“It’s easy to make a buck. It’s a lot tougher to make a difference.” -Tom Brokaw

All too often I see hard-working people with good jobs struggling to get by. (Are you a doctor, lawyer, dentist, or another high paid professional? – Professionals page)

These are the same people who are forced to take stressful promotions at work, commuting in the car for a couple hours a day (hopefully listening to the SimplePassiveCashflow.com podcast), going home to the home they think they own but in reality, they are just a slave to the mortgage company.

The NEW “Rich Uncle Project”

The mission has always been to help educate people financially. Most of our clients and investors are mostly Gen-X and Baby Boomers. I have been searching for a new means to help younger millennials and Gen-Z to not make a lot of the same financial mistakes that we were mislead to.

No Its not another Tic-Tok or Clubhouse room…

Introducing the new…”Rich Uncle” Youtube Channel!

These “good citizens” are victims of an engineered system to keep then investing in 401Ks, mutual funds, and stocks.

“With the high prices in Hawaii, buyers ALWAYS try to buy at the top of what they qualify for. I try to help them see the big picture before tying themselves up in a jumbo loan for the next 30 years of their life. It’s a vicious cycle. Now they are forced to work the next 30 years and gun for promotions and raises as more expenses come in like children. I cannot control what someone wants to do with their money but I can at least help them get the most value out what they have.”

This financial system is setup where the insiders are stealing the majority of your returns (and you take all the risk – to learn more about this go to SimplePassiveCashflow.com/FP).

Traditional options from a financial planner (just another commission based salesperson) or options from your Vanguard/Fidelity type broker offer do not fit any of these criteria.

Related – My list of Financial Dogma out there

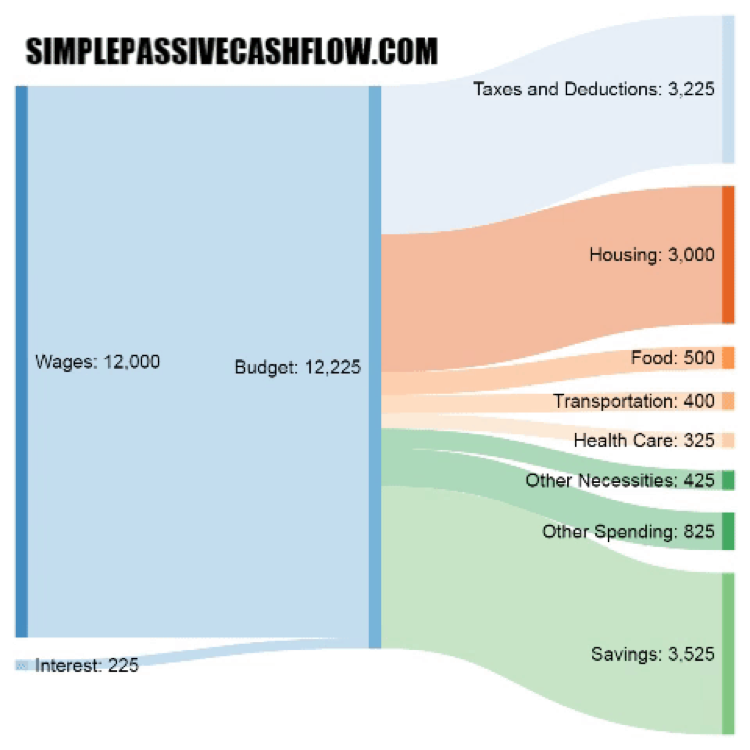

1) evaluate income and expenses for positive cashflow

2) leverage with favorable debt terms

3) hard asset

There are two types of people I meet these days:

1) those “hoping and praying” that their investments will grow to a magic number where they can live off the dividends

2) those who have opted out of the rat race got involved in direct real asset investments and become financially free in less than 5-10 years

“Hoping and praying” does not work and those who blindly follow this strategy subconsciously know it and live like Scrooges, pinching every penny they have.

The following is the financial secret that has mislead the majority of hard-working Americans…

The system is rigged against you. Dare I say, “engineered” to extract your hard earned wealth from you without even knowing it.

Did you ever see the movie “Office-Space” where the disgruntled trio made a plan to steal a small point zero zero one fraction of every transaction from the big bad company?

We that’s what Wall Street, Mutual Funds, 401Ks, and special interest groups are doing to you. But instead of taking .001 fraction they are gutting you alive often taking over 20% without you even knowing.

This is the reason Hui Deal Pipeline Club members are able to retire in 5 years, instead of 40. Or have one spouse stay at home or work part-time in something they actually want to.

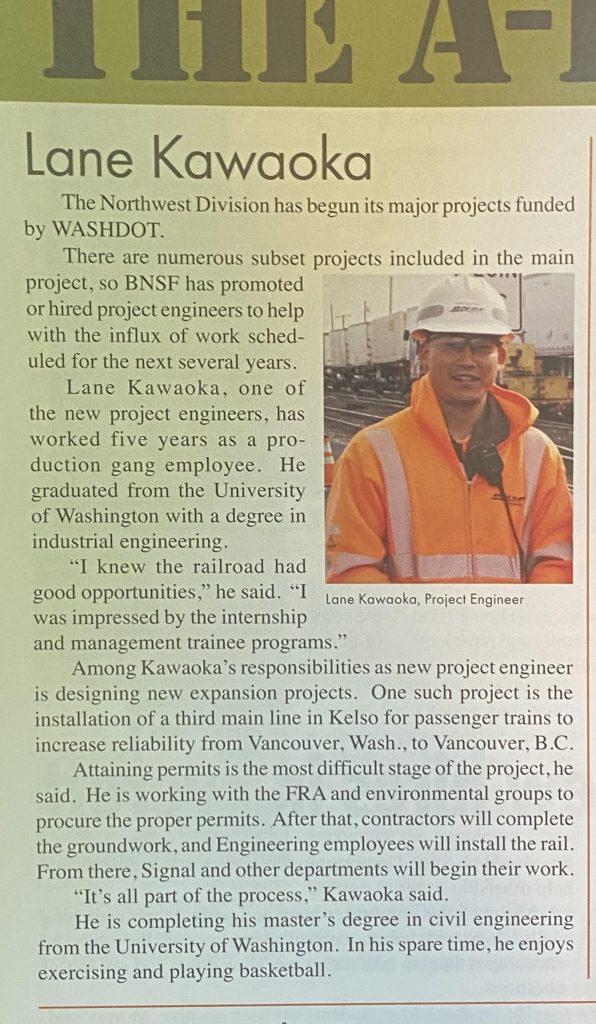

My name is Lane Kawaoka and I am a professional engineer. I walked the linear path of studying hard, going to school in Washington State, to become an engineer. I had a good paying job but it was stressful and I found myself in the rat race.

I fooled myself into living in Seattle for 14 years away from my family, friends, and the sun which I only saw 45 days out of the year. All because job pay in Hawaii was 30% less and the cost of living was 10% more.

I was frustrated by working for someone else and building someone else’s dreams and paying taxes.

I did the math and knew that if I did not change what I was doing, I would be dependent on a job for 40 years as my investments slowly compounded at a turtle’s pace assuming I could service the turmoil of a few market cycles.

Tell me the fundamental difference on what the rich people do compared with the poor and middle class?!?

The short story is Wall Street greed. Wall Street has created this really profitable game for itself. This mission is how I found my happiness and meaning in the world.

Here’s how it goes.

They employ the best minds in marketing… not your dime a dozen millennial social media manager.

This marketing spans multiple generations and has become infused with conventional knowledge.

Evidence of this are sayings like “diversification”, “how the market typically goes up”, and “save-save-save and you should have enough”.

You work hard to make money. You entrust your money in Wall Street through your wealth manager with hopes that your wealth will grow. But…

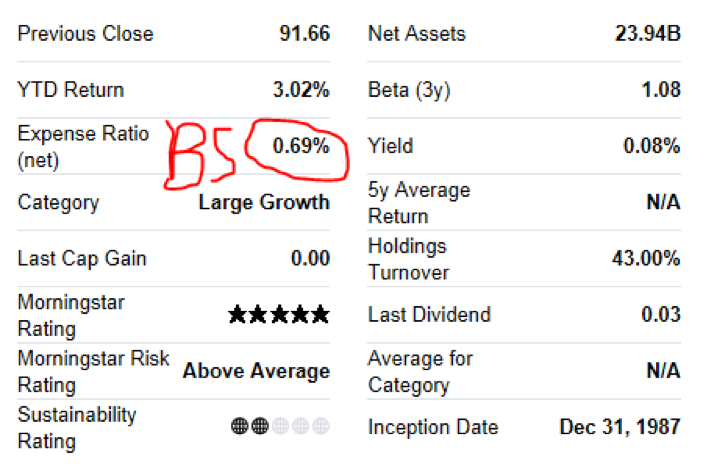

There is a hidden 4-5% of fees.

And don’t believe the so-called expense ratio listed on the front page of the prospectus or Yahoo-Finance. Let’s talk about that…

Just google “mutual fund + No 12B-1” – basically paying for them to advertise to more investors.

If we can agree for a second that the “market typically goes up” (deadman’s last words) this fails to take into account, the aforementioned fees of 4-5% which on an optimistic annual return of 10% a year… that’s 50% of your hard earned gain.

You take all the risk and they take their cut. Sort of sounds like real estate brokers who always get paid regardless you make money or not.

Do you not see something wrong with this? How can you not call BS?

Truth is, this business structure is very profitable and scaleable.

Everyone upholds this Wall-Street dogma and relights on the minion salespeople who get feed on sales commissions and hidden fees.

I have interviews with many of these financial planners who have once sold these products and agree that it’s a pretty messed up system… usually, the financial planners are younger people (who need to pay the bills) or greedy senior managers who are either ignorant to what is going on or don’t care because they have kids they need to put through college or a mortgage to pay. The vicious cycle continues.

Wall Street is over all this and making money on every transaction like how our Government is making money on everything that passes though the “world bank”.

Wall Street also makes big bets with your money so they can make even more money for themselves – almost like it’s not their own money.

When they win, they win big but you don’t get to see the money.

When they lose, they are too big to fail so they get bailed out by you—the tax payer.

What’s that you have a guy? So called financial advisor? Probably a “nice guy” but misguided and is paid off commission and likely to be living paycheck to paycheck too (in the same rat race as you).

The wealthy focus on buying streams of income that produce today which is called cashflow.

The poor and middle class go buy things and hope and pray it goes up in value.

One of the reasons rental real estate is such a popular choice is because it provides cashflow. It’s very Simple, the rents cover the mortgage, expenses including professional 3rd party property management.

The 2008 collapse simply kicked the proverbial “can” down the road…

How else will we pay for artificially low-interest rates (quantitative easing) and bailouts of these big banks.

A correction is coming and the sophisticated investors out there investing in real hard assets are going to stay afloat and even excel.

Note: If you are hoarding cash you are playing the game not to win. Robert Kiyosaki’s says “savers are losers.”

Why do the masses keep playing along? If we keep investing and holding on to the debt/money habits that were “inception-ed” into our culture we know what is going to happen, its simple math.

Doing the same thing over and over and expecting a different result is the definition of insanity, right?

How has it gone on for so long after? We are smart and educated professionals!

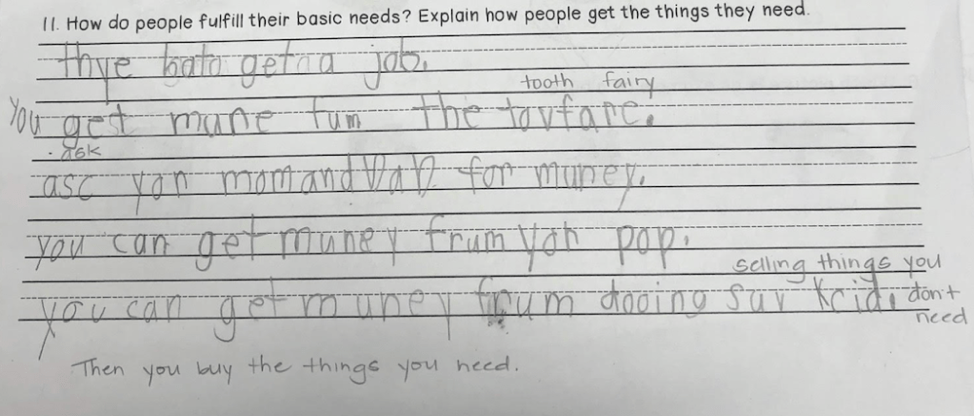

What kind of financial education did you get growing up?

Look what these Kindergarteners said when asked “how to make money?”

It’s funny… but also sad that the messaging is likely coming from the parents who don’t have a clue.

Chances are if you were lucky, you were taught about basic personal finance and not going into debt – not spending what you don’t have.

Often times the get out of debt gurus like Suzi Orman or Dave Ramsey clash with the ideals of the wealthy.

Sophisticated investors do not pay attention to “debt” or “interest rates.” Instead they focus on the “impact to their growing net worth” and “cashflow.”

When we get out of school, what replaces the classroom? How do we make up for what we haven’t learned? Where do we turn to for answers when we need to learn about real life?

The answer…CONVENTIONAL WISDOM! And the 18 year-old heck some 40 year-old “boy-in-man’s-body” goes out and gets a job, buys a big house/mortgage that does not produce cashflow, and gets stuck.

The conventional wisdom is often NOT right. Conventional wisdom once thought that the world was flat.

Conventional wisdom, believe it or not, might not even be unbiased. In the case of money, it is perpetuated by big money, big banks—Wall Street.

Let’s identify the conventional financial wisdom? Let experts invest your money in a diverse portfolio of stocks, bonds, and mutual funds.

Why is that conventional wisdom? Well, my parents got good educations, got good careers, pitched pennies, driving base level Japanese cars, and were able get by to retire their last fraction of their lives.

Not bad, they did make it. And it seems logical to repeat the proven process for my own life.

How many people do you know have gotten wealthy BECAUSE they invested in stocks, bonds, and mutual funds?

The wealthiest families in the world, like the Waltons and Rothschilds invest in mutual funds? Of course not!

For extra credit Google “what do wealth family offices do?

People who come to SimplePassiveCashflow.com are questioners… they think for themselves and opt out of the mouse trap that we are conditioned. We are not mindless drones that grow up on kiddie playground equipment at McDonalds and eat there our entire adult lives.

Then why do most high paid professionals believe that investing in mutual funds is the responsible thing to do? Because it’s conventional wisdom.

Where did conventional wisdom come from if its apparently the wrong way to do things?

It came from Wall Street and its special interest groups. It has been hammered into you as gospel and to stray from that line of thinking feels dirty, risky, and irresponsible.

When did we start using the term “alternative assets” to label real hard assets such as real estate? And when did we start calling stocks, bonds, mutual funds, puts, calls, derivatives, mortgage backed securities, sub-prime, and non-prime assets that are traded by bots and artificial intelligence, “traditional investments?”

I’m not telling you I’m right or wrong. Just encouraging you to have an open mind, to question everything.

I began investing in single-family homes using 20% down payment loans that were backed and by sound post-2008 underwriting standards set forth by Fannie Mae and Freddie Mac. The income (rents) exceed my mortgage, insurance, debt payments, expenses, and third-party profession property management. I simply rinsed washed and repeated and slowly build my net worth and cashflow to have my passive income exceed my expenses in less than 10 years.

You might be thinking… “I don’t have any money to invest!”

The Wall-Street two-step has worked on you!

You can invest your 401K and IRAs. Via a self-directed IRA. As the name says you have control over this money and can invest in real assets. Call up your 1-800 and as your investment broker and ask them if you can invest in real estate. They will likely say no… complete BS. What the 12 dollars an hour guy does not know nor does the 15-dollar per hour supervisor knows is that you can (legally per IRS code) and this is what the wealthy do.

Again, Google this stuff for a third opinion. “Can I self-direct my IRA.” (You might have to sort through a few of the paid advertisements before finding it)

Often times it takes a couple phone calls or one internet form and a couple weeks for the funds to get transferred. Heck you can even email me for my guy.

I’ll be honest it took me a few years to withdrawal my 401k and invest in brick and mortar assets. It seems like a sin! There is even this thing called a “early withdrawal penalty”. Yikes I don’t want a PENALTY that’s bad. But don’t worry it’s not a penalty its an entry fee to unlock your money to put into safety and higher yield investments.

When I ran the numbers I calculated that I overcame the penalty in 12-18 months. As I say in every podcast, think for yourself and do the numbers cause the numbers don’t lie… the only liars are greedy Wall-Street marketers who do not want their gravy train to end.

Why doesn’t everyone know about this?

The wealthy who have an increasing net worth damn right know about this.

Time is the most important thing.

Time and money are interchangeable. Many people in the SPC family have mentioned spending money to get back time by paying for house cleaners, in home cooks, grocery delivery, and paying above retail for things on Amazon just to get back time to spend with friends, family, or worthy passion projects.

Don’t delay. I hope I can instill a sense of urgency. Your portfolio is getting eaten alive as we speak. Do the math, for every $25,000 your currently have you could buy one turnkey rental property and produce $300 per month in cashflow alone (not including tax benefits, mortgage pay down, or appreciation).

If you have $200,000 that’s (200k/25k = 8 x $300/month) $2400 you are losing out on!

That is years from living the life you want or worse you can’t even imagine at this point.

Time is the most important thing.

Yup folks we are talking about living life with a purpose.

Opting in for once.

Because you deserve it and you owe the world to produce and implement your individual genius. Not for the paycheck or putting food on the table but because it is your passion or mission.

Don’t have a mission yet? Don’t worry it will come to you once you are financially free.

As we say at SimplePassiveCashflow.com, the passive cashflow is the simple part of it. What you do with your time and resources after… now that’s the real challenge.

If you want access my Google drive of analysis spreadsheets and resources so you can start your education process, please text “simple” to 314-665-1767.

We help the hard-working middle-class build real asset portfolios by providing free investing education, podcasts, and networking plus access to investment opportunities not offered to the general public.

The Hui Deal Pipeline Club is a free investor club where I filter investments and underwrite the numbers and partners myself. Unlike other investor lists and groups, my investors have personal access to me and know that I personally have skin in the game investing alongside my investors. My vision is to create a boutique syndication co-op where I know everyone and a part of your successes. We crowdsource deals and do due-diligence together.

Four ways you diversify in syndications:

1) Different leads/operators

2) Asset classes such as MFH, self-storage, mobile home parks, assisted living

3) Geographical markets

4) Business plans (5-year exits vs legacy holds)

*Smart investors place no more than 5% of their net worth into anyone deal

“I lost $40K as a Limited Partner in my first syndication. I don’t want anyone to have to go through that. We mitigate this by working with only people I know, like, trust, and one degree of separation. And since good people do bad deals from time to time we underwrite the profit and loss statements, rent rolls, and comparables.”

If you would like to connect with me and diversify from the Wall-Street roller-coaster email me at Lane@SimplePassiveCashflow.com. And to join the Hui Deal Pipeline Club go to SimplePassiveCashflow.com/Club

Learn more about me

How can you leave a legacy:

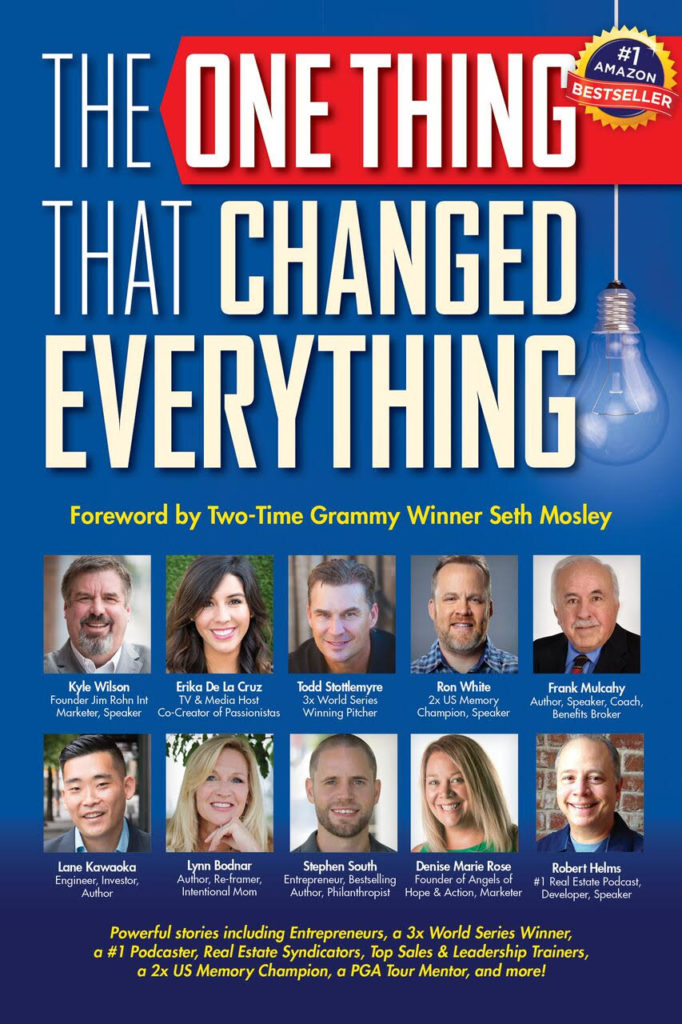

From the 12+ Time Best Selling Book:

The One Thing That Changed Everything: The Engineer Who Escaped the Rat Race and Achieved Escape Velocity

I walked the linear path for much of my life. Raised as part of the disappearing “middle-class” programmed me to study hard in school, checking the boxes on extracurricular activities, cramming for the SATs, and getting a high GPA to get into college, all to live a “practical” life.

Growing up, we were told to “waste nothing” and turn off the lights every time you leave a room. I still feel guilty to order a soft drink at a restaurant as opposed to tap water.

In college, while other cohorts were playing Frisbee in the quad, I was stuck in the basement of the industrial engineering lab. Why was I not playing the sun? Because Google told me what the highest paid undergraduate professions were. Driving on autopilot for much of my early twenties, I went for a higher-level master’s degree and tested to become professionally licensed as an engineer for the job security.

Upon entering corporate America, I spent my first five years of my career working for a for-profit, private company as a construction supervisor managing a bunch of entitled journeymen who were older than my parents. Facing the rigors of junior level employment, I played my role as the young guy, traveling 100% of the time for my company, sacrificing quality of life, as I navigated the operational clusters, toxic management, and other backstabbing pawns in the company.

I have a lot of scar tissue from that decade of working for the man not to mention building someone else’s dream. You tell me how engaged you would be if meeting protocol was to sit next to your superior and not speak unless directly instructed to or if you were asked to address a director two levels up by mister or misses!

One day an internal company email went out notifying of a friend/ex-direct report had died in a work accident. My boss was uncompassionate about the situation, looking out for the big bad machine first (mostly his annual bonus and agenda). This really put things into perspective for me.

As a corporate road warrior, it was novel being on company expenses all the time and maxing out on airline and hotel points, but you can only have steak and lobster so many times…. The only people who cared about my platinum status were the other suckers in first class who were working for the paycheck or an acceptable quarterly review. Although I am grateful that I had a well-paying job post-2008 recession, I traded the most important resource, time, for money.

The linear path instilled delayed gratification, living below my means, and an overall scarcity mentality of saving money instead of earning more, being more. I was entranced by the pervasive Wall Street marketing to blindly put money into a company sponsored 401K plan only to “hope and pray” that compound interest would carry me to a secure retirement.

Let’s not even talk about the student loans I had…

I knew where this path was going…I mean I did the math and it told me so. This is my story of how I freed myself financially, how I took ownership of my life’s direction, and the series of events that allowed me to find my calling.

Seeing the (Economic) Matrix

A steady diet of ramen noodles and a free birthday latte per year made it possible in 2009 to purchase my own home to live in. Being a bachelor who was only home on the weekends, I realized that having this large home was a waste of money. I made a decision to rent it out and became a real real estate investor. You might be thinking that this was the big change, but at the time it was simply a lot of beer money after collecting the rents and paying the mortgage.

I don’t know if it was the beer or being love drunk with cash flow, but I opted out of the linear path in my early twenties.

From that point on I devoured podcasts, books, and online forums on every keyword iteration of passive real estate investing. At a few hundred dollars of passive cash flow per home, the process was simple, buy a rental property where the income exceeded the expenses and mortgage, then rinse, wash, and repeat. Like a space shuttle that accelerates through gravity and escapes the atmosphere into Zero-G, this was my way to financial freedom. Up to that point, the biggest breakthrough in my life was discovering the .MP3 format that compressed and played music digitally in my teens. Using this intellectual technology, I progressed intentionally to eleven rentals in 2016.

At that time, a few of my friends wondered why my ramen noodle diet was being replaced by Starbucks coffee and yummy double bacon and egg breakfast sandwiches. They wanted a piece of the action too. Duh, it was about time seven years later, said the little red hen who did all the work by herself…. As much as I liked helping people, I got tired of answering the same questions. So what does any other late Gen-X/Millennial do but start a blog? Unfortunately, the words I write, even if spelled correctly do not usually make proper statements in English, so I uploaded my Simple Passive Cashflow podcast to iTunes where I could ramble and honestly talk about what I was going through as an investor.

I began living more consciously, opting into more meaningful engagements with people and projects, and searching for meaning and purpose. I was beginning to ask myself, “after sitting on a beach with my unlimited supply of piña coladas and time…then what!?” Needless to say, my motivation for working in the hostile work environment that I once tolerated dwindled, so I switched to work in the non-profit public sector. I started to see the economic “matrix” where people essentially trade time for money and the rich let others build their dreams.

Being an introvert, it was paradoxically energizing to see my audience grow as I began in-person meetings and online groups I sponsored. I provided hundreds of free coaching sessions to guide newbie investors. With my engineering background and a little “bro-science,” I saw patterns arise in the stories from well-paid professionals who were led into an unfulfilling lifestyle unaligned with their passions. Abolitionist Henry David Thoreau said, “The mass of men lead lives of quiet desperation and go to the grave with the song still in them.” People do not have any time to look inwards and are constantly living with anxiety and self-doubts because they are working like machines in order to meet their basic needs without the freedom to find their true passion.

Why did so much hard-work lead to financial scarcity and lack of fulfillment?

This self-selecting group of hard-working professionals searching for more all had a common thread. A moment that pushed them over the edge and made them realize that the path they were on was unacceptable.

These are some of those tipping points:

- Seeing younger, less experienced workers being “red-circled” as future management and advanced through the company “fast-track”

- Being fired to cover up shortcomings in a budget

- Internal theft by upper management

- An affair by a superior lead to bankruptcy of a startup company affecting many innocent employees

- Chronic drain of working with deadbeats

- Getting lost in the office politics of getting your objectives completed when they do not align with your boss’ objectives

- A retirement party for a coworker is catered with crappy Chinese noodles due to the cost control

- When you don’t get the job because you do not have enough grey hair

- Because you have too much grey hair

- Being criticized for not being business savvy from those who live paycheck to paycheck (when you have a personal portfolio of a few hundred rental units)

- Sitting through endless meetings that should have been sufficed with an email

- Circle jerk meetings where the boss’ dumb ideas are exalted by their minions

- When your boss with no technical experience misuses terms like artificial intelligence, big data, machine learning, and deep learning

- Being enslaved with the “golden handcuffs”

- Seeing an ambulance come to the office routinely during layoff season

- Being around the negative W2 worker speak and adopting the prevailing victim mentality

- The road warrior gets an early quit on Friday only to see the spouse at home with the pool boy

- Watching your friends receive the Seiko stainless-steel watch retirement gift

If you have found a calling in something you are good at and truly love doing it…clap, clap, good for you. Keep doing what you are doing and consider yourself lucky. If you relate to any of the moments above, read on.

The One Idea

My online journal resulted in many emails of gratitude and acknowledgment because I was empowering people with the “how to” and inspiring them to take a leap of faith to change their financial life forever. I suspect the most effective part of my message was showing people that if little, awkward engineer me could do it, how bad could it be?

I started up-leveling my peer group, and through osmosis, this brought me to a Tony Robbins event where I literally walked on burning coals! There were a multitude of top-down and bottom-up techniques Tony Robbins spoke about during the intensive four-day event. One of those lessons was “things happen for a reason,” and boy, was I glad I did not leave to use the restroom when he outlined the six human needs.

These are the 6 Human Needs:

1) Growth

2) Contribution

3) Significance

4) Uncertainty

5) Certainty

6) Love and Connection

Here was the game-changing moment: Tony Robbins said, “The most important thing is contribution because the secret to living is giving. If you catch onto that, you start realizing that there’s nothing you can get that comes close to what you can give. Life is calling all of us to be more than just about ourselves and that is when we get that spiritual hit.”

Apparently, Mr. Robbins did not endorse the mission of sitting on a beach with an unlimited supply of piña coladas and taking food porn pictures while gallivanting the world as a tourist. Nor did he support playing it safe with a bunch of passive investments.

Later that Easter, I was baptized, and the message there too was “go forth” and help others.

Then another of my mentors, real estate legend Robert Helms, said, “When you are successful you have an obligation to send the elevator back down.” I made it to my penthouse and now I and this elevator are heading back down to get folks!

We all have a finite time on Earth and an empty canvas to create a legacy. This was my one shot! Opting out of the linear path was not about getting financially free and sailing off into the sunset, but it was about standing up for change and creating the greatest impact!

The fan mail all followed a common thread of pain. Many hard-working professionals who are busting their butt on the linear path are being misled down a comfortable life of un-fulfillment.

Many of them were enslaved by the “golden handcuffs,” running in the hamster wheel of the day job working for someone else. Some, like doctors, lawyers, dentists, accountants, and engineers make more money to get the big house and nice car, but in the end, they are just a bigger hamster.

The dogma of the Wall Street “buy and pray” method is a cover up to insidiously steal investment returns from the people who are doing all the work.

Life is a three-phase screw job:

Phase 1: You enter the workforce with the worst jobs with the lowest pay. Time is abundant.

Phase 2: When marriage and kids enter the picture (and ailing grandparents) this is the time when one should be excelling at their time- consuming career. Money is abundant.

Phase 3: Your teenage kids hate your guts and your health starts to fail. Time is abundant.

The Next Chapter

My mission is to teach and empower good people to realize the powerful wealth-building effects of real estate so they can spend their time on more important ventures and passions instead of working long hours and worrying about their financial troubles.

In real estate we use leverage, and by teaching others, I am leveraging other people to achieve their financial goals in hopes that they too will send the elevator back down for the next person.

SimplePassiveCashflow.com seeks to educate those looking for diversification and better returns outside of traditional investments such as mutual funds and stocks. This is part of a large effort to redirect billions of dollars going to the corrupt Wall Street roller coaster and help the shrinking middle-class find safer and more profitable investments in projects that benefit Main Street such as affordable workforce housing rather than luxury housing for the rich.

The true meaning of wealth is having the freedom to do what you want, when you want, and with whom you want. Building cash flow via real estate is the simple part. The difficult part occurs after you are free financially to find your calling and fulfillment. But that’s a great problem to have 😉

Join the team!