines as the buyer, but be out there aggressively selling. And I think that would be is the thing to do there’s time to buy at a time to sell, I think right now it’s time to sell. Yeah. I think it’s I think there might be a divergence within like residential stuff, which you guys work with.

And then the commercial assets, like I haven’t seen the run-up in prices in commercial assets, maybe like a quarter point across the board of cap rates, lowering, which by the way, it’s you guys means that the prices are going up when the cap rates are what they sell for lower. But nothing nearly is like the residential world.

That’s what I’m like. I’ve lower my like waterline for like people to buy turnkeys to me buying is make absolutely no sense. Right now. But so if I were to understand how you’re thinking in summarize it, you’re thinking this is an opportunity to sell residential properties

What do you think a lot of people in the middle of the pandemic and the summertime will creating a lot of videos that YouTube offers. God love them, right? They’re always doing those tweetable or those SEL terms where the world’s going to end. There’s the weight loss of foreclosures.

Is that really gonna happen? Where are you putting your money? I put my money on that. I think there will be a bigger disruption. I think I was in Dallas, Texas last week for a couple of conferences, had a meeting with some manager of the billion dollar fund that we were talking about.

What would they thinking? And it lines up with I’m thinking this cycle will end and we’re not sure if it’s going to end in six months. 12 months, 18 months, but this high that the cycle will end and then it will go the other way.

In the managers Words it will lead to an extended period of depreciation. And we’ll see these prices steadily declined and his thought was late this decade. Our economy is really weak right now. And the fundamentals are not good. I think there’ll be Some significant challenges ahead.

They’re not reflected in the current real estate market, but at some point they will be. And most of the rosiness today is the result of, a good chunk of it is government intervention, which is the record low interest rates are near record low, and then all

the the stimulus money that has been pumped into the economy over the last year that’s been, I think that’s there’ll be another side of this, that we’ll pay for it. I think about 2005, six, seven, it was such a. Dramatic run-up, there had to be a turn and eventually it turned in late oh seven and through oh eight.

And if it came a people were at that point, you got to, oh, nine, 10 people are looking back at oh seven and oh eight and oh six and thinking, what were they thinking? Why do they think this will keep going up? Why were they paying so much for houses? And and I think right now, fast forward, A year, two years, three years.

At some point, there’s going to be people looking back and saying, what were they thinking in 2021 people are paying For assets, be it a mortgage or a real estate. I’m happy to sell into that market. In fact, I’m thrilled to sell in that market, but I’d be really scared as a buyer I’m having to buy.

And I know, talking to some of the funds, they have to buy they have money. They can’t not use it. And so they have to buy they’re buying, with expectations of Very modest yields like low single digits that they have here. They’re getting four or 5%.

And that is not even three and a half percent people. It’s better either. They have a super cheap cost of capital, which some of them do, or it’s better than not investing the money at all, but I’d be nervous if they, if you buy something and you’re getting three, four, 5% return, and then the market turns and suddenly you lose your road, your principal That would be challenging.

So my thought, if you own real estate or you own a mortgage or any kind of type of asset with the exception of probably hospitality or our office buildings, which are probably you sell in today’s market, you probably won’t do well, but everything else by and large, not residential real estate, I think to do with that, I think it’s definitely time to be a bestseller.

You think It all indication because of the stimulus money and things move slowly. What we have, pretty high, maybe single digit GDP growth, these next couple of quarters, at least. Yeah. That could be the case. But I think it’s slightly artificial just because of the stimulus, I think that’s driving it.

It’s not the That the economy is doing as great as the numbers may reflect. So at some point maybe once that burns off, people are going to have struggling to pay their mortgages. And that’s going to start the foreclosure that perhaps they come in and move into our apartments. Yeah.

Reversal. The reality is, think about this the rallies, there’s millions of families who are having trouble making their payments right now. You just wouldn’t know it necessarily because there’s millions. There’s a significant number of millet. There’s millions that are in some kind of forbearance or other types of a payment plan.

And that is, I, in my mind is masking the underlying challenges, which will, you know, once the foreclosure moratorium, Zen. Once you know, the forbearances and it’s pulling up the covers. What’s really going on down here. And I think that’s when we’ll start seeing some disruption that’d be a trigger.

Now what concerns me and what we’re trying to get ahead of is once these foreclosure more attorneys lift, there will be In my expectation is that there will be millions of loans that are suddenly moving through the foreclosure process that will clog the courts that will just clog the whole system.

Now, what if we have a loan today and we’ve exhausted the options of modification or any type of consensual solution, we are trying to move that. Forward as fast, as possible. And also as far as possible, recognizing that in some cases we can’t complete the foreclosure because of some kind of restriction like a moratorium.

And so we move it to that point and then the foreclosure moratorium is lift and we can, we’re far along in the process. And part of it, there is a little bit of it that some consumers, some borrowers maybe You are saying, Hey, I’ll just deal with this. Once they can actually foreclose on the home.

And then I will be more than maybe I’ll do a modern or something like that. And that’s fine. We’ll work on some mods then, but some people are just not responding to any kind of outreach today because they know that we can’t foreclose on their home and that’s a little bit frustrating, it’s the way it is and we will recommend it.

But I think there’s a lot of struggles right now. Families that are hidden by all the government intervention that foreclosure moratoriums is extra stimulus money, the extra unemployment money, there’s a lot of stuff that is propping.

This country’s economy up. And I think that kick out a couple of stilts and we’ll start seeing some adjustments and things won’t be so rosy and people won’t be making multiple offers, sight unseen, no contingencies, all this stuff that we’re seeing today, which is great if you’re a seller, but not so good if you’re the buyer who is looking in two years and saying, oh my gosh, oh, 20% more than my house is worth.

Which is what happened last time. And then people stopped paying and then people who aren’t even in trouble say I’m not going to pay because I own, 20% more than my house is worth. It does make sense, which is what happened last time. And then it just starts this thing where people go, everything collapses the other way.

Sounds good to me. Cause I got a couple more properties. So single-family homes that I’ve reluctantly done the purchase strategy with we’ll probably sell here in the next year, hopefully. And I think that’d be great timing for me. Yeah. Exit. My message is to sell while you can.

For HP servicing, we have two things. One is we built a service or partially in anticipation that we want to be ready for the next turn and for the next downturn. And We will be here once there’s all that disruption occurs, we expect that our servicing portfolio will significantly grow.

And now we can grow as a company. So that’s a period. Those periods of disruption is where you can take market share away from the market leaders and hopefully become a market leader ourselves. And that’s when you guys start thinking your chops with all that stress out there.

Exactly. It’s a stretch. it’s an opportunity to make money, but it’s also opportunity to help people. They can’t be one in the same thing in our attention, this and do that. One of the big questions that my folks have asked me, or they asked, I got a question like that somewhere every month is HPS retentions.

And some people I’m just like, seriously, it’s not like a fricking bank. You can’t just put money in a fund and expect it to come back out, maybe comment on there was a big, a lot of people that panicked right in the beginning of COVID that wanted their money back and it’s just that’s not how it worked, guys.

I know that we had one internet trouble that was like, HB is horrible. I like it. When you look at them profile and it says, who’s this ? There was one guy who had a hundred dollar investment who was waiting on his redemption and he was like, every place he could go, he was like, this is terrible.

It was a hundred dollar investment. Here’s where we are with redemptions. That’s why not a credit investors , you don’t want them. Yeah, we do, but we didn’t expect this to happen, but here’s what happened. We offered redemptions best efforts redemptions.

So if somebody requests their money back, we would undertake our best efforts to redeem that money within 30 days. And we started offering them in 2016 with the first regulation A-plus offering 20 1500 plus. And we were able to consistently do them within 30 days. And COVID hits.

We had, and that’s what I did. I took her ademption at one time, I needed to take some money and go into a syndication deal. That was more long-term. That was more of an equity deal. And then I put the money back. I think I took a month or two to process it. That was the reason why I went into the fund because there was like, there’s nothing out there that has something that even resembles redemption, but I knew very well.

I’m a responsible investor informed investor, knowing that, Hey, it’s up to you guys to see if it works. The most important thing is the fund and the whole investor base. Exactly. I’m glad you brought that up because last year we could have just simply said, Hey, we’re just going to not buy anything.

And every dollar we get our hands on returned it to, that comes in and revenue return it to investors. But for the investors that are staying in this that are in it for the long haul, that would have been the best strategy. We were seeing great opportunities. We spent a lot of money last year, almost $50 million or over the period from July, 2020 to February, 2021 in buying loans.

And those investments appear to be paying off very well this year as we resolved them. But now our focus is returning money. We don’t see opportunities. You’re absolutely right. We have to look out what’s best for the company.

And we want to honor redemptions. I think we’ll be back to honoring redemptions within 30 days this summer and right now without buying anything new and of significance and selling as much as we can, we’re starting to see big cash come in. In a nutshell on the redemptions.

So we’re having big cash come in and we are starting to redeem significantly. And this month, I think we’re in a process around 200 redemptions, a couple million dollars. There’s probably another 2 million that we probably right at the end of this month. And then through Late June, July, I expect we’ll probably have about close to $8 million.

That’ll come in. And a good chunk of that can go to redemptions as well. I was curious because you had a big backlog, right? And they were sitting in there when you’re like, Hey, we lean, it’s your turn. What percentage of people are actually following through now that we’re on the other side of COVID it’s like you’re just getting scared.

You’re absolutely right. I think yesterday we sent out about 100 emails to investors saying, Hey, we have money available to redeem. We’re seeing about 25% maybe even a little bit more that are saying, Hey, don’t worry about it. And and they don’t need it anymore. So that’s fine.

That means we just , move down the road to the two additional investors we have. Currently, and ever since COVID started, we’ve been. Processing redemptions in the order received. Whoever requested earliest, those are the ones getting redeemed. And we got wildly behind , in March and April last year, we had a huge number of redemption requests.

But now we chipped away at it through the year. Now we’re making big strides and I think we’ll start seeing over the next couple of months They’re getting actually caught up in being back to the point of where we are reviewing within 30 days.

Yeah. It’s harder than I thought. I’ve not thought it’d be more like half, but that’s a surprise. I’ll make people actually follow through. Yeah. I know actually a fair amount. Yesterday we sent out a hundred. I’m not sure what, number previously it’s been more modest numbers.

I’d say about 25%. Maybe a little bit more, based on what we had through the beginning of the end of last month, we forecast a 25%. We’ll cancel it. It may even go up and you’re right. I wasn’t really focused on it, but now that COVID has easing people, seeing the market NHP getting stronger, I think they start thinking, Just leave it in there, if that’s all your true friends are I understand some people were calling in, Hey, I need money for payroll.

I got a margin call because you remember a year ago or when COVID first hit, the stock market was wildly fluctuating, and a lot of people lost a lot of money. And they needed to cover stuff. So I get it. And people also. You mentioned big landlords their forecasts were like a huge number of people were not going to be paying rent that never really materialized as much.

Certainly it was an impact, but it wasn’t as severe, I think as people were nervous about, but all those things were factors. And I certainly understand people’s concerns. If people needed to bail, we’ve done our best. I appreciate patients from those investors. And I think the extent you still need the money we are working on getting those back in and we’ll probably be completely caught up in the next couple of months.

Maybe part of that’s my fault too, because I wrote that article spool pass a castle.com/oh, fund. I use you guys as like an opportunity fund that kind of siloed money as I’m waiting for another deal to come by. And this is a lesson learned on my part. I should not have the expectation to get at that money.

Within a couple of months. I need to have some other dry powder elsewhere. A lot of people, I do know a lot of rehabbers and investors who they’d get, close the sale. They would put the money with us and it worked pretty well. Through we were able to get the money back promptly before COVID hit.

And I think it works so people needed the money, Hey, entered under contract. I need the money in a month or two. They got it, but COVID hit. And that was no longer The issue, so what’s coming up next. I’m in that other fund. That gives 12%.

Cause I was one of the early adopters you’re kicking me out now, our first fund you’re right. First regulation A-plus fund was 12%. That’s 2015, eight plus it’s been close to investments since 2018. It’s now been five years, or I should say not now,

0:00

Everything we do is done with a social impact in mind. Our mission is work with these families who are struggling with their mortgage in order to find sustainable solutions that oftentimes other lenders are not willing to consider.

0:15

This is a story about a dude named Lane he moved to the mainland and bought one place to stay. And then one day he went try to rent them out. And then he became one real investor.

0:30

Hey, simple passive cash flow, nation. This is George Newberry again, doing another webinar. A few years later, we met what back in 2016. I’ve been investing in hp. Since then, I’ve got about enough money to put in there to get my car payment paid for me for the last three years. So thanks. Thanks for that,

0:56

George. You’re welcome. I hope you’re enjoying the car.

0:59

Yeah. It’s been a couple of cars, but the money keeps coming in every month to pay for that. So we are going to be talking about HP servicing. And the you guys are buying some new notes. And we’re opening the fund to new investors. So this is a reg a plus offering, which also includes non accredited investors, and accredited investors. And we can mass market this since you have the right filing created. But I’ll let you drive from here. And if anybody has questions, you can type it into the question and answer box and we’ll go from there.

1:37

Absolutely. And so I’m going to go through about eight slides just kind of give everyone anyone who’s new a history of HP, and also for the and then provide some updates and our visions for the future. Especially for those who are existing investors in order to know so and then at the end, any questions you have, I’m here to answer them all and And I appreciate your interest just to correct a little bit on on linear. I appreciate your introduction. The fund has actually been reopened since November. This is the first time we’re actually

2:13

reaching out, raising awareness again.

2:18

In order to because we see a new, we have a pool that we’re trying to close next week and there’s a couple of other pools that we are working on for April. So we are trying to back into capital raising mode on a on a decent scale. So I appreciate the introduction again, lane. My name is George Newberry. I’m the founder and CEO of both American homeowner preservation and HP servicing. And I’ll share a little bit about us. So American homeowner preservation we started 12 years ago in 2008. We’re a nationwide purchaser of non performing mortgages, particularly those secured by homes in low to moderate income neighborhoods, and many times we’ve discovered heard that the largest banks in Wall Street don’t like to deal with the lower balance loans and they’re more prone to selling those at margins that we can generate good returns on. When we started buying loans, we were advised that we need to use a licensed servicer to service our loans and we went through we started out with a company called a resurgence servicing and then we went to a company called face servicing, which is here in Chicago. Then we went to FCI. Then we went to sn servicing then we went to home servicing then we went to land home, BSI Carrington. And every time I thought that this service so we’ll be the one that provides the service that matches what we’re expecting and every time we were disappointed, so, in 2017, it was kind of like we’ve used every service or none of them has performed To our expectations, and we talked to other note investors and funds and they share lamented about the same problems with their servicers that they’re just not that great. So the thought was we needed to become or we decided to become HP create our own servicer. It’s HP servicing. It’s a nationwide mortgage servicer, and we service loans, both those loans that are owned by HP, as well as loan loans owned by third parties. We have dozens of third party clients. And when we service, we still are executing the same vision we had originally which is to treat homeowners to treat homeowners with respect and to especially in low to moderate neighborhoods where many times Wall Street kind of neglects the needs. So the customization of workouts for them we’ve strived to deliver solutions that homeowners find very favorable, but also just Generate solid returns for investors. And over the years we’ve keep kept thousands of homes and thousands of homeowners in their homes, we put thousands of vacant homes back into service, we’d extinguished hundreds of millions of negative equity. And today, millions of dollars annually are being saved by homeowners on their payments as a result of HPS intervention. Here’s the timeline.

5:25

Well, let me let me kind of just so we don’t lose any investor. Sure. You know what, so what George and his team does is they buy mostly non performing notes. So we all those of us who are homeowners, you know, you have a mortgage, and that is paper. So investors can actually sort of buy that paper from the bank who originates that paper. In some cases, I don’t know what percent of the time they go non performing, that the person is sort of naughty and doesn’t pay their bills and it turns into a non performing note. And that is where someone like George can go and buy them in huge lots. I mean, how much is this next slot? You’re gonna buy like,

6:11

million this this? Yeah, it’s a few million dollars, but it’s higher value home. So it’s 27 loans, totaling about $8 million in debt.

6:20

So they’re gonna buy it at a huge discount. And what George does with his service, he heard that word earlier servicing company. The servicers are the ones who call the homeowner and say, Hey, man, you know, you’re you’re behind on your payments, what’s going on? You know, can we come to work on an agreement since we bought at a discount, there might be some margin for you know, keep you in that home and you may be lower your payments or work something out. So it’s kind of a win win situation all the way around. And we’re also you know, investors in the fun. Of course, they get theirs too.

7:00

That’s great. I appreciate you sharing that sometimes. I get in the thick of this and I forget it. People don’t realize a lot of thing. A lot of people it’s difficult to imagine, initially, that, you know, somebody owes Chase Bank $100,000 and Chase Bank decides to sell that loan for $50,000 for whatever reason, and that’s not uncommon. Now the question is what happens to the other 50,000 it’s still due from the homeowner, but Chase has written it off. It’s it’s gone to them. And now we bought it for 50,000. And we can, if the homeowner wants to stay, we can provide a modification that oftentimes can reduce the principal can forgive some of the delinquency reduced the mortgage payment and still generate a good return because we bought it for 50 when they really owed 100. And the same is if they don’t want to stay the home in the home or it’s already vacant. We try to track him down and offer them cash for a deed in lieu When we get that, then we sell the property and you know, they’re buying, they owe 100, and we’re buying it for 50, it’s probably worth 90, you know, the home’s worth 90. So actually, more commonly they owe 150, it’s worth 100. And we’re buying it for 50. So the discounts are pretty substantial. And that’s because people, banks are looking at it, okay, if we spend a year or more to foreclose on this, and we spend all these legal fees and taxes and other holding costs, those are going to cost us this plus time and effort, it’s better just to take some take those losses now and reduce it and and sell it to HP or any of the other number of funds that buy these types of loans. So to give you the history, when we started in 2008, we were actually a nonprofit organization, we received our 501 c three from the IRS. We would advocate one by one for the homeowner with their different lenders, and we discovered that the lenders and the servicers were not quick to resolve these loans not quick to respond. To request oftentimes, requests that were very fake provided favorable outcomes for the lenders. So that led to us becoming a for profit and deciding to buy these mortgages. So then we could control it. So the banks regularly sell mortgages, oftentimes in large pools, and it could be banks, hedge funds, other lenders, and they’ll sell those on stocks, and then we would buy the loans and then reach out to the homeowners through our servicer. And initially, we started a hedge fund. It was accredited investors only it was reg D. fairly simple to set up. And we would raise money from friends and family. We couldn’t advertise. We couldn’t even really speak to the media. And that’s what we did initially. And that went well. But when I heard about crowdfunding in 2013, I said that’s a great way to expand our audience. So we started using 506 C, which allows us to generally solicit more and essentially market the the offering go on Lane’s podcast simple passive cash flow and and share the opportunity freely and we We started doing that in 2013. But there was one big restriction was that even though we could tell everybody about what we’re doing, and market our fund, we could only accept investments from accredited investors. And we had a lot of non accredited investors come to us and they would sometimes even show up in our office with good size checks that we could not accept it. So that was frustrating. And in, but when we heard about regulation, a plus, which allows us to crowdfund from not only accredited and non accredited, credited, we promptly engaged an attorney to go through the SEC qualification process. And in 2016, we were the 16th company in the country to raise money utilizing Regulation A plus, opening this to non accredited investors. That grew a lot in our first month of operation. This is the 2015 A plus fund we raised about half a million dollars by the 24th month because the SEC allows you to raise money for 24 months, the 24th month we raised over $10 million. So In one month, so went from 500,000 to $10 million in two years. So grew, grew and grew. Uh, this was so that fun close 2015, eight plus closed in, in May of 2018. And that was the fund that I joined in initially. That’s when we first met Lane.

11:16

Correct. And I’ve been investing ever since.

11:19

And I just want to say that the reggae plus offering is really cool, because now you can bring in non accredited investors. And as you were a non accredited investor at one time, George, I mean, you can, how do you get yourself? How do you get yourself over a $1 million net worth when you’re investing in garbage investments, right, like and that’s the frustrating part and you’re not allowed to invest in most deals. Until you are and no, it’s very frustrating. It’s a, especially today, think about how low the interest rates are. Today, if you go to the bank, you know, they’re gonna offer you on a savings account, something 1% and point, one point something that I’m And so it’s a very, it becomes very frustrating. So you can save and make very, very little. And there’s other other investments open and non accredited investors, but they’re typically lower yielding. And and you’re right, it’s tough to get ahead with that. So reggae is definitely something we’ve embraced. And we in fact, did our second Regulation A plus offering, which launched in November 2018. And that was for HP servicing. This one is a little bit different than 2015 a plus in that it had two purposes. One was to do what we had have always done, which is to purchase non performing loans at big discounts. But the second thing we were doing with the money that we raised was to build out a nationwide mortgage servicer. And that’s what we’ve endeavored to do. We’re still working on it. And there’s still a couple states as we’ll get to a little bit later that we’re working on approval on. And then finally, I want to share and I’ll share a little bit later more details. But this this last week, we launched a new product which is called pre Ario, which is a platform to connect local investors with holders of the faulted mortgages secured by baking properties in order to help address the problem of these vacant properties that are oftentimes sitting in limbo. And we’ve provided we’ve come up with a solution that appears to be getting some traction with some of the larger funds. And I’ll share a little bit on that in a few moments. So right now, here’s the let’s talk about the national service or so, as with many entrepreneurial activities, our pursuits, you know, we did not think it would take as long as it has to get this going. The servicing portion and also so it’s costing more and taking more customer money and taking more time. So here’s the big advantages to being a national service are one is as an investor in mortgages, we can much better control the disposition of our assets we can act nimbly and fast and to move things along. The other, move things along towards a resolution the other way. The other big advantage is the ability to generate feelings. So we are, this is an operating business where we’re charging fees to service loans for other funds and other mortgage holders. And we charge fees for doing that. And that fee income is there, whether it’s a we’re in a down market or an up market. So if things are going bad in the real estate market, and prices are declining, and there’s a lot of defaults, we charge fees if the market is increasing, and it’s tough to buy loans like it is today with good margins. And you know, the real estate market is strong, like it is today. Then we still charge fees every every time any of us who have a mortgage is paying that mortgage it’s to a service are typically in that service or is taking a modest fee. And but they do that times thousands 10s of thousands, hundreds of hundreds of thousands and even in some cases, millions of loans. And that’s how the mortgage servicer make money. So our challenges so far have been the licensing process which we started in mid 2017 is taking longer than that. expected, we’re now licensed in 48 states, plus Puerto Rico, the only two outstanding licenses are California and New York. And those are both in process. We believe we’re near the end of those. That process we’re in both states, but it’s still.

15:17

I wish it were today. I’m hoping it’s going to be in the next 30 to 60 days. And this is a startup we’re startup mortgage servicer with costs that are front loaded, we invest, we’ve signed a contract for almost a million dollars on our servicing technology, and a number of other personnel costs. That and other vendor costs in order to get this set up. So it is costing more and taking more time than expected. But the upside is we have a management team that we’ve attracted some of the top talent in the industry. The most recent hire started this week. He just came from Goldman Sachs. And so people are leaving much bigger companies to join HP because they believe in the vision and they can see a roadmap where this company is out. Very successful. We are transitioning to Black Knight servicing technology. This should go live next month in April. And one of the the impetus for this is some of the larger I should say most of the largest servicers in the country are using black knight technology. Now, it’s cost per it was cost prohibitive when we started. But it’s something that we’ve found is essential to us going forward if we want to scale as a servicer because many of the biggest funds in the country are using servicers that have like night, they’ve built different integrations with Black Knight. Even the regulator’s prefer Black Knight just because it’s something that they’re familiar with. So we made the decision to to move to Black Knight and getting those final two state approvals should open up. We should be able to get a lot of larger funds to say we’re going to service with hp. The other component to growing is getting government approvals so we don’t just service these distress loans like we’ve historically been doing but we can also service loans backed by the VA FHA, Fannie, and Freddie. So we did recently get our VA approval so we can now purchase and I’m sorry, we can now service and purchase loans that are backed by the VA. And we’re also working on getting the same designation for FHA, Fannie Mae and Freddie Mac. Finally, in December, we were designated as a minority owned business. And that is going to that should also help get additional government contracts. Plus, many banks, like Chase, for instance, have mandates to award some of the business to minority owned firms. So we believe that will also be helpful in our plans to grow. So ingredients to growth, there are two big ones. One is those two final states, I need to get California I need to get New York, we’re really focused on that and we need to get the blacklight technology fully implemented, that should happen the first of April, and then the green is to go big is to get those remaining government approvals. And then the probably the biggest factor is and what the original vision was, is that once we have the service are fully set up fully licensed everywhere and a downturn hits, we will be extremely well positioned to both act as a servicer for third parties and buy more loans, and service those and ultimately help more families. There’s many competitors that service 40,000 to 100,000 loans, you know, the typical servicing fee ranges from 20 to $95. That’s a big range. The reason for that is the 20 bucks, that’s probably a loan, which is just making a payment on time every month, it’s a performing loan, the $95 loan would probably be one or certain $95 servicing fee would probably be applied to a loan that’s in bankruptcy or has severe litigation. So that’s the range of servicing fees. But it leads us to a goal where we can get to 100 million dollars in monthly gross servicing fee revenue at some point in our future, and that’s that’s what we’re working towards. And that’s why we’re attracting the talent that we have Because we think we see a huge opportunity here.

19:02

So for those of us who are like rental property owners that $20 and $95 think of that as like the property managers take up, they’ll take like 10% of the gross revenue. They’ll also take half a month a full month’s rent of a new lease up fees to so don’t forget about that. But is that like, Is there a certain percentage that normally is if the mortgage they bring in or

19:26

the so lots of times on government loans, for instance, it’s 25 basis points. So if the mortgage is, you know, $100,000, they’re probably getting 25 dot $25 per month on that loan. As an example, with distress loans, there’s usually no monthly payments. So it’s typically just as a set fee, which could be often 40 to $95. So that’s what we see is the opportunity, you know, we’ve served with, I mean, we currently in New York, for instance, we have loans that we own in New York, but we can’t service them ourselves. So we use a third party which is called sn servicing artists. from them as a service about 40,000 loans and and then face servicing is in our building, we understand that they service over 100,000 loans. So it’s definitely a it’s definitely a business that’s always there can always generate income and the fact that this downturn is ever elusive because a year ago, I was thinking, Oh, it’s going to turn soon, it’s going to turn sooner and it hasn’t really turned. This enables us to in that interim generate fee income. And so here’s another another as we talked about fee income, HP 2015. A plus purchased a lot of loans in that were backed by the reverse mortgages backed by vacant homes, particularly in judicial foreclosure states, and this would be a state like New York where it could take two to three years to foreclose, even if nobody’s fighting the foreclosure. It’s just the process takes forever. So there’s a lot of incentive to find the bar and make a deal, but sometimes that can happen. The bar may have passed away the there may be a second mortgage which doesn’t want to make any kind of settlement deal. So you have to complete the foreclosure to get title the home could be a divorce, both parties don’t don’t agree. So any of those situations leave these vacant homes. Sitting in states, it could be New York, Ohio, Illinois, Indiana, Florida. There’s many other judicial foreclosure states where it’s going to take a year plus to foreclose. And this is a big problem for us and for other lenders. They will get a request from the city to cut the grass, shovel the snow board up the property to a registration, vacant property registration on the property the property could be subject to vandalism or their deterioration. So we have been scratching our head about how do we get a better solution to the these mortgages and we instead of just going through the foreclosure process when we can’t make a deal with a homeowner, and we came up with the concept of pre RTO and pre RTO is a site that just went live last week. It has Some test data has some real live assets on it, we’ve already actually sold a few. And what we’re doing is we’re trying to connect lenders such as ourselves with local investors fix and flip rehab buyers, real estate investors, like you probably have many in your audience. And they can buy these assets. And then what they’re doing is they’re buying a first mortgage, but we provide them a roadmap to do a few things that are unusual. One is to work with a law firm to appoint a receiver to take control of the property, repair it and lease it during the foreclosure process. And that is something where instead of that asset, that first mortgage, the mortgage holder having to pay taxes, insurance and other carrying costs and be at risk for

22:47

for vandalism and things like that. They can simply sell it at a price that’s attracted to them, because they’re eliminating all those costs and time and it’s also attractive to the real estate investor because they’re probably buying an reo at seven 25% of what, what it would otherwise sell for is an Oreo. They’re just getting it earlier in the process and the ability to go and get a court order by appointing a local real estate agent or property manager to become to take control of that property and lease it is something that’s unique and novel. And we’ve had a great response not from other funds about putting assets on there. Right now, there’s a couple of hundred loans on there. Mostly ones that we own, we expect in 30 days there to be over 1000 assets all over the country. And and the ones that are on there now are mostly low to moderate income neighborhoods, because those are mostly ours. As we reach out, there’s a lot of other lenders who have much higher value assets assets in California in the West Coast, which we don’t have many of that will soon be going on there. I think about the fix and flip lenders, a lot of the fix and flip lenders are getting a lot of defaults. So we’re pitching people to get their servicing but also to offer those assets through pre RTO. Now, fee income pre RTO is only By HP 2015 a plus. And it is we charge a $2,000 program fee for every asset is sold. So once again fee income which should be there, whether our ability to invest in distressed mortgages is is there or it’s not there we should be able to generate income from, from endeavors such as this. So I encourage you I gave a lot in about two minutes and that it’s a fairly, I guess it’s it’s a fairly detailed concept but I encourage people to go to pre RTO calm, especially if you’re a real estate investor. And if there’s nothing in your state like California or Hawaii, then you can create an alert as soon as there are assets in there then you will be notified. Now this investment now we’re back to investing in HP servicing and Layne has touched on a few of these things is why invest. Again, we’re open to accredited and non accredited investors the minimum entry point the minimum investment is $100. This is an you’re investing in a business you’re messing an HP servicing, which is uncorrelated to the market, we collect fees in a down market and and up market, investors get their share of profits first up to 10%. liquidity, if you need your money back, we will undertake our best efforts to liquidate the investment and get your money back within 30 days. Big Big Asterix on that though view if you actually the slides a little wrong here, so I’ll correct it. If it’s liquidated in the first year, the returns are reduced to 8%. In the second year, they’re reduced to 9%. If you hold keep the money in the fund for at least two years, then you get to keep the full 10%. And everything we do is done with the social impact in mind. Our mission is work with these families who are struggling with their mortgage in order to find sustainable solutions that oftentimes other lenders are not willing to consider. And so the investment right now if you were to invest, we’re going to be using those funds for Our next purchase, which the one we’re working on right now is has an acquisition price of just over 4 million. And here are the numbers that may kind of make this more tangible on that that $4.1 million will be used to buy 27 loans, the average debt is $331,000. The total debt is 8.9 million. The we’re buying those loans for the 4.1 which equates to roughly $154,000 per loan. The home values here averaged 272,000 and the total estimated home value 7.3. So think about that. We’re buying it for 4.1. The families Oh 8.9. And the estimated value of their homes are 7.3. So that gives you you know, we’re buying it at 3 million plus less than what the homes are worth, you know, $4 million plus less than what they currently owe. So we have a lot of flexibility when we go there’s homeowners too Try to make deals that are attracted to them. And if they don’t, we can’t make a deal with them, then we can go ahead and proceed with a foreclosure or sell it on pre reo, calm and still make a realize a return. So that is

27:17

the current focus. And again, we’re working on a couple of other opportunities for next month. This one we’re trying to close next week, mid March. The next two, we’re trying to close in April and we’ll share details as those come closer to closing. If you decide to invest, you can go to HP servicing comm you can invest without any. You can invest all online, the process is all automated. With the exception of IRAs. We do accept IRA investments, you can start the investment online but then we’ll have to do some of the process off the platform and one of our representatives will get in contact with you to do that. So that is what we’re offering now.

27:54

So with this, these deals, it’s a little bit different, like portfolio that you bought in the past no You’re kind of slumming it with 50 $100,000 houses. Right? This is a lot better paper.

28:08

cleaner assets.

28:10

I would agree it’s an odd right now we Yeah, let me backtrack for a moment right now we’re not competitively bidding. So we will find, if we’re just bidding against other people, it doesn’t really work that well, because so many people are willing to pay more than we are at this point in the in the market. However, we are looking for relationship type deals. This was brought to us it’s a modest sized deal brought to us by one of our our partners, and it’s, it was backed by these higher value homes. So definitely makes sense. We’ve done these before, but you’re right. Typically, they’re much lower value homes. But this one, the discounts are still there, even with the higher value. So I think it makes a lot of sense.

28:49

Yes. Like, what 5050 cents on every dollar is it for these nicer stuff?

28:55

Exactly. Well, yeah, they’re usually trading at 50 to 60 cents, sometimes even even Even more in today’s market.

29:03

So on the on like the lower class stuff like the 50 100 grand there, what’s like the average like 30 cents on the dollar, it used

29:10

to be around 30 cents and then it creeped up to 40. But now it’s some of those, those are even trading in the 50s. And that’s if there’s big issues where they can drop down to the 40s. But they’re just not that many left anymore that are that we can see at those types of price levels, you know, to come back, but it’s just not there today.

29:29

Right. So what George is trying to do here is he picks these properties up at 50 cents on the dollar. He turns around he gives the homeowner a call and says hey man, let’s make a deal. Let’s try and keep keep you in the house. Maybe we can lower your payment. There’s obviously a lot of room for negotiation here. Obviously they don’t know how much George picked it up for so he has the cards on his favor. But if any, anything you’d say like what what what’s like the average situation one of these guys In, you know, like, what’s

30:03

it can be anyone from losing a job a divorce a death in the family?

30:07

Like how late are they behind? Like,

30:10

what’s the kind of the profile? Yeah, it’s oftentimes a year or more behind. So many of these are severely delinquent. They didn’t just fall behind a couple months ago, they’re severely delinquent. And most of these will be in those judicial foreclosure states where it takes a while to foreclose, which is why the lender is, is looking to sell them at a decent sized discount.

30:28

And do you have an indication like, I guess, like, how many of these people you can keep in their houses and how many just you’re just gonna have to unload?

30:36

Yeah, sure. Good question. My guess is we’ll probably end up historically, we’ve kept about a third of the families in their homes. You know, originally when we thought when we conceived this, we thought that everyone want to stay in their homes. That was, I think, maybe overly optimistic, maybe a third in reality, about a third of the people end up staying in their homes, maybe a third of us, take cash for de leeuw and there’s gonna be a third that nothing can this There’s no resolution except to, to proceed to a foreclosure. So that’s the that’s the offering. I’d certainly open to any. Are you asking questions or is there like a chat?

31:12

There’s a chat. If you guys want to type your questions in the chat, we can answer it there. There’s one in there. But I’ve got a few questions, please, that I had. So a lot of a lot of investors that invested in the first one and they kind of saw some personnel changes. They saw you leave for a little bit and come back like a shining night like Howard Schultz did at Starbucks, Steve Jobs. Can you kind of talk a little bit about like, kind of what what, what went down and sure the lessons learn?

31:44