Just sold rental 8 out of 11!!!

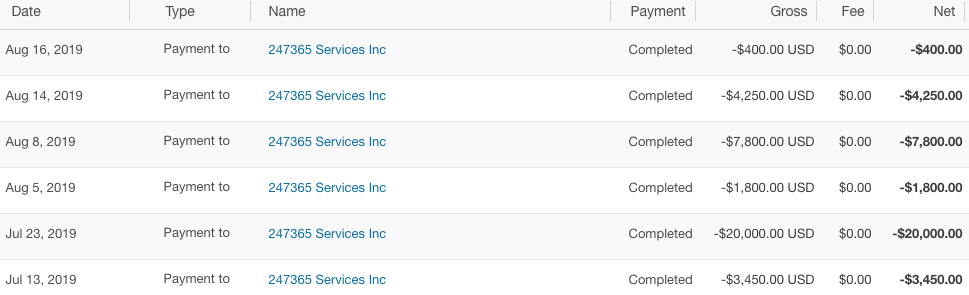

2157 Sara Ashley Way, Lithonia, GA 30056 I purchased this property back in 2015 as turnkey rental.It was a B class rental in B- location and rented for about $850 a month. It was a very stable property for a few years but in 2019 we had to evict the tenant who left this. When […]

Hunter Thompson from Cashflow Connections (Ep 164)

Hunter is a full-time real estate investor and founder of Cash Flow Connections, a private equity firm based out of Los Angeles, CA. Since starting CFC, Hunter has helped more than 200 investors allocate capital to over 100 properties, which have a combined asset value of more than $350,000,000. In connection with these investments, he […]

Richard Duncan’s Economic Predictions (2 parts)

Richard Duncan is back here in Simple Passive Cashflow (2022)! Part 1: U.S. Economy: Foundation of Today’s Crisis | Podcast With Richard Duncan It’s a 2-part podcast and in this podcast with Richard Duncan, he discussed the foundation, how the economy and the Fed work, the relationship between gold and the dollar, and understanding our […]

Ep 153 – Lessons from the Wealthy w/ Frazer Rice

The audio was pretty terrible on this live recording from FinCon. Below is a little better audio version. Buy the book we discussed here Coming out of college—I worked for the department of economic development up in Albany New York, and it was a really interesting experience. I was charged with helping being a part […]

The Newbie Wall

I have had over 1,000 calls since 2017-2019 with investors just like you. And now that I am not working… I admit that’s a few calls a day while I was taking my extended breaks at work. All kinds of investors some not listening to my directions of checking out the first 20 podcasts and those […]

Is All Debt Bad Debt?

Lane’s comments as of 21.10.24: Quantitate easing (QE) is scheduled to start tapering which means that the inflated stock market might be coming back down to real life Price/Earning rations. Many of us who have been in our Hui community prior to 2020 knows that when the government says one thing that it takes awhile for it […]

143 – Interview – Designing your Life with Daniel Goodenough

Daniel Goodenough is the author of the recently released book of fiction, The Caravan of Remembering, A Roadmap for Experiencing the Awakening of Your Life’s Mission. He has been a professional musician, research scientist, and graphic designer. In the past 30 years, he has taught thousands of students through The Way of the Heart program to […]

Our 2018 Charity: Choose Love for Our Students

Teachers are good people but man do they not make any money! Often times they have to pull money out of their own pocket to pay for things the School District cannot afford. We decided to change that! The DonorsChoose listing link. Later that day… We definitely scored one for the kids! Here is what we […]

2019 Launch

SPC followers are typically younger than 30 or older than 35. My observation is that when people have kids, that takes all precedence. Launch 2019 with a 50-minute goals brainstorming session. (we will not be talking real estate investing – the second half of the presentation will be our 2018 Quarterly recap – this will […]

135 – Interview – Financial Advice from a Broke Millenial with Erin Lowry

Erin Lowry (https://brokemillennial.com/) is the author of Broke Millenial, a book about how to stop scraping by and start getting your financial life in order. She talks about how she learned about finances at a young age, how she gave up her dream school so she could live her dream life, and how living in […]