2021 Changes to Real Estate’s Biggest Tax Incentive

The 2018 tax and jobs act allowed for a bonus depreciation and whole bunch of passive losses that you could extract from deals that do cost segregation. The bonus depreciation was, Hey, if you have five, seven, 15 year property, anything less than 20 years. You could choose to accelerate the depreciation. Now let’s […]

2021 Tax Changes | What You Should Do

What are you thinking it’s coming up in the future. It’s like the Biden clan going to be getting rid of that 10 31 exchange out of the 10 31 exchange. They want to get rid of step up and basis, and that’s going to affect all of us. That’s huge for anybody who has […]

Pursuing Purpose Through Masterminds and Nonprofits w/ Tim Rhode

Hey, simplepassivecashflow listeners. Just want to wish everybody a Merry Christmas. I don’t know if you celebrate Christmas, but Hey, we got the day off, right? That’s all that really matters. Want to alert you guys that I dropped the new syndication. E-course. Now this is not going to teach you how to be. No […]

Announcing the 2021 Virtual Bubble Mastermind – January 16-17

We’re talking to Ryan, he’s one of my, accredited investors, been in a bunch of deals with me. he came down to the hui mastermind retreat in Honolulu, Hawaii last year. once you give us a little quick take on, what did you like about it? and then, , I’ll give you the big news […]

2020 Advanced Tax Saving Tips w/ Toby Mathis [Part 2 of 2]

So what if I have an asset, I did a cost segregation. I shipped that all the passive losses and I slide that asset into profit. Do I have to give up those passive losses personally or no? Passive loss is in the year that it’s earned. So the same way you can be a […]

New Tax Implications from the 2020 Election w/ Toby Mathis [Part 1 of 2]

Hey, simple passive cashflow listeners. Today. We have Toby Mathis here, a partner at Anderson advisors, the guys who got me to pay no taxes. Thanks again, Toby for that. although I was the one putting in a whole bunch of money into deals, par in economy through the pandemic. So I can say I […]

How to Set the Reversion (Exit) Cap Rate

0:00 Then the reversing cap rate that we’re using is 6.25, using a 6.25. But what are assets trading here with low fives, 0:10 yeah, five, and even under five, depending on where it is, 0:13 we’ll get into that in a bit. 0:21 Going back to the reversing cap rate, we’re using a 6.25, […]

Dealing with Natural Disasters – Multi-family Real Estate

0:02 On question seven here, investor asks, you know, these Gulf states are always getting hit with storms. I think we were just reminded about that. A couple few weeks ago, we’ve actually got some properties in Biloxi. Kyle and I are in some projects not with each other. So we have bring a wide […]

Accredited Coaching Call – CPA from Hawaii

What’s up guys on today’s podcast, we are going to be interviewing on a coaching call and a credit investor who is a CPA here in Hawaii. We’re going to dig in and see what his net worth, see what he’s been up to and advise them along. But before we get going, and I […]

How to Get Into the GP With No Money Down

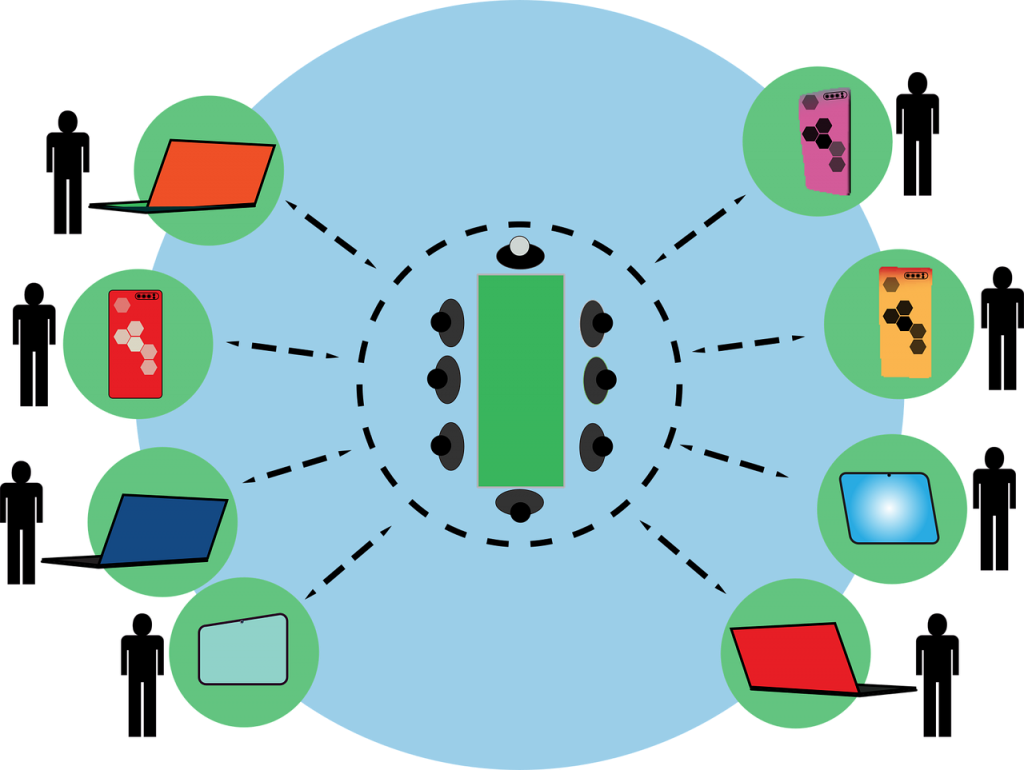

0:15 So the question often comes up, how do I become part of the general partnership and get a little bit more bang for my buck, one of those ways is becoming what’s called a key principle or loan guarantor for the team. So what this is here for as we go out and get […]