After 3,000+ strategy calls (Free for new investors who join here) with investors and coaching clients over the past few years, this is what I tell W2 employees.

For those who are able to save more than $30k a year or have substantial liquidity (over 200k), being a landlord and especially flipping houses is a lot of work. If you like it cool/good for you, just remember why we got into this in the first place: To be free from a JOB.

A lot of us (80%) who stumble upon simplepassivecashflow.com and start drinking Kool-Aide will be financially free in 4-7 years pending taking action.

Check Out a Property Tour

If you’re interested in investing in deals with us, make sure you sign up and join the club to get access to deal information!

“Start with the end in mind and take a more passive approach – invest as a passive investor in a larger syndication/private placement.”

What is a Syndication?

A syndication is pooling of capital to invest in an opportunity. The benefit of putting capital together is that it might make it possible to purchase something that one person or small group may not be able to on their own with a joint venture agreement. We use syndications to get into opportunities to get away from the mom and pop chaotic and highly competitive space of under $1M-$2M deals.

In addition, we try to stay under $10M-$20M purchase price sizes so we do not compete with larger institutions or hedge funds who are mostly interested in capital preservation not optimizing equity growth.

You can syndicate anything from a shave-ice store or pizza store to a multi-million dollar development. I just try to stay in my lane and focus on cash flowing real estate where the tenant demand is high.

Video version of this article with extra commentary:

Time to Take Action!

Video: What Syndication or Private Placements Exist

Are You New to Investing?

If you are new to real estate investing (less than 6 months in) please do not invest with me or anyone else until you have built relationships with at least a couple other high net worth passive investors (not including me) who are not positioned to make a referral fee or sell you something.

The reason my deal vetting today is so strong is because I started building my network the right way with quality relationships.

Until you have your own network everyone who pitches you a deal will sound friendly and seem like a good place to invest.

Be skeptic and take your time.

Don’t be like me back in 2013 where I lost all my money in one of my first deals because I did not have a solid relationship with the operator/sponsor or had a network to vet the operator/sponsor.

Also before you book an on-boarding call with me please make sure you and your spouse are aligned.

I don’t want to be the one who gives you all these alternative ideals and starts a fight at home.

Not aligned yet? Read this post.

I recommend for investors to get their feet wet with investing in single-family properties first.

Yes, I previously noted issues with single-family homes, which you will experience at some point. But there is no better way to learn and build up the war chest as a prerequisite for more scalable investments and private placement syndications.

I believe that once an investor understands this then he can: 1) build some sort of liquidity and cash flow and 2) be able to call BS when a syndicator starts to use bogus proformas and assumptions.

If your net worth (income minus expenses) is under $200,000 or barely save $30,000, then syndications are not for you.

Stick with these Turnkey rentals despite what Gurus (who are trying to sell you their program) tell you for now. They have a little higher gains (a lot more volatility) but a syndicator who is willing to put you in a deal with more than 10-20% of your net worth is asking for trouble.

Mostly because it is a sign of a desperate syndicator with little to no track record and/or the deal is not strong. I call these deal sucker deals as it preys on new investors who have little experience and more importantly little peer investor network (other LPs around them).

Do the math here… you with 300 dollars per property (2 months of work to buy a turnkey rental) you are going to need 20-40 of these to replace your income. I had 10 of these and had systems in place but had 1-2 evictions a year and 3-4 big things that happened. Imagine if I had 30, just 3 x those numbers.

*PS I never liked the idea of wholeselling where you basically steal houses from people at 50 cents on the dollar and say you are “helping people solve problems”

My Experience with Syndications (Brief Background Story)

In 2016, I paid over $30,000 to get the mentorship to be an apartment operator/investor. What I learned in the process was that I did not need to be a General Partner because I had enough income and net worth to invest as a Passive investor (LP). After doing turnkey single-family homes from 2009 for 7 years I was ready to graduate to bigger deals as a passive investor.

Technically, I paid $40,000 on this fiasco too.

Since then I have been General Partner and Limited Partner on over a dozen deals from 2017 on. Click here for all past projects.

Webinar – What are Syndications/Private Placements?

Why Invest as an LP in syndication?

1. Minimizing Headaches (simplepassivecashflow.com/

2. Asset Diversification: Many commercial real estate investments have high acquisition prices (think $10M+) where most people don’t have access to. You want to get away from these other Mom and Pop invests like these 1-40 units. When I was a syndication newbie and thought I could do everything by myself and did not trust anyone. I then realized in a few months that 1-40 unit deals had horrible pricing because all the amateurs were involved and the ones that looked good from a per unit price prospective were under 80% occupied and had ISSUES. Investing passively in a group can allow you to invest in multiple asset classes (apartment/mobile home/assisted living), in multiple locations and with varying business plan duration.

3. Avoid Credit and Liability Risk: Investing passively allows one to avoid being exposed to credit or liability risk. No W2 documented income no problem! You do not need to personally guarantee multi-million dollar loans and and be the fall guy. Plus now you can get into all the travel hacking credit cards and tradelines you want (Simplepassivecashflow.com/

Banging your head against the wall with a Bank

Banks are in the business of giving loans to business owners based on asset quality and borrow qualifications in order to make “good bets” for their business of keeping their loans preforming for them.

One of the most straight forward aspects of borrow qualifications that rental property investor face is the “debt to income ratio” or DTI. The lower the better, but most lender won’t want to go over 50% and more conservative banks over 40%. The debt to income ratio is defined as gross pay ($4,000 a month) and your debt payments ($1,000 a month) you are at a 25% DTI or $1,000/$4,000 = .25. Seems pretty black and white but most rental property owners bang their head against the wall with a conversation with the bank spanning several days going something like this:

Annoyed Rental Property Owner: So you have my current W2 pay and rental income documents why are you calculating my DTI less than 50%. Oh we also have a signed lease for 3 months on our new rental in Memphis rental, can we add that to our borrower profile?

Banker (recent graduate): Um, let me check with my underwriter. [Wait 2 days] Ok sir, we can only count leases that are a year or longer. If it is a short term lease, or under a year, you have to show 2 years of tax returns before we can count that.

Annoyed Rental Property Owner: Hmm. What about my spouses small business (non-W2)? They have done that for years, we can count that?

Banker (recent graduate): No, sorry. We have to go off your tax returns. Due to your mileage and business write-offs, we can’t use that income as it is pretty much zeroed out and last year. Plus my underwriter told me that its going to be tough to push through.

Annoyed Rental Property Owner: Seriously? You told me that her income was going to be more than enough to push our DTI across the finish list. Anyway, my wife now has a new W2 job.

Banker (recent graduate): Ummm sorry, we can only use income you are actually receiving on a regular basis that you can show via paystubs at the time of qualification.

Annoyed Rental Property Owner: Ok, well that makes sense. But why do you have her student loan payment listed? Those are in deferral until October.

Banker (recent graduate): Yes, but payments start up within 36 months. When payments are in deferral, we have to take 1% of the outstanding loan balance as a payment which I know is lower than your scheduled payment that will start in October.

Annoyed Rental Property Owner: So let me get this straight. You can’t use her INCOME yet that starts next month but you have to factor in her DEBT payments that don’t start up for THREE months AND that payment factor is HIGHER than the payment WILL be when they start AND by the time the first mortgage payment will be made, she WILL be receiving a paycheck and STILL not have to be making student loan payments??

Banker (recent graduate): Yes, that is correct. And I see you have those other rentals in an LLC and not your personal name. I’m confused?

Why would you want to be at the mercy of the banking system?

Let us get the loans in our names and deal with lenders (more sophisticated commercial lenders).

4. Cash Flow: The goal of a LP syndication investor is to create a “ladder” of investment that create accumulated cashflow and cash out (refinance or sell) at different times. It’s like your grandpa’s CD ladder strategy but with 10-30x returns.

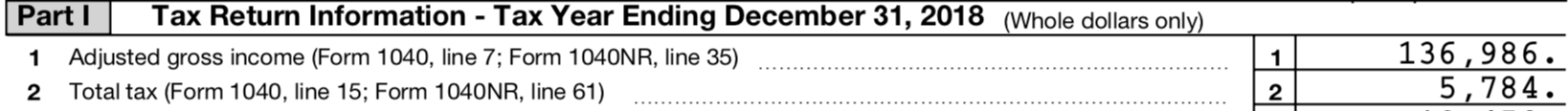

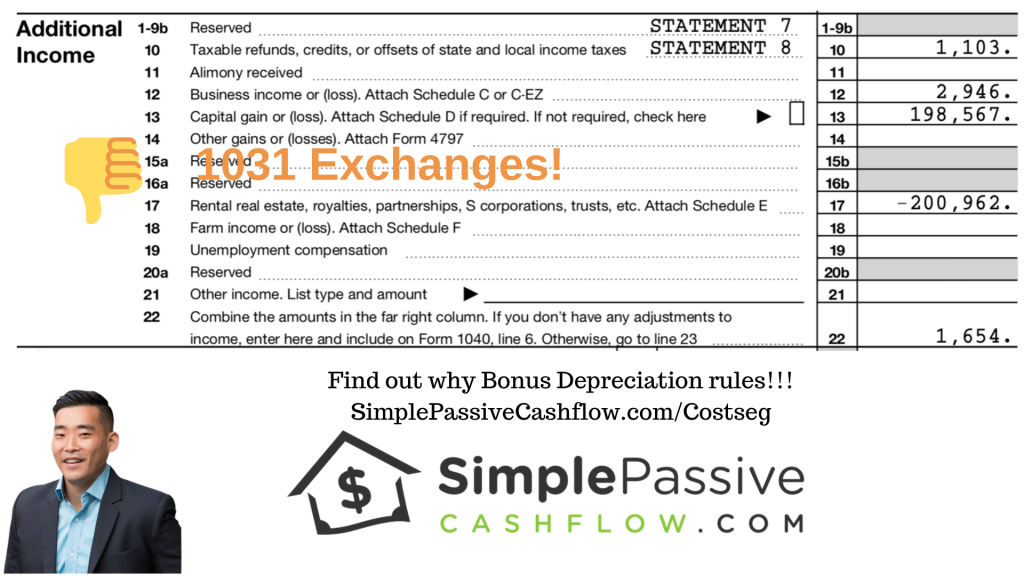

5. Taxes: All the deprecation benefits of single family home being your DIY direct investing but even better! Bigger deals are able to pay for a cost segregation to squeeze out even more depreciation. More info Simplepassivecashflow.com/

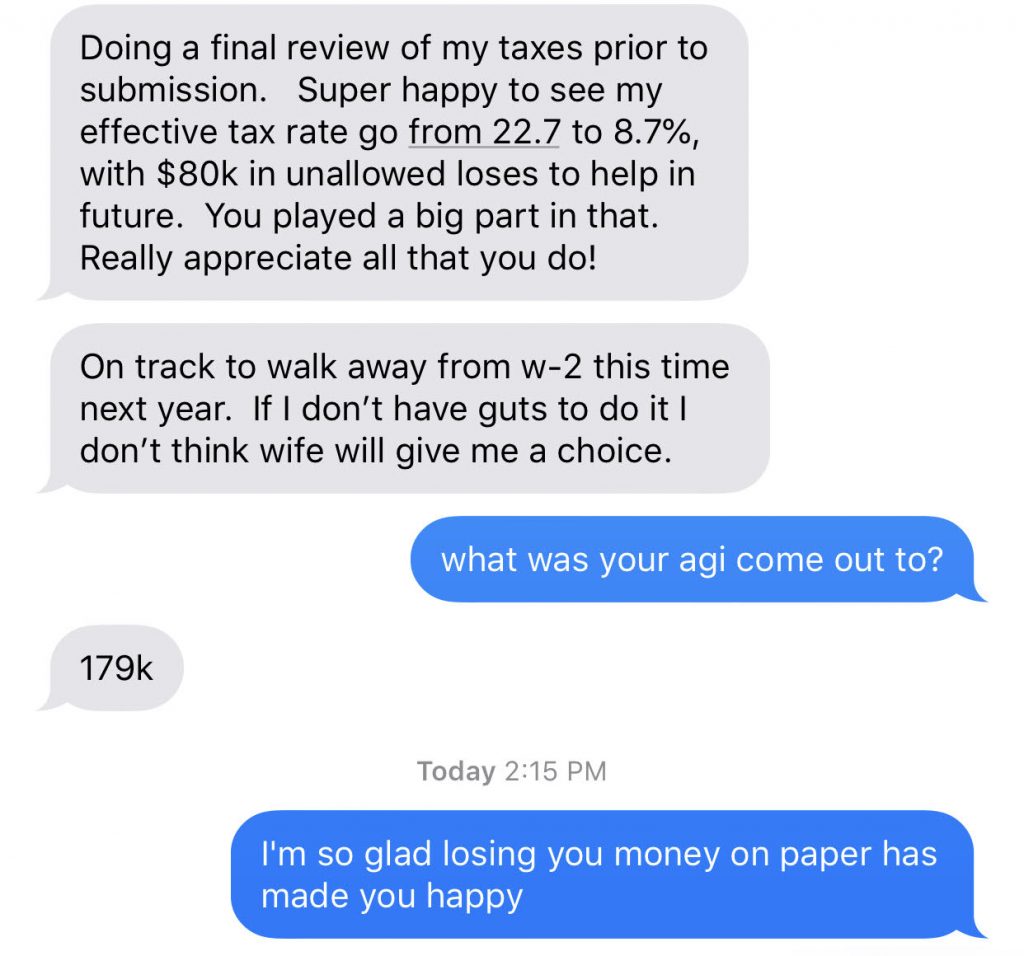

- I paid 4% in taxes in 2018. All because of the passive losses that real estate gave me.

TAKE NOTE: Bonus Depreciation has made 1031 Exchanges obsolete

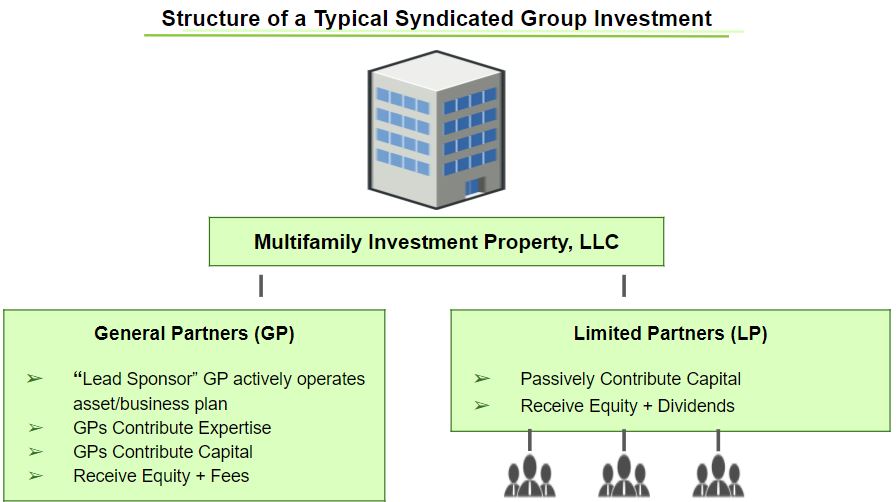

What are the Various Roles in a Syndication?

Whenever you are learning something new like ballroom dancing for example its best to learn the definitions first. Then once you understand those we will build up on the concepts. Remember mastery only happens with the right Mastermind and actually jumping into deals.

I use an airplane analogy when I explain these syndications.

In an airplane, there are the General Partners (GPs) who act as the pilots and fly the airplane (find deal, negotiate, find investors, line up lending, manage the 3rd party property management, operate the investment). They are interchangeably known as the Sponsor, Lead, Manager, Operator, or Syndicator. Being in over a dozen different arrangements I can tell you that sometimes there can be a lot of dead weight in a GP however if you are looking to be in the GP you need to help with the deal with 1) finding it, 2) doing the grunt work, 3) bringing in a lot more capital than a typical Limited Partner.

Here is what the GP does and why they deserve the extra compensation:

Source and identify assets

Underwrite and discover hidden value

Pursue, negotiate and win deals

Develop asset business plans

Negotiate purchase and sale agreements

Conduct thorough due diligence

Secure financing

8. Close deals

9. Manage assets

10. Lease to new tenants

11. Renew leases with existing tenants

12. Perform and manage capital expenditure projects

13. Execute asset business plans

14. Dispose of assets; and

15. Deliver investment returns

Video: Why Invest in Syndications Instead of REITs

Video: Course Targeting LPs

In coach, you have the passive investors or Limited Partners (LPs) who come on the plane and go to sleep. LPs provide most of the money to finance the deal and in return they receive equity, a monthly or quarterly cash dividend, and receive profit shares when the property is sold (based on their equity shares).

Video: Difference Between GP and KP

Video: Loans, Exit Strategy and Returns Unveiled

What is an Accredited Investor?

An accredited investor is a defined by the United States Securities & Exchange Commission as someone who:

- Made a minimum of $200,000 ($300,000 if filing jointly) in the previous two years

- Have a net worth of 1 million dollars excluding personal residence.

The significance of being an accredited investor is that you can invest in things that those with less money, cannot. You can also be something called “a sophisticated investor” which has a much more nebulous definition but essentially says you know what you are doing even if you don’t have that much money. These laws were put in place long ago to “protect” the average person from predatory activity.

Video: Will SEC Relax Rules on Accredited Investor Status

The irony of this all is that there is no protection for the average Joe, or pension funds for that matter, against investing in a wildly bloated stock market at record valuations. Every major trader out there knows we are in a bubble, but there is no protection for individuals dumping money into their retirement accounts to buy mutual funds. It’s an archaic system which makes little sense. Certainly, there has been some recognition of this fact.

The 2012 JOBS act made it easier for Main Street America to participate in “alternative” investments via crowdfunding and made it easier for sponsors to advertise previously unknown opportunities. However, we have a long way to go. I would advise you that you need to know the lead syndicator personally. None of this “we met at a local REIA and he pitched me his deal”. If a guy does not have a list of solid investors they must lack the track record. Also I did a podcast with Amy Wan a syndication attorney talking a lot about this topic.

How does a Non-Accredited Investor Get Into the “Country Club”

I’ll be blunt, non-accredited investors are painful to work with from a syndicator’s point of view due to the following reasons:

- Require special handling due to protections enforced by the SEC

- Require education because non-accredited investors are in low net worth peer groups and not privy to sophisticated/accredited investor knowledge

- Often times the minimal investment is a great amount of their net worth and along that comes with a lot of emotional ties to the money. I.e. they bug the syndicator all the time.

- A few deals will exhaust the Non-Accredited investors funds. Minimal customer lifetime value.

- Their peer group is filled with more… Non Accredited investors

Some tips for getting into 506B – Deals that accept non accredited investors.

- Understand that many syndicators will have a no Non-Accredited policy

- Be serious and get educated so when you build a relationship with a syndicator you separate yourself from the rest of the “tire kickers”

- Always give a reason for not investing, always close the communication gap

- Be forthcoming if you are “kicking the tires”

- Add value to the syndicator, respect their time. They are interviewing you as much as you are interviewing them.

Two Types of Syndications

A single (of finite number of assets) that are going to be put into the ownership entity. For example we are going to syndication the purchase and rehab of a 200-unit apartment complex at 123 Main Street. The assets are identified before capital is raised. This allows sophisticated investors to vet the deals on an individual basis.

A Blind Pool Fund (like a real estate fund) where capital is raised based on the sponsor’s vision, track record, and reputation. The capital is raised first the sponsors will then go out and acquire properties.

Generally speaking, I recommend investing in a specific property.

A blind pool allows a syndicator a lot of freedom to go out and find an asset. I have seen a more scams in blind pools partly because its hard to track the dollars.

“Hey man… Give me plenty of money… I’ll just flip a bunch of houses”

I like to invest in a specific property that you can vet the asset’s past performance and understand the business plan before the team picks it up.

Syndication Property Types and Deal Structure

Property Type: Most commonly bought are large “multifamily” rental properties (apartments). They have “value-add” opportunities (adding amenities, remodeling unit interiors, fixing up exteriors, or improving management). These “value-adds” ensure foreseeable appreciation which increases the property value regardless of market conditions.

Property Size: These deals can range from 100-500+ apartment units that have amenities such as pools, gyms, management offices, etc.

Video: Time Frame of a Deal: From Operator to LP

Location: They are bought in growing cities that have diverse economies and large populations. The properties and locations are typically Class B which attracts the largest group of potential working class tenants.

Price: Deal prices can range from $5-$75 million. 20% of the deal price plus a little extra for those “value adds” needs to be raised to fund these deals.

Equity Split: The common share in ownership between LPs and GPs is a 70/30 split. LPs get 70% of the total equity for providing most of the money to fund the deal while the GPs get 30% for finding, executing, and maintaining the deal.

Timeline: The typical investment time frame is 5 years.

What are the Returns for Syndications?

In terms of returns, being the direct operator normally produces higher gains. Generally, 25-35% a year on paper if purchased correctly. However with my track record I consistently lost money on 3 out of ever 10 rentals, but overall I hit my anticipated $200-$300 per month cashflow per property. Throw in the chance of a disaster tenant in there like my $30,000 repair bill and a few months of vacancy and you can see how you can quickly go into the red.

The only way you can protect from this volatility is to get more properties!

Something to think about in a correction if you are buying turnkey/retail properties is that you will likely be in the red with equity as unlike being a passive in a syndication you are not buying with forced appreciation.

Returns from syndications usually run in the range of 80-100% return in 5 years or 17-20% a year. This is less than being your own operator on a small rental. In terms of risk you are putting a lot of risk that the General Partners will uphold their fiduciary roles.

Assuming you mitigate this as best you can by checking backgrounds and only working with those you know, like, and trust with one degree of separation, the volatility of returns is much less than the smaller rental variety.

What I like about syndications is that a deal is not done unless there is a lot of meat on the bone which helps protect your equity position in a downturn – just beware of the loan terms and if it is a recourse or nonrecourse loan.

Video: Are Returns Guarantee a Preferred Return

I would say 80-95% of LP investors don’t know what is truly a good deal and invest off what other LPs say (who don’t know either) and pretty pictures. How do I know well I talk to a lot of LPs so that’s why. And a lot of people only invest off the executive summary which does not include the T12 P&L (Trailing 12 month Profit and Loss statement) and rent rolls. Crazy huh?!?

Here is a shotgun spreadsheet that will get you 10% of the way there but in order to truly vet a deal you need to build your network to vet the person via conferences, masterminds, paid coaching from me which I could walk you through a deal.

What is Preferred Equity?

In a large deal the sponsor team does everything for the passive investors.

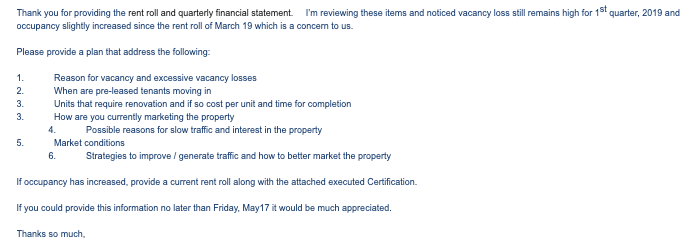

Sample of a past monthly report:

Value Add + Work Force Housing = Dynamic Duo

Things we look for when we tour properties:

Not updated (entrance) property sign/logo – must adapt to current times not when the property was first built; must attract high quality residence

Logo not in appropriate sizing/ color, not big enough to see – logo must be emphasized so people can see hence it will bound to be useless; so people will be aware where to go

Not well maintained foliage or garden strips

Not coordinated paint scheme (exterior) of the units

Wall (exterior) stains

Furniture (owned by tenant) not well kept in front of the apartment unit

Placement of barbecue grill (personally owned by the tenant) in front of the apartment unit- fire hazard

Light fixtures (interior) must be change, must be uniform- existing lights have combination of white and yellow

Even if the bathroom and kitchen area looks fine, it needs cleaning (TLC)

Mismatched appliances (refrigerator white in color while the oven is color black) – small details make a huge difference. May change the refrigerator into black so it will match the other appliances

Changing kitchen cabinet staining- that will resemble with the appliances

Private backyard not enclosed – can charge additional in the rental fee if backyard is enclosed

Not enough accents in the pool area (ex. placement of umbrellas, gazebo, arrangement of pool chairs)

Not enough benches; repurposing of existing outdoor picnic benches and tables needed – to experience more of the outdoor area amenities

Outdoor public grill placed in a health hazard area (rusty and too near the benches)

Recent Investor FAQs

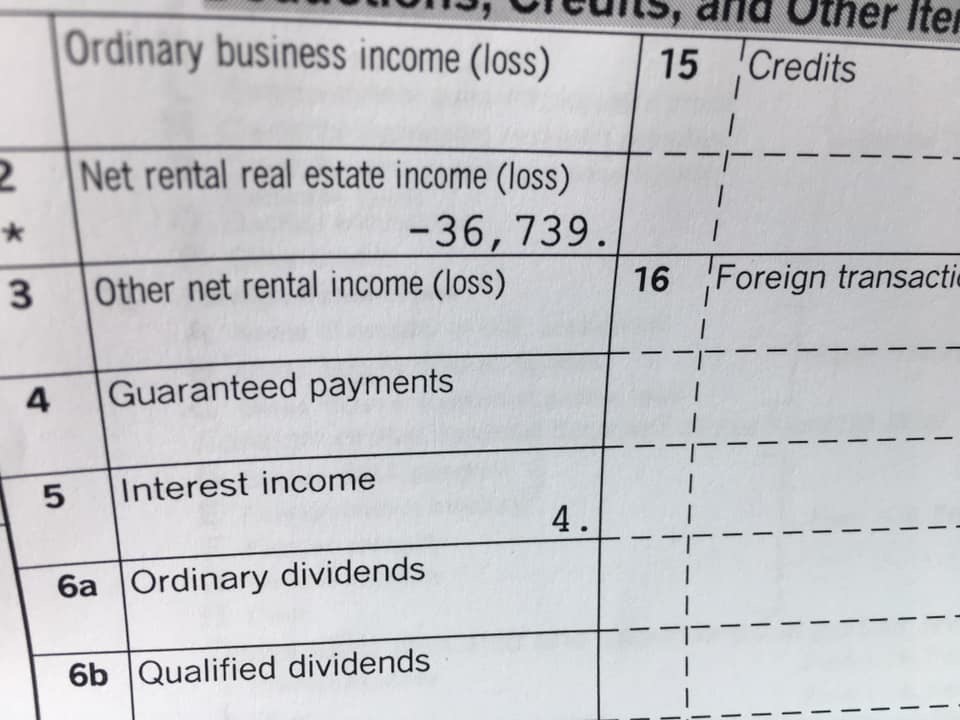

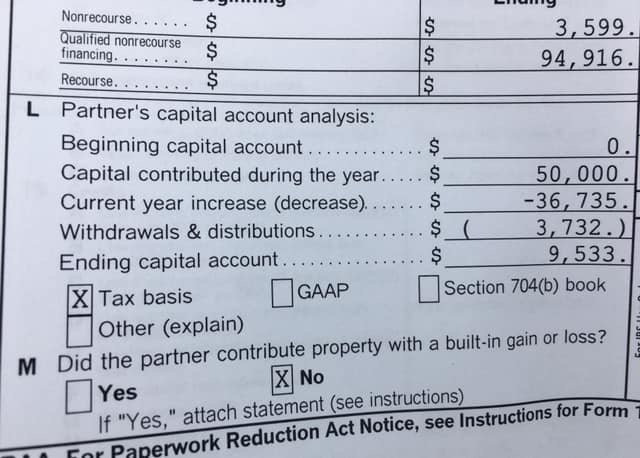

We do the cost segregation on the partnership level and distribute the losses on your Individual K1.

You mentioned getting a real estate professional status can help me deduct taxes even more – can you point me to where on the website that is? Couldn’t find it.

If you are able to implement a real estate professional status tax strategy (REP) you can use passive losses from syndication deals to lower your ordinary W2 income. If not (i.e. two full-time working spouses) your only other option is going into land conservation deals, solar deals, or oil and gas deals – all of which have some risks.

Taking step backwards depending on how verse your are in this subject. Consider the following:

1) There are ordinary/W2/active income on one side. Lets call that the 😔 side.

2) And there is the happy side: Passive income (syndications, passive partnerships i.e. medical/dentist offices) and passive losses (depreciation, bonus depreciation via cost segregations common in syndications). You can you passive losses to neutralize/eliminate passive income. Thats what this is the good side and why passive losses are called PALs too for passive activity losses.

So there is a barrier between 1) Active Income and 2) Passive Income above. You cannot offset passive losses (PALs) for active income. UNLESS you are are real estate professional status for tax designation purposes and able to create a “grouping/active participation”. We work with our FOOM folks to help them craft their individual plans if REP status is possible for them. I get frustrated because most people a) don’t stick with this and try to learn it… trust me its easier than first year college physics… but it will take you a few times to get it and after networking with real people doing this or b) they say its seems risky and listen to their lazy/ignorant CPA who by the way has been stuck in they same occupation for 20-30 years… why would you want to take financial advice from someone who is not financially free. If you came to our Bubble/Masterminds or met a few sophisticated investors in our community you would likely fire your current tax professional.

So when a deal is successful and sold (full cycle) what happens then?

All investors will have to pay back the depreciation recapture (losses taken throughout the hold) and capital gain (the big payout on the end which is sale minus cost basis). But don’t despair because although this is the case when you look at it myopically, in reality most investors go into multiple deals accumulating 100s of thousands of passive activity losses in their first few years investing. Those losses do not go away, but they become suspended to be used to offset future passive income and sales/capital events like this in the future. When you exit a deal, what normally ends up happening (like Tom Brady keep winning more Super Bowls) is that you go into two more deals (with now double the amount of capital) and you will likely find that with those new K1s you could result in you having way more passive losses you began with If you can see where this is going… yes, experienced investors with a lot of capital deployed might have 500k-1M+ suspended passive losses and have not paid taxes in years and do not appear to pay taxes for years! (you can find how much suspended passive losses you currently have on your IRS Form 8582 – which your CPA is likely not giving to you and in that case you should get a new one)

PS – I am not an CPA or attorney but I became financially free doing this for myself after 10 years working as a w2 engineer 🙁 and I am sick and tired of seeing highly educated and hard working professionals getting stuck in the rat race because we deserve financial freedom and the option to do more with it.

More info – SimplePassiveCashflow.com/tax

Ummm, I’m still confused why are we doing this again?

Investing in a boring asset that is stabilized today makes sense. And that asset is something that this country needs more of which is value/budge housing for the lower class (since the middle class is shrinking). Add in the value add component to force appreciate the asset price and your capital

I’m still confused?

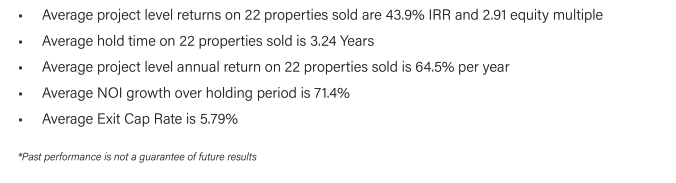

Look… 😁 Past performance is not an indicator of future success but here is the numbers of our most recent close (70-unit in Huntsville, Alabama).

Treehaven Sale Price. $3,000,000

Actual closing costs $131,267

Subtotal $2,868,733

Total Investor principal returned to LPs $647,500.00

Hypothetical amount remaining to split 80/20 $877,554.16

Hypothetical amount to Investors $702,043.33

Hypothetical amount to Managers $175,510.83

Total Property Return 135.52%

Total Investor Return 108.42% (For LPs in three years)

Total Property IRR 30.68%

Total Investor IRR 15.53% (Over the 3 year hold)

I still don’t understand?

Investor more than doubled their money in three years.

Passive LP Investors Quick Cheat Sheet to Reviewing a Multifamily Offering

“Never invest in a business you can’t understand.” – Warren Buffett

Don’t stay naive.

Nothing is more devastating than when you ask yourself, “Why did I ever enter this deal I don’t know about?”.

Is it only because your colleagues advise you to do it?

Educating yourself is crucial to the kind of investment you want to venture into as well as determining your risk appetite, these should include as the ultimate steps.

This holds in Multifamily Investing.

It is quintessential to your goal of wealth creation and reaps financial security benefits.

Here, shortcuts are NOT allowed.

Start learning and let’s focus on investing in multifamily syndication.

There are three conditions for you to be qualified in the multifamily offering. These are: (1) Must prefer real estate as an investment (2) Determined to become a passive investor, and (3) With an existing capital at hand of a minimum of $50k.

In investing in multifamily offerings, you need to establish your role either as a General Partner (GP) or as a Limited Partner (LP).

General Partners are directly involved in administering the properties while Limited Partners do not have (or have limited) power over managing the multifamily investment yet they are passively invested in it and will earn profit.

Asset Types for Multifamily Offering

When diving into multifamily offerings, every asset is uniquely categorized depending on the risk versus benefits it entails.

Core Properties

These assets are located in prime, urban areas (e.g. Downtown Chicago, Manhattan) and are most currently built. They are not difficult to maintain and do not require any renovation. They can provide steady income with low risk.

Core Plus Properties

Here, location can be either in the city or submarkets within the city that gives liquidity. Properties are still new so very few renovations are necessary. Leverage can be about 45% to 60% in these real estate properties.

Value Add Properties

Most often, there are maintenance problems or operational issues with these investment properties. These have higher leverage than Core Plus properties which is 60% to 75%.

Opportunistic Properties

Unfortunately, these properties provide the most uncertainty of all and also the riskiest yet can provide the highest return capacity. Located mostly in newly developed areas and possibly on highly distressed sites. They have very high leverage of approximately 75% to 90%.

6 Essential Steps of Multifamily Investing

If you believe Multifamily Investing is for you, then conquer the ropes and ignite with these steps:

Discover Sponsors and Review Deals

Generally, the General Partners (GPs) are in charge of showing propositions of which is a better deal that fits you. At any transaction, it is best to pick out who you’re going to deal with and take note of the SEC codes.

These are the details that you need to look out for when choosing a General Partner

- Familiarize yourself with the GP’s background, their team, and their company

- Number of syndications they already did and number of deals they were able to achieve in full cycle

- Ask about the challenges they faced and how they solved it

- Mode of communication with their investors

- Ask if they have quarterly report

- How many of their investors decided to re-invest

- If they are contributing to deals using their own capital

- Category they consider in choosing a market

- Determine the asset class they’re targeting

- Know their particular investment strategy

It’s like interviewing a new staff member to join your team. Be meticulous and sensible. You might have multiple deals with them so always think of this as a long-term relationship.

That is if you clicked!

Evaluate and Determine Market Location

To begin, determine and evaluate the market where the multifamily offering is located. These metrics can help you decide: (1) population, (2) job opportunity and diversity, (3) income advancement, (4) property value growth, (5) favorable tax laws, and (6) status of crime rate.

These data are usually found online or you can directly ask the General Partner (GP) to hand it over. Additionally, request for market vacancy rate, rent growth, and market cap rate for comparison with what the GP is stating.

This information is good to have but be mindful of “marketing” tactics that they might be using to boost their property offering. You may ask for additional information about property improvements, past tenants, etc.

Evaluate the Multifamily Property

Understand that there are risks in multifamily investing. By evaluating it and knowing its specific class, you can mitigate, strategize, and prepare on how to deal with the profitability of the offering. Identify building components, the age of renovation (exterior and interior), and if there’s a need for more.

Multifamily Class Rating

Class A

- Constructed within the last 10 years or slightly older

- With renovations done (possible years before)

- Located in better location among the others

- Done using first-rate materials, amenities, landscaping, construction

- Provides highest rents, catering to higher credit tenants

Class B

- Constructed within the last 20 years or can be even older

- With recent renovations

- Amenities are of lesser quality than Class A but still with good quality construction, and little deferred maintenance

- Exhibits lower rents compared to Class A

Class C

- Constructed within the last 30 years or can be even older

- Recently renovated

- Slightly outdated amenities (exterior and interior) with some deferred maintenance and original appliances still in place

- Exhibits lower rents than Class B.

Class D

- Constructed 30 years or more

- Usually in outskirts, fair location, less desirable neighborhood

- Almost little to no amenities available

- Bordering quality of construction condition

- Lowest rents of all rating

Remember to be thorough in knowing the real property ratings you want to venture in, to have a better perception of the deal. Some may produce cashflow immediately while some need further improvement to contribute to more cashflow.

Comprehend Deal’s Structure

Understand the following property metrics in the structure of the offering:

- Equity ownership between the passive investor and LG/GP. Commonly, it is a 70/30 split wherein 30% goes to the GP/LP while 70% is owned by the passive investor.

- Preferred return is the amount paid to LPs before GPs eye on profit and approximately it is 6%-10%.

- Class A consume more cashflow and lesser upside at a sale or refi as compare to Class B

- Sponsor structuring profit split in a transaction right after certain hurdles are encountered while other sponsors offer a “straight split”.

- Around 3- 10 years holding time for apartment syndication

- Fees must be paid to GPs such as the following:

✔️Acquisition fee 1-3% of purchase price

✔️Asset management fee 1-2% of gross collected rents

✔️Disposition fee 1% of the sale price paid to GP

Note: Take it as a warning if they’re not taking in any fees!

Grasp Underwriting Principle

First off, underwriting is a process that lenders use as a basis to determine the risk of granting a loan to the borrower. This includes investigating the borrower’s credit score and scrutinizing every aspect of the loan application. If there are no issues on the borrower’s side, the lender will grant the loan.

Here are some factors that affect underwriting

- Compare existing operations to projected operations. Is there a huge discrepancy in the size? And does it make sense with the business plan they came up with?

- Check purchase price with sales comps of similar build, age, sq. ft. and location

- Take a look if there is little to no rent increase to be protected in year 1.

- Be sure taxes are calculated accurately and are included in the underwriting

- Check and compare purchase cap rate and exit cap. Usually, there is an additional 10- 15 basis points for the cap rate per year to make it conservative.

- Refinance predictions and will LPs still be invested in the deal

- Type of debt is secured on the property

- Determining break-even occupancy rate and minimum number of units required to be occupied to include all expenses including debt service

- Availability of reserves to cover operational expenses

- Predictions of the first and succeeding distributions (quarterly or monthly)

Additionally, this will provide you with a good grasp of the real estate market (viability of the investment property), and a wider scope for analysis (specifically for the lenders).

Be Critical With The Legal Documents Needed

In investing in multifamily offerings, there are legal documents that you need to familiarize yourself with. It is highly recommended to consult an attorney especially if you are a “newbie” investor. Somebody “got to have your back” to explain each party’s obligations and expectations.

Legal Documents You’ll Encounter In Multifamily Investing

- Subscription Agreement

This agreement is mainly for the investor if they are qualified and suited to invest in the offering. Contract price (amount of money) invested must be stated here to be reviewed by the attorney.

- Operating Agreement

This agreement is between the GP and LP. This outlines each parties’ duties and rights that are involved in the transaction (e.g. profits and splits, investor distributions, bylaws, voting rights, and fees collected by the sponsor).

- Private Placement Memorandum (PPM)

This legal document discloses possible implications in entering the contract. This may include (but not limited to) operation and management status of the company, projections in distributions, fees, payment terms, conflict of interest, and investment’s liquidity.

To sum up:

Multifamily offering can be a complex, tedious passive investment route. The money you invested can be confined in the offering as long as the project stands. BUT if you are driven and determined to go through the process, investing in multifamily offering can be a lucrative PASSIVE investment that can create steady cashflow.

Why Did I Focus on Being an LP

Again for me, it was simple math. The assumption was that my money would grow at 15-20% a year in part cashflow and equity & forced appreciation. The syndications that I do are not BS REITs and RE Funds where you know the people running the deal for you and you don’t have layers of people taking hidden fees.

I get all the pass-through tax treatment and depreciation and interest expense. In fact it is stronger than my direct ownership rentals because of cost segregation and bonus depreciation. See our tax guide.

What I give up for control (most of which is an ego thing) I gain in diversification (multiple partners, markets, business plans, and asset classes). And the property management is typically a lot more professional than the property managers in the residential (1-20 unit) world.

Note: Market appreciation is sometimes considered as luck as it is not creating more value in the property with rehab or management improvement to increase the value or force the appreciation of the property.

I was on the flight path to Financial Independence. And this is why I have shifted my focus to non-investing activities and enjoying the journey.

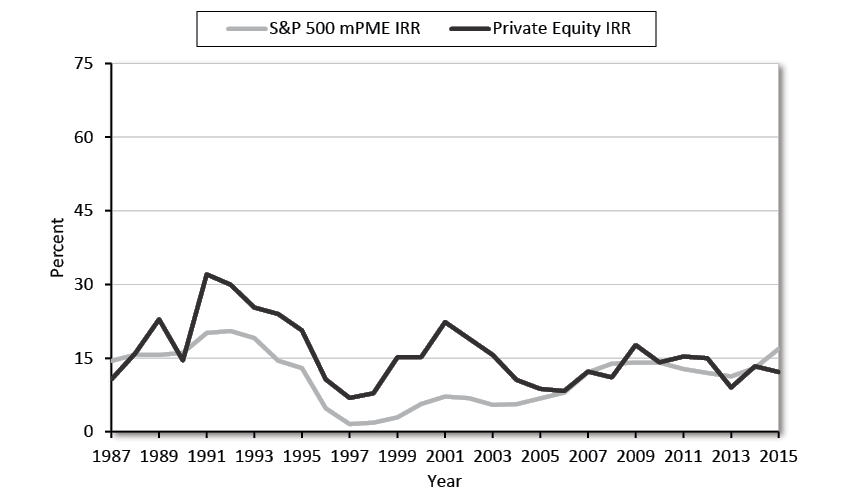

[Private Equity kicks S&P500 butt]

Source: Cambridge Associates, “US Private Equity Index and Selected Benchmark Statistics,” March 31, 2017, https://40926u2govf9kuqen1ndit018su-wpengine.netdna-ssl.com/wp-content/uploads/2017/08/WEB-2017-Q1-USPE-Benchmark-Book-1.pdf. 19.03.4

I made the jump to MFH/Syndications after more than 7 years in the SFH mindset. Read more here.

I laugh with other peer investors today how silly we were trying to max out our 10 Fannie Mae/Freddie Mack loans. And now we are in syndication we don’t need W2 income to qualify for loans because the loans are not even in our name!

Saying a loan to value (LTV) is too high on a deal is a blanket statement. Much like saying a steak takes 9 minutes on medium-high heat… BBQ aficionados will give you some formula based on weight, thickness, and then a core temperature. We are real estate aficionados! You can learn to be one here.

Every investor is at different stages of the game. This article aims to offer guidance on when to make the jump to more scaleable syndications.

Like ‘Rome’ I believe all most paths lead to investing in Syndications (as long as you are not a jerk and can halfway network with people).

When I was paying a boat-load for trainings and masterminds I was unconsciously finding other peers who where also doctors, lawyers, engineers, accountants, dentists, etc like me. All I had to do was reverse engineer what the smart money was doing.

Those smart guys at Cambridge Associates (investment firm that works with institutions and family offices) did a study of 132 prominent endowments and foundations over a 20-year period. Thrasher, Michael (March 5, 2019), “Cambridge Associates: HNW Investors Should Have 40 Percent in Private Placements.” The top 25% performing institutions allocated at least 15% of their investable assets in private investments and the top 10% allocated at least 40% to private placements. Among the best of the best, the Yale Endowment, which allocated 80% of its portfolio to private investments in its fiscal 2018 year, saw a return of 12.3% in a year when S&P was down 6.2%.

Video: Evaluating Commercial Real Estate Syndication as an LP

Video: Involvement of LP to Syndications

Bigger is better

Theoretically, it does make sense. Larger investment deals, such as syndications or apartments, would likely bring in larger cash flow and better deals due to better teams. If you do the math, you will likely net at least $100-300/month per property with a single-family turnkey rental. Assuming you earn a decent wage as W2 employee, you will probably need 20-40 of these single-family rentals to replace your income.

Cost segregations that typically cost around $5,000 create bonus depreciation. Bonus depreciation creates more upfront depreciation – often front loading in the first year of ownership. This is only practical in larger assets or scale.

Not making any promises as depreciation amount is primarily based off building specifics and amount of leverage used in a deal but here is a real-life example from a $50K investment in the first year K-1 in 2018 utilizing cost segregation.

Passive Losses!

Note: This is a Class C apartment deal like this

Cost Segregation & Bonus Depreciation – https://simplepassivecashflow.com/costseg/

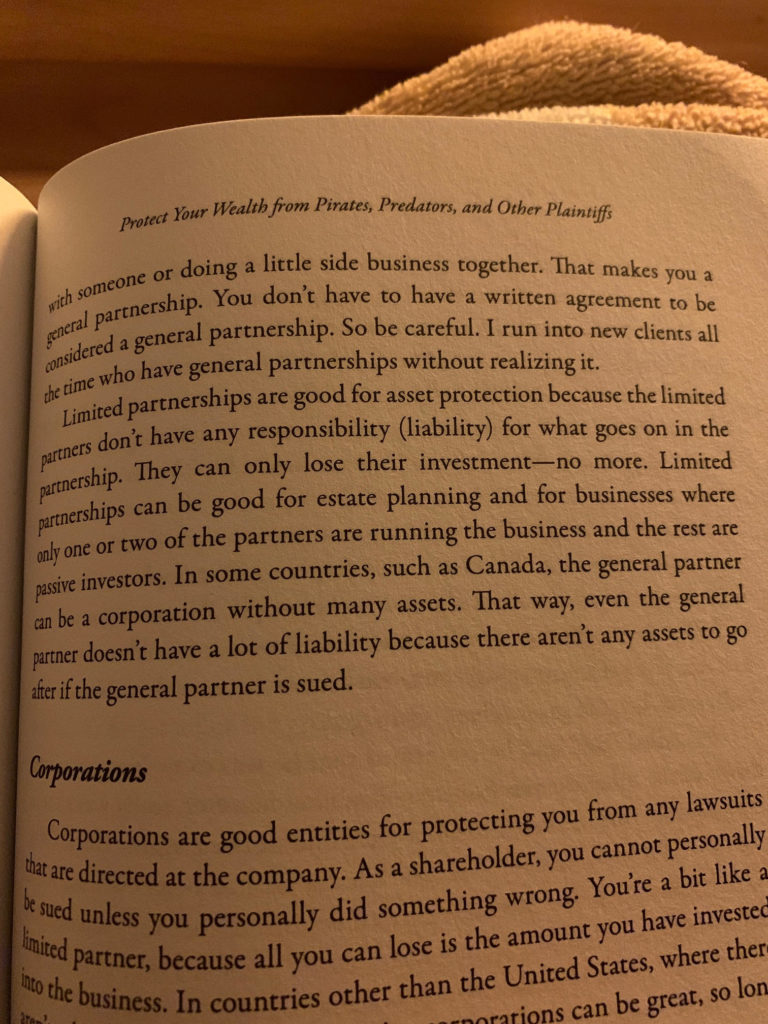

From Tax-Free Wealth by Tom Wheelwright – more on Taxes

I personally had 11 single-family homes, but experienced one or two evictions per year. On top of that, there could (and have) been other big maintenance and capital expenditure events that happen (3-4 a year with the same sample size of 11 homes). In other words, single-family homes can only get you so far and you will need to invest in more to truly generate more cash flow.

Thus, investing in syndications can be an attractive way to achieve true financial freedom because it is even more passive than SFH’s.

And there isn’t the PITA associated with doing Turnkey rentals.

The Caveat

But before you jump the gun, let us assess the full picture. From 2016-2018, I have had over 1000 strategy calls with real estate investors and coaching clients. (Today Calls are only available to Hui Deal Pipeline Club members) Many new real estate investors want to skip investing in single-family homes and jump into the deep side of the pool and invest in large syndications as a private placement. Who knows if they can swim? Some individuals can make this jump into syndications. Great for them! Keep in mind that this transition is a big step that requires more capital, a larger barrier-to-entry, skills, network, and unequivocally more risk. It might make sense to get a mentor to point you in the right direction.

If you are planning on being an operator or a general partner (GP) with no prior experience then I think you are smoking crack and I wish you luck. Jay Papasan, author of The ONE Thing, agrees here. You will always make a mistake and I would rather see you make it with a small deal first. Entrepreneurship is often about survival. Stay alive until you get lucky. I am one for going after a bunch of singles first then going for home runs. Plus, if you like real estate investing and want to become an operator, you will benefit by building valuable experience as you mold your track record and brand from starting with small rentals. I think that is why SimplePassiveCashflow.com has become so popular because it started small and progressed organically. Its funny that most of my coaching clients who have phenomenal W2 salaries want to start with the small stuff as if they are gluttons for punishment (I think it speaks to their character and how they achieved so much) and the folks with no track record of any success and are broke always want to swing for the fences.

And by the way to be a General Partner you need to find the deal, run it, bring a large portion (25% of the total capital), and answer annoying questions from the bank like this:

If you are planning on being a passive investor or limited partner (LP) with no prior experience then there is room for some debate.

More often than not, some investors just try it on their own. They network with some lead investors/syndicators and believe in every executive summary they read. Do not be a sucker. This is not a good approach and often leads to investors getting taken by the glossy PDF and profile pictures.

“Crowdfunding websites take huge cut of your investor profits. Go directly to the source and cut out the middle man and invest with us.”

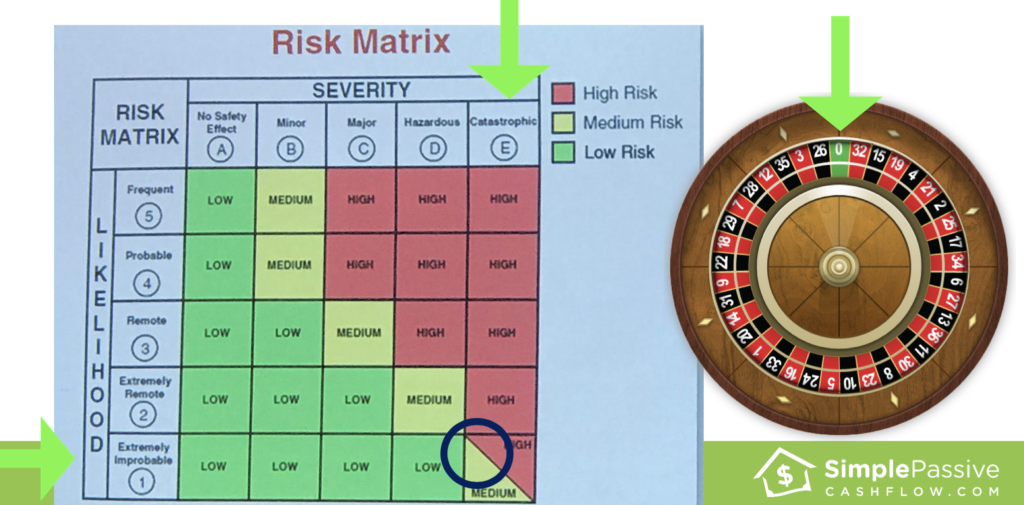

A discussion of risk and severity

The biggest problem with being a LP on a syndication is the potential of working with a shyster who takes your money. This is a very small chance of happening and can be mitigated by due diligence and creating a network that verifies characters. The risk and severity are modeled below.

Being a single family home operator has its own headaches and dangers which I have documented on past articles. It is “extremely remote” to have a $10,000-20,000 move out disaster and a lawsuit. Being a direct operator has higher returns coupled with more risk.

In my analysis of risk, a syndication (with the right people) decreases the variability of the investment performance as shown below. For example, a deal may not perform up to pro forma so instead of a 100% return in 5 years, you get 70% return in 5 years.

In my analysis of risk, a syndication (with the right people) decreases the variability of the investment performance as shown below. For example, a deal may not perform up to pro forma so instead of a 100% return in 5 years, you get 70% return in 5 years.

One Investor’s Story

In terms of my investment ideas/activity, here’s what is spinning around in my head (Note: The ideas listed below are going to conflict with one another because each path is a different approach):

1. Duplex, Triplex, Fourplex or small apartment complexes – This was the path I was going towards before we got into contact. I’ve been looking at Columbus and Cleveland, Ohio. I liked Columbus more because of population/economic growth. Got in contact with a couple agents from BP that service Columbus and I haven’t found anything that cashflows at a reasonable rate. A lot of deals cashflow at like $50-$150 per door and that’s going to be eliminated as soon as someone moves out. So while I’ve been looking for a bit, nothing yet.

2. Syndications – After coming across your stuff, I thought being a LP may be the preferred route. I get that I wouldn’t get the experience of knowing the ins and outs of RE if I did it myself, but what do I really want out of life? Do I want to spend so much time finding deals, buying, building the portfolio, or should I just be a LP and use my time for other life goals? Not quite sure, but the idea of being LP sounds like a solid approach. In any case, I won’t have accredited status for 2+ years, so I can’t even go full blast into this path unless I get in on similar deals like the ATL one you had.

3. BRRR – Open to doing any BRRR activities. I thought about this path for single-family homes, but I felt like it may be too hard to jump into BRRRing something out of state. That’s why I’ve been focusing on 1. above because Im trying to find stuff that doesn’t need a ton of work. If it needs relatively minor stuff that a PM can fix, that would be preferred before I jump into BRRRing things.

You could pursue a hybrid approach of investing in all of the above (although 2 of 3 would be more practical to not spread yourself too thin). Again, it totally comes down to how much money and time you have. More specifically if you have a lot of liquidity then you can do more than one track. All these things are totally correct and shows that you have the big picture.

Just a matter of choosing which path you want to go on. Congrats!

The Process

The following is how the process typically works.

- Someone finds a deal.

- GP ties up the property up in a contract and starts building their GP team. (This is where they call me and see if the Hui Deal Pipeline Club is interested in the deal).

- The GP performs their due diligence and in parallel they get the syndication lawyer (not another run of the mill person who happen to pass the BAR) to create an investment package typically referred to as a Private Placement Memorandum or PPM. The PPM includes details of the property/deal, terms, sponsor contribution, equity splits, projected returns (proforma), fee structure, payout structure, and other marketing. The PPM is a heavy document over 100-pages. In most cases it scares new investors because it discloses all the risks that can happen. In the end it does two things: 1) Signs the GP up to be fiduciary to no lie, cheap, steal, and run the investment to the best of their ability and 2) Signs the LP up to minimize their ability to sue the GP incase the deal does not go well after all in everything there is risk and sophisticated investors know this.

- The GP will then go about raising money from investors (LP). They will decide a minimum investment amount based on the down payment needed, cash reserves, capital needed for extra construction, fees/compensation for putting the deal together. Experienced GPs will always write the PPM to allow some wiggle room incase an extra 5-20% of capital is needed so they don’t have to spend another $10,000 for another irrevocable PPM. I am mentioning this because a common question from LPs is why does the PPM say the max raise is $4M and the sponsor just told me their take get is $3.5M? As a LP it is important to understand the rough breakdown on what the initial capital raise is being used for. Beware if capital is being raised to pay out investors in the first year. This is technically a semi-legal Ponzi Scheme but is not a good best practice by a GP and a way of tricking unsophisticated LPs.

5. Once there is enough capital and the financing is worked out, the property will be purchased and the sponsor manages and operates the property. This is always a monumental movement as millions of dollars are being wired in from dozens and dozens of LPs in just a matter of days.

6. After the property is acquired the fanfare and excitement goes away and the GP rolls up their sleep and gets to work. Distributions and profits are given as outlined in the PPM. In a way the LP courting stage is over, the wedding was a blast, and now we see how well this marriage lasts/goes.

Other Notes

Whatever you do, try to stay as close to the investment as possible. Knowing your syndications’ operating team is the most important part of the deal. Do not invest with random people. Even if the operators are good, there is the chance that good operators do bad deals and you need to be able to be on the lookout for the “money-grab.” You want to have the experience to understand their offering at the surface level as opposed to blindly jumping on board because of the promised return on investment. And to do this you need to analyze the Profit and Loss statements for the last 12 months, rent rolls, and pull your own rental comps. These items are typically never disclosed to investors. As you can see it’s a game of smoke and mirrors. The less data they give you the less questions and the less question the more likelihood of you investing.

Crowdfunding sites are great in theory but sort of like online dating websites for syndicators who can’t find funding. Do you really want to work with these people?

Well online dating really isn’t too bad and in some ways become the normal from 2010 on but Crowdfunding sites are still in their infancy.

There is a lot of consolidation in this new space. Think of the many competitors there was before there was the Ebay or the Amazon. I stay away from Crowdfunding sites personally.

Update: Realty Shares going under – [a sign of more consolidation to come]

They were one of the biggest Crowdfunding sites however they went under because they “can’t afford to secure additional capital to fund additional investor acquisition. In other words, the marketing to get people to sign up is coming from outside sources (venture capital) and not from their business. This is typical of a tech startup. Click here to learn more about crowdfunding websites.

In the end, do not forget your end-goal. About 80% of investors who stumble on Simple Passive Cashflow want passive income. Folks start drinking the Kool-Aid, and will be financially free in 4-7 years pending taking action. Always keep your end in mind by taking a more passive approach and start designing your ideal lifestyle today.

See chart here for further visualization

“You give up a little control, you gain a lot of diversification” – Lane Kawaoka

Beware of going the Mom and Pop route

You’re competing with the pros.. People who spend all their conscious and subconscious time trying to source the best properties and managing people correctly. You may kick butt at work but often managing white collar subordinates does not translate to leading blue collar personnel. Many deal hunters I know spend off hours taking brokers out to lunch or a Dallas Mavericks game frequently to get to the top of the list for the next deal. Your competition also has overseas virtual assistants combing seller lists for the next deal. Not saying you cannot find a deal on your own but who are you kidding?

Lets assume at one in one-thousand deal falls into your inbox.. This is at best because I personally get over 20 deals in my inbox a day and a few syndication deals that has met their minimal deal standards (however they may be).

Mom and pops – you have to love them! They go into single-family homes and scale up to duplexes, triplexes, quads, and to 8 units, 16, 20…

They read something like this and they think they get some property management ($12-$15 an hour employees) and think they are good. #BiggerPocketsBro

Here are more reasons why this path is flawed:

- Lending terms over 4 units and under 1 million dollar loan size is no man’s land for lending. Banks know this because amateurs do these types of loans and the failure rate is so high. Worse rates, terms, and resource debt.

- Mom and pops have all their money (100-400k) in one deal. This is not diversification.

- A few years ago me and my partner had the idea that we would just pull our money together and go into one of these under 50 unit apartments since at the time we were a still wary about trusting another person. But as we started looking for deals and running the numbers we realized that the pricing was worse than the over than 60 unit deals due to the competition of unsophisticated mom and pop investors.

- Mom and pop investors usually suffer from trust issues. They have severe blind spots and it is rare that they are a sophisticated well connected investor. Yes they take painstakingly care of the property and pick up trash when ever they are there but that only takes you so far.

What I like about mom and pop investors is that they eventually screw up and sell to us sophisticated investors at a discount.

I know that’s not nice :/

Ultimately the reason I decided to not do a 4-50 unit by myself was because of the leading options under $1M are horrible and full recourse. Check out with these options for debt that the pros use which are typically out of reach from mom & pop investors.

Commentary from other Hui Deal Pipeline Club Members:

“My near term goal (2 to 3 years) is to invest $500k to make $4k to $5k per month of low risk, real estate passive income (if still possible), I was thinking that deploying this as a limited partner over a few geographically diversified multi-family investments was a good way to get started, and to start learning. One of your first podcasts I listened to (SPC080) was one about when you decided to move to Multi-family from Single family. I agreed with most of your arguments in that podcast: 1) I don’t want to buy another job 2) SFH’s only scale so far 3) the return on SFH’s may not be big enough to justify the time put in (most of the turnkeys I’m looking at now have pretty low cashflow), however, it is a good small investment to learn the business. The 1st rule, or course is to not lose money… So, therefore, following your path and taking it step by step is more prudent.”

“Many of the points you hit on are the same pain points that I am currently working through myself in regards to real estate investing. 1) I’ve invested in SFH rentals currently and in the past, and the cash flow from these deals are great. However, the time commitment to my W-2 career prevent me from scaling this investment model. 2) Syndications are the way to go, and that’s why I’ve sought out a trusted mentor like yourself to teach me the ropes, and to bounce ideas off of to try and mitigate risk as much as possible. It’s tough giving someone your money in hopes that they will maintain and deliver on their fiduciary responsibilities. If the opportunity is good enough for you to place your hard earned money, based on the trust I’ve developed in you, it’s good enough for me. Right now I’m building my war chest so I can go to battle on financial freedom.”

Real estate is a people business. It is not like buying a stock where you can get wherever. You cannot apply some fancy AI or algorithm. You have to create a network to vet out good operators. You are investing in non-commodity investments where no two are alike.

Other resources:

What is Internal Rate of Return (IRR)? Plus IRR Spreadsheet Calculator

Here is info in Turnkey rentals or Turkey rentals.

Example of a Class C apartment renewal – https://my.matterport.com/show/?m=6gtjTYdwegh

Here is a webinar I did explaining what a syndication is: https://youtu.be/n_qsZHBOCS4

Our latest 253-unit acquisition in San Antonio (Mystery Shopping): (March 2018) –

Post-purchase mid-rehab walk-through (March 2018) – https://youtu.be/-5h2GKZ3I58

Here is another 52-Unit deal in Iowa: https://youtu.be/rzLARk-x0JY

Post-purchase early rehab walk-through (April 2018) –

https://www.youtube.com/watch?v=bgxEV68CWpE&feature=youtu.be

More videos and webinars provided to Hui Deal Pipeline Club Members. Join here!

For actual FAQs from past deals please email Lane@SimplePassiveCashflow.com for the password.

This why we invest in B and C Class deals and stay away from Class A (typically unless its a good risk-adjusted return).

Sample of Advanced topics in eCourse and Mastermind

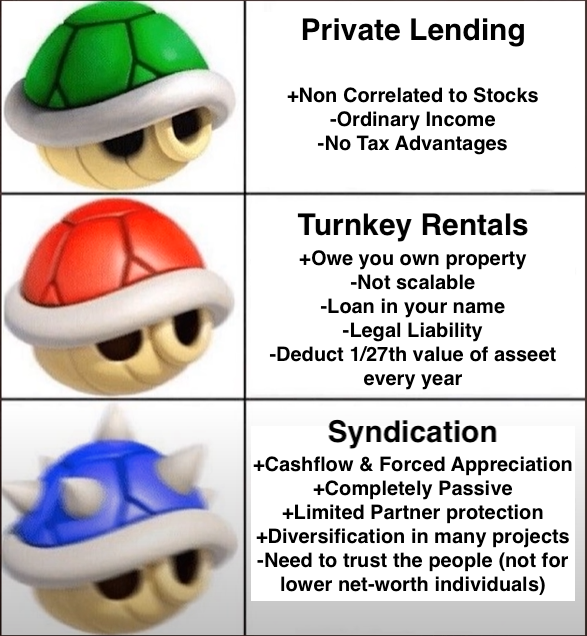

Menu of Investing Options

Click here to access the growing list of things you can investing and my personal notes on each. Let me know if you care to add to our growing information repository.

Other Resources:

Four ways Sophisticated investors diversify in syndications:

1) Different leads/operators

2) Asset classes such as MFH, self-storage, mobile home parks, assisted living

3) Geographical markets

4) Business plans (5-year exits vs legacy holds). And take advantage of the overall scalability and Cost Segregation & Bonus Depreciation

*Usually I see investors place no more than 5% of their net worth into anyone deal (~$50,00 per deal)