How much useful/engaged time I have left…

Life is funny, about the time you achieve something you realize that there is something else to go after.

“Obviously I’m a few years older than you but the writing is absolutely on the wall, I was at work last night and had a critical care where I was having to intubate and put central lines in anyhow my aunt was actively having a stroke at the same time and my cousins were asking for guidance on what to do and how far to push the limits, I made the right decision cutting back no question, family first” – Hui Member

When I was going after that magic number “10” single family homes I was all consumed by the chase. Then when I got there the next goal was 1,000 units. Got there and it was the same result. Taking a step back I realized that happiness was not about getting to a magic number or properties or money (although it is a great way to keep score).

I wanted to get back home to Hawaii after 14 years of living in Seattle. Done! (And you can see why by visiting)

For a long time, I have written down my “I would be happy when…” or IWBHW’s and they always change and I am always chasing the next thing. Not until recently did I realize that it was not about the chase to the next goal but embracing and enjoying or the Journey… Follow along on mine.

We all have heard about the Gallup article that said that once someone has $75,000 of income a year their happiness does not grow by leaps and bounds. I’m not here to debunk it but to ask why and more importantly how can I apply it? [I personally thing 75/k a year does not cut it in Hawaii/California/Seattle – most of us are shooting to that magic critical mass number of 4.5M net worth because at that point you can pass the trust off to clueless offspring and it can still grow]

After quitting my job in 2019, and transitioning to a life of working on what I want to instead of working for someone else (obligation) I discovered that everyone will always work. If you think retirement is just golfing… well that’s fine but many people SPC investors find that their life energy is better served to go into something bigger. But it does not have to be a structured 40-80 hour work week. As little as 8 hours a week is all this study says we need to achieve autonomy. However I find I still work 10 hours everyday on building the SPC community and adding more content.

I have built up a large network of other investors who have enough “simple passive cashflow” and the common thought pattern switches from making money to getting back time and living a more fulfilled life.

Unfortunately, happiness is not as easy as in a video game

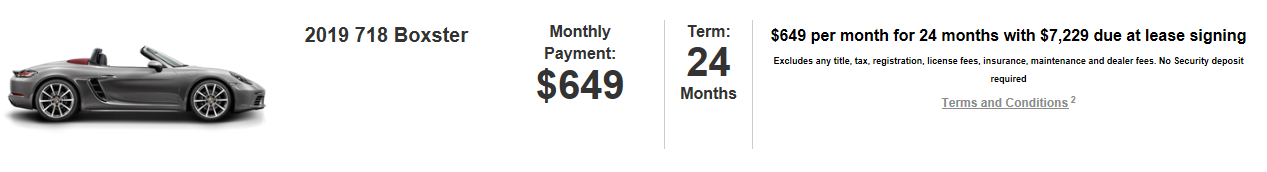

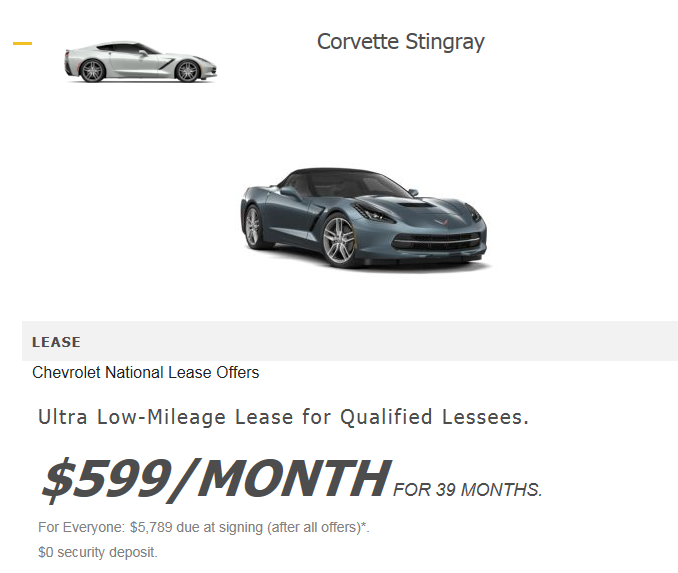

These days I ponder… how I can hack happiness? After all, more money won’t make that much difference. (Although I would like a Mercedes Tesla Convertible Porshe/Corvette since its safer than my electric bike.

I tried using Maslow’s hierarchy as a framework to dissect happiness but I have found it to be a little too bit “basic” as it applies more to those in third world countries and people with real problems in life. I don’t want to sound basic I mostly have “first world problems” which I am very grateful for.

In 2016, I went down to Texas to attend a Tony Robbins seminar and discovered my current framework to backward engineer happiness.

Mr. Robbins outlines six human needs:

1) Growth

2) Contribution

3) Significance

4) Uncertainty

5) Certainty

6) Love and Connection

The lowest on the spectrum of human needs is to be Loved/Connection. I talk to so many people in my free investor calls and it is very apparent who are givers and who are takers. Why do people act so selfishly and so seriously? Perhaps it takes an old soul to realize it but in the end relationship that we build on the journey are what really matter and what we will cherish. (per Ray Dalio)

Action item: How can I get more Love/Connection? Schedule it? Attract more people of that nature? Create a podcast and network of other like-minded investors.

This $6.2M home in Hawaii looks pretty lame when you focus on the fact that is not filled with people and without meaningful relationships.

Certainty and Uncertainty are complete opposites. Certainty is having a reliable and safe life but at some point, we thirst for spontaneity.

Action item: How can I get more Certainty/Uncertainty? How do I build a routine? How do I put myself in places to get lucky? How do I free myself to go on more controlled impulses?

Significance is about feeling special.

Action item: What do I do that is my competitive advantage? Where can I get praise?

Contribution is about aligning your life’s work for the benefit of others. A mission. Apparently, Mr. Robbins did not endorse the mission of sitting on a beach with an unlimited supply of piña coladas and taking food porn pictures while gallivanting the world as a tourist. Nor did he support playing it safe with a bunch of passive investments.

Action item: What has been your biggest pain point growing up and maybe you can help others? What pisses you off most in this world? Realize that you might have to take a bit of monetary risk here to make a bigger impact.

Why do you think I accept non-accredited investors into my projects? Not because I love being super careful to follow SEC regulations. Certainly not because I have to expend so much energy to educate non-accredited investor and they invest all their money in just a couple deals. I do it because the middle-class non-accredited investors who go to work every day need these types of investments the most and damn it, I’m going to do that because it’s the right thing to do.

And the final need is Growth. Improving as a person.

Action item: Think about the different aspects of you life (physical, relationships, money, spiritual, to name a few), which ones need work? Many call this the wheel. I call it a stool (four pillars: health, relationships, spiritual, money/business) because I try to make things simple.

Tony Robbins six needs is a great starting point to see how we can increase our happiness. If you really think about these are the things that really make us happy. Lets us put focus on what makes us happy because in the end, that is what really matters. And the score of the game 😉

In another study, researchers asked 10,000 people to list 10 happy moments. This generated a corpus of 100,000 happy moments called HappyDB.

Here are the patterns that came up.

Here is where the team/comradary componet came into play…

Complete study write up.

Too often passive cashflow is associated with scammy multi-level marketing ploys to get people who don’t have the money in the first place to buy into expensive education systems. If the goal was to just make money and not to create value there are many things you could do such as sell drugs or sell a testicle.

“Hey man… let me tell you about passive cashflow and how you can get rich with little to no effort… do you feel that… its called entropy man!” (In a sleazy tone)

As mentioned before SPC-1.0 is getting into the rental property game and getting your mindset out of the Dave Ramsey/Millionaire Next Door lizard brain where you are just focused on putting food on the table and making ends meet. As you build up your cashflow you move from more scarcity mindset to abundance mindset.

“It is unlikely for someone to transform from a scarcity mindset to an abundance mindset (without a life altering experience ie. life-death experience, LSD, tribal drugs, or passing of loved one) without reaching or getting on the path to financial freedom. On my journey to financial freedom, I was cheap with my money and time. Somewhere along the way my outlooked changed but it is a process… you cannot just meditate or recite mantras to and obtain an abundant mindset. Perhaps scarcity mindset is the fire under your ass to do something. And beware of “Cheap Easy Free people” (CEF) along the journey because it typically a sign for a scarce mindset. CEFs are usually 1) not very much fun, 2) have lame relationships and friends, 3) looking out for themself first.”

SPC-2.0 is turning into more of a passive investors as I have traded my single family home rentals to more scalable limit partnership positions in syndications, and now after I have cashflow (food on the table) I can take some risks and go after SPC-3.0 which is Simple Passion Income.

Being a working W2 professional I have a soft spot for those in my position… It makes no sense for a computer engineer who has a family and working 50 hours a week at a $200K W2 job to do what is required to become an operational lead on an apartment deal. Doing such would require 12-18 months of relentless work without monetary gain and little success to build relationships with brokers, travel to the markets.. and put up hard money to close the deal.. I have tried to make a team atmosphere where talented professionals can dip their toes in to “scratch their entrepreneur itch” yet keep their regular salaries.

“Entrepreneurship is all about you! A job is more about sucking up and politics.”

All too often the entrepreneurs out there reaching success are not those who possess the skillsets but they just went after it and got lucky. Don’t get me wrong they deserve it because of all the sacrifices but imagine if you combined that grit with talent?

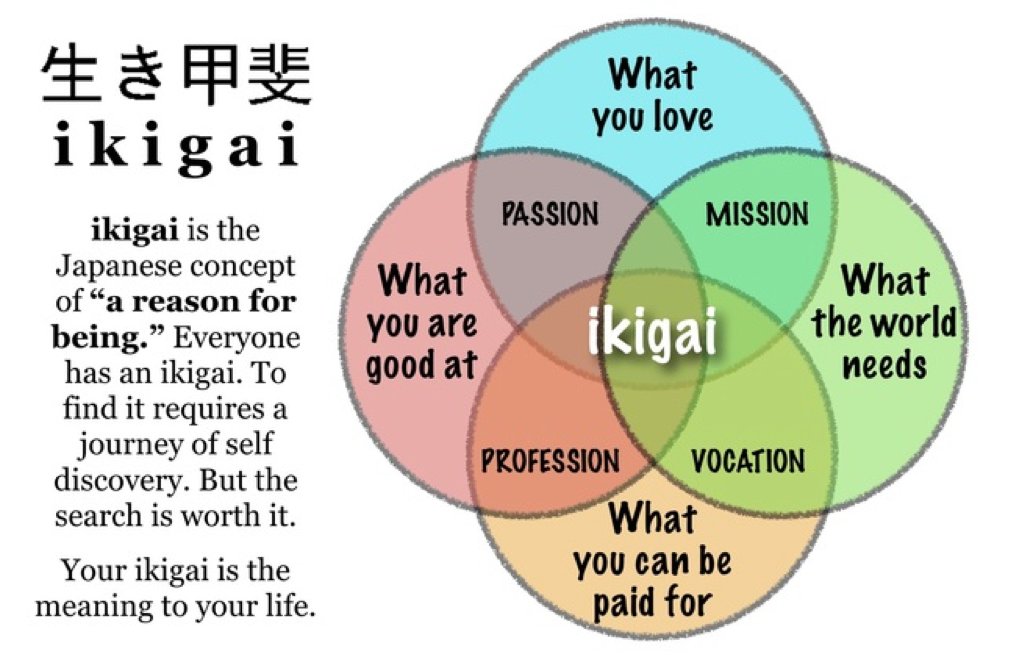

Ikigai is the alignment of doing something that is 1) you passion, 2) makes money, 3) you are good at and 4) good for the world. When you get this it is like arranging the Infinity Stones on the gauntlet and a higher level of achievement and happiness.

What is SPC-4.0? Maybe mentoring the next generation but at that point, we are playing with house money!

SPC followers are typically younger than 30 or older than 35. My observation is that when people have kids, that takes all precedence.

“What do I love to do and get paid to do it” Russell Grey or the Real Estate Guys Radio show.

The pursuit of an entrepreneur dream is not for everyone.

It requires an investment in time and money. And whenever you make an investment, you take on risk. In this case its taking time and energy away from a day job that already makes a lot of money.

In order to get enough critical mass behind an idea to turn into a thriving business, you must devote time, often many years. There are no guarantees that your efforts will be rewarded a lot of time luck is required. This Time Risk is that all of your time will be for nothing.

The saying “good is the enemy of great” comes to mind here. For many high paid working professional, you make enough money to be happy but part of what we are going for is not the extra wealth but “passion income.” Feeding that entrepreneur itch or as Buck Joffrey says that primal to our core instincts.

Below are some money ideas that I have come to adopt. If there are any that do not make sense to you please feel free to reach out.

1) Money is not everything… but it sure makes life easier

2) Define the Rules of the Game

On my calls with people, I often talk about defining the monthly cashflow goal (5k-20k for most) where they will create the lifestyle that they want. Only fools work past that point. The exception is unless they find that the act of creating value as sport and fun.

3) Time is interchangeable with Money. You can trade your time for money all day. But you cannot buy time! But you can buy freedom!

4) Experiences are the currency of Happiness, Social capital trumps monetary capital

5) Unproportionate wealth comes to those who create value. Trading things buy low sell high is a gimmick.

Ben-Shahar shares four archetypes in his book called Happier outlines how we fall into these four “the happiness archetypes”:

- Rat Racer – enjoy the idea of a future destination, but neglect the present

- Hedonist – enjoy the journey (right now), but neglect the future

- Nihilist – enjoy reliving the past, but neglect the present & future (because it’s hopeless)

- Happiness – enjoy the experience of climbing toward the peak

The happiness archetype is the ideal.

Except from the 12+ Time Best Selling Book:

The One Thing That Changed Everything: The Engineer Who Escaped the Rat Race and Achieved Escape Velocity

I walked the linear path for much of my life. Raised as part of the disappearing “middle-class” programmed me to study hard in school, checking the boxes on extracurricular activities, cramming for the SATs, and getting a high GPA to get into college, all to live a “practical” life.

Growing up, we were told to “waste nothing” and turn off the lights every time you leave a room. I still feel guilty to order a soft drink at a restaurant as opposed to tap water.

In college, while other cohorts were playing Frisbee in the quad, I was stuck in the basement of the industrial engineering lab. Why was I not playing the sun? Because Google told me what the highest paid undergraduate professions were. Driving on autopilot for much of my early twenties, I went for a higher-level master’s degree and tested to become professionally licensed as an engineer for the job security.

Upon entering corporate America, I spent my first five years of my career working for a for-profit, private company as a construction supervisor managing a bunch of entitled journeymen who were older than my parents. Facing the rigors of junior level employment, I played my role as the young guy, traveling 100% of the time for my company, sacrificing quality of life, as I navigated the operational clusters, toxic management, and other backstabbing pawns in the company.

I have a lot of scar tissue from that decade of working for the man not to mention building someone else’s dream. You tell me how engaged you would be if meeting protocol was to sit next to your superior and not speak unless directly instructed to or if you were asked to address a director two levels up by mister or misses!

One day an internal company email went out notifying of a friend/ex-direct report had died in a work accident. My boss was uncompassionate about the situation, looking out for the big bad machine first (mostly his annual bonus and agenda). This really put things into perspective for me.

As a corporate road warrior, it was novel being on company expenses all the time and maxing out on airline and hotel points, but you can only have steak and lobster so many times… The only people who cared about my platinum status were the other suckers in first class who were working for the paycheck or an acceptable quarterly review. Although I am grateful that I had a well-paying job post-2008 recession, I traded the most important resource, time, for money.

The linear path instilled delayed gratification, living below my means, and an overall scarcity mentality of saving money instead of earning more, being more. I was entranced by the pervasive Wall Street marketing to blindly put money into a company sponsored 401K plan only to “hope and pray” that compound interest would carry me to a secure retirement.

Let’s not even talk about the student loans I had…

I knew where this path was going…I mean I did the math and it told me so. This is my story of how I freed myself financially, how I took ownership of my life’s direction, and the series of events that allowed me to find my calling.

Seeing the (Economic) Matrix

A steady diet of ramen noodles and a free birthday latte per year made it possible in 2009 to purchase my own home to live in. Being a bachelor who was only home on the weekends, I realized that having this large home was a waste of money. I made a decision to rent it out and became a real real estate investor. You might be thinking that this was the big change, but at the time it was simply a lot of beer money after collecting the rents and paying the mortgage.

I don’t know if it was the beer or being love drunk with cash flow, but I opted out of the linear path in my early twenties.

From that point on I devoured podcasts, books, and online forums on every keyword iteration of passive real estate investing. At a few hundred dollars of passive cash flow per home, the process was simple, buy a rental property where the income exceeded the expenses and mortgage, then rinse, wash, and repeat. Like a space shuttle that accelerates through gravity and escapes the atmosphere into Zero-G, this was my way to financial freedom. Up to that point, the biggest breakthrough in my life was discovering the .MP3 format that compressed and played music digitally in my teens. Using this intellectual technology, I progressed intentionally to eleven rentals in 2016.

At that time, a few of my friends wondered why my ramen noodle diet was being replaced by Starbucks coffee and yummy double bacon and egg breakfast sandwiches. They wanted a piece of the action too. Duh, it was about time seven years later, said the little red hen who did all the work by herself…. As much as I liked helping people, I got tired of answering the same questions. So what does any other late Gen-X/Millennial do but start a blog? Unfortunately, the words I write, even if spelled correctly do not usually make proper statements in English, so I uploaded my Simple Passive Cashflow podcast to iTunes where I could ramble and honestly talk about what I was going through as an investor.

I began living more consciously, opting into more meaningful engagements with people and projects, and searching for meaning and purpose. I was beginning to ask myself, “after sitting on a beach with my unlimited supply of piña coladas and time…then what!?” Needless to say, my motivation for working in the hostile work environment that I once tolerated dwindled, so I switched to work in the non-profit public sector. I started to see the economic “matrix” where people essentially trade time for money and the rich let others build their dreams.

Being an introvert, it was paradoxically energizing to see my audience grow as I began in-person meetings and online groups I sponsored. I provided hundreds of free coaching sessions to guide newbie investors. With my engineering background and a little “bro-science,” I saw patterns arise in the stories from well-paid professionals who were led into an unfulfilling lifestyle unaligned with their passions. Abolitionist Henry David Thoreau said, “The mass of men lead lives of quiet desperation and go to the grave with the song still in them.” People do not have any time to look inwards and are constantly living with anxiety and self-doubts because they are working like machines in order to meet their basic needs without the freedom to find their true passion.

Why did so much hard-work lead to financial scarcity and lack of fulfillment?

This self-selecting group of hard-working professionals searching for more all had a common thread. A moment that pushed them over the edge and made them realize that the path they were on was unacceptable.

These are some of those tipping points:

- Seeing younger, less experienced workers being “red-circled” as future management and advanced through the company “fast-track”

- Being fired to cover up shortcomings in a budget

- Internal theft by upper management

- An affair by a superior lead to bankruptcy of a startup company affecting many innocent employees

- Chronic drain of working with deadbeats

- Getting lost in the office politics of getting your objectives completed when they do not align with your boss’ objectives

- A retirement party for a coworker is catered with crappy Chinese noodles due to the cost control

- When you don’t get the job because you do not have enough grey hair

- Because you have too much grey hair

- Being criticized for not being business savvy from those who live paycheck to paycheck (when you have a personal portfolio of a few hundred rental units)

- Sitting through endless meetings that should have been sufficed with an email

- Circle jerk meetings where the boss’ dumb ideas are exalted by their minions

- When your boss with no technical experience misuses terms like artificial intelligence, big data, machine learning, and deep learning

- Being enslaved with the “golden handcuffs”

- Seeing an ambulance come to the office routinely during layoff season

- Being around the negative W2 worker speak and adopting the prevailing victim mentality

- The road warrior gets an early quit on Friday only to see the spouse at home with the pool boy

- Watching your friends receive the Seiko stainless-steel watch retirement gift

If you have found a calling in something you are good at and truly love doing it…clap, clap, good for you. Keep doing what you are doing and consider yourself lucky. If you relate to any of the moments above, read on.

This is ME today January 2023…

Life Lessons From Real Data:

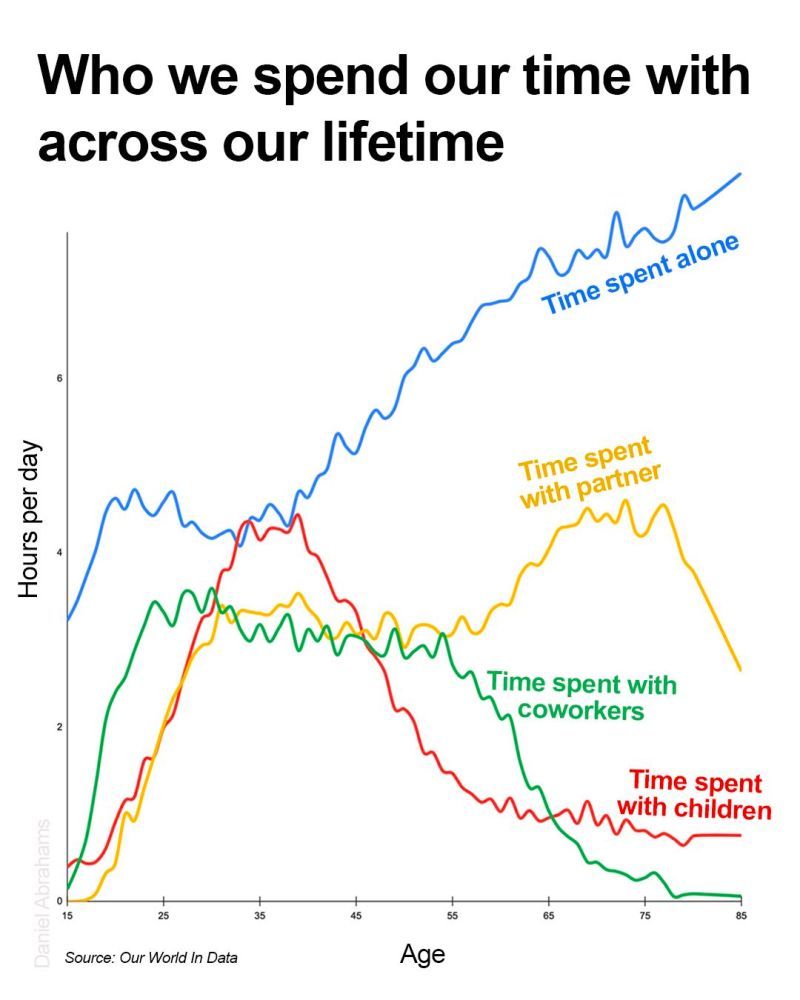

1. Time Spent Alone (Blue line)

– Steadily increases over your lifetime

– Learn to be comfortable being alone

– Enjoy time to yourself. You’ll have lots of it

2. Time Spent With Partner (Yellow line)

– Trends upwards until “death do us part”

– Ensure you enjoy spending time with your partner

– Choosing a partner is one of the biggest decisions in your life

3. Time Spent With Coworkers (Green line)

– Highest during peak working ages from 20-55

– Make sure you enjoy the company of your coworkers

– You’ll often see more of your colleagues than your kids

4. Time Spent With Children (Red line)

– Drops away sharply from ages 45 onwards

– Enjoy moments with your kids. They don’t last long

– Family first, always

Key Life Lessons:

– Love yourself

– Pick a partner you love

– Work with great people you like

– Treasure every moment with your kids

The One Idea

My online journal resulted in many emails of gratitude and acknowledgment because I was empowering people with the “how to” and inspiring them to take a leap of faith to change their financial life forever. I suspect the most effective part of my message was showing people that if little, awkward engineer me could do it, how bad could it be?

I started up-leveling my peer group, and through osmosis, this brought me to a Tony Robbins event where I literally walked on burning coals! There were a multitude of top-down and bottom-up techniques Tony Robbins spoke about during the intensive four-day event. One of those lessons was “things happen for a reason,” and boy, was I glad I did not leave to use the restroom when he outlined the six human needs:

1) Growth

2) Contribution

3) Significance

4) Uncertainty

5) Certainty

6) Love and Connection

Here was the game-changing moment…. Tony Robbins said, “The most important thing is contribution because the secret to living is giving. If you catch onto that, you start realizing that there’s nothing you can get that comes close to what you can give. Life is calling all of us to be more than just about ourselves and that is when we get that spiritual hit.”

Apparently, Mr. Robbins did not endorse the mission of sitting on a beach with an unlimited supply of piña coladas and taking food porn pictures while gallivanting the world as a tourist. Nor did he support playing it safe with a bunch of passive investments.

Later that Easter, I was baptized, and the message there too was “go forth” and help others.

Then another of my mentors, real estate legend Robert Helms, said, “When you are successful you have an obligation to send the elevator back down.” I made it to my penthouse and now I and this elevator are heading back down to get folks!

We all have a finite time on Earth and an empty canvas to create a legacy. This was my one shot! Opting out of the linear path was not about getting financially free and sailing off into the sunset, but it was about standing up for change and creating the greatest impact!

The fan mail all followed a common thread of pain. Many hard-working professionals who are busting their butt on the linear path are being misled down a comfortable life of un-fulfillment. Many of them were enslaved by the “golden handcuffs,” running in the hamster wheel of the day job working for someone else. Some, like doctors, lawyers, dentists, accountants, and engineers make more money to get the big house and nice car, but in the end, they are just a bigger hamster. The dogma of the Wall Street “buy and pray” method is a cover up to insidiously steal investment returns from the people who are doing all the work.

Life is a three-phase screw job:

Phase 1: You enter the workforce with the worst jobs with the lowest pay. Time is abundant.

Phase 2: When marriage and kids enter the picture (and ailing grandparents) this is the time when one should be excelling at their time- consuming career. Money is abundant.

Phase 3: Your teenage kids hate your guts and your health starts to fail. Time is abundant.

The Next Chapter

My mission is to teach and empower good people to realize the powerful wealth-building effects of real estate so they can spend their time on more important ventures and passions instead of working long hours and worrying about their financial troubles.

For the parents and the next generation: Sports help children (and people in general) to have a healthy lifestyle early on. Not only that, sports teach them discipline, grit, confidence, persistence, and teamwork.

SimplePassiveCashflow.com seeks to educate those looking for diversification and better returns outside of traditional investments such as mutual funds and stocks. This is part of a large effort to redirect billions of dollars going to the corrupt Wall Street roller coaster and help the shrinking middle-class find safer and more profitable investments in projects that benefit Main Street such as affordable workforce housing rather than luxury housing for the rich.

The true meaning of wealth is having the freedom to do what you want, when you want, and with whom you want. Building cash flow via real estate is the simple part. The difficult part occurs after you are free financially to find your calling and fulfillment. But that’s a great problem to have 😉