Podcast Edition: The Journey To Simple Passive Cashflow | Why Syndications over BRRRR or Turnkey Rentals | Chapter 4 of 8

This is the Simple Passive Cash Flow podcast, but we have taken it over and releasing my latest book that was released a couple years ago, the Journey to Simple Passive Cash Flow. This chapter is chapter four. Why syndications over burr or turnkey rentals We’re really gonna be diving into Yeah, syndication are really […]

High Interest Rates: Pivoting to Development From Value-Add

What’s up folks? If you guys have been noticing, interest rates are high and a lot of operators these days aren’t doing deals. If you’re hanging out with a lot of other past investors, deal flow is very slow these days. and, we haven’t not been doing anything. We’ve been busy managing the current assets […]

BIG MISTAKE in Managing Real Estate Property

What are any lessons learned to open up the spending money stuff? Because I think you’re a big inspiration and building your portfolio but I think people here they’re already doing that. They know it works but how do you take it and get from scarcity to abundance mindset. Yeah. I think part of it […]

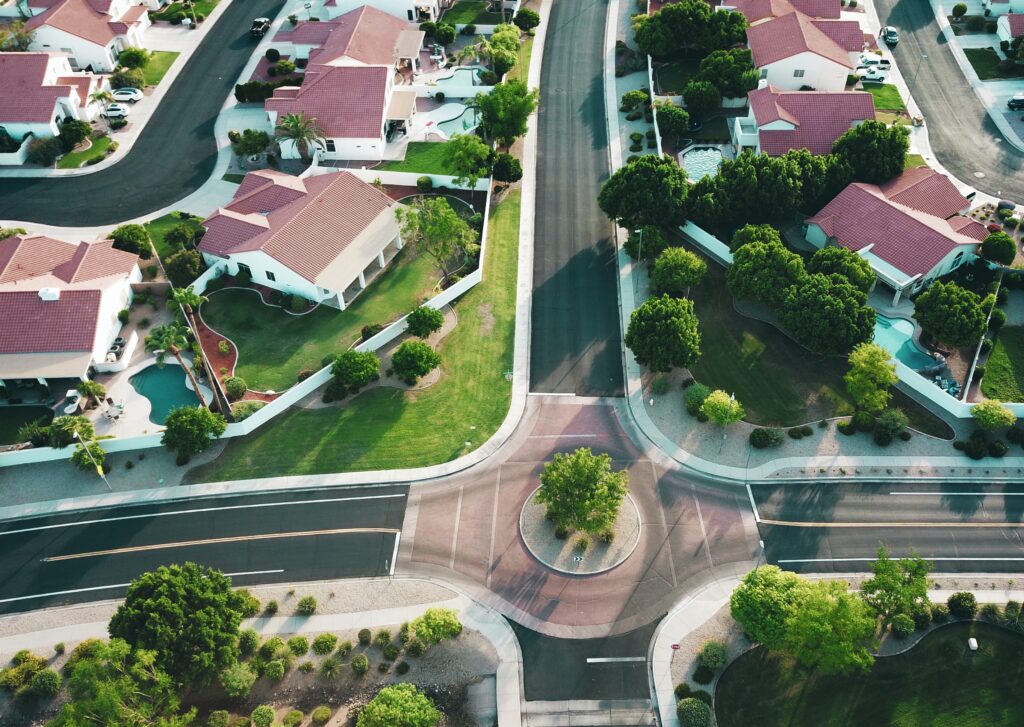

Why Investors Must Consider Real Estate in Huntsville Alabama

As of today, half of the year 2021 has passed. Though there is presence of COVID- 19 vaccine in the market, uncertainty in what things may come and in the real estate industry still never left. While we cannot eliminate the presence of uncertainty in our lives and what lies ahead, these two indicators drive […]

Why Invest in Houston Texas

Houston, Texas is one of the hottest real estate markets in the country right now, luring droves of newcomers from California, the northeast, and other pricier real estate markets. From 2017 to 2018, the Houston area saw an average of 250 people moving to the region every day, a trend that has stayed mostly on […]

September 2021 Monthly Market Update

Welcome everybody. This is the monthly market update for September, 2021. If you guys want to check out past episodes, you can go to simple passive cashflow.com/investor letter, and we are going to be going over some teaching points and some articles that I’ve stumbled across over the past. Some freebies for you guys, if […]

When Should You Not Invest in Syndications?

If your net worth, income minus expenses is under $300,000, or you’re barely able to save $30,000, look, syndications are not for you stick with these turnkey rentals or even do these BRRRS that we’re kind of against in this whole video. And you’re going to have a little more gains that way. What you’re […]

How to Set the Reversion (Exit) Cap Rate

0:00 Then the reversing cap rate that we’re using is 6.25, using a 6.25. But what are assets trading here with low fives, 0:10 yeah, five, and even under five, depending on where it is, 0:13 we’ll get into that in a bit. 0:21 Going back to the reversing cap rate, we’re using a 6.25, […]

Dealing with Natural Disasters – Multi-family Real Estate

0:02 On question seven here, investor asks, you know, these Gulf states are always getting hit with storms. I think we were just reminded about that. A couple few weeks ago, we’ve actually got some properties in Biloxi. Kyle and I are in some projects not with each other. So we have bring a wide […]

Save Taxes via Cost Segregations w/ David Brizel

0:00 So if you didn’t use a home office in your home exclusively for business, and then you don’t want to have to face the capital gain consequences when you sell, you would need to stop using that home office for business purposes for at least two years. 0:28 Hey simple passive cash flow listeners. […]