"When did start calling stocks/mutual funds 'Traditional Investments' ...and started calling real estate 'Alternative Investing'?"

The “Bread and Butter” investments:

Leveraged stock investing (E-Mail for details)

Exotic Investments:

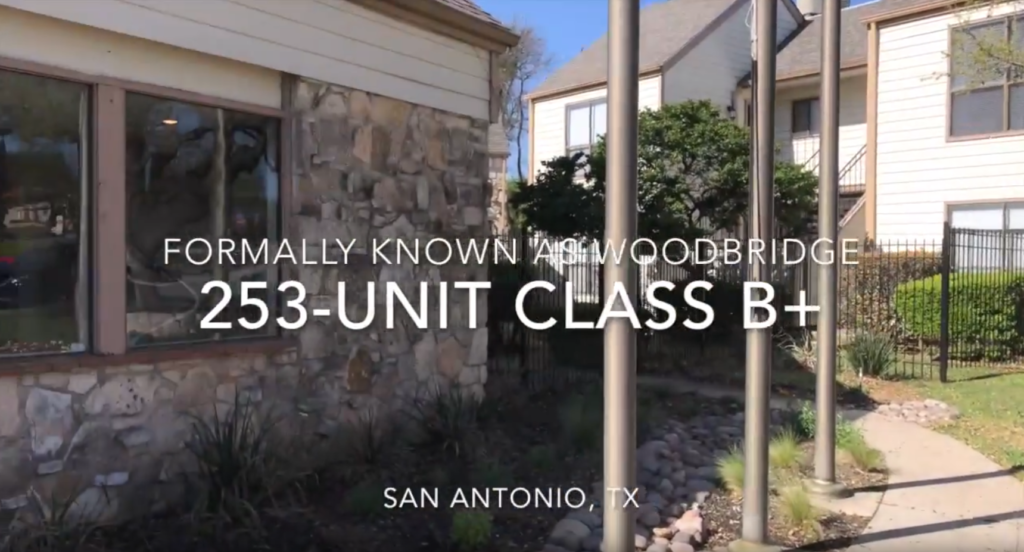

Commercial real estate

Industrial real estate

Tax liens

Private mortgages

Flipping houses

Lease options on real estate

Farmland

Timberland

Storage units

Water rights

Fishing rights

Airspace rights

Mineral rights

Cell tower leases

Horses

Livestock

Municipal liens

Film tax credits

Private company stock

Oil & gas LPs

Franchises

Network marketing

Accounts receivable financing

Royalties

Fixed annuities or equity indexed annuities

Publicly traded stock options

Warrants

Options on stock

Preferred stock

Insurance structured settlements

Airplane leasing

Precious metals (gold, silver, platinum, palladium)

Cash

Clean energy tax credits

FOREX

Futures / commodities speculation

Futures options

Peer-to-peer lending

Virtual currency or cryptocurrency

Municipal bonds

Infrastructure bonds

Infrastructure investments

Master limited partnerships (MLP)

Real estate investment trust (REIT)

REITS are like mutual funds. There are so many middlemen taking your money with hidden fees. It is like investing in real estate just as much as drinking high-fructose corn syrup “real” soda. -Lane Kawaoka

Derivatives

Private equity

Private placements

Intellectual property

Lottery structured settlements

Equipment leasing

Hedge funds

Housing tax credits

Pay day loans

Title loans

Parking lots

Distressed securities

Variable annuities

Small business lending

Classic antique cars

Business development companies (BDC)

Insurance settlements

Structured products

Not Passive or Sustainable:

Not Direct (Middlemen involved):

Crowdfunding Websites like Equity Multiple

If you can’t tell I like comic movies 😁